地产寒冬贝壳天价年薪火了!“打工皇帝” 彭永东、单一刚两年豪取 20 亿,经纪人群体炸了锅

In the winter of the real estate industry, the high annual salaries of KE Chairman Peng Yongdong and Executive Director Shan Yigang have sparked heated discussions. Peng Yongdong's salary for 2023 is 713 million yuan, while Shan Yigang's is 530 million yuan, with a total compensation of 2.072 billion yuan over two years. Peng Yongdong's compensation mainly comes from stock payments, with equity incentives granted amounting to 809 million yuan in 2022 and 1.226 billion yuan in 2023. Peng Yongdong previously worked at companies like IBM and co-founded KE in 2017, taking over as chairman in 2021, promising to carry on the wishes of the founder, Zuo Hui

The real estate industry has not yet weathered the winter, and the sky-high salary of KE has sparked heated discussions.

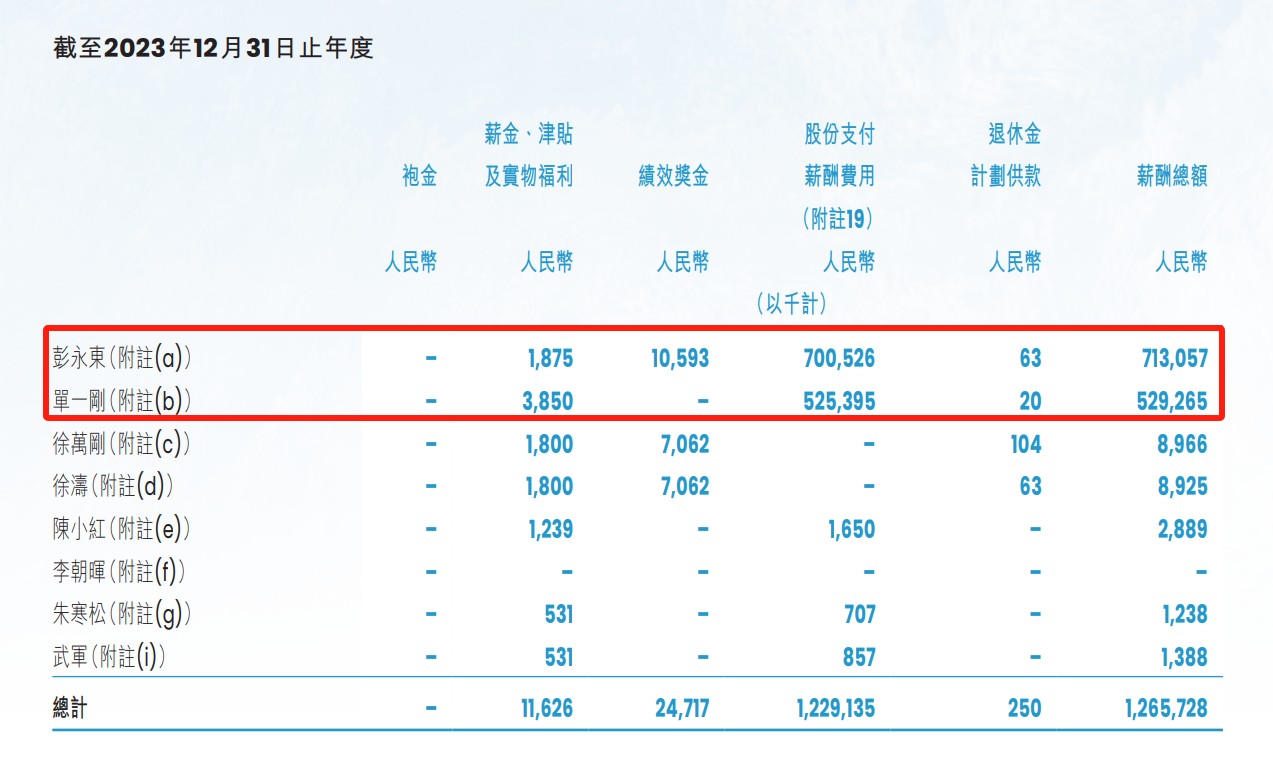

Recently, the annual salary of KE Chairman Peng Yongdong at 713 million yuan and the salary of Executive Director Dan Yigang at 530 million yuan suddenly became a hot topic. The financial community noted that the relevant data comes from KE's 2023 annual report, which was released as early as April this year.

