CRRC Times Electric: Replacing the Old with the New to Tackle the Risks of Rail Transit

Time Electric (3898.HK/688187.SH) released its annual report (ending in December 2022) following the market close on the evening of March 30th, 2023 Beijing time. The highlights are as follows:

-

Overall Performance: CRRC Time Electric achieved revenue of RMB 7.158 billion in the fourth quarter, a year-on-year increase of 8.5%, and the main driver of the company's revenue growth came from the emerging equipment business. The gross profit margin of the company in the fourth quarter was 31.8%, and the decline in gross profit margin was mainly due to the decline in gross profit margin of the traditional rail transit business and the structural impact of the business. The company achieved a net profit attributable to the parent of RMB 0.993 billion in the fourth quarter, a year-on-year increase of 21.8%.

-

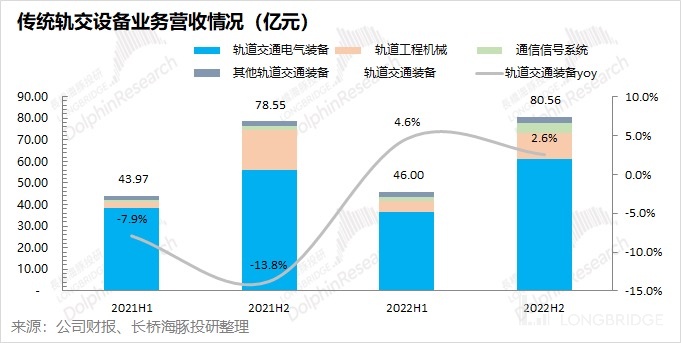

Traditional Rail Transit Business: CRRC Time Electric's traditional rail transit equipment business achieved a revenue of RMB 8.056 billion in the second half of the year, a year-on-year increase of 2.6%. The company was able to achieve slight growth despite the unstable macro environment. However, the gross profit margin of the traditional rail transit business also fell to 33.8% in the second half of the year.

-

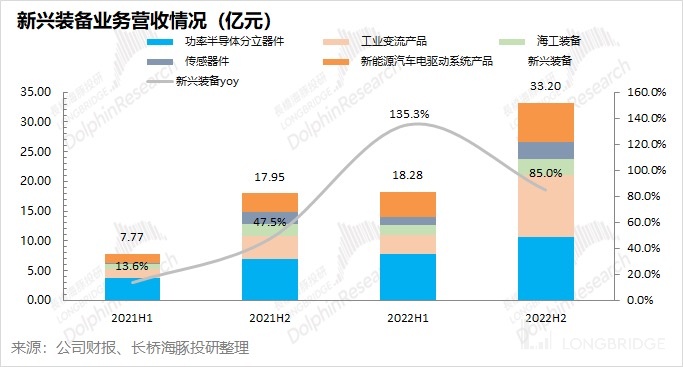

Emerging Equipment Business: CRRC Time Electric's emerging equipment business achieved a revenue of RMB 3.32 billion in the second half of the year, a year-on-year increase of 85%, and this is the major contribution to the company's growth. Among them, power semiconductors, new energy electric drives, and industrial inverter products all achieved growth of more than 50%, mainly driven by the demand in the new energy field.

Overall, CRRC Time Electric's financial report is in line with expectations. The company's traditional rail transit business is still the largest basic plate, and it has maintained growth in the second half of the year despite the impact of the macro environment. The emerging equipment business also achieved rapid growth as expected in the second half of the year.

Looking forward to the new year: 1) Traditional Rail Transit Business: With the recovery of economic life, rail transit can drive social demand and employment, and is expected to continue the growth trend in the new year. Due to the high base itself, the growth rate is difficult to achieve high growth. 2) Emerging Equipment Business: The current business proportion has reached nearly 30%, and it can also obtain a certain share in the market. It is expected to continue the growth trend in 2023, but the growth rate will decrease.

