Posts

Posts Likes Received

Likes ReceivedLi Ning: Fight to the end, even with the odds against us?

Hello everyone, I'm Changqiao Dolphin.

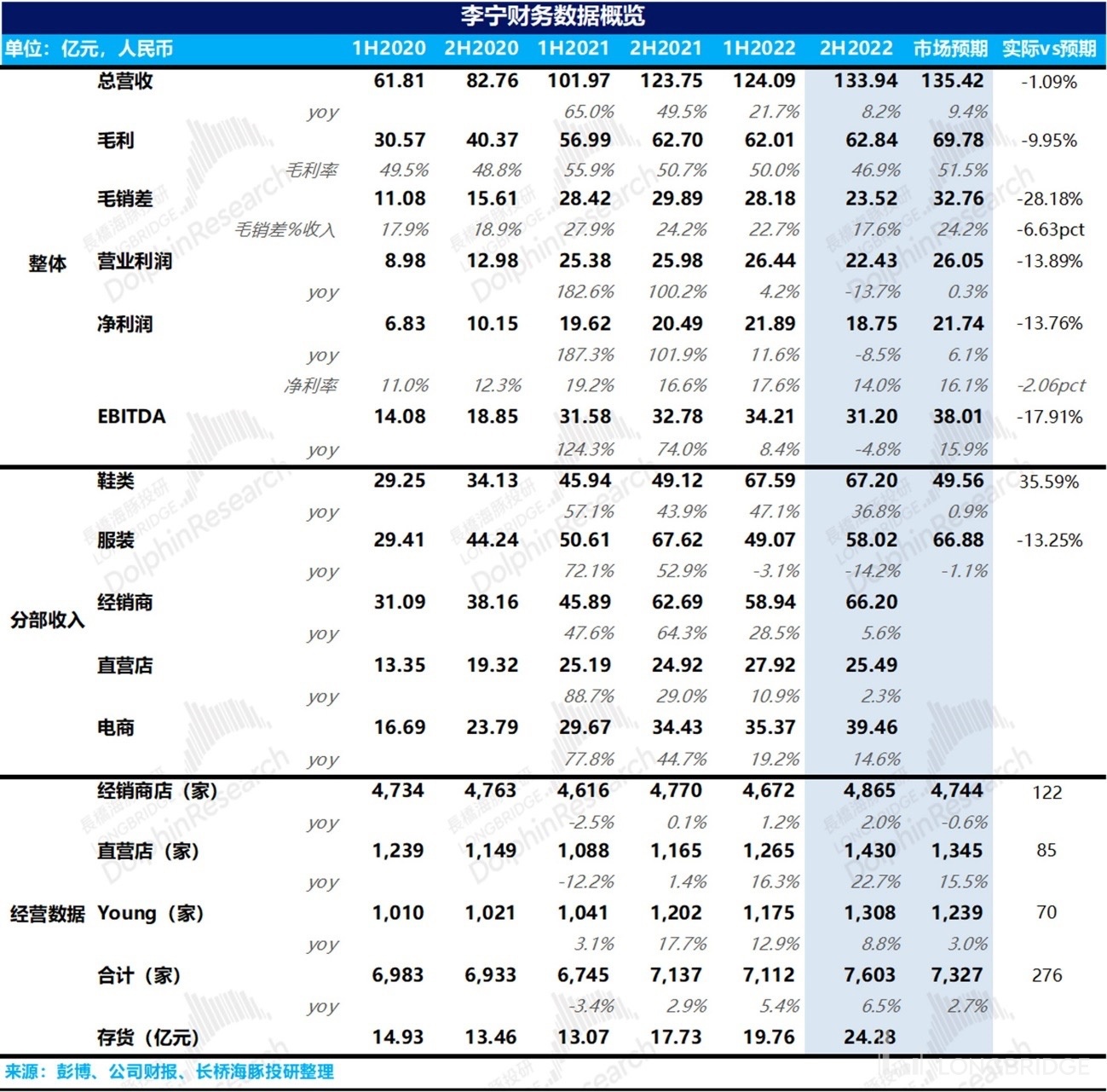

Before Hong Kong stock market opened on March 17th Beijing time, Li Ning ($LI NING(2331.HK)) released its full-year results for 2022. Based on the dual impact of limited physical store operations in the second half of last year and rapidly rising infection rates, I (Dolphin) speculated that overall sportswear sales in the second half of the year would not look good. What is particularly surprising is that the gross sales margin decline is quite severe, which has affected the company's net profit in the second half of the year to decline below market expectations.

The key points are as follows:

1. Slowing Revenue Growth: Given the shorter business hours last year, it was already difficult for offline channels to maintain growth. Looking at the operating conditions of physical stores, the overall revenue increase mainly comes from the continuous expansion of distribution channels. However, same-store sales, whether in direct sales or distribution channels, have declined, only to varying degrees.

2. Expansion of Physical Stores: It exceeded market expectations, not only for "Young" stores, which the market was eagerly anticipating, but also for aggressive expansion of directly-operated stores. However, considering risk preferences, the market is unlikely to give more valuations during headwinds and rather concerned with operating risks. The offline business has just begun to recover and the current expansion speed is in a gambler-like state. If the industry is truly reversing, Li Ning can reap more repair dividends. If not, it will be a heavy burden.

3. Revenue: It seems that the company has sacrificed gross profit margin and expense ratio, and spent all its efforts to maintain positive revenue growth. Among different categories, the growth momentum of shoe sales is even stronger than expected, mainly due to product improvement. However, the downward trend in clothing sales basically follows the industry trend, and Li Ning's high base last year has further worsened this trend.

