Tonight, two non-farm payroll reports will be released simultaneously. Will "bad news" become "good news" for the market again?

Against the backdrop of Powell's clear shift towards "job preservation," the market is forming a new consensus: weak employment data will enhance expectations for further interest rate cuts by the Federal Reserve, potentially driving up U.S. stocks. A Bloomberg survey shows that the median for November's non-farm payrolls is only 50,000, with a forecast range from a decrease of 20,000 to an increase of 130,000; the unemployment rate is expected to rise to 4.5%, which, if realized, would be the highest since 2021. As for October's non-farm payrolls, there is even greater divergence among investment banks, with many institutions predicting negative growth

As the Federal Reserve has just completed its third interest rate cut of the year and the market is still debating whether there will be further cuts in January next year, the non-farm payroll report, delayed due to the U.S. government shutdown, is finally set to be revealed tonight, and it will be a two-in-one report for October and November. Against the backdrop of Jerome Powell's clear shift towards "job preservation," the market is forming a new consensus: weak employment data will enhance expectations for further rate cuts by the Federal Reserve, potentially driving up U.S. stocks.

On Tuesday evening Beijing time, the U.S. Bureau of Labor Statistics (BLS) will simultaneously release the non-farm payroll reports for October and November, but due to the suspension of household surveys during the government shutdown, the BLS will not publish data such as the October unemployment rate. The BLS has previously warned that the statistical error for the November household survey will be significantly higher than normal, and the volatility of related data may also be greater in the coming months.

From the expectations, the market has hardly formed a consensus. A Bloomberg survey shows that the median estimate for November non-farm payroll additions is only 50,000, with predictions ranging from a decrease of 20,000 to an increase of 130,000; the unemployment rate is expected to rise to 4.5%, which, if realized, would be the highest since 2021. As for October's non-farm payrolls, the predictions among investment banks are even more divergent, with many institutions expecting negative growth.

Goldman Sachs expects that non-farm employment in October will increase by only 10,000 (with a private sector increase of 70,000), and by 55,000 in November (with a private sector increase of 50,000), slightly above market consensus but below the average level of the previous three months. Morgan Stanley, on the other hand, predicts a decrease of 30,000 in October and an increase of 50,000 in November, with the unemployment rate expected to rise to 4.6%.

Morgan Stanley's Chief U.S. Equity Strategist Michael Wilson stated, the current market has returned to a state where "good economic news is bad news for the stock market," as a strong labor market would reduce the likelihood of the Federal Reserve cutting rates next year.

Morgan Stanley's Chief U.S. Equity Strategist Michael Wilson stated, the current market has returned to a state where "good economic news is bad news for the stock market," as a strong labor market would reduce the likelihood of the Federal Reserve cutting rates next year.

Government layoffs become the core variable suppressing non-farm payrolls

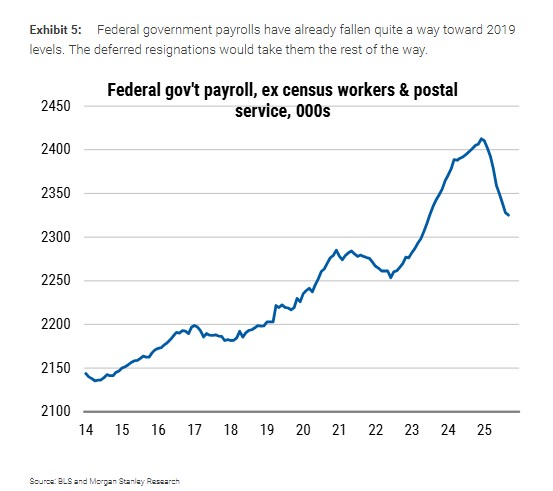

The biggest "technical noise" in this round of non-farm payrolls comes from the sharp contraction of federal government employment.

According to the U.S. Office of Personnel Management, approximately 144,000 government employees have accepted the "Deferred Resignation Program." It is expected that about two-thirds of these resignations will take effect in October, leading to a significant decline of 100,000 in federal employment.

Goldman Sachs expects this factor to drag down October non-farm payrolls by about 70,000 and November by about 10,000; Morgan Stanley, JPMorgan, Citigroup, Wells Fargo, and other institutions also believe there is a risk of negative employment numbers in October. In contrast, private sector employment continues to maintain moderate positive growth, but it is difficult to fully offset the impact from the government side

In addition, this year's Thanksgiving is relatively late, which may delay the start of holiday hiring and could suppress November retail and temporary job employment. Goldman Sachs estimates that this factor may reduce November non-farm employment by about 15,000, but the corresponding increase may be pushed to December. Historical data from the bank shows that in years when Thanksgiving is later, employment growth in the retail sector tends to be weak.

It is worth noting that due to the government shutdown setting a historical record of 43 days, this employment report faces multiple abnormal factors. The U.S. Bureau of Labor Statistics extended the data collection period for November, but could not retroactively collect household survey data for October, which means the October unemployment rate will be permanently missing.

Morgan Stanley assesses that the accuracy of the data will not significantly decline as a result. The bank points out that the accuracy of the November employment data will fall between the first release and the second revision, while the October data will be close to the standard of the third revision. Federal employees returned to work on November 13, during the November survey period, so there will be no direct distortion to the unemployment rate.

