June FOMC Meeting Review - The Federal Reserve is in a dilemma, and staying put may be the best choice

The Federal Reserve maintained the benchmark interest rate at the June FOMC meeting, in line with market expectations. Although inflation and employment data support a rate cut, officials expressed concerns about the uncertainty surrounding tariff policies, leading to market expectations that the Federal Reserve will not cut rates. Powell holds a cautious attitude towards the economic outlook, believing that maintaining the status quo is the best option at present

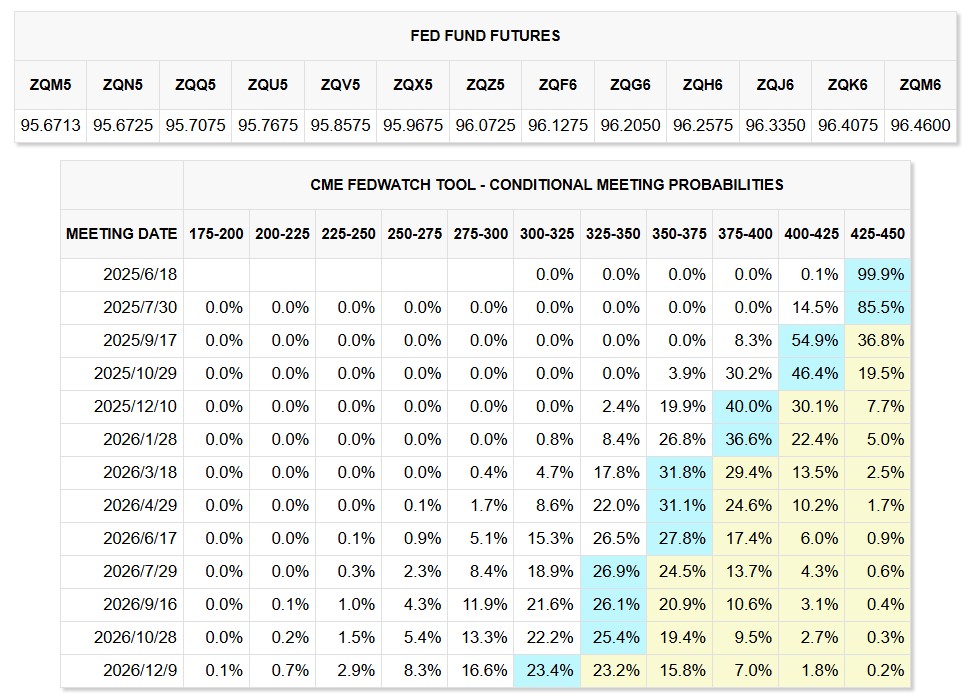

TradingKey - On June 18, Eastern Time, the Federal Reserve's June FOMC statement was released as scheduled, maintaining the benchmark interest rate at 4.25%-4.50%, in line with market expectations. After Powell's remarks, the market quickly digested the information, with the latest dot plot indicating a 90% probability that the Federal Reserve will not cut interest rates in July, while the pricing for rate cuts for the year remains at two times, although 7 out of 19 officials believe there will be no further cuts this year.

Despite the May inflation data and employment figures supporting the Federal Reserve to initiate rate cuts again, the Federal Reserve officials had previously communicated expectations to the market, repeatedly stating that the uncertainty brought by tariff policies is the main reason affecting the Federal Reserve's decisions, showing a greater willingness to "wait and see." Therefore, the market had already priced in a high probability that the Federal Reserve would not cut rates in June.

Data Source: FedWatch, compiled by TradingKey as of June 18, 2025

Federal Reserve Statement Consistent with April

In this statement, the Federal Reserve revised "the uncertainty of the economic outlook has further increased" to "uncertainty has decreased but remains at a high level," which is a significant difference in expression from the April FOMC. At the same time, the median GDP growth forecast for the U.S. at the end of 2025 and 2026 was lowered to 1.4% and 1.6%, respectively.

Powell Maintains Caution but Releases Dovish Remarks

At the press conference, Chairman Powell expressed overall concerns about short-term inflation and economic outlook uncertainty but still conveyed a dovish attitude to the market.

- He believes that although the tariff policy from April has "temporarily come to a halt," the cost of living driven by tariffs will gradually become apparent in the coming months;

- The job market remains "robust," with the unemployment rate continuing to stay at a low level;

- The economy is currently in a stable state, although net exports have shown unusual fluctuations causing some distortions in GDP structure, it is growing at a stable rate of 1.5%-2%.

In addition, Powell clearly expressed a negative attitude towards the option of "raising interest rates" and believes that the Federal Reserve may reach an appropriate position for rate cuts in the future.

