业绩失速、闭店增多,锅圈正被 “抛弃”?

GUOQUAN is facing the dilemma of declining performance and store closures. In the first half of 2024, GUOQUAN's revenue and net profit decreased by 3.5% and 20.16% respectively. The overall profit margin of the hotpot industry is as low as 0.37%, leading to a large number of hotpot restaurants closing down. GUOQUAN's stock price has plummeted by as much as 83.6% in the past year. To address the challenges, GUOQUAN is expanding its business through investment and upgrading its supply chain, acquiring a cold chain company, and opening new format stores in agricultural markets, focusing on frozen and prefabricated foods

Editor/Yang Bocheng

Cover Photo: IC Photo

Is hotpot, the top category of Chinese cuisine, being abandoned by consumers?

According to the semi-annual report of Haidilao in 2024, during the reporting period, Haidilao's revenue and core operating net profit increased by 13.8% and 13% year-on-year, reaching 21.491 billion yuan and 2.799 billion yuan respectively. However, Haidilao's average customer spending has seen three consecutive declines. In contrast to Haidilao's growth in performance, in the first half of 2024, Xiabu Xiabu not only saw a 15.87% decline in revenue, but also a net profit turnaround from profit to loss, with a loss of 273 million yuan.

Image Source: Haidilao Financial Report

The losses of Xiabu Xiabu may be a true reflection of the current hotpot industry. Data from the Beijing Municipal Bureau of Statistics shows that in the first half of 2024, the total profits of Beijing's catering companies above the quota decreased by 88.8% year-on-year to 180 million yuan, with a profit margin as low as 0.37%, reaching an industry low.

This situation has forced hotpot restaurant owners to joke that if you eat a 300 yuan hotpot in Beijing, they only earn 1 yuan. The continuous decline in profit margins is accelerating the wave of closures of hotpot restaurants. Data from Qichacha shows that as of August 20, 2024, the number of closed or revoked hotpot restaurants nationwide has reached 39,000.

It's not just hotpot restaurants, but also the tough times for hotpot ingredient stores.

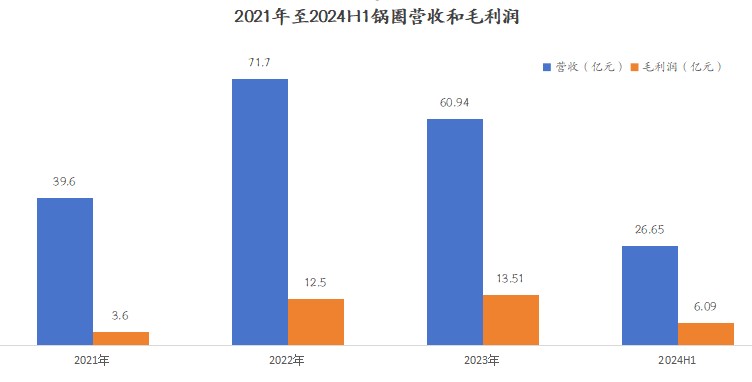

According to the Guoquan semi-annual report in 2024, during the reporting period, Guoquan's revenue and net profit decreased by 3.5% and 20.16% year-on-year, reaching 2.665 billion yuan and 85.984 million yuan respectively. The slowdown in core performance has kept Guoquan's stock price in a long-term downward trend. In the past year, Guoquan's highest and lowest stock prices were 12.5 Hong Kong dollars per share and 2.05 Hong Kong dollars per share, with a decline of up to 83.6%.

Image Source: Snowball

Facing the slowdown in performance, Guoquan is taking various measures to turn things around. Firstly, it is expanding its business footprint through investments and upgrading the supply chain. In July this year, Guoquan strategically cooperated with four retail food brands, including Xiaobandeng Hotpot, Weila Xiaohuoguo, Zhengxiwang BBQ, and Wuxuezhang Grilled Skewers and Pancakes. In the same month, Guoquan fully acquired Huading Cold Chain to improve its cold chain system.

Secondly, it is expanding new forms of stores through Yaoyao Lingxian. Yaoyao Lingxian focuses on locations in farmers' markets, targeting families' three meals a day, specializing in selling frozen ready-to-cook products, pre-made dishes, and various fried foods. Guoquan's founder and chairman, Yang Mingchao, stated that pre-made dishes can solve the "trouble" of cooking at home; choosing farmers' markets is because there are over 600,000 administrative villages, more than 40,000 townships, over 2,000 counties in China, and 80% of the population is there, they are the demanders and consumers of our globally high-quality protein food ingredients Thirdly, expanding new marketing methods, in the first half of this year, GUOQUAN expanded or enriched all mainstream online channels: GUOQUAN APP, WeChat mini program, food delivery platforms, and Douyin live e-commerce. In September, Bai Kainan transformed into a GUOQUAN star store manager selling pickled fish hot pot sets in Douyin live stream.