Goldman Sachs emphasizes that while the DRP (Deferred Retirement Plan) delay in resignations impacts total employment numbers, it will not affect private employment data, which will provide a clearer reading of labor market conditions. The bank advises investors to focus more on changes in private sector employment rather than the overall data affected by policy factors.

High-frequency data split: Employment is cooling, but not "collapsing"

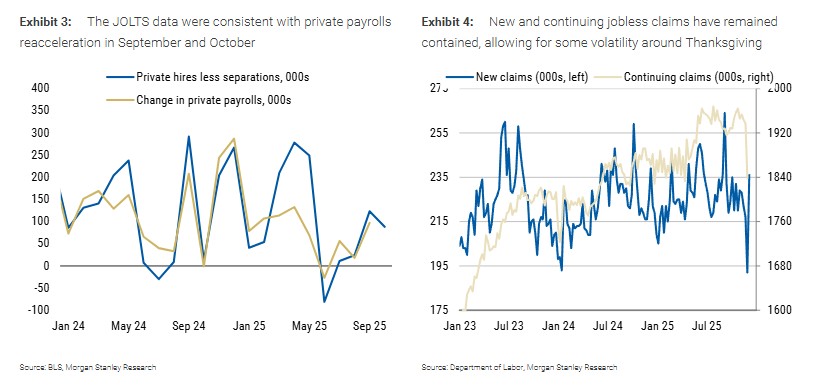

From high-frequency indicators, the U.S. labor market shows a typical "slowing down rather than collapsing."

On one hand, initial jobless claims during the November survey window were significantly lower than in September and October, with the four-week average continuing to decline; October JOLTS job openings slightly rebounded, indicating that companies are not laying off large numbers of employees.

On the other hand, ADP data shows that private sector employment decreased by 32,000 in November, and RevelioLabs' non-farm proxy indicators were negative in both October and November, with hiring momentum continuing to weaken.

Overall, layoffs remain controlled, but new job creation has clearly slowed, which is highly consistent with the Federal Reserve's emphasis on "cooling labor demand."

Powell's shift reshapes the interpretation of non-farm data

Both Goldman Sachs and Morgan Stanley believe that Federal Reserve Chairman Jerome Powell's statements after last week's FOMC meeting set the tone for the market.

Powell emphasized that the labor market faces downside risks and warned that non-farm employment data may overestimate job growth by about 60,000 positions each month. If revised, the current real employment growth rate may be close to zero or even negative. He also stressed that at this stage, policymakers are more concerned about the downside risks to the labor market rather than a resurgence of inflation.

This means that the market no longer simply judges non-farm data as "better than expected or worse than expected," but is more focused on: whether the data confirms that employment is continuing to cool, thereby providing space for further easing.**

"Bad Non-Farm" May Actually Be Good for U.S. Stocks?

In this context, the logic of the U.S. stock market is undergoing subtle changes.

Michael Wilson, Chief U.S. Equity Strategist at Morgan Stanley, pointed out that the market has returned to a familiar state: good economic news is bad news for U.S. stocks, while bad economic news may actually be good news. A strong job market means limited room for interest rate cuts, while a moderately weak job market helps solidify expectations for easing.

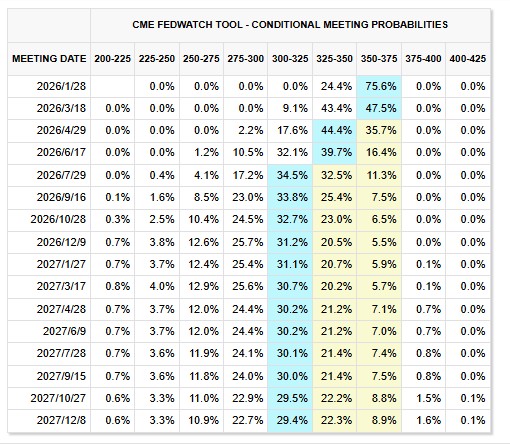

Currently, the market is betting on at least two rate cuts next year, higher than the one implied by the Federal Reserve's dot plot. As long as employment data does not show uncontrolled deterioration, a "weak but not collapsing" Non-Farm report is precisely the most comfortable range for risk assets.

From a pricing perspective, the market is not tense about tonight. The implied one-day volatility of S&P 500 options is about 0.65%, at a low level compared to previous Non-Farm report release days in recent years. The Federal Reserve has already signaled rate cuts and released dovish signals in advance, and policy uncertainty has been partially digested.

The response from the interest rate market will show clear asymmetry. If the unemployment rate remains around 4.5%, even if Non-Farm payrolls are weak, the room for interest rates to decline may be limited; however, if the unemployment rate unexpectedly rises to 4.6% or higher, front-end rates may quickly decline, re-pricing the rate cut path for 2026.

In terms of the stock market, institutions like Morgan Stanley believe that moderately weak data is more likely to be seen as positive, helping to alleviate the pressure from the previous significant outperformance of cyclical stocks. What could truly pressure the stock market is unexpectedly strong employment data and a drop in the unemployment rate—this would force the market to reassess "whether so many rate cuts are really necessary."

The foreign exchange market is similar. Karen Fishman, a senior foreign exchange strategist at Goldman Sachs, believes that weak employment data may temporarily suppress the dollar, benefiting low-yield currencies like the yen and the Swiss franc, but since Powell has hinted at viewing the data "with skepticism," the overall volatility may be lower than traditional Non-Farm nights