Increased demand for graphics cards, let's see what Meta, Google, and Microsoft have to say

In recent overseas financial reporting season, Meta/Google/Microsoft's performance frequently exceeded expectations, with a shortage of computing power cards

The three giants of cloud services, Amazon, Google, and Microsoft, occupy 65% of the global cloud service market share, known as the "AI shovelers". The significant demand for computing power driven by AI from these three companies has always been a focus of the market.

Today, Google and Microsoft successively held their first-quarter earnings calls. Overall, driven by AI, Google's Q1 24 revenue and profit exceeded expectations, while forecasting at least a 49% year-on-year increase in Capex for 2024; Microsoft's revenue and profit also exceeded expectations, with guidance to continue expanding AI investment in 2024, expecting significant growth in the next quarter.

1. Overseas financial reports gradually reveal increased capital expenditure on AI

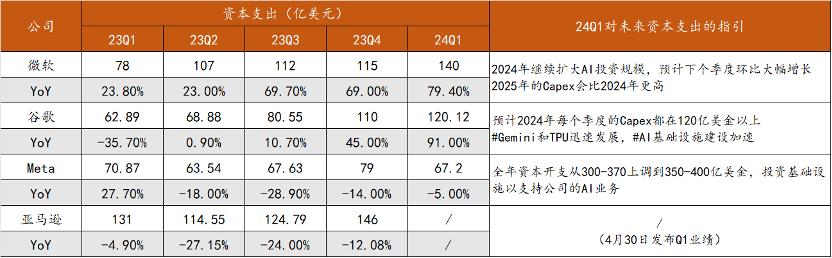

Overall, the demand for AI infrastructure is very strong:

• META: Annual capital expenditure raised from 300-370 to 350-400, to build data centers to support AI business;

• Google: Expects capital expenditure in each quarter of 2024 to be over $12 billion, with a year-on-year increase of at least 49%, to maintain a leading position in AI infrastructure;

• Microsoft: States that the demand for computing power cards exceeds supply, deciding to expand the scale of AI investment, with capital expenditure of $14 billion this quarter (expected $13.14 billion), expecting significant growth in capital expenditure in the next quarter;

• Amazon: Awaits the first-quarter earnings call on April 30.

2. Strong demand, insufficient supply of computing power cards

During the earnings call, Microsoft mentioned that the current market demand for AI exceeds the company's reserves. Additionally, during this financial reporting season, increased capital expenditures by various manufacturers were observed, indicating the high prosperity of the current AI industry.

From a supply chain perspective:

Training End —

• By the end of 2023, a total of 1.2 million H100 cards were shipped (Omdia data)

• Training a GPT-4 with 1.8 trillion parameters: requires 8000 H100 cards

In other words, the current market supply of H100 cards is sufficient to train nearly 150 GPT-4 models. However, considering the iterations of GPT-5, GPT-6, as well as the demand for image and future video models, the demand for training end is still very tight. In a paper released by Factorial Funds in March this year, it was mentioned that approximately 720,000 H100 cards would be needed to run Sora.

Inference End —

In 2023, with the functional optimization of various large models, many models have been opened to the consumer market, catalyzing the market demand for inference cardsNVDA mentioned at a recent conference that the demand for inference cards in 2024 will see a significant increase compared to 2023, with a shipment ratio reaching 70%.

The recent market focus on reducing delivery cycles is speculated to be more due to the release of CoWos and HBM production capacity.

However, it is still necessary to be cautious about the industry's cyclicality. Referring to history, the semiconductor industry cycle is around 4-5 years, with each cycle catalyzed by new technological iterations. It is important to continue monitoring when the peak of this AI cycle will arrive.

3. AI Empowering Business Growth

After applying AI to its products, Meta has achieved good performance returns. Google and Microsoft have also achieved good revenue and profit under the drive of AI.

Currently, Google has a clear commercialization path for AI in advertising/cloud/subscription areas:

• Advertising: AI integrated into the push system to improve precision

• Cloud services: Leasing of computing power cards

• Subscription: Launch of large model subscription services

Microsoft has also launched corresponding products in Office/Windows/cloud areas:

• Office: Integration of Copilot, launch of subscription services

• Cloud services: Leasing of computing power cards

At this performance meeting, both Microsoft and Google's cloud service businesses have grown significantly, and both have increased capital expenditures to support the construction of AI infrastructure.

4. Unprecedented Dividends, Google Faces Value Reassessment

As both "AI shovelers," Google's valuation is significantly lower than its peers.

On one hand, this is due to the challenges faced by the search business from GPT and Perplexity; but another very important reason is that Google decided not to pay dividends from the day the company was founded. Instead of returning profits to shareholders through dividends, Google prefers to invest profits in research and development. This is very unfriendly to the company's market value management, so the company's valuation is much lower compared to its peers.

However, unexpectedly, Google announced its first dividend at this performance meeting. Alphabet stated that the board of directors has approved a cash dividend of 20 cents per share to shareholders registered as of June 10, to be paid on June 17, and "intends to continue paying quarterly cash dividends in the future." In addition, the company has authorized an additional $70 billion stock repurchase. After the performance meeting, Google rose by 12.18%, increasing its market value by nearly $236.2 billion (approximately RMB 1.7 trillion)Overall, the sustained prosperity of the AI industry has brought a shining moment to "AI shovel sellers". As a key part of artificial intelligence infrastructure, the demand for computing power cards will continue to grow. In the future, how will "AI shovel sellers" further expand the market and explore new growth potential? It is worth looking forward to.

Here are the key points from Google and Microsoft's earnings calls:

Google's Q1 Earnings Call:

Financial Highlights:

- Revenue: $80.5 billion (YoY +15.4%), exceeding market expectations by 1.9%;

- Net Profit: $23.7 billion (YoY +57%), exceeding market expectations by 21%;

- Q1 capital expenditure of $12.012 billion (YoY +91%, QoQ +9.2%);

- Expected Capex for each quarter in 2024 to be above $12 billion, with a yearly growth of at least 49%, exceeding expectations;

- "Historic" first dividend and a $70 billion share buyback plan.

Business Highlights:

- Clear AI commercialization paths in advertising, cloud, subscriptions, etc.;

- Besides TPUs, also providing NVDA computing card services, including H100 and the latest release of Blackwell;

- Reduced sales, general, and administrative expenses, but increased research and development.

Microsoft's Q1 Earnings Call:

Financial Highlights:

- Revenue of $61.9 billion, YoY +17%, surpassing Bloomberg's consensus expectation of $60.9 billion;

- Net Profit of $21.9 billion, YoY +20%, surpassing Bloomberg's consensus expectation of $21.1 billion;

- Capex for the quarter YoY +65%, QoQ +13%;

- Guiding to further expand AI investment in 2024, expecting significant QoQ growth next quarter.

Business Highlights:

- 30% growth in Q1 cloud services, guiding for continued growth in cloud services next quarter;

- Stating that the current inference computing power is in short supply