Historic outflow of $218 million in a single day hits the US Bitcoin ETF

The American Bitcoin Exchange Traded Fund (ETF) experienced a significant fund outflow in the past week, with a single-day outflow reaching $218 million. This reflects a significant decrease in demand for risk assets due to the weakening expectations of a rate cut by the Federal Reserve. The BlackRock Bitcoin Fund has performed well for 71 consecutive days, raising nearly $18 billion in funds. However, as the cryptocurrency market frenzy cools down, investors have gradually withdrawn. The price of Bitcoin has stabilized at $64,497, down from its mid-March high

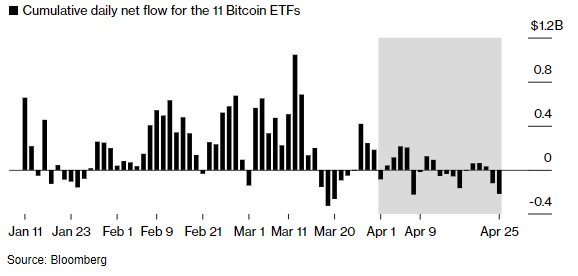

According to the Zhitong Finance and Economics APP, in the past week, the American Bitcoin Exchange Traded Fund (ETF) has experienced significant fund outflows. On Thursday local time, investors withdrew a total of $218 million from the ETF market, marking one of the most severe single-day fund outflows, reflecting a significant decrease in demand for risk assets due to the weakening expectations of a Fed rate cut. In this withdrawal, Fidelity Wise Origin Bitcoin Fund alone withdrew $23 million, marking the first fund withdrawal since January 11 when it started trading alongside products like BlackRock Inc.'s iShares Bitcoin Trust.

Figure 1

Although the total assets of the investment portfolio consisting of nearly 12 ETFs have reached a historical high of about $54 billion, the rise in long-term borrowing costs shown by inflation data and the increase in U.S. Treasury yields have created unfavorable conditions for investing in high-risk assets like Bitcoin.

Cryptocurrency market analyst Noel Atchison pointed out in his "Cryptocurrency is Macro" newsletter, "As long as macroeconomic sentiment continues to support higher yields, we can expect Bitcoin to face downward pressure."

Furthermore, the $218 million outflow ranks fourth among all outflow events, following the end of a 71-day inflow streak by BlackRock funds on Wednesday. As of the time of writing, the price of Bitcoin is stable at $64,497, down from its mid-March high of $73,798.

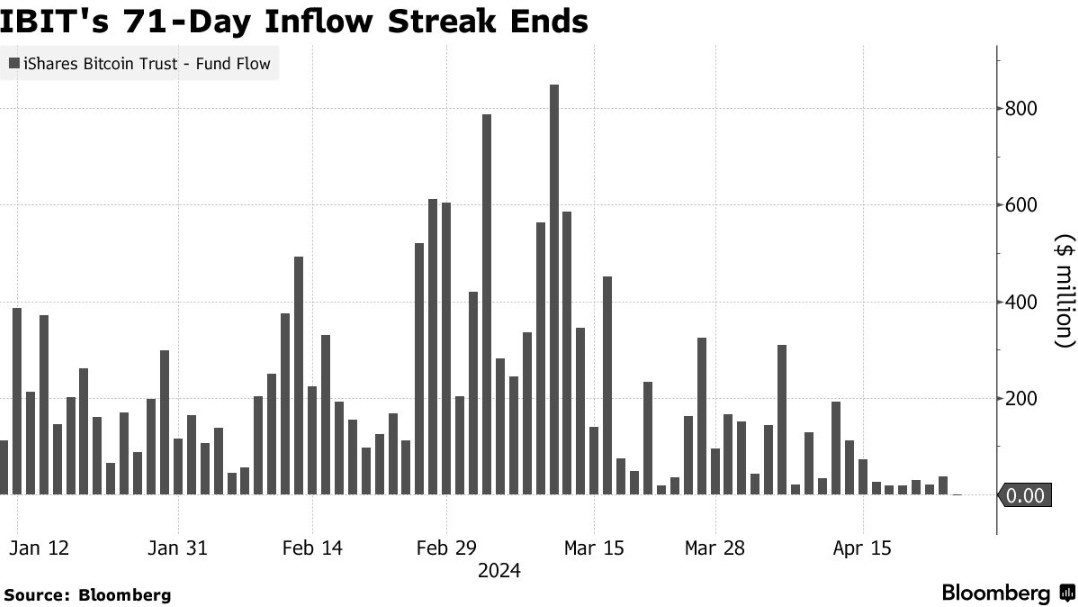

It is understood that BlackRock's Bitcoin fund has performed well for 71 consecutive days, raising nearly $18 billion in funds, making it one of the largest exchange-traded funds in history in terms of scale. However, as the cryptocurrency market frenzy cools down, investors have gradually withdrawn.

Statistics show that the inflow of funds into BlackRock's iShare Bitcoin Trust (IBIT.US) dropped to zero for the first time on Wednesday. Since April, the net inflow of this ETF has accumulated to $1.5 billion.

Figure 2

After the ETF frenzy in March helped Bitcoin reach a historical high of nearly $74,000, IBIT's performance further reflects the weak trend in the cryptocurrency market. Since then, the price of Bitcoin has dropped by nearly 15%, and the Bitcoin halving event on April 20 did not immediately boost market sentiment It is worth mentioning that Hong Kong is about to launch its first physical cryptocurrency ETF next week, which is expected to further increase market volatility.

Eddie Wu pointed out that although this is good news for the industry, it may not attract a large inflow of funds on the first day. In the long run, this will help improve the accessibility of cryptocurrencies and expand related education.

Overall, despite the Bitcoin ETF portfolio currently being at a historical high in terms of total funds, recent market trends and policy changes indicate that investors may need to reassess their investment strategies for such risk assets, especially in the current macroeconomic environment