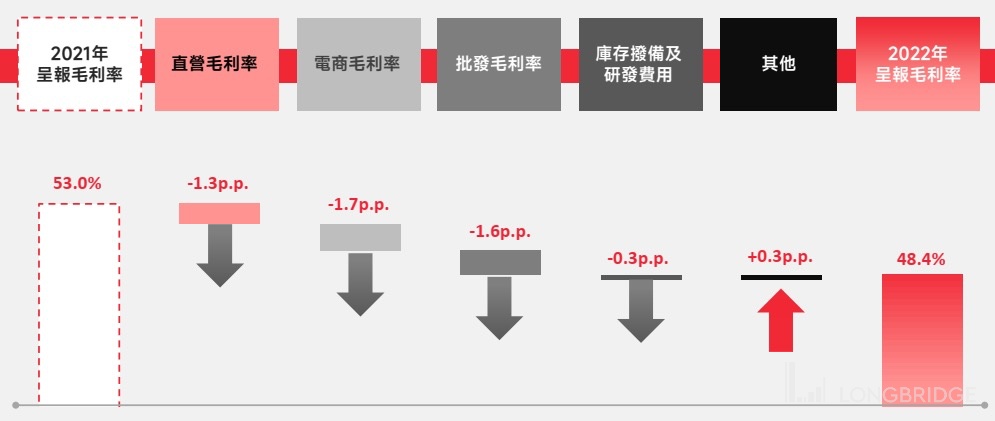

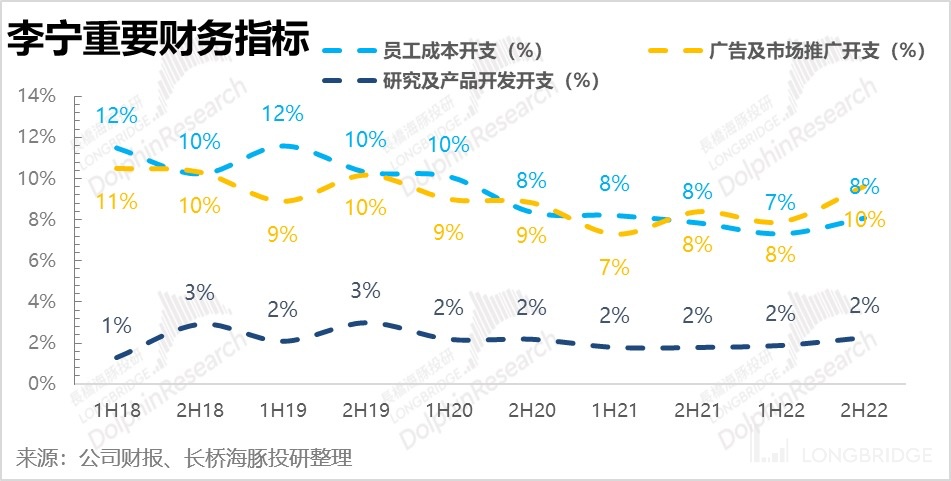

4. Increased Discount Efforts (main impact) and Fluctuations in Costs (secondary impact) Led to Gross Margin Decline. Meanwhile, the increase in sales expenses combined to create a significantly worse gross sales margin than market expectations, down by 7 percentage points. Net profit margins can only be saved by interest income. In addition to sales expenses, other expenses, such as employee costs and research and development costs, are also increasing.

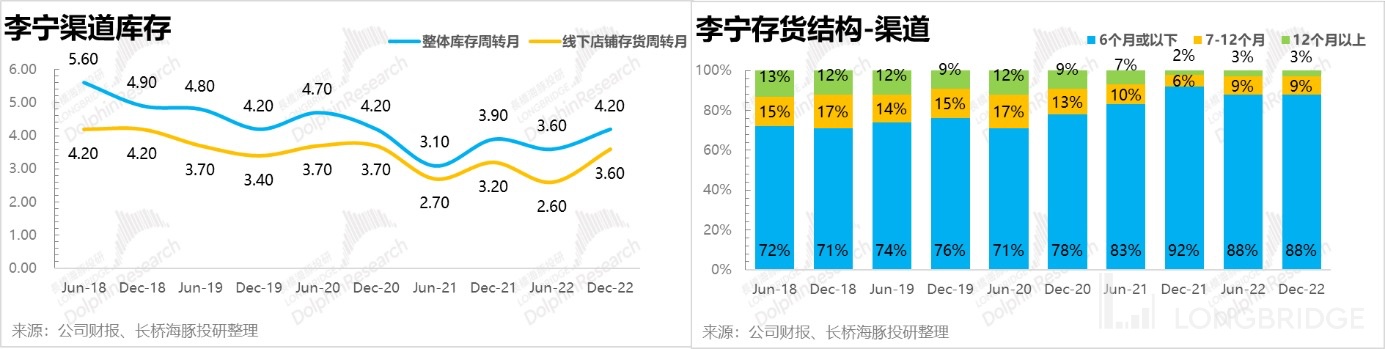

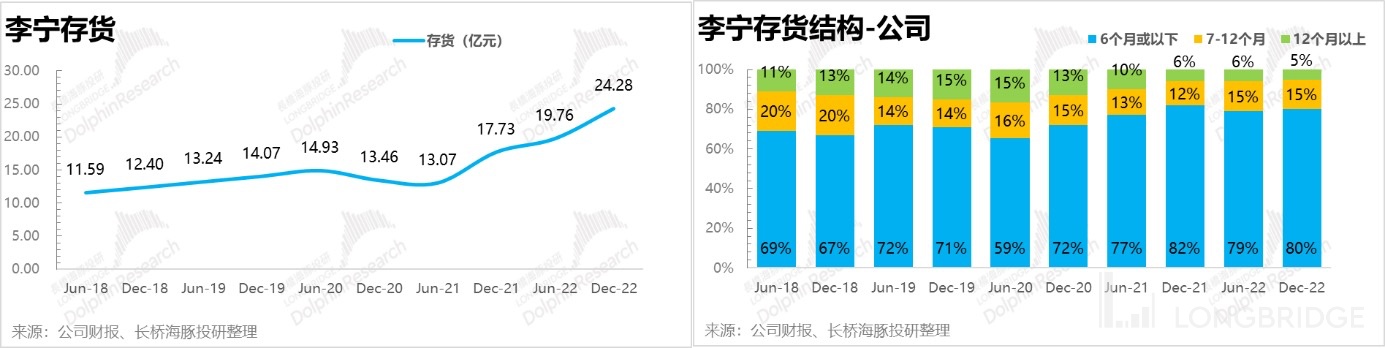

5. Improvement in Inventory Trends Stopping: During this round of the inventory cycle, Li Ning is in a relatively advantageous position, and the pressure is not as great as that of its peers. Store inventories are basically controlled below 4 months, and for 2 quarters, controlled below 3 months. However, the continuous reduction in inventories has indeed stopped, and by the end of last year, inventories showed an unusual upward trend. Although it is still manageable at this point.

