Posts

Posts Likes Received

Likes ReceivedHas Anta handed in a perfect exam? Beware of the "hidden reefs"

Hello everyone, I am Changqiao Dolphin!

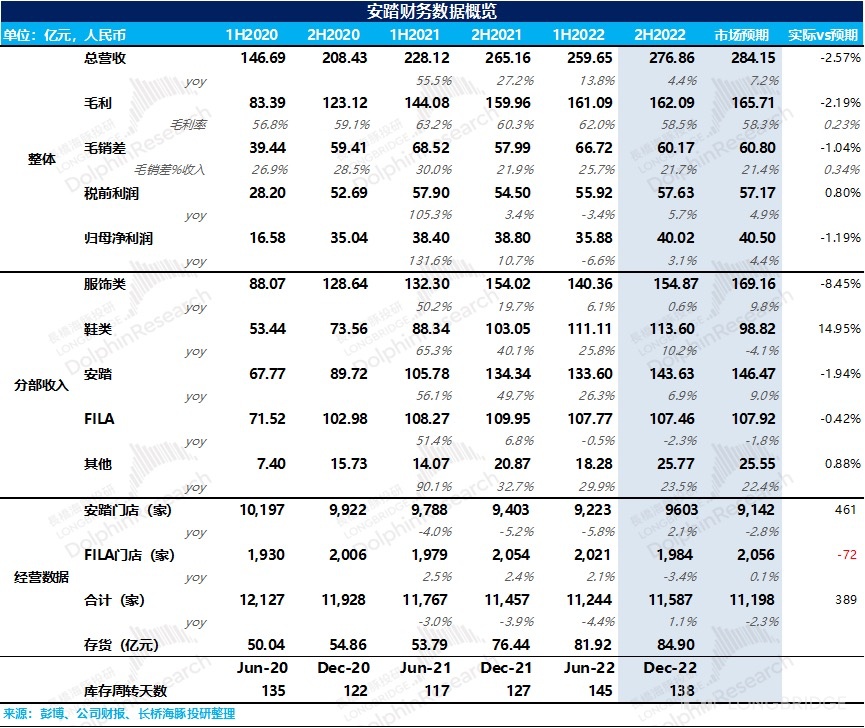

Before the midday break of Hong Kong stock market on March 21st Beijing time, ANTA (2020.HK) announced its 2022 annual performance. As ANTA had already disclosed its operating performance for Q3 and Q4 of 2022 in January and October last year, the market had a relatively accurate expectation of its total revenue. Differing from Li Ning, ANTA successfully held its gross profit margin steadily while maintaining growth and controlling inventory!

The key points are as follows:

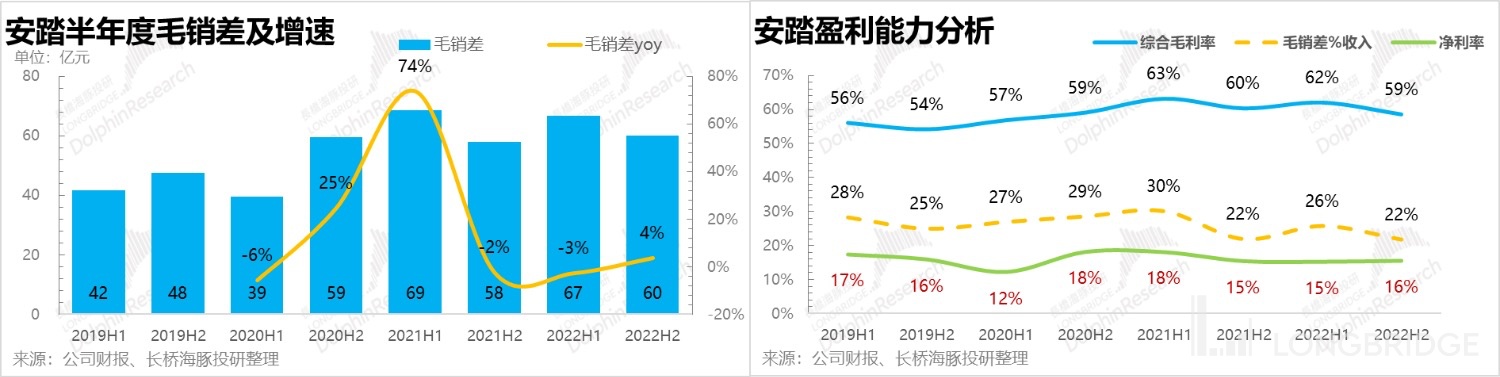

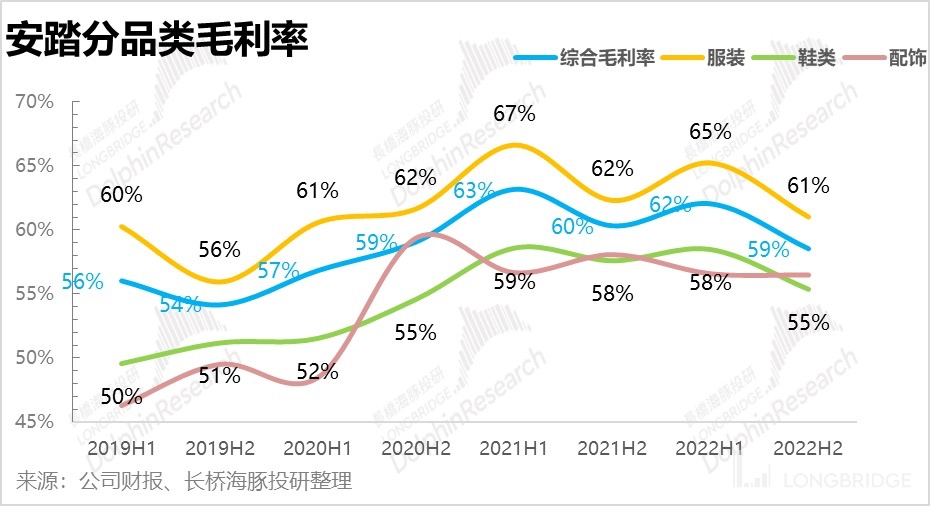

1. Gross profit margin and gross sales difference: barely changed compared with market expectation and the same period last year. Despite costing fluctuations and the offline store business obstruction that had negative impacts on the gross profit margin, ANTA managed to stabilize it through structural transformation to DTC, playing a decisive role.