In the annual report, Peng Yongdong's total compensation amounted to 713 million yuan, consisting of four parts: salary and allowances of 1.875 million yuan, performance bonuses of 10.593 million yuan, retirement benefits of 63,000 yuan, and the largest portion being share-based payment expenses, reaching as high as 700 million yuan.

The data for 2022 is equally astonishing, with share-based payment expenses of 463 million yuan, bringing the total compensation to 475 million yuan. From 2022 to 2023, Peng Yongdong's two-year compensation reached 1.188 billion yuan.

Another executive, Dan Yigang, also had a high salary, with a total compensation of 529 million yuan in 2023, compared to 355 million yuan in 2022, totaling 884 million yuan over two years.

The total compensation for the two "working emperors" reached 2.072 billion yuan over two years.

According to KE's official information, on May 5, 2022, Peng Yongdong and Dan Yigang received 71.8243 million shares and 53.8682 million shares of equity incentives, respectively, with 50% of the shares being released from restrictions within two years, granting 809 million yuan and 1.226 billion yuan in 2022 and 2023, respectively.

Peng Yongdong's career is full of drama. This high-achieving graduate of Zhejiang University and Tsinghua University worked at well-known companies like IBM in his early years and joined Lianjia as CEO in 2010. Under the leadership of Lianjia founder Zuo Hui, Peng Yongdong helped the company solve long-standing pain points in the real estate agency industry, such as inconsistent service standards and false listings. In 2017, he co-founded KE and served as CEO.

Peng Yongdong has always been regarded as Zuo Hui's capable assistant and successor. He once admitted that his strategy was to "follow Zuo Hui closely," which easily evokes comparisons to Joseph Tsai's relationship with Jack Ma at Alibaba. After Zuo Hui's sudden passing in May 2021, Peng Yongdong took over as Chairman of KE. Upon taking office, he proposed to inherit Zuo Hui's wishes: "Persist in doing the difficult but right thing."

However, Peng Yongdong's takeover of KE was not smooth sailing. In 2021 and 2022, the company suffered losses for two consecutive years, with a significant decline in transaction volume, and a substantial reduction in the number of stores and agents. There were rumors in the market that Peng Yongdong might leave KE. Just as the company's performance hit rock bottom, Peng Yongdong's salary surged from 8.478 million yuan in 2021 to 475 million yuan in 2022, and reached an astonishing figure of 713 million yuan in 2023 The situation of another co-founder and executive director, Shan Yigang, is basically similar.

The exorbitant salaries have sparked heated discussions online, and the agents on the KE platform are "in an uproar," with many expressing their dissatisfaction.

From an industry perspective, in the real estate sector, which is experiencing salary cuts and layoffs, the salaries of KE's two top executives are "far ahead." For example, in 2023, the total salary and equity incentives of Longfor Group Chairman Chen Xuping approached 50 million yuan, only 7% of Peng Yongdong's salary. Vanke's Chairman Yu Liang voluntarily waived his 2023 annual bonus and only received a pre-tax monthly salary of 10,000 yuan.

Looking at the entire A-share market, the highest salary in 2023 was that of WuXi AppTec Chairman and actual controller Li Ge, with a salary of about 42 million yuan; the second and third places were held by Tongwei Co., Ltd. Vice President Li Bin (salary of 26.28 million yuan) and Mindray Medical Chairman Li Xiting (26.6282 million yuan), which is negligible compared to Peng Yongdong and Shan Yigang.

However, under Peng Yongdong's leadership, KE achieved a turnaround in 2023. The annual net revenue reached 77.8 billion yuan, a year-on-year increase of 28.2%, with a net profit attributable to the parent company of 5.89 billion yuan. KE's stock price also showed a stabilizing and rising trend at the beginning of 2024. As of now, KE's U.S. stock is about $22 per share, with a total market value of approximately $26.5 billion.