Federal Reserve RMP+ U.S. Treasury Department U.S. debt issuance management ≈ QE?

Bank of America believes that the Federal Reserve's Reserve Management Purchase Program (RMP) combined with the Treasury's bond issuance strategy adjustments forms a "quasi-QE combination." In 2026, the Federal Reserve is expected to purchase $560 billion in short-term bonds, while the Treasury will simultaneously issue an additional $500 billion in short-term bonds and reduce the issuance of medium- and long-term bonds by $600 billion. This change in supply structure will effectively reduce market duration risk and is expected to exert downward pressure of 20-30 basis points on the yield of 10-year U.S. Treasuries

The Federal Reserve's newly launched Reserve Management Purchases (RMPs) program, in conjunction with the U.S. Treasury's bond issuance strategy adjustments, is generating market effects similar to quantitative easing (QE).

On December 15th, according to news from the Chase trading desk, Bank of America stated in its latest research report that if it were solely the RMP, it would not be equivalent to QE; however, if we consider the Federal Reserve's purchasing actions in conjunction with the U.S. Treasury's bond issuance strategy, this constitutes a standard "quasi-QE combination."

The report states that the Federal Reserve began implementing the RMPs program this month. Although this is not traditional QE, it indirectly allows the Treasury to increase the issuance of short-term Treasury bills while reducing the supply of medium- and long-term bonds. Bank of America expects that by 2026, the Federal Reserve will purchase a total of $560 billion in Treasury bills through RMPs and MBS reinvestment, while the Treasury plans to issue an additional $500 billion in Treasury bills and reduce the issuance of medium- and long-term bonds by $600 billion.

This parallel adjustment of the Federal Reserve's balance sheet and the Treasury's issuance strategy exhibits characteristics of financial repression. Analysts at the bank believe that a higher proportion of short-term bond issuance will effectively reduce the duration risk faced by the market, thereby exerting downward pressure on long-term interest rates. This combined operation is expected to exert a downward pressure of 20-30 basis points on the 10-year U.S. Treasury yield by 2026.

How does the RMP mechanism evolve into "invisible QE"?

Technically, the Federal Reserve's Reserve Management Purchases program is not direct quantitative easing, as the central bank does not directly remove duration supply from the market. However, the program creates space for the Treasury to adjust its issuance structure by purchasing short-term Treasury bills.

The key variable here is the U.S. Treasury. The Federal Reserve's entry into the market to purchase short-term debt allows the Treasury to increase short-term debt issuance while reducing the net supply of medium- and long-term bonds.

Because the Federal Reserve effectively absorbs the new short-term debt supply, the share of short-term debt held by the private sector in the Treasury market remains unchanged or even slightly decreases.

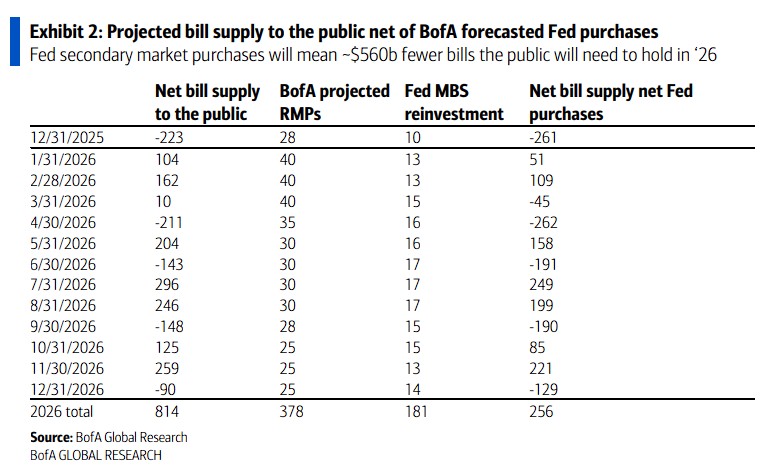

Bank of America points out that the Federal Reserve's RMP provides the Treasury with ammunition to create a "QE effect" through issuance management. According to the research report, to quantify this impact, Bank of America conducted a detailed analysis of the cash flow for the calendar year 2026 (CY26), and the numbers are quite astonishing:

Federal Reserve Purchases: The total short-term debt purchases by the Federal Reserve for the year are expected to reach $560 billion, including $380 billion from RMP operations and $180 billion from MBS (Mortgage-Backed Securities) principal reinvestment.

Treasury Supply Adjustments: Compared to 2025, the Treasury is expected to issue an additional $500 billion in short-term debt in 2026 while reducing the issuance of medium- and long-term bonds by $600 billion

Bank of America stated that this significant shift in supply structure (issuing fewer long-term bonds and more short-term bonds) is primarily to address the large amount of medium- and long-term bonds maturing in 2026 and the increased Treasury buyback operations. The "perfect alignment" between the Federal Reserve's balance sheet and the Treasury's issuance plan effectively removes duration supply from the market.