2. Revenue performance: As the revenue performance had already been disclosed in the early operational announcement, it was very close to the market expectation.

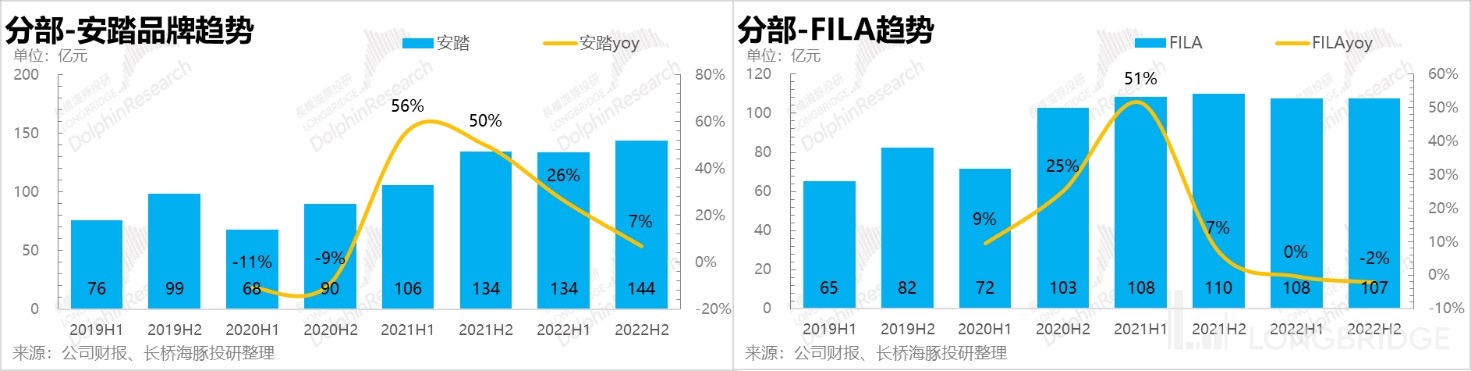

Looking into divisions, ANTA continued to play a major role as a stable pillar and maintained its growth trend, while still increasing the proportion of high-quality products (keeping a steady gross profit margin). FILA showed a slight sluggish growth and a slight decrease in gross profit margin of 5% in the second half of the year. Comparing with Li Ning, the sales of shoes exceeded market expectation.

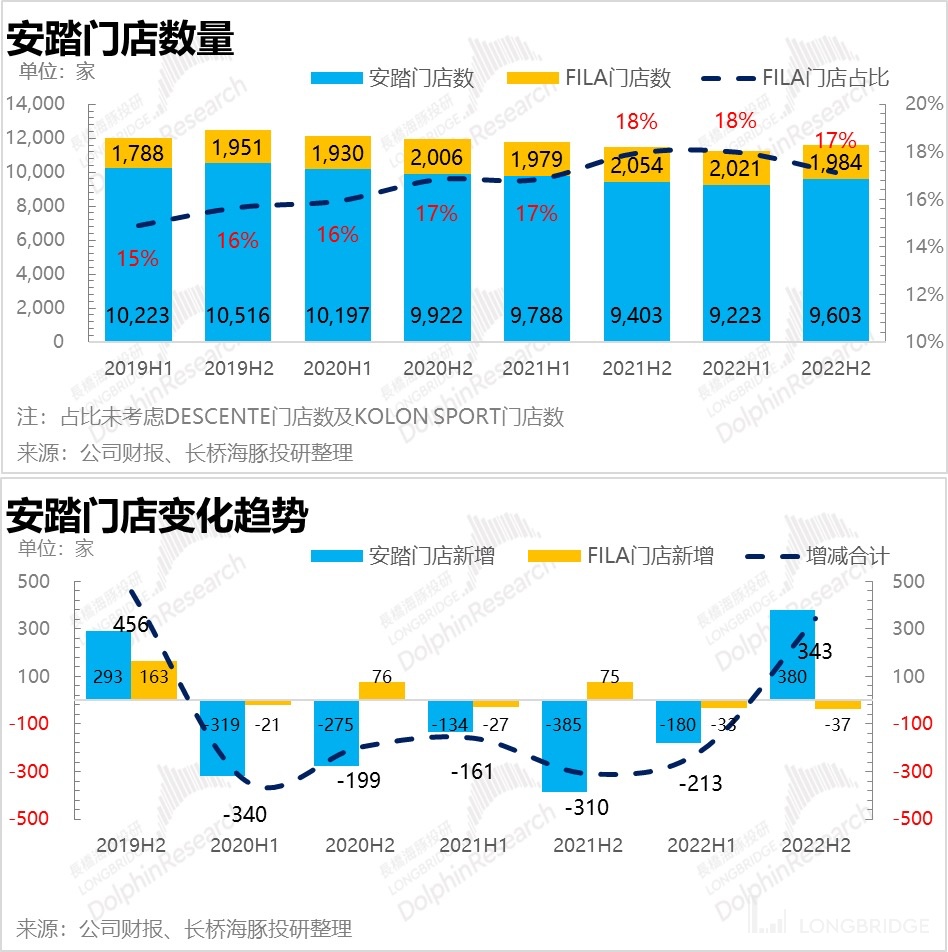

3. Store expansion: It exceeded market expectation, and was different from the store net decrease evident in the past periods. Since the outbreak of the epidemic, the net increase of stores appeared for the first time in the latter half of last year, mainly contributed by ANTA brand stores (FILA appeared as net decrease). From the performance of ANTA and FILA brands over the past three years and 2023 store goal of ANTA (exceeding more than ten thousand stores, adding a net of 400 stores +, and FILA remaining stable at 1900-2000 stores), top brands are maintaining an optimistic attitude towards the industry's recovery.