Dolphin's Overall View:

Overall, Li Ning's performance in the second half of the year can be considered as the tallest among dwarfs. However, because its peers had already released their operating data earlier, Li Ning had not previously announced theirs, and it is understood from some industry information that Li Ning's unit price is still very stable. Therefore, the market is more optimistic about the net profit expectations. The revenue gap is not great this time, but the gross sales gap is somewhat unbelievable. However, after careful reading, Dolphin believes that Li Ning has put more energy into maintaining its scale, temporarily sacrificing gross profit margins and expense ratios. By increasing discount efforts and strengthening channel expansion, Li Ning has made a fairly big bet on the reversal of the future industry. In the second half of last year, when the industry was in difficulty, such sacrifices, although maintaining revenue, did not continue to improve inventory, indicating that the results of maintaining revenue were still quite tragic.

However, Dolphin still sees some hope, that is, when the industry is not doing well, not only Li Ning, but also the overall domestic brand is carving out its own way with its own ability. Domestic market share is continually increasing, not only through the improvement of concentration, but also by squeezing the market share of overseas brands over the past two years. As mentioned in the previous in-depth report, "How much longer will Li Ning's 'cyclical disaster' last?" Chinese brands are still popular. In this trend, Li Ning still has a good chance of winning.

_If you are interested in following the conference call for earnings guidance, Dolphin will subsequently share conference call notes through the Long Bridge App community platform or investment research group. Interested users are welcome to add the assistant WeChat account "dolphin R123" to join the Long Bridge Dolphin Investment Research Group and receive them in real time. _

The following is a detailed interpretation of the financial report:

1. Just managing to maintain revenue, gross profit margins did not hold up

Last year was a tumultuous year, not only enduring coronavirus-induced fluctuations, but also facing significant cost pressures for most manufacturing companies. Clothing manufacturing companies, especially sportswear companies, may not be as sensitive to costs as other manufacturing companies due to their higher product gross margins (around 50 percent), but with a sharp decline in revenue growth, any tiny differences will be magnified.

Throughout last year, Li Ning's revenue growth was only in the single digits, even disregarding the impact of the 2020 base year (the compound annual growth rate from 2021 to 2019 reached 25-30 percent), and the gap was quite obvious. Particularly in the second half of the year, there was almost no growth, and offline stores performed even more poorly due to restricted business hours.

Dolphin believes that given the environment last year, particularly the pandemic outbreaks which affected offline sales and the peak in infection rates in the fourth quarter which had a double impact on traffic, achieving growth was already quite difficult.

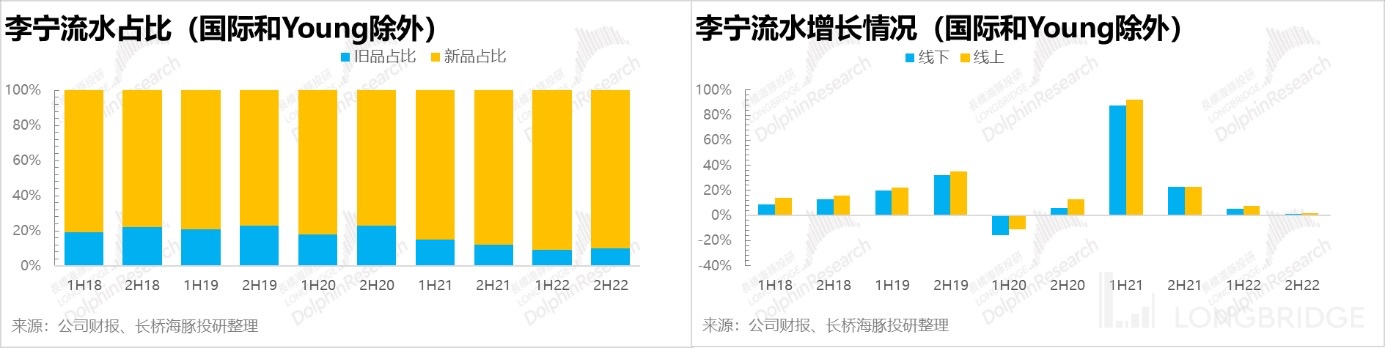

Li Ning (excluding international operations and Young) still has an absolute advantage in new products. Regardless of the acceptance of consumers or the burden of enterprise inventory, Li Ning currently has no major burden.

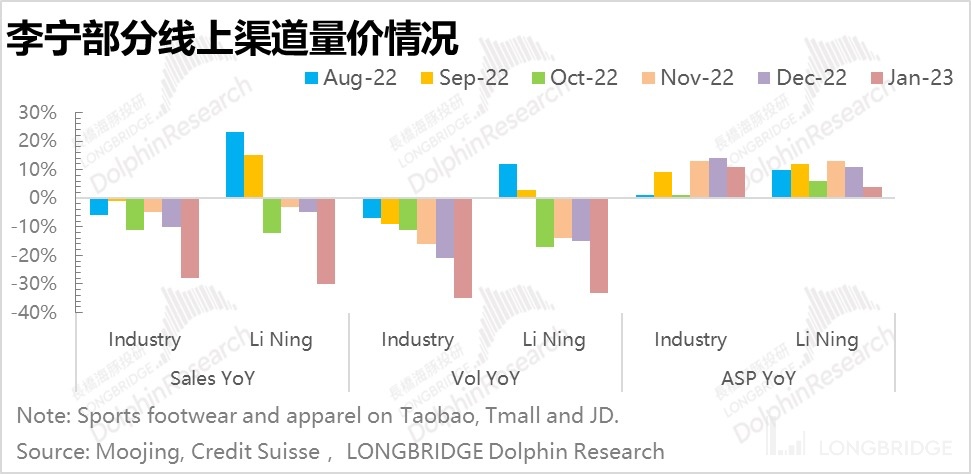

Annual revenue reached 25.8 billion, which is basically in line with market expectations. Of course, market expectations have been adjusted based on the performance in the fourth quarter of last year. Although the company did not make a performance forecast, the fact that can be perceived is that online, the flow of various sportswear brands on the major online retail channels (Taobao, Tmall International, Jingdong) in China in the second half of last year was basically a single-digit decline or flat state. Offline, the store operation was restricted, and the decline of single stores has almost been determined.