Complex Situation, Domestic Risks Increasing, "Wait and See" Becomes the Best Choice

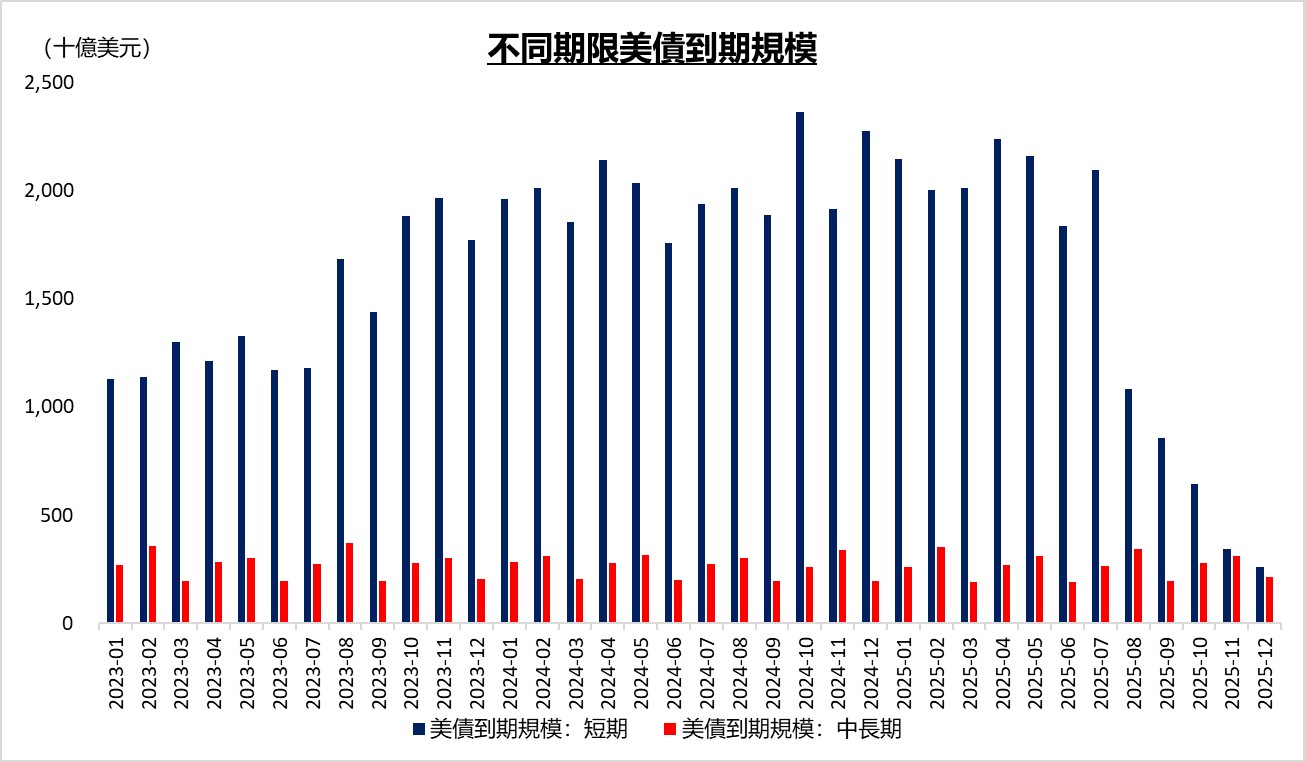

Currently, global geopolitical conflicts are "turbulent," and the struggle between the two parties in the U.S. is intensifying. The Federal Reserve's decision to "hold steady" may be the best choice. Internally, tariff policies will inevitably lead to a significant increase in the cost of living for U.S. residents, which has not yet been reflected in inflation data mainly due to retailers hoarding goods in advance and consuming inventory, along with a noticeable cooling in housing demand leading to a decrease in rentsOn the other hand, the fiscal discipline in the United States has not improved. Once the big beautiful plan vigorously promoted by Trump is passed, it will completely offset the fiscal deficit reduction effects brought about by the tariff policy and the efficiency of the government. Although Trump has repeatedly criticized and even threatened Powell, the latter, in addition to considering inflation and employment issues, must also maintain the attractiveness of U.S. Treasury bonds and the dollar. As the scale of U.S. national debt continues to expand, after Yellen took office, the pressure of interest payments due has been alleviated through the "borrow short, repay long" operation. This year, the scale of maturing U.S. Treasury bonds is enormous, with short-term bonds accounting for the vast majority. The yield on short-term bonds is more significantly affected by rapid changes in interest rates; a rapid rate cut could lead to a decline in demand for medium- and short-term Treasury bonds in the market, ultimately facing maturity mismatches, rising financing costs, and even events similar to the 2023 Silicon Valley Bank collapse.

Data source: Reuters, compiled by TradingKey, as of June 19, 2025

From an external perspective, the current risks in the Middle East are rapidly rising, and the conflict is expected to further escalate. The attitudes of the U.S., Israel, and Iran are tough; even if Trump chooses "TACO" again, the escalation of conflicts between Israel and Iran will lead to oil prices being prone to rise and difficult to fall. Against this backdrop, if the Federal Reserve chooses to cut interest rates, it will further drive up the prices of international commodities dominated by oil, leading to an uncontrollable situation of domestic inflation in the United States, pushing the U.S. economy further towards "stagflation."