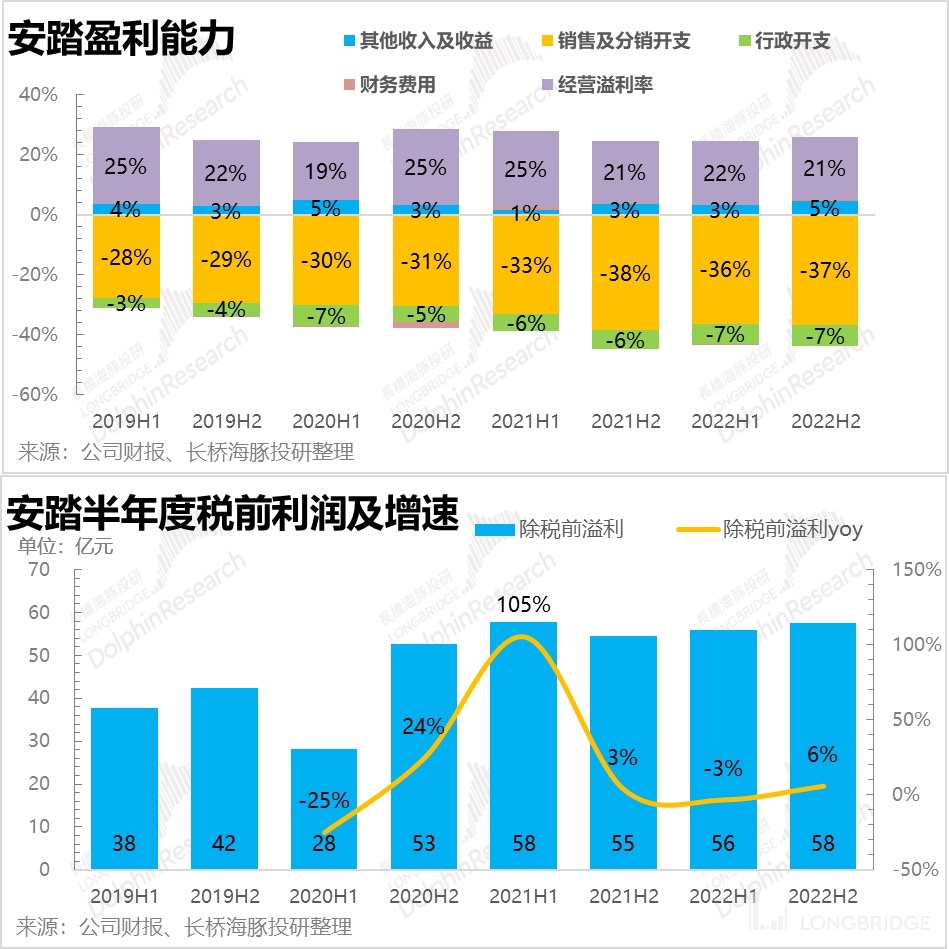

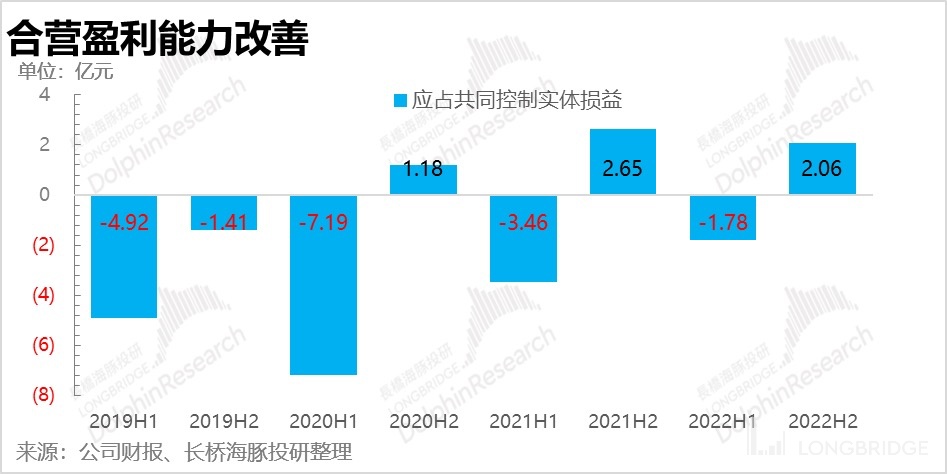

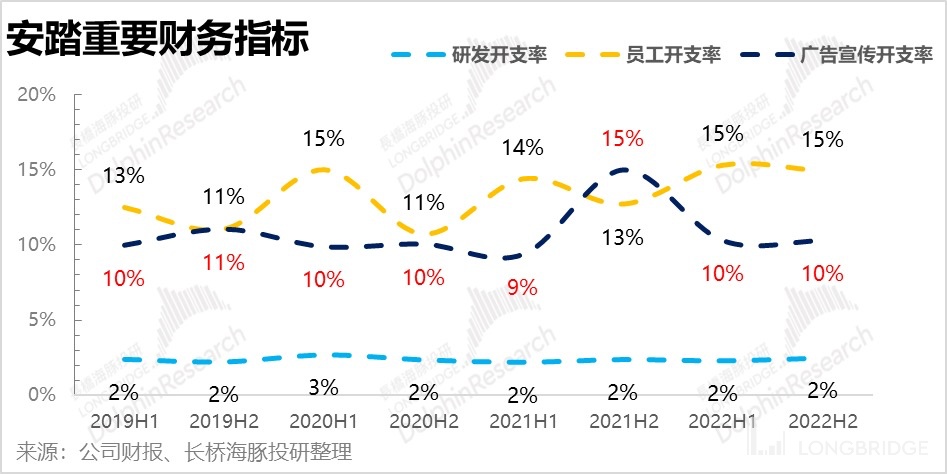

4. Expense situation: Based on the stable gross profit margin, expenses were also strictly controlled. Except for employee expenses and other hardly adjustable expenditures, advertising expenses changed significantly. Almost all of the contribution of stabilizing gross profit margin was transmitted to the profit end, and the profitability of joint ventures also improved, leading the overall net profit to rise (net profit trend less than net profit attributable to shareholders).