Annual revenue reached 25.8 billion, which is basically in line with market expectations. Of course, market expectations have been adjusted based on the performance in the fourth quarter of last year. Although the company did not make a performance forecast, the fact that can be perceived is that online, the flow of various sportswear brands on the major online retail channels (Taobao, Tmall International, Jingdong) in China in the second half of last year was basically a single-digit decline or flat state. Offline, the store operation was restricted, and the decline of single stores has almost been determined.

And two months ago, Anta Sports (2020.HK) had already released its operating performance. The revenue of Anta and FILA brands was negative growth. Therefore, the market did not originally have high expectations for Li Ning's revenue.

In the previous in-depth report "How long will Li Ning's "periodic disaster" last?", the Dolphin mentioned that Li Ning used a longer time than its peers to digest the inventory in the last inventory cycle. Realizing the painful lessons, Li Ning is slightly lower than its peers in this inventory cycle, and the burden is not too heavy.

From the perspective of flow and revenue, Li Ning can be regarded as the tall one among the short ones. But even so, it is the result of sacrificing gross margin and expenses.

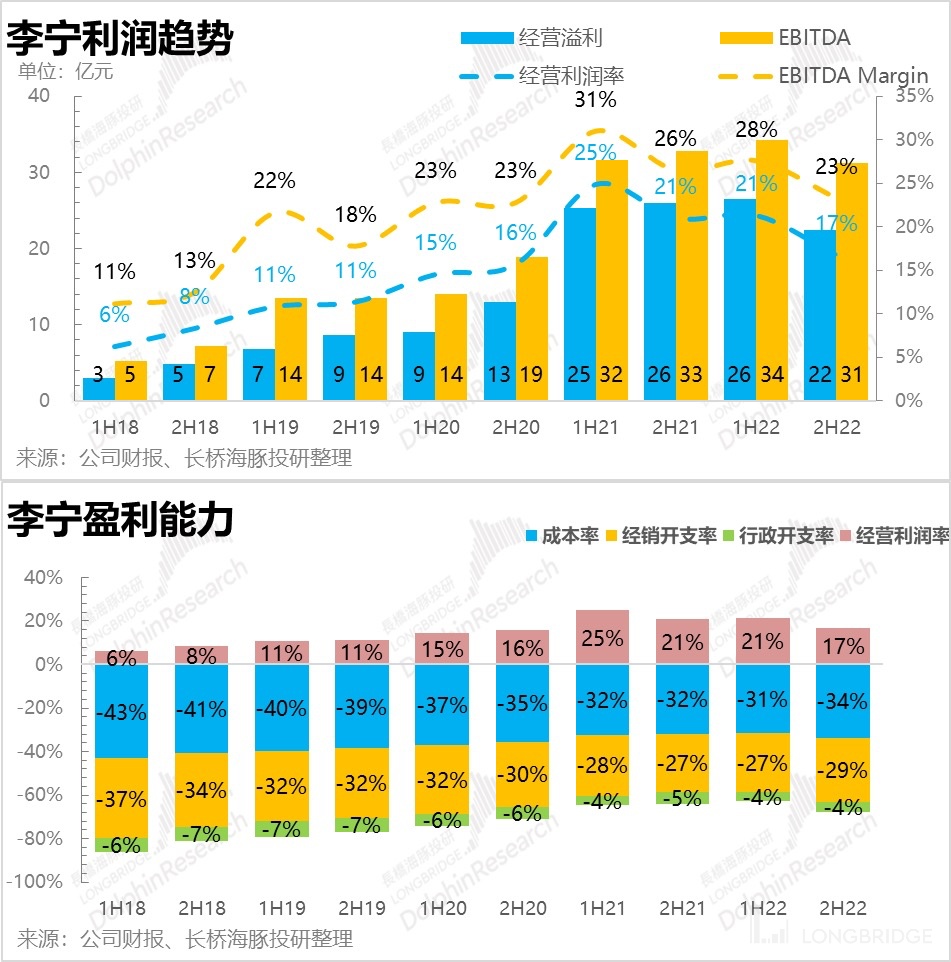

From the marginal perspective, the company's revenue growth rate in the second half of the year dropped one more level, with a growth rate of only a high single digit, which restricted the net profit to around 2 billion. In the situation where the revenue growth rate is difficult to maintain, a slight fluctuation in gross margin and expense ratio is likely to cause a decline in net profit.

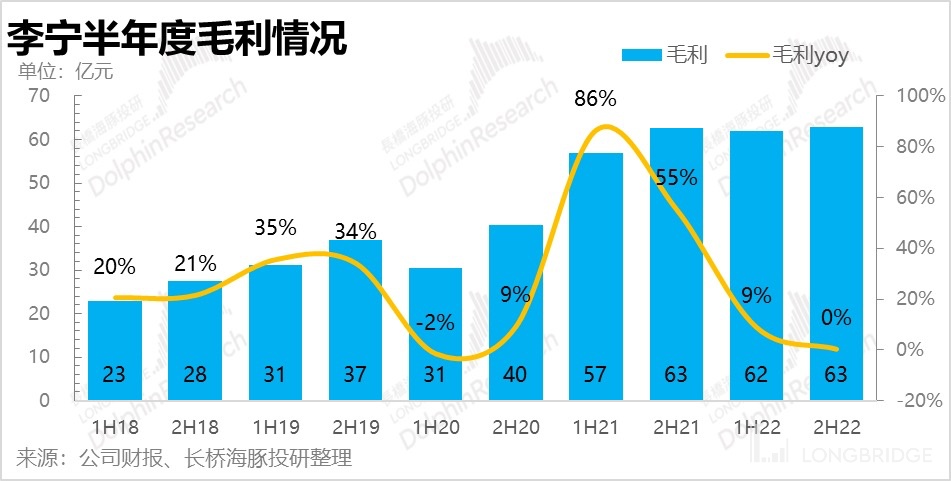

Li Ning is just like this. After enjoying a period of high gross profit for a period of time, it finally couldn't hold on in the second half of last year. Its stock price fell for the first time since 2021 and even fell below 50%, the lowest in nearly five years.