Although GUOQUAN's determination to self-rescue is firm, the continuous siege of offline hot pot restaurants, struggling franchisees, and the natural limitations of the scattered fresh store model pose challenges. GUOQUAN still has a lot of work to do on this path of self-rescue.

- How does GUOQUAN deal with low-priced self-service mini hot pot?

Faced with the current situation of hot pot restaurants, industry practitioners are self-rescuing in various ways. Firstly, under the trends of single economy, loneliness economy, solo dining economy, home economy, and the market segmentation, and supply chain upgrades, the industry is undergoing a transformation towards self-service mini hot pot. Previously, self-service mini hot pot was generally considered "cheap and low-quality" due to the combination of old and worn-out facilities and ingredients, which appeared to be less fresh and was not favored by consumers.

However, in a visit by DoNews to the Darenfa shopping mall in Linquan, Anhui, a restaurant named Xuanfeng Mini Hot Pot with bright lights and a variety of ingredients, offering unlimited eating and drinking for 25.8 yuan per person, attracted a large number of consumers in the county.

Image Source: DoNews

In comparison, on the same shopping mall, Liu Yishou Hot Pot and Guojiujiu Hot Pot were relatively quiet on the evening of our visit, with no large number of diners in the store and no consumers waiting in front of the store.

Image Source: DoNews

Image Source: DoNews

The situation of Xuanfeng Mini Hot Pot store may be a microcosm of mini hot pot restaurants nationwide. According to enterprise investigation data, as of August 15, 2024, the number of mini hot pot restaurants nationwide has reached 56,000, accounting for 13.3% of the total number of hot pot restaurants in the country, and showing a gradual growth trend.

Secondly, from first-tier cities to county markets, the hot pot industry is launching a price war. Taking Chengdu, one of the benchmark cities for hot pot in China, as an example, Luo Er introduced a pot base annual card for 299 yuan, only 0.8 yuan per day.

Hai Di Lao's sub-brand Xiaohai Hot Pot reduced its per capita consumption from 70-80 yuan to over 50 yuan, and the price of the split pot was reduced from the original minimum of 19.8 yuan to 9.9 yuan. Nan Hot Pot's 3.0 store in Chengdu Taikoo Li directly launched a seven-day free meal event for Chengdu residents before the store opening.

In the more sinking county markets, some hot pot restaurants in Jieshou, Anhui, have a per capita consumption of less than 40 yuan, while hot pot restaurants in Shenqiu, Henan, have a per capita consumption of less than 70 yuan. In addition, some hot pot restaurants have price inversion issues to address insufficient customer flow As the industry gradually pushes the price of 3 catties of butter pot base to below 50 yuan, but according to the calculation of 10 yuan per catty of pot base, the cost of 3 catties of butter pot base is already at 30 yuan. If we add the costs of butter, scallions, ginger, garlic, and other ingredients as well as labor and logistics costs, hotpot restaurants are basically losing money even if they make some profit.

Image Source: Douyin

Thirdly, hotpot restaurants are rolling out scenes, marketing, and dish presentations, such as market hotpot and street stall hotpot, around festivals like May 20th and Qixi, introducing various beef platters symbolizing love. The more offline hotpot stores roll inwards, the less appealing it is to eat hotpot at home.

From the consumer's perspective, when the price of offline hotpot restaurants is lower than or even slightly higher than buying ingredients from the market, eating hotpot at home involves cleaning up, washing utensils, etc., which is less convenient than dining out.

Not only hotpot, but the positioning of street stalls has two main focuses: hotpot combo meals in cold weather and barbecue combo meals in hot weather. The ideal of street stalls is ambitious, but the reality they face is harsh, similar to the problems faced by barbecue.

The social operating rules in county towns are "age is valuable, ability is a reference, relationships are the most important." Middle-aged men in county towns can build relationships and get things done by drinking. A few drinks to confide in each other, relationships evolve from strangers to close friends, and the network of relationships continues to expand.

However, middle-aged men in county towns consider that eating barbecue at home will affect their children's rest and family relationships, so they prefer to dine at street stalls or food stalls. This explains why in many county town summer street stalls or food stalls, you can always see middle-aged men eating barbecue, drinking, and chatting. For middle-aged men living in county towns, they are not just eating barbecue or drinking, but dealing with social relationships and connections.