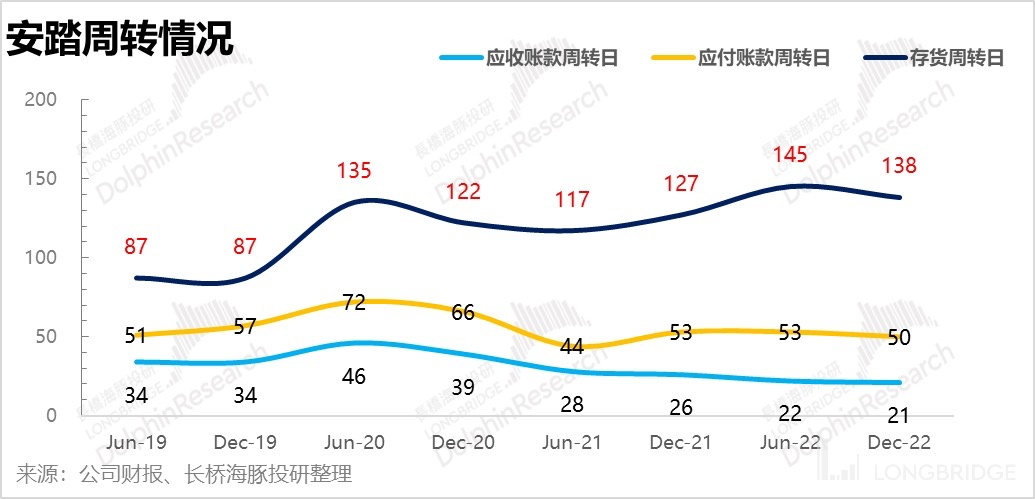

5. Inventory situation: It is hard to imagine that ANTA not only held its revenue and gross profit margin steadily against the industry's headwinds, but also managed to control inventory, with an absolute value of inventory rising by only 300 million. Judging from the industry trend, Dolphin believes that ANTA may have transferred part of the inventory pressure to dealers.

Overall View of the Dolphin:

Overall View of the Dolphin:

Overall, the most surprising performance of Anta Sports in the second half of the year is the stabilization of gross profit margin, especially compared to the significant decline in gross sales of next door Lao Li. Although the revenue is mediocre, the market reaction is still acceptable because the market has been vaccinated in advance.

Moreover, this steady ability is reflected in every detail of the report. Almost all projects have some degree of optimization, not only relying on the stability of gross profit margin, but also in the control of expenses and the improvement of joint venture companies, which are contributing positively to the overall profit of the group.

Regarding inventory, the dolphin still maintains a certain degree of caution. Although the report shows that the company's inventory is well-controlled, given the industry's overall decline in the fourth quarter and the decline in turnover, the dolphin believes that there may be risks behind the shiny report. It is highly likely that the company passed the inventory pressure on to the channel (distributor), and such behavior undoubtedly puts a landmine for the future. We will continue to learn about the specifics of inventory through subsequent conference calls.

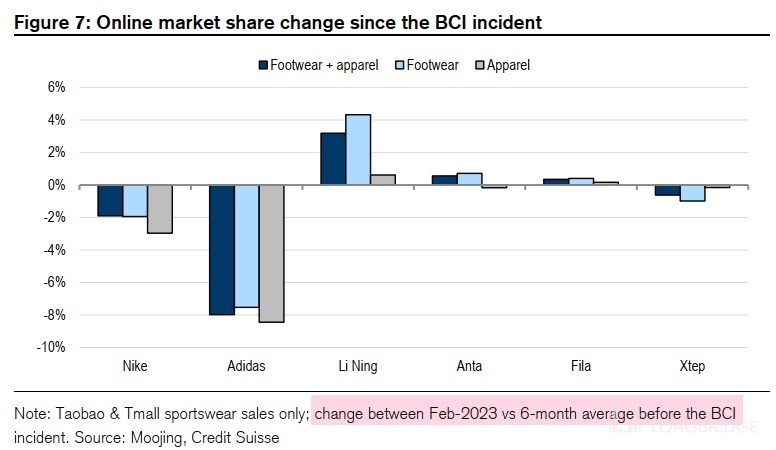

Overall, the trend of increasing the market share of domestic brands has not stopped due to the industry's downturn. On the contrary, the change is becoming increasingly apparent. Considering the change in market share, the dolphin believes that Li Ning, which has undergone sufficient adjustment of stock prices, has better opportunities.

If you are interested in the management exchange during the financial report conference call, Longqiao Dolphin will share the summary of the conference call through the Longqiao App's community platform or investment research group via "dolphinR123" WeChat account. Users interested in the conference call summary are welcome to join the Longqiao Dolphin Investment Research Group.

The following is a detailed interpretation of the financial report:

1. Secure Revenue, Resist Gross Margin Pressure

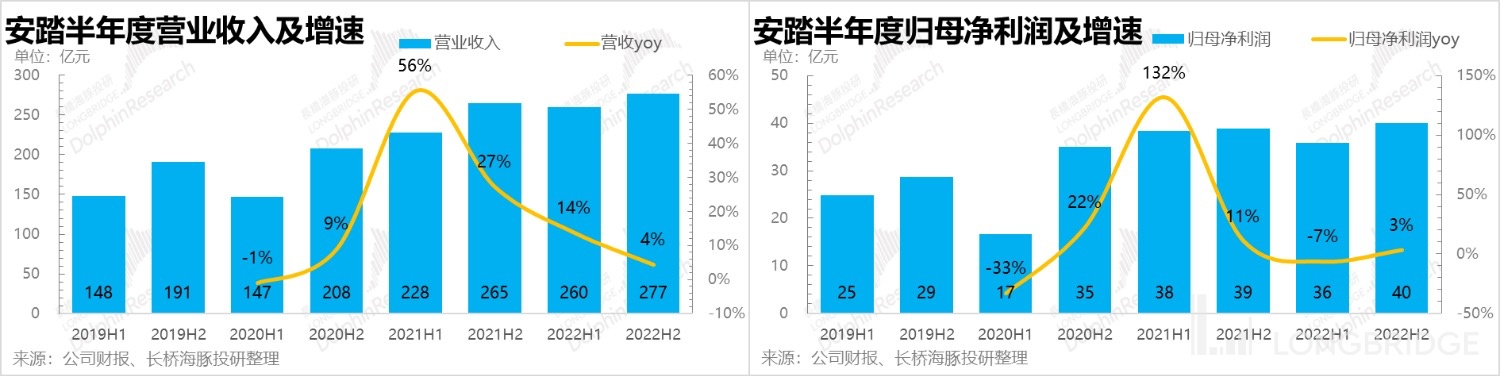

The annual revenue reached 53.7 billion yuan, which is basically consistent with market expectations. This is mainly due to two factors. On the one hand, the company had announced the operational performance of the third and fourth quarters of 2022 in October of last year and January of this year. On the other hand, from the performance of Li Ning and other peer companies, as well as the overall industry performance, there is basically no particularly high market expectation for the performance in the second half of the year. Therefore, this revenue growth and market expectations are still acceptable.