On the one hand, due to the rise in costs and increased discounts (which have a greater impact), the gross profit margin fell by 3.8 percentage points in the second half of the year (a decrease of 4.6 percentage points for the whole year, and the negative impact is even greater offline), and on the other hand, the increase in marketing promotion led to the increase in the sales expense ratio in the second half of the year. In total, the gross sales difference was 6 percentage points lower than market expectations, which was far below expectations. I thought it was difficult to sell goods in the second half of the year, but I didn't expect it to be so difficult.

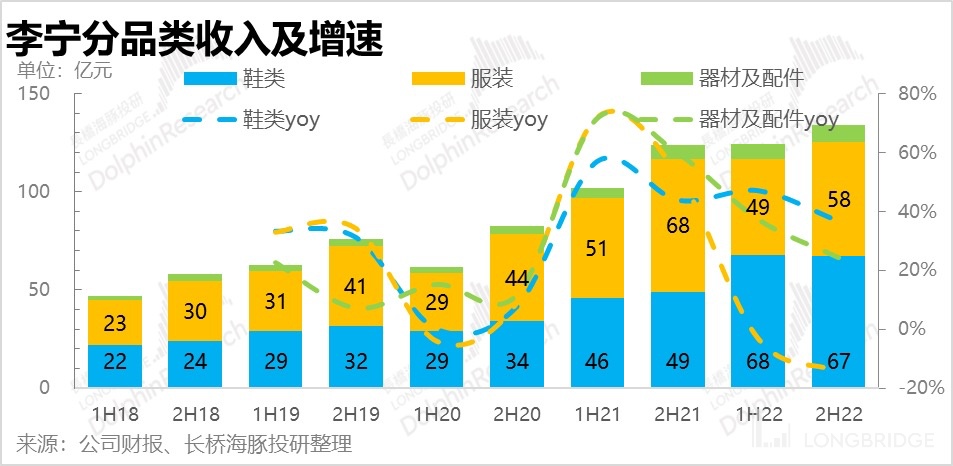

Second, shoes sell better than clothes

Looking at different categories, it is completely different from market expectations.

Li Ning's shoes still maintain a high growth trend (no wonder it is Li Ning's trump card). It is not easy to achieve such a growth rate. In fact, the base for shoe sales in the second half of the previous year was not low, and in the second half of last year, in addition to the interference of the epidemic, the traffic in December also decreased significantly due to adjustments in epidemic prevention policies. The decline in the clothing category performance is in line with the industry situation. However, due to the high base of Li Ning's clothing category operating income in the second half of 2021 (reaching 6.8 billion yuan, the highest in history), it has intensified the downward trend of Li Ning in this category in the second half of last year.

Overall, these two major categories had a similar growth rate before 2021. However, as the base grew larger in 2021, the gap began to widen gradually, with Li Ning's shoe category having a stronger growth momentum.

It is understood that not only Li Ning, but also other sports brands, it is easier to create explosive points in the creation of popular products with shoes than with clothing categories, and it is also easier to stand out. The recognition of domestic brands of shoes is slightly higher, and many series of items have been created in the past that have been popular. Not only for wearing purposes, some styles have collection value. However, the collectability of domestic brand clothing categories is slightly weaker, and basic classic sports jerseys are from overseas brands.

What is relatively difficult for Dolphin is that in the second half of last year, the ability to hold steady was basically dependent on the increase in ASP. Taking online sales as an example, most brands, including Li Ning, performed very poorly in terms of sales volume, especially in the fourth quarter of last year. However, the proportion of online sales is currently not high. Most brands are maintained at around 30%, and the main force is still offline. Moreover, there is a trend of continuous diversion from online to offline recently.

III. Heavy dependence on offline sales, continuous expansion of stores

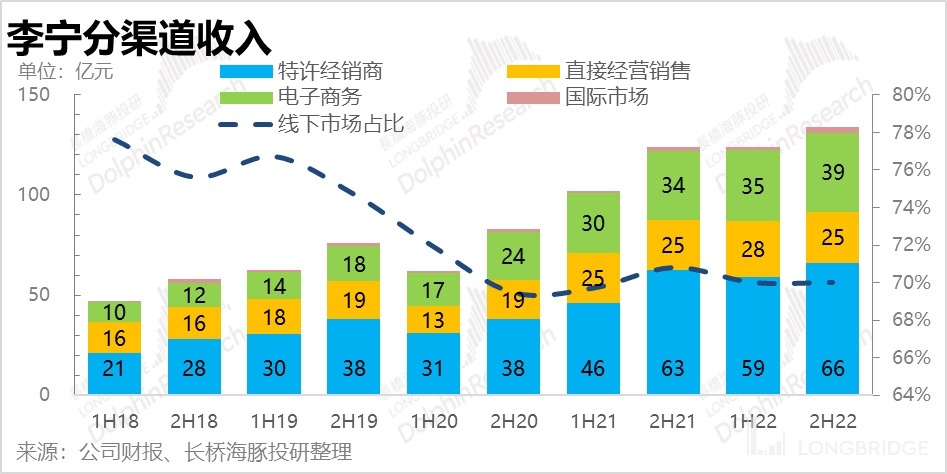

Next, let's take a look at Li Ning's channel performance. The company's main sales channels still rely on offline sales. Against the backdrop of the relentless attacks by e-commerce businesses, offline sales still account for 70%.