CRRC Time Electric's ability to maintain the growth trend in the past year is indeed not easy. In the new year, the rail transit business is expected to rebound, but the overall expectation of the new energy business may weaken. Currently, the company's overall valuation is less than 20 times, which is low for the new energy and semiconductor business, but high for the traditional rail transit business that is not growing.

Therefore, the valuation of CRRC Time Electric still needs to be separated into two parts. In the view of Long Bridge Dolphin, although the company's performance has shown strong resilience, the opportunity for CRRC Time Electric to break away from an independent market trend is not great under the current expectation of new energy downgrade.

Below is a detailed analysis by Long Bridge Dolphin on the CRRC Time Electric financial report:

- Overall Performance: Business Renewal and Counter-trend Growth

1.1 Revenue

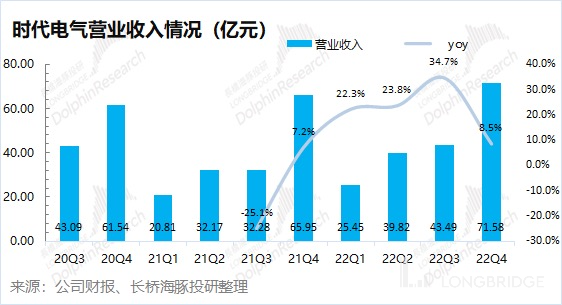

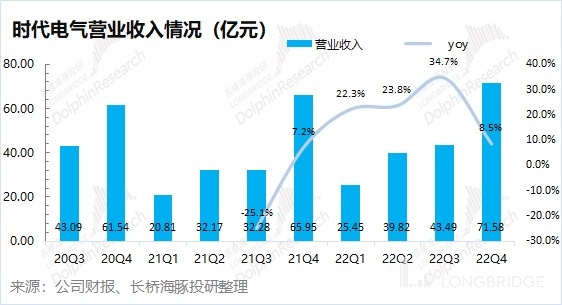

CRRC Time Electric achieved revenue of RMB 18 billion in 2022, a year-on-year increase of 19%. The company's revenue growth was mainly driven by the continuing high-growth of the emerging equipment business. Overall, in the past year, it has not been easy for the company to achieve year-on-year growth in an unstable macro environment.

Looking at it from a quarterly perspective, in the fourth quarter, Times Electric achieved a revenue of 7.158 billion yuan, a year-on-year increase of 8.5%. The company's revenue was still at its peak in the fourth quarter, mainly because some of the rail transit equipment needed to be delivered that year.

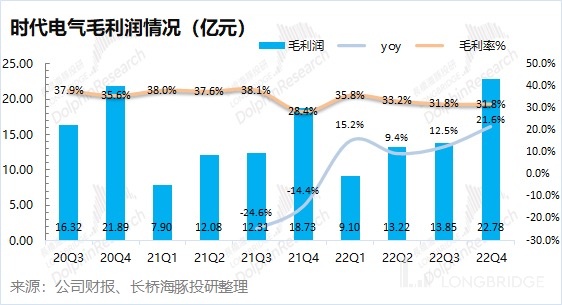

1.2 Gross profit and gross profit margin

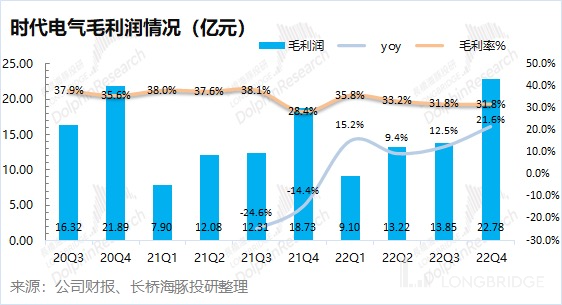

In 2022, Times Electric achieved a revenue of 5.9 billion yuan, a year-on-year increase of 15.6%. The company's gross profit margin has slightly decreased for the whole year, and gross profit growth is mainly driven by revenue.