Marginally speaking, the company was able to maintain 4% revenue growth in the second half of last year, which is really not easy under the background of poor turnover (especially the particularly dismal fourth quarter). In fact, the semi-annual revenue growth rate has been declining every quarter, and almost every sporting goods brand has the same trend. Anta's foundation is relatively large, and this performance still reflects the company's relatively steady style.

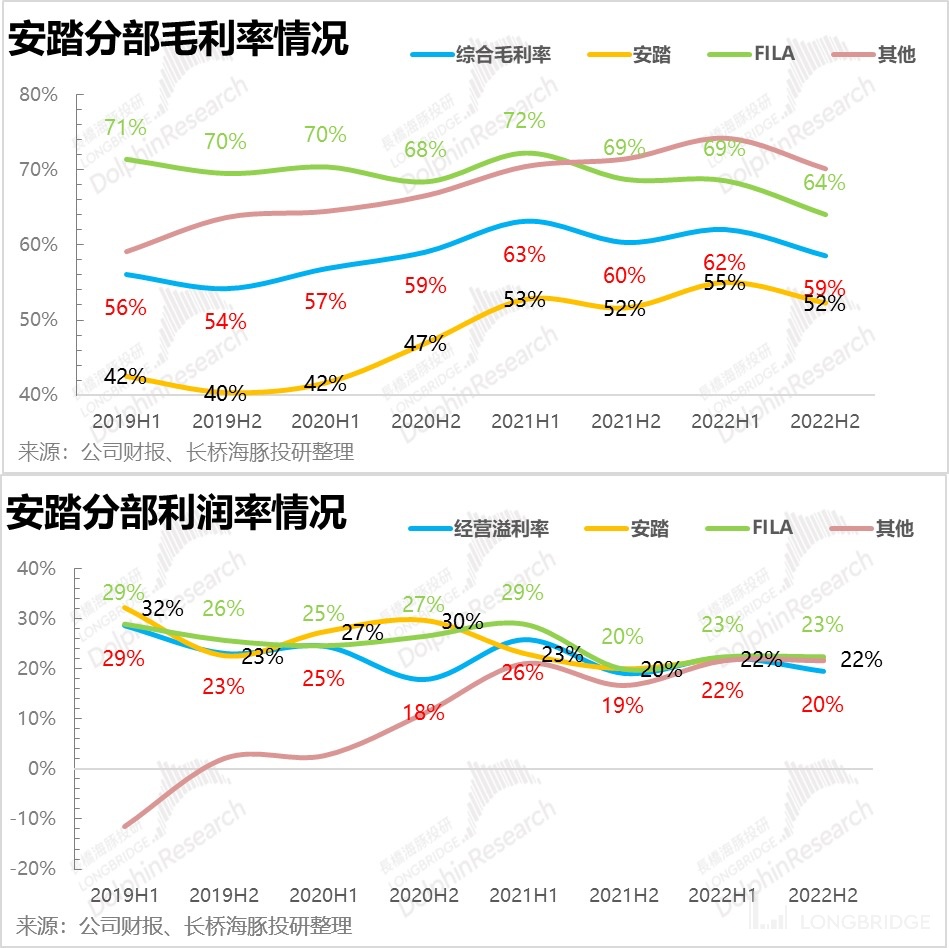

In a previous in-depth report on Li-Ning, we mentioned that due to the favorable position of sports brand companies in the industry chain, generally speaking, the gross profit margin will be relatively high. In the past, ANTA’s gross profit margin remained stable at over 60% (because FILA has a gross profit margin of around 70%, which structurally improves the company's overall gross profit margin), and Li-Ning also maintained at 50%. Moreover, the fluctuation of gross profit margin will not be particularly large.

In a previous in-depth report on Li-Ning, we mentioned that due to the favorable position of sports brand companies in the industry chain, generally speaking, the gross profit margin will be relatively high. In the past, ANTA’s gross profit margin remained stable at over 60% (because FILA has a gross profit margin of around 70%, which structurally improves the company's overall gross profit margin), and Li-Ning also maintained at 50%. Moreover, the fluctuation of gross profit margin will not be particularly large.

However, in the past two years, business has been difficult, and all companies are facing pressure to clear inventory. The operating hours of offline stores were also greatly restricted last year. Therefore, although Li-Ning's revenue in this financial report season is close to market expectations, the gross sales are declining significantly, mainly due to the deepening of discount rates, which affects the decline in gross profit margin.

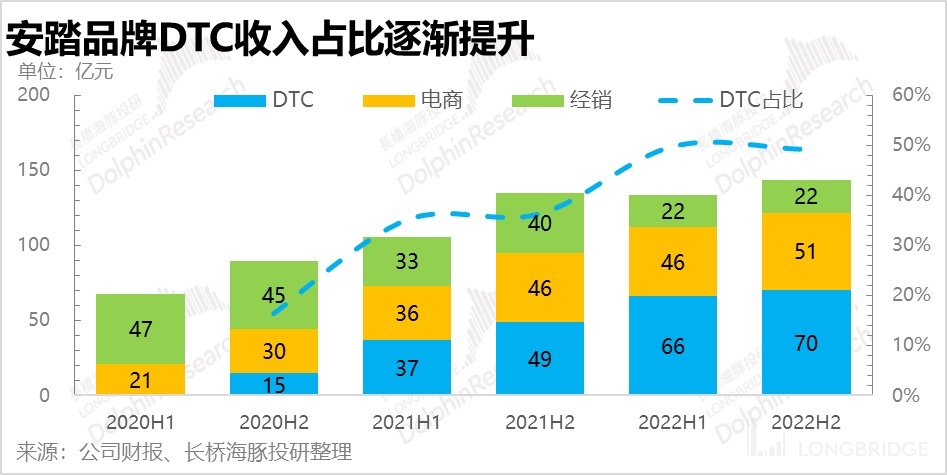

However, ANTA did not experience the same situation in this period! Both the gross profit margin and net profit margin are basically consistent with the same period last year, with only a slight decline (a decrease of about 1 percentage point, while Li-Ning's gross sales decline by about 7 percentage points). Similarly, ANTA also faced the problem of rising raw material prices. However, ANTA has been continuously transforming into DTC in recent years, making the proportion of ANTA's own stores gradually increase and thus improving the gross profit margin of this division (ANTA brand). Therefore, it has a positive contribution to the company's overall gross profit margin (detailed analysis will be discussed later).