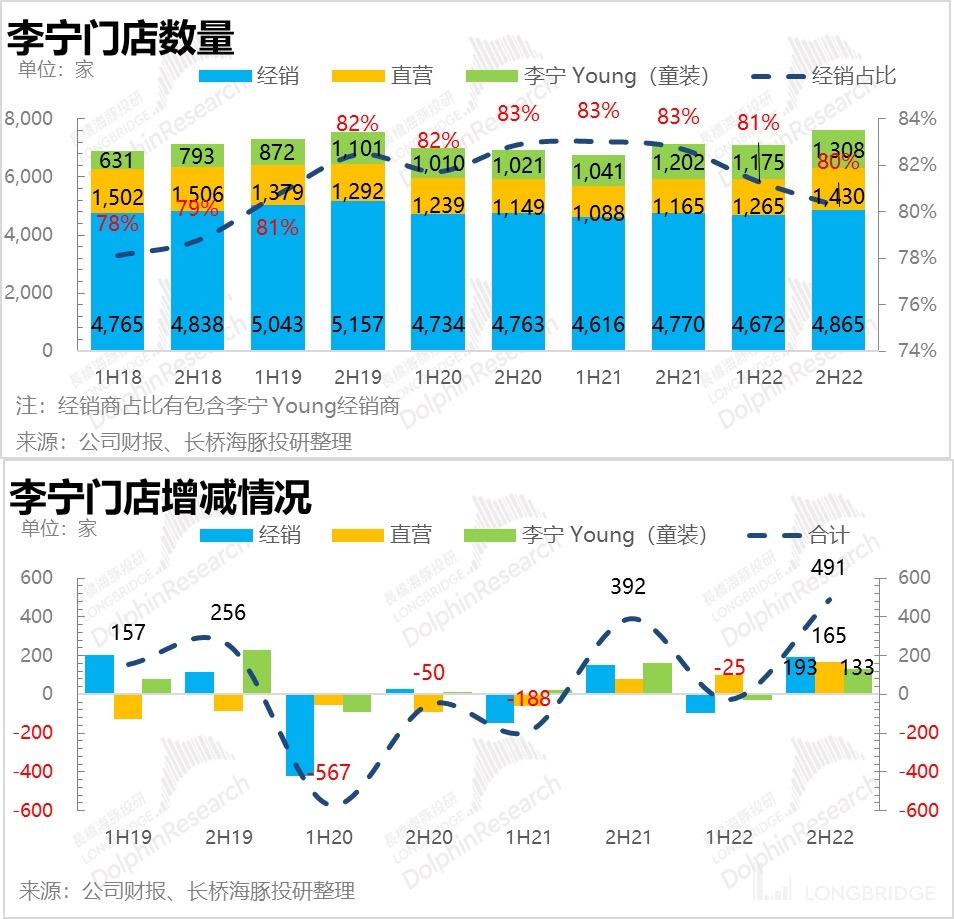

Before we look at the specific performance of the business segments, let's take a look at the store expansion.

3.1 Continuous expansion of stores

Store expansion is also a relatively scarce highlight seen by Dolphin in this financial report.

Despite the outbreak of the pandemic in the second half of last year, the company still maintained an increase in channels, and this increase far exceeded market expectations. Previously, the market's expectations for Li Ning's Young segment were slightly higher, and as one of the few high-growth sub-sectors in large industries such as apparel, the performance of children's clothing has been quite good. Li Ning's performance in this area last year was also considered average.

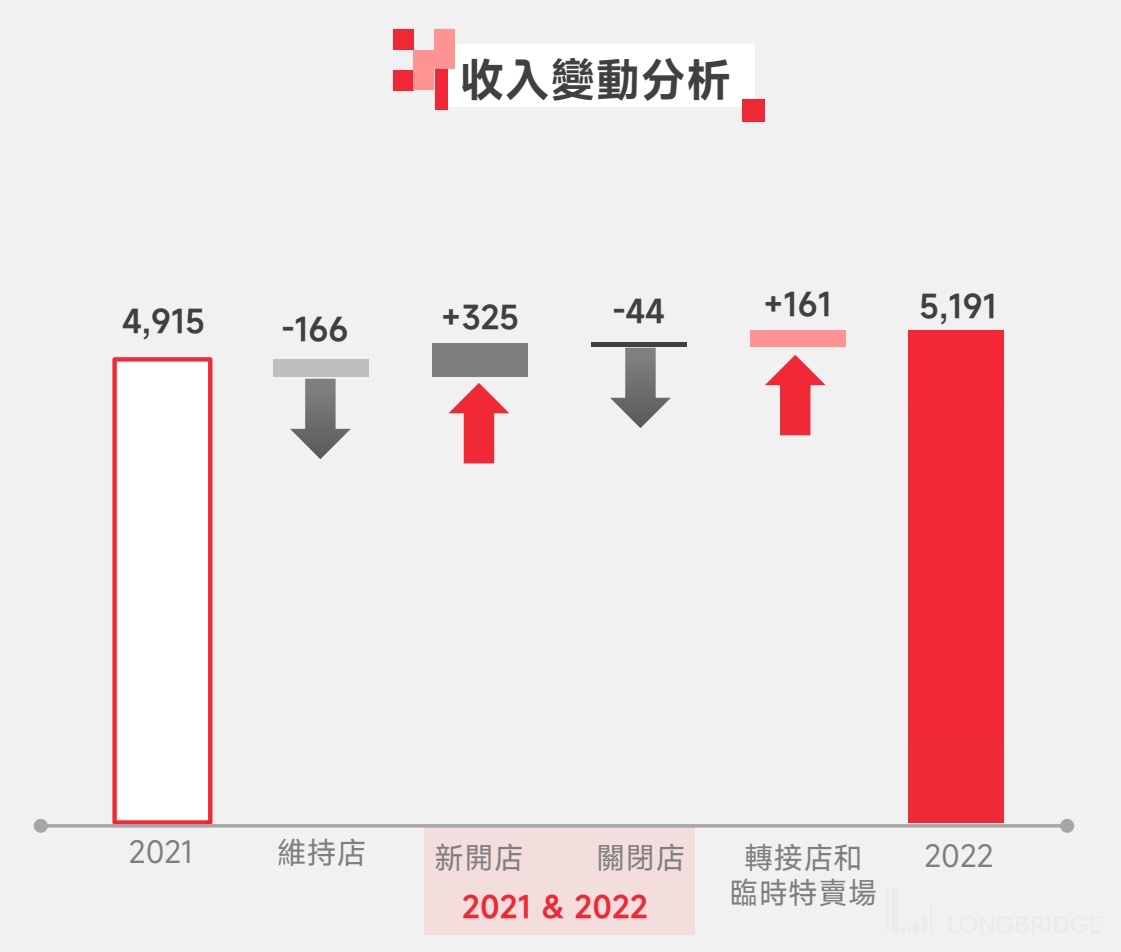

The highlight is that Li Ning continued to expand its channel with large stores as the core in the second half of last year, and the effect was very obvious. Both the number of distribution outlets and direct sales outlets increased beyond expectations. With the trend of being diverted from online to offline, after the adjustment of epidemic prevention policies, the passenger flow of offline stores has gradually recovered. At this time, channel expansion is definitely advantageous for the company's continuous market share growth. 3.2 Offline distribution resists the trend

Both dealer channels and direct sales channels are able to maintain positive growth, stabilizing the overall offline growth rate at a mid-single digit level.