Looking at it from a quarterly perspective, in the fourth quarter, Times Electric achieved a gross profit of 2.278 billion yuan, a year-on-year increase of 21.6%. The gross profit margin in the fourth quarter was 31.8%, a year-on-year increase of 3.4pct. The year-on-year increase in gross profit margin is mainly due to the increase in the gross profit margin of emerging equipment business. However, we can also see that the overall gross profit margin of the company has shown a downward trend, mainly due to the increasing proportion of emerging equipment business with lower gross profit margins, which structurally affects the overall gross profit margin of the company.

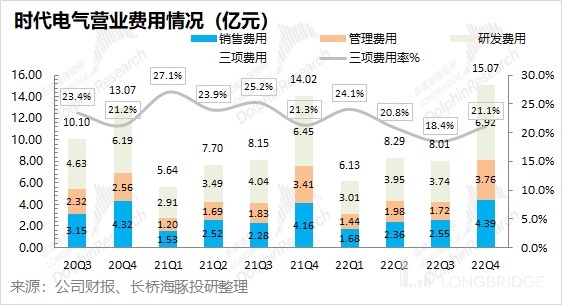

1.3 Operating expenses

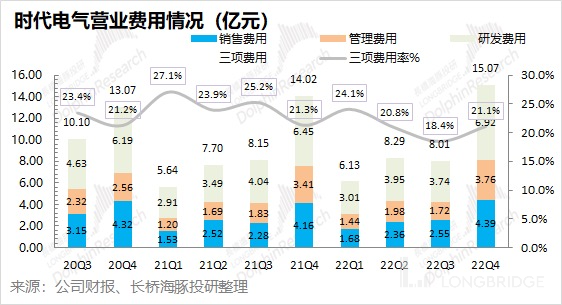

In the fourth quarter, Times Electric's operating expenses were 1.507 billion yuan, a year-on-year increase of 7.5%. The growth in operating expenses is basically synchronous with the growth in revenue, and the operating expense ratio in this quarter is 21.1%, which is close to the same period last year.

1) R&D expenses: This is the company's largest operating expense. R&D expenses in this quarter were 692 million yuan, a year-on-year increase of 7.3%. The R&D expense ratio was 9.7%, similar to last year. The absolute increase in R&D expenses is mainly due to the increase in personnel compensation and technical service fees.

2) Sales expenses: In this quarter, sales expenses were 439 million yuan, a year-on-year increase of 5.5%. The sales expense ratio was 6.1%, a slight decrease of 0.2pct compared with the same period last year. The increase in sales expenses was mainly due to the expansion of sales scale.

3) Management expenses: In this quarter, management expenses were 376 million yuan, a year-on-year increase of 10.3%. The management expense ratio was 5.3%, a slight increase of 0.1pct. The increase in management expenses was mainly due to employee compensation, depreciation and amortization expenses, and maintenance fees.

1.4 Net profit

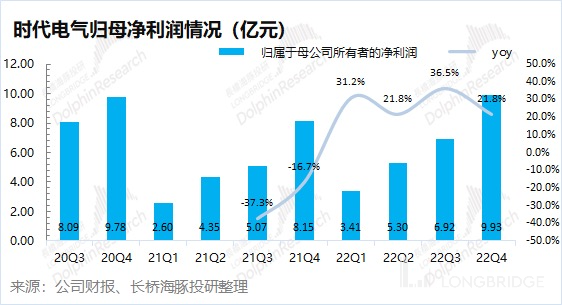

In 2022, Times Electric's net profit attributable to the parent company was 2.556 billion yuan, a year-on-year increase of 26.67%. The growth rate of net profit was faster than that of revenue, mainly because the company's profitability also improved significantly this year. Looking Only at the Fourth Quarter, the Company Achieved a Net Profit of 993 Million Yuan Attributable to Its Parent, a Year-on-Year Increase of 21.8%, Maintaining High Double-Digit Growth.

II. Business Segmentation: Heavy Rail Transit Weighs Down, New Kinetic Energy Released