Therefore, against the background of certain control of sales expenses, the gross sales and net profit have been maintained. In the past two financial report periods, ANTA's gross sales have been in a negative growth state. When the company grows to a certain size and faces a difficult market environment, occasional small single-digit negative growth can be understood. However, the base of the second half of the previous year was not particularly low, with CNY 5.8 billion. The company was able to maintain it, and some effort was put into cost control.

In a previous in-depth report titled "How Long Will Li-Ning's 'Cycle Robbery' Last?," Dolphin also compared the pressure faced by ANTA during the de-stocking process of the previous inventory cycle. However, the company previously communicated in the conference call that in order to maintain the brand's tonality, the company will not blindly discount. From the changes in gross profit margin in this period, the company's words and actions are basically consistent. Under certain control of the discount intensity, the growth of company inventory is not particularly significant.

Considering that other companies in the industry basically deepen discounts, and the decline in gross profit margin is accompanied by an increase in inventory, coupled with the dismal customer traffic in the fourth quarter of last year. Dolphin believes that there is some contradiction between the overall performance of the industry and ANTA. It is highly possible that ANTA has increased dealer inventory, which is not reflected in the company's financial statements yet, but puts some pressure on terminal sales. If the industry remains depressed in the second half of the year, this pressure will be balanced in future sales.

二、DTC Contributes Significantly

2.1 No Difference in Performance from Branches and Expectations

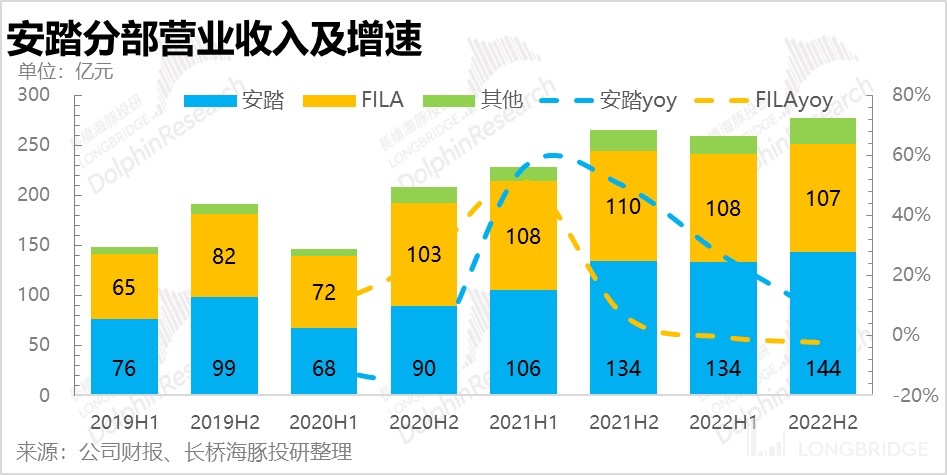

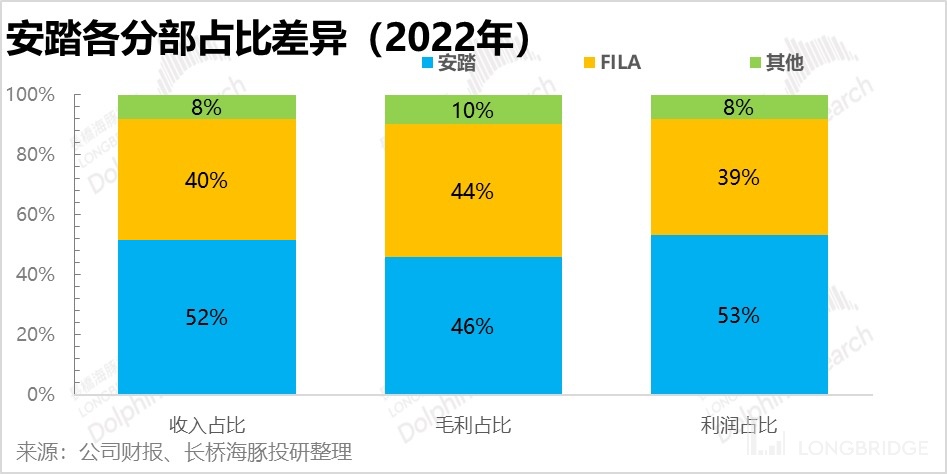

From the perspective of different branches, Anta's performance is consistent with market expectations (both Anta and FILA meet market expectations). In recent years, the proportion of Anta and FILA brands in the group has gradually become an equal-status situation. This is mainly because the growth of FILA in recent years has shown some signs of fatigue, while Anta has still maintained growth in the context of a larger base, becoming a mainstay for the company.

Especially in the second half of last year, the positive contribution of transforming to DTC through e-commerce and continuous transformation in China enabled the Anta brand to achieve single-digit growth. Since adopting DTC in 2020, the percentage has increased rapidly and has already reached 50%. The advantage of this approach is that it can be more favorable in managing channels and maintaining stable growth, but it also means that more inventory is being carried.

As for FILA, even with some compensation in e-commerce, the negative impact of terminal retail has caused an overall downward trend.

2.2 Profitability: Weakening FILA, Anta Brand Maintains Status Quo

In terms of profitability, the divergence between the Anta brand and FILA has gradually become apparent.

Due to differences in direct sales and franchise models (FILA is direct sales, and Anta's brands are half direct sales and half franchise), as well as differences in brand positioning and price range, the gross profit margins of FILA and Anta's brands have always maintained a certain gap. FILA has maintained more than 70% in the past, while Anta's brands are basically around 40%.