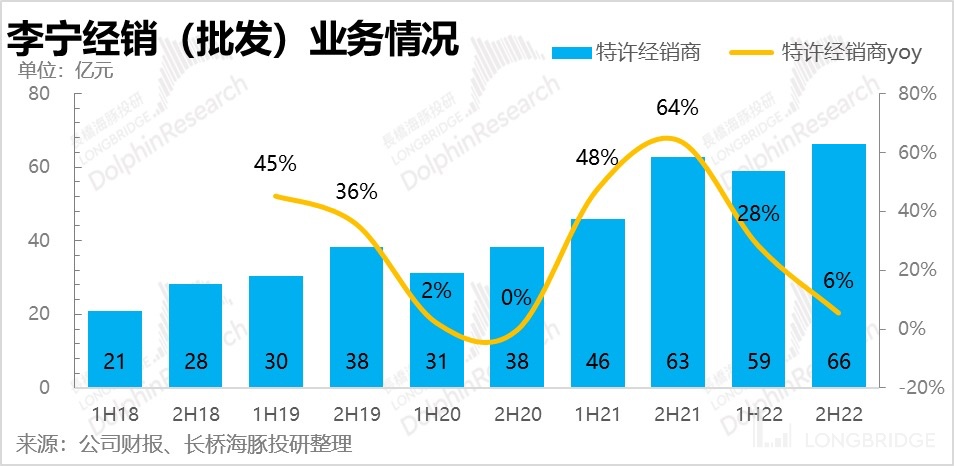

1) Dealer channel

Despite efforts to maintain growth at 6%, it is difficult to avoid a declining trend in dealer (wholesale) business. In fact, in comparison to the channel expansion mentioned in the previous section, it is clear that although the number of channels continues to expand, the slowdown in business growth is essentially due to the decline in same-store sales, especially in the fourth quarter of last year, where same-store sales of dealerships dropped nearly 20%.

2) Direct sales channel

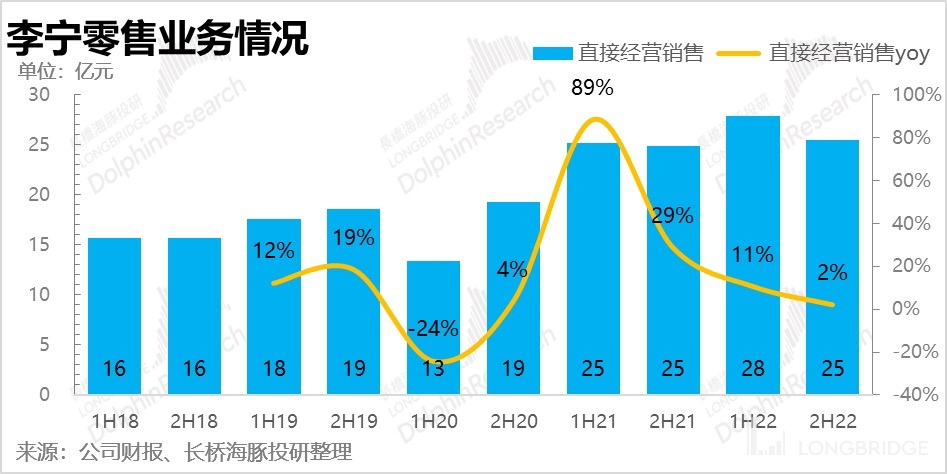

In contrast, the performance of direct sales is somewhat awkward, although it expands faster, the decline in same-store sales is also faster. Especially in the fourth quarter of last year, the same-store sales decline almost reached 30%. From the change in revenue throughout the year, the contribution of the company's direct sales business income comes from new store openings, while store efficiency is basically at a plateau or a decline in single digits.

3.3 Online business is relatively small in proportion

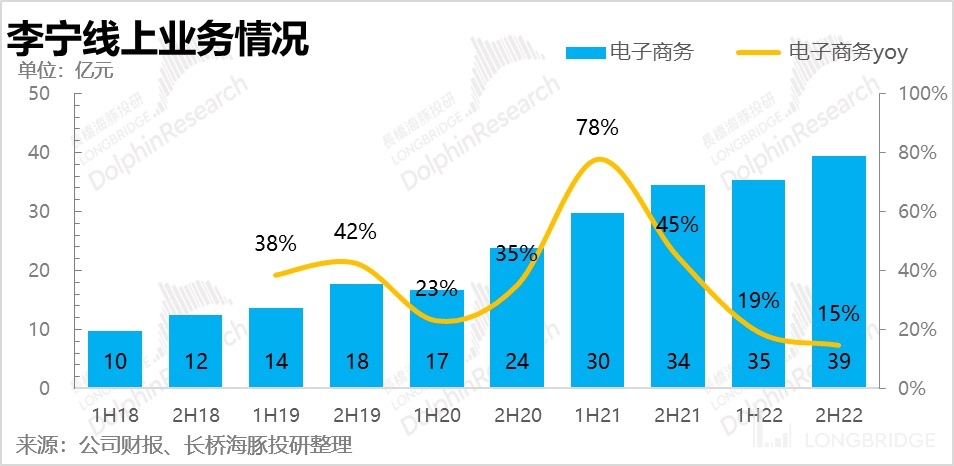

Online business is one of the better performing sectors, maintaining stability throughout the four quarters of last year without any single quarter decline.

IV. The industry faces great difficulties or sees the buds of growth

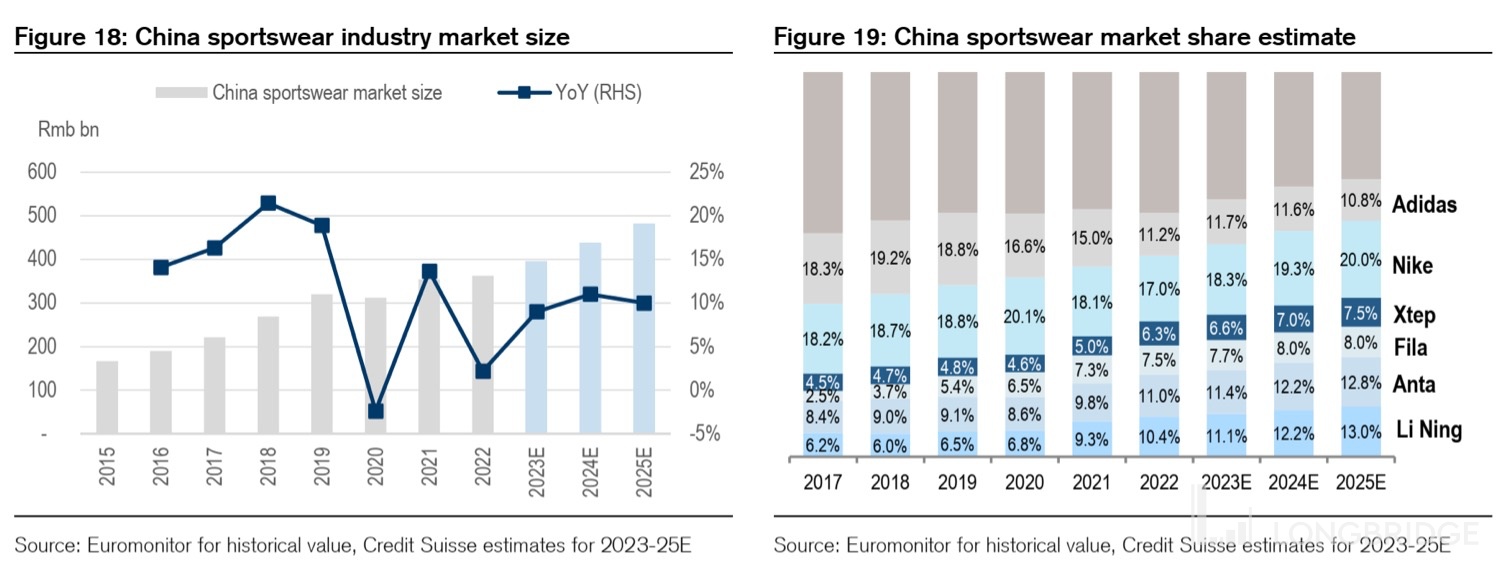

According to Euromonitor's statistical data, the domestic sportswear industry's retail sales growth rate in 2022 is only 2% year on year. The main reason for this is the prolonged epidemic control measures in some domestic first and second-tier cities, including Shanghai, from March to May last year. In addition, as the year-end approached, the domestic epidemic gradually spread, and most of the retail stores running offline were affected. The drop in customer traffic caused by the peak infection rate in December dealt the final blow to offline retail sales. However, despite such a background, domestic brands have still achieved good results compared to international brands. Among domestic brands, the combined market share of the top three has increased by 3.7pct and overall domestic brands have increased by 4.9pct. While domestic brands such as Anta and Li Ning have worked hard to support themselves, Nike and Adidas continue to lose market share in China.

The improvement in the market share of domestic brands is due on the one hand to the continuous strengthening of the domestic product power, with brands such as Li Ning continuously improving the quality and design of their products that better fit the current consumer preference for Chinese-style fashion, which was also repeatedly mentioned in our previous in-depth report.

On the other hand, we cannot ignore the continued impact of the BCI event. Taking online sales as an example, since the BCI event, the market share of Li Ning and Fila has increased significantly in channels such as Taobao and Tmall, while the performance of Anta has been average, and Xtep has almost no upward trend in the major categories (shoes, clothing). The difference in the market share increase between domestic high-end brands and non-high-end brands essentially reflects the continuous shift in customer preference from Nike and Adidas.

Looking towards the future, it has become an established fact that offline retail traffic is gradually recovering. According to the social and retail data released by the National Bureau of Statistics for January and February, the overall growth rate is 3.5%, with apparel growing at 5.4%, which is a relatively high growth rate among the social and retail categories, and last year's base was not low due to the Winter Olympics held in Beijing.

Against the backdrop of high base numbers in January and February, it can be said that repair is already underway. Coupled with the fact that the industry has been at a relatively low base since last year's second quarter, we believe that the recovery will gradually improve over the next three quarters.

At the same time, the offline performance may be more embarrassing. According to data from testing agencies, the online sales of sportswear are still in a state of sustained negative growth (data is up to January, partly due to the impact of the Spring Festival).

Regarding the life-threatening inventory, due to the early inventory crisis, Li Ning was cautious after 2018, and with the strong sense of design of new products and popularity in the circulation market, the company is now in a relatively favorable position in this inventory cycle. The company’s inventory is still being depleted, which was very ideal in the first half of last year (less than 4 months), but after a difficult business in the second half of the year, there were some signs of deterioration in inventory. However, from the perspective of structure, the proportion of old products is still decreasing, which indicates that there were considerable discounts in the early stages of sales. Although this has increased the flow, it unfortunately hurts some of the profit margin.

VI. Costs & Expenses

6.1 Sacrificing Profit Margin

Last year, the gross profit almost did not grow, and the gross profit margin dropped by 4 percentage points. In the past, the company's gross profit margin had been relatively stable. As one of the top five domestic brands and the second largest domestic brand, the company has reached a considerable scale, and its gross profit margin is at a relatively high level (50%). Generally speaking, the impact of cost on its gross profit margin is not that great.

The greater discount intensity is the main factor that caused this. Some clues can also be seen from the inventory changes. The decrease in passenger flow has led to poor sales of goods at the terminal.

6.2 Increased Sales Expenses

Under these circumstances, increasing sales expenses is not a contradictory move, as all actions are taken to maintain income. In addition, employee costs and R&D costs have also slightly increased.

Thanks to the large amount of cash that Li Ning has on hand, the interest alone contributed an additional 300 million yuan to the company last year. Therefore, the decline in net profit margin is not as ugly as that in gross profit margin.

Overall, the industry has indeed faced considerable pressure in the past six months. As a leading company, Li Ning has tried its best to maintain its scale and continuously expand its channels, but at the same time, its profitability has been sacrificed. Currently, the industry seems to be entering a reversal phase. Will the first strike before dawn work? The Dolphin believes that the industry has already been struggling at the bottom for a long time, so the chance of a hit is greater.

Changqiao Dolphin's "Li Ning" Historical Articles: On February 1, 2023, the in-depth report "Is it time to reevaluate Li Ning's counterattack?" was released.

On January 31, 2023, the in-depth report "How long will Li Ning's 'cycle rob' last?" was released.

Risk disclosure and statement for this article: Dolphin Investment Research disclaimer and general disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.