How does it affect U.S. Treasury yields?

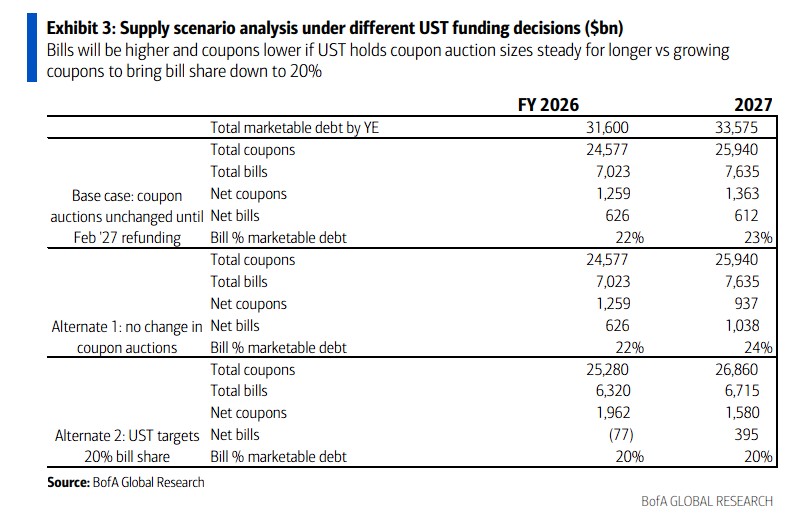

The U.S. Treasury has clearly expressed its intention to maintain a stable scale of long-term Treasury auctions in the "coming quarters" by increasing the issuance of short-term Treasury bills to meet incremental financing needs.

At the bond issuance meeting in November, the Treasury hinted that growth in medium- and long-term bonds may not begin until the fiscal year 2027, and it received support from the Treasury Borrowing Advisory Committee to focus issuance on the mid-section of the yield curve.

According to Bank of America's scenario analysis, under the baseline scenario, the Treasury will begin to increase the auction scale of 2-7 year bonds starting from the bond issuance meeting in February 2027. However, in an alternative scenario, if the Treasury continues to keep the auction scale of medium- and long-term bonds unchanged, or adopts a strategy to reduce Treasury bill supply to 20% of the long-term average level, the market impact will be significantly different.

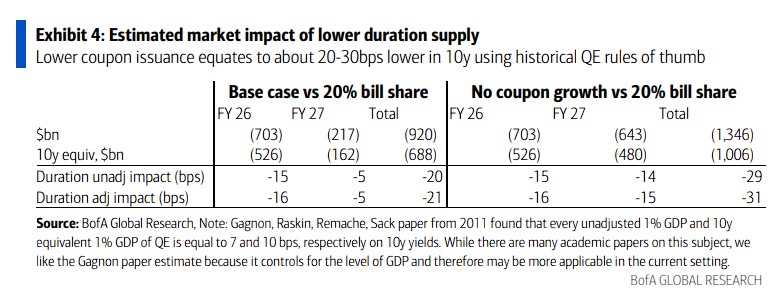

Based on calculations, in the fiscal years 2026 and 2027, a higher Treasury bill issuance scenario will reduce the 10-year equivalent supply by $700 billion to $1 trillion compared to the scenario where the Treasury bill proportion is reduced to 20%. This difference in supply structure will translate into a net easing effect of 20-30 basis points on the 10-year rate.

Bank of America Merrill Lynch used a quantitative model based on historical QE experience to quantify the market impact of the current policy mix. Based on the research findings of Gagnon et al. in 2011, the bank estimates that each 1% of GDP equivalent QE corresponds to a 10 basis point decline in yields.

In the comparison between the baseline scenario and the 20% Treasury bill proportion scenario, the duration adjustment impact for the fiscal year 2026 is 16 basis points, and for the fiscal year 2027, it is 5 basis points, totaling 21 basis points. If the Treasury chooses not to increase the issuance of medium- and long-term bonds at all, the total impact could reach 31 basis points.

Bank of America recommends seizing opportunities in a loose environment

Based on expectations of RMP and adjustments in the Treasury's issuance strategy, Bank of America recommends that investors focus on three types of trading opportunities. Specifically:

First, go long on front-end swap spreads, with the current 2-year spread at negative 18 basis points, where the main risk comes from unexpected deterioration in the fiscal deficit.

Second, go long on 5-year real yields, currently at 103 basis points. Historically, a looser financial environment usually supports inflation compensation, coupled with the Federal Reserve's policy stance leaning towards easing, providing support for a long position in real yieldsThe third is to sell the volatility spread between the 1-year and 10-year maturities, with the current spread being 2 basis points. The main risk comes from the rising uncertainty of Federal Reserve policies. The bank's analysts believe that the current policy mix should help reduce recent interest rate volatility