However, in the past three years, with the transformation of Anta's brand to DTC, the gross profit margin of this branch has been improved to more than 50% (with significant changes after 2020).

During the same period, due to changes in the domestic and foreign macro environment, FILA's terminal sales still faced considerable pressure, and its inventory situation was very prominent, with slightly inferior performance relative to Anta's brands (and other domestic high-end counterparts). The company has made certain concessions in discount rates, resulting in a decline in gross profit margin to the current 64%. However, in terms of profit margin, although the gross profit margin of ANTA brand is in the first tier, due to the fact that it still has a certain proportion of wholesale (distributor) business, the expense ratio (mainly sales expenses) of ANTA brand is relative lower. Therefore, there is no significant difference in operating profit margin between FILA and ANTA brands.

2.3 Continuous expansion of stores, but with differentiation

After understanding the different performances of FILA and ANTA brands in the past few years, I believe that everyone can understand why ANTA brand's stores will show a trend of re-expansion after several years of streamlining. However, the overall proportion of FILA stores has recently remained stagnant (excluding the number of DESCENTE stores and KOLON SPORT stores), slightly decreasing to 17%, compared with previous years when FILA's store openings were the main driving force for growth.

Moreover, in the second half of last year, ANTA stores saw a net increase in numbers for the first time since the outbreak. Considering that LI-NING also vigorously expanded its stores in the second half of last year, it shows that the attitude of leading companies towards market share is very consistent. After 2-3 years of continuous washing, when there is a faint improvement in the industry, everyone is not idle, but is trying to make a big effort (from the ratio, LI-NING is more aggressive).

For this year's plan, ANTA still maintains this trend. FILA continues to stabilize and maintain around 1900-2000 stores. ANTA plans to re-open 10,000 stores, with approximately 200 new stores for ANTA and children's clothing stores, respectively.

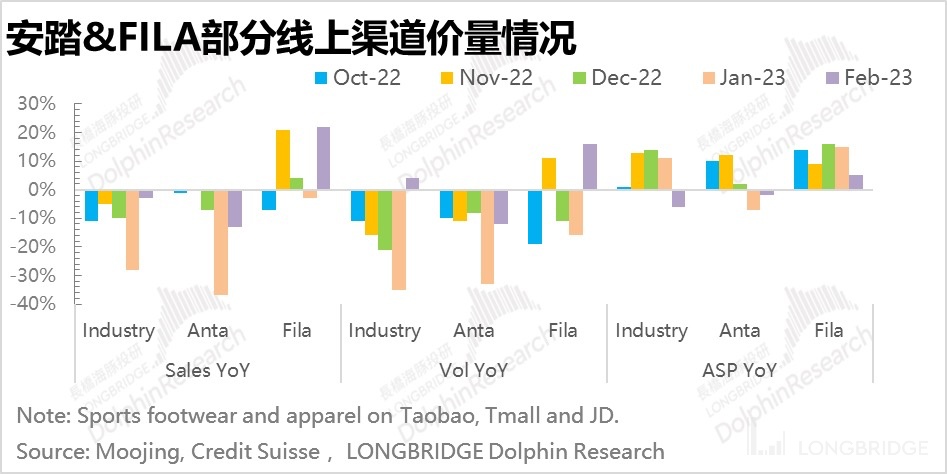

2.4 Price increase and quantity decrease

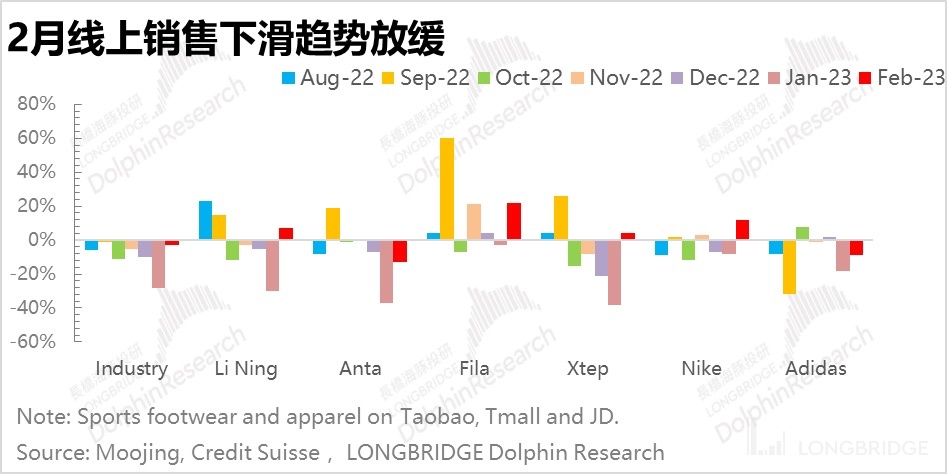

Similar to LI-NING's situation, both FILA and ANTA brands show a state of price decline and quantity increase. According to online sales data (Taobao, Tmall, and JD.com), from the fourth quarter of last year to the present, both the industry and companies (including LI-NING) have basically experienced a decline in sales volume, only LI-NING and FILA have slightly reversed in the second quarter of this year, and sales revenue mainly comes from ASP increase support.

Three, shoes are easier to sell

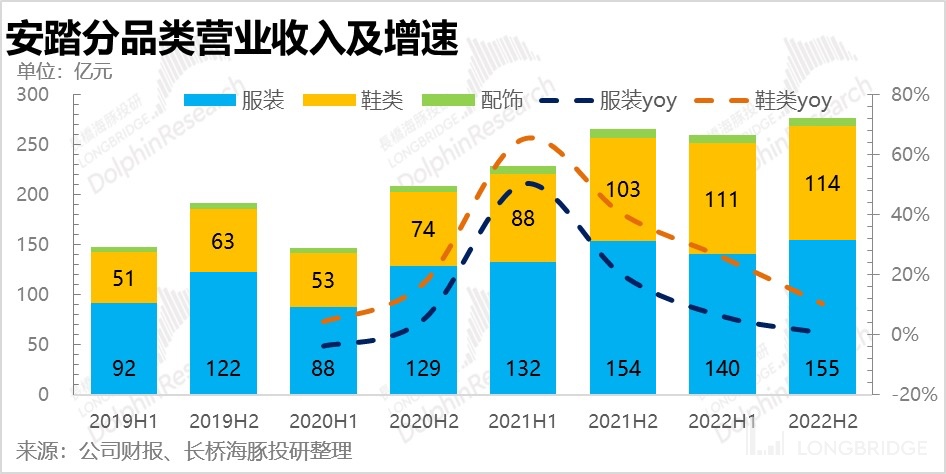

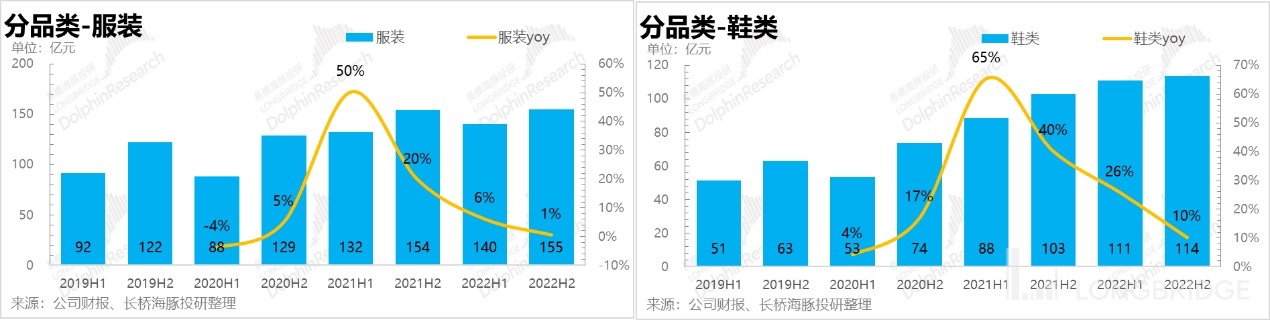

Looking at it by category, it is completely different from market expectations.

Similar to Li Ning, Anta's growth in shoes is better, and in the previous year, it was not a small base period. Anta's shoe products have stood at more than 10 billion yuan for three consecutive periods (the market expected 9.8 billion in the second half of last year), basically confirming that Anta can maintain a certain direction of growth as a whole.

In the second half of the year, Anta's clothing sector hardly grew, only 1%. Although there is a big deviation from the market expectations (170 billion yuan, higher growth rate is required, and the difference is too large to be ignored), but in the environment of last year, not having negative growth is already a very ideal state, especially At the same time, the gross profit margin is still within a controllable range. The gross profit margin of the clothing sector has only slipped by 1pct, and the gross profit margin of the shoe sector has slipped by 3pct.

4. Can the industry rise?

As we mentioned in the comment on Li Ning's financial report "No matter if it's life or death, fight to the end?" before, the industry had a very difficult year last year, and the year-on-year growth rate of China's sports apparel retail sales was only 2%. In the social retail data of January and February this year, there seems to be some budding states (based on the high base period of the previous Winter Olympics). From the latest online monitoring data, various brands seem to have eased (Li Ning and FILA), and the downward trend of the industry is also slowing down.

In addition, unlike January, Li Ning's market share increase trend is more obvious (Dolphin likes Li Ning more), FILA and Anta's performance is slightly inferior, and Nike and adidas are actually regressing.

5. Where did the inventory go?

In the previous issue, we talked about the fact that Li Ning's inventory pressure was slightly smaller in the early stage. Anta still has a relatively heavy burden. What surprised Dolphin more is that while Anta's gross sales difference has hardly changed, the inventory change is not very obvious (the discount rate of the next door Lao Li has increased while inventory is also increasing). **Combining with the trend of the industry in the past six months and facing great pressure in the terminal, either increasing discounts to maximize turnover (sacrificing gross profit), or maintaining tone and waiting for the industry to turn around (maintaining gross profit, passively accumulating inventory), it is difficult to achieve both. Li Ning was unable to do both, with a drop in gross profit margin and an increase in inventory, although not much.

In my opinion, Anta may have continued to pass some of the inventory pressure on to dealers. If the industry continues to struggle in the future, this approach will only make things worse. Therefore, it is not advisable to be too happy about some of the data in this issue too early.

VI. Costs & Expenses

As we examined before, due to the improvement of DTC, the comprehensive gross profit margin is steady, so we won't repeat it here. In addition to cost-efficiency efforts, the company has done its best to control expenses, mainly through more obvious control of advertising spending.

Overall, Anta's report card this time is still satisfactory. From the perspective of the basic market, the expansion is relatively orderly, which also conforms to the industry trend, and the trend of market share increase is still relatively obvious. However, it cannot yet be concluded that there are some contradictions between the trend of change in gross profit margin and inventory in this period and the industry, and the trend of future changes needs to be observed.

Dolphin "Anta Sports" Historical Articles:

Earnings season

August 31, 2022 telephone conference, "Anta: The effect of DTC transformation continues to be reflected, and the development momentum of high-end brands is good."

April 14, 2022 telephone conference, "Anta Sports 22Q1 Flowing Telephone Conference Summary."

March 22, 2022 telephone conference, "Anta Sports Telephone Conference Minutes: Short-term fluctuations in the epidemic, the 22-year goal can still be achieved smoothly." On March 22, 2022, Financial Commentary on ["FILA's Myth of High Growth Being Shattered, How Far Can Anta's Story Go?"](https://longbridgeapp.com/news/58156511)

On August 24, 2021, Financial Commentary on ["Anta Sports, the Light of Made-in-China, Keeps Pace with Adidas and Nike"](https://longbridgeapp.com/topics/1076225?invite-code=032064)

Depth:

On September 10, 2021, ["Anta Sports (Part II): The Unstoppable Counterattack"](https://longbridgeapp.com/topics/1137088?invite-code=032064)

On September 6, 2021, ["Anta Sports (Part I): From 'Grassroots Style' to 'Celebrity Style', the King of Made-in-China's Counterattack"](https://longbridgeapp.com/topics/1122538?invite-code=032064)

Hotspots:

On October 12, 2021, "After Collective Selling, Can Anta Still Perform?" (https://longbridgeapp.com/topics/1199974?invite-code=032064)

Risk Disclosure and Statement of this article: Dolphin Research's Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.