Image Source: DoNews

Perhaps the special period from 2020 to 2022 will temporarily disrupt the decision-making of middle-aged men in county towns, but as Jia Zhangke wrote in "Jia Xiang," life in county towns, today and tomorrow are no different, a year ago and a year later are also the same. Under the operating rules of county towns, street stalls are facing pressure in the county town market.

Zhang Ming (pseudonym), a delivery driver from Jieshou City, Anhui Province, told us that local street stalls receive less than a dozen orders for delivery in a day, and many delivery drivers may not receive a single street stall delivery order in a week. If users do not purchase street stall deliveries, what can we do?

- Street stall franchisees struggling from thousands of yuan per month

Zhang Ming's words can also be confirmed by Liu Wei (pseudonym), a street stall franchisee in Fuyang, Anhui. Liu Wei told us that before 2020, old franchisees who joined street stalls could be said to have made a lot of money during the three special years, with many franchisees earning tens of thousands of yuan per month. However, after 2023, the performance of many franchisees has been continuously declining. While old franchisees may rely on the profits earned in the previous years to support their stores, the payback period for new franchisees is continuously lengthening First, the official data provided by GUOQUAN shows that the comprehensive gross profit margin of a single store is 35%. However, considering factors such as promotional subsidies, delivery fees, and the frequent reduction or absence of subsidies for GUOQUAN, the actual comprehensive gross profit margin of a single store is around 25% to 28%.

In addition, the main operating cost for GUOQUAN stores is electricity expenses. Several refrigerators in the store, combined with the requirement to keep the air conditioning on all day during summer as per GUOQUAN regulations, means that if some stores are located in commercial electricity zones, the electricity cost during summer could amount to several thousand yuan.

Secondly, various multi-format brands such as new tea drinks, snack discount stores, and electric bicycles are claiming to have over ten thousand stores. However, can the limited population in specific regional markets really accommodate so many stores? Behind the rapid growth of many brand stores lies a serious issue of franchisee competition. GUOQUAN had promised franchisees a 3-kilometer radius of territorial protection, but in many cities, there are instances of two stores within a 1.5km radius, leading to a significant diversion of store traffic. Moreover, compared to retail discount stores that use low-priced beverages as traffic drivers, GUOQUAN currently lacks a flagship product that can attract consumers effectively.

Thirdly, although GUOQUAN only has one store in many towns and markets under the jurisdiction of Fuyang City, the operating costs in these towns and markets are not high due to lower rent and labor costs. However, operating stores in these towns and markets is not easy.

On one hand, the consumer population in these towns and markets is insufficient. Considering a population base of 10,000 in some towns and markets, and taking into account the severe aging of the population and the lack of a habit among the elderly to eat hot pot at home, how many core consumers are actually left to support GUOQUAN store consumption?

On the other hand, there is a difference in the diversion of GUOQUAN's business between towns and county towns. Young laborers in towns eat hot pot less frequently. Young parents in towns are more concerned about their children's health and prefer to buy fresh meat products rather than frozen ones. With these factors intertwined, how much monthly revenue can be generated? Even though GUOQUAN operates at low costs in towns, how many franchisees are willing to continue enduring this situation with GUOQUAN?

As Liu Wei mentioned, considering that Douyin group buying is gradually penetrating into county markets, and some catering businesses are directly posting Douyin group buying packages in their stores to guide consumers to place orders through Douyin group buying. In other words, Douyin group buying is becoming an important channel for various businesses in county towns to attract customers.

However, based on the Douyin group buying activities displayed by multiple GUOQUAN stores in Taihe County, Linquan County, and Jieshou City in Fuyang City, many stores have either low consumer numbers or low review counts. Even if some stores have accumulated over 1000 consumers, can the existing franchisees really achieve profitability based on an average customer spending of 29 yuan and a 28% comprehensive gross profit margin?

During our visits in Fuyang City, we found that some GUOQUAN stores in towns have posted notices for store transfers. According to GUOQUAN's 2024 semi-annual report, the current number of stores is 9960 As of January 30 this year, there were 10,281 GUOQUAN stores, which is equivalent to 321 stores closing in 5 months.

Image Source: DoNews

In April this year, GUOQUAN stated that it plans to open 20,000 stores in the next 5 years. To achieve this goal, GUOQUAN continues to invest in franchise advertising on internet platforms. However, whether maintaining existing franchisees or expanding new ones, GUOQUAN urgently needs to address a key issue: how to shorten the return cycle for franchisees? How to make franchisees willing to continue following GUOQUAN?

Image Source: App Growing

Looking at GUOQUAN's financial reports, from the first half of 2022 to the first half of 2024, GUOQUAN's revenue has been declining, but gross profit has been continuously increasing. In the first half of 2024, GUOQUAN's gross profit increased by 5.3% year-on-year to 609 million RMB, with a gross profit margin of 22.8%, an improvement from 20.9% in the same period of 2023. GUOQUAN's explanation is that economies of scale have led to cost reductions, the proportion of self-produced items in the supply chain has increased, and both new and old product gross profit margins are expanding.

Image Source: GUOQUAN Financial Report

However, Lu Wei (pseudonym), an e-commerce manager from a food company in Henan, explained to us that GUOQUAN's financial report can be simply interpreted as decreasing sales revenue but increasing profits, which contradicts the development of the retail industry.

Whether it is the traditional distribution model or the live streaming sales model, a relatively healthy and sustainable retail model ensures a relative balance of interests along the entire chain from the factory end to the final consumer end. Many top influencers this year are either transitioning or reducing the frequency of live streaming sales, as top influencers take the majority of profits along the chain. Businesses that no longer want to operate at a loss are turning to smaller influencers for sales or transitioning to live streaming themselves.

For GUOQUAN's S2B2C model "platform," a healthy and sustainable development model would be: GUOQUAN can earn less, after all, to ensure the normal profits of upstream manufacturing factories and expand more product categories. It is even more important to ensure the profits of downstream franchisees, especially against the backdrop of this year's food industry price war, in order to maintain stable stores. If GUOQUAN goes against this principle, what kind of situation will its store numbers face in the future?

- The YAOYAO LINGXIAN store model is limited, making it difficult to expand downwards and upwards.

Currently, GUOQUAN is vigorously expanding its YAOYAO LINGXIAN stores, which mainly sell ingredients that are ready to buy, cook, and eat. In simple terms, when a consumer wants to make a dish like spicy and sour shredded potatoes, YAOYAO LINGXIAN stores will provide pre-cut and prepared ingredients, allowing consumers to stir-fry at home easily GUOQUAN's choice of this store model is based on meeting the needs of the lazy economy in high-line cities and leveraging its existing supply chain to support it, thereby increasing single-store revenue. This model is quite common in southern vegetable markets and requires no market education. Based on this, GUOQUAN has set a target of 200 stores for the YAOYAO LINGXIAN store by 2024. However, to achieve this goal, GUOQUAN still needs to solve many problems.

From the perspective of net vegetable processing, compared to large retail supermarkets, the high wastage of vegetables makes many large supermarkets focus more on attracting customers in their fresh departments, with limited profit margin requirements. In addition, it is almost rare to see large supermarkets selling processed net vegetables from high-line cities to sinking towns. The difficulty lies in the fact that once vegetables are processed into net vegetables and become unsalable for various reasons, they cannot be stored fresh or reused in other scenarios. The uncontrollable product turnover brings high losses, making net vegetables unable to truly enter the shelves of large supermarkets for many years.

From the perspective of regional market differences, the YAOYAO LINGXIAN format may be more suitable for southern cities or high-line cities. On the one hand, the Northeast region has long and cold winters, and local consumers tend to stock up on vegetables. Bloggers in the Northeast region on internet platforms usually buy hundreds of kilograms of vegetables such as Chinese cabbage and potatoes, rarely buying small portions of net vegetables.

On the other hand, sinking markets are important production bases for fresh produce. The combination of local advantages and some farmers' direct sales to consumers has made fresh products in sinking markets more price competitive than in high-line cities. This summer, due to the simultaneous listing of watermelons in several important domestic watermelon bases, the price of watermelons in many towns and markets in Shenqiu County, Henan Province, directly dropped to 0.5 yuan/jin, and street vendors sold them for as low as 1 yuan for 3 jin.

This advantage makes pre-made dishes clearly lack a survival soil in sinking markets. Many restaurants in county towns adopt on-demand cooking to dispel consumers' concerns about pre-made dishes. This will not only affect the current store turnover of GUOQUAN but may also affect the expansion of YAOYAO LINGXIAN stores in the future.

From the consumer side, vegetable prices are influenced by factors such as weather, production volume, and planting area, leading to significant price fluctuations. This summer's high temperatures have caused vegetable prices to soar in many parts of the country. With the rising prices combined with the essential nature of vegetables and the increasingly rational consumer market, how many consumers are willing to accept the secondary price increase of processed net vegetables?

Conclusion:

If the special period from 2020 to 2022 has contributed to GUOQUAN's success, how will GUOQUAN's story of eating hot pot at home be told in the future? Moreover, where will GUOQUAN's future transformation lead? With continuous investment and mergers and acquisitions by GUOQUAN, there are still many questions left for GUOQUAN. With the continuous decline in stock prices, will the capital market be patient enough to wait for GUOQUAN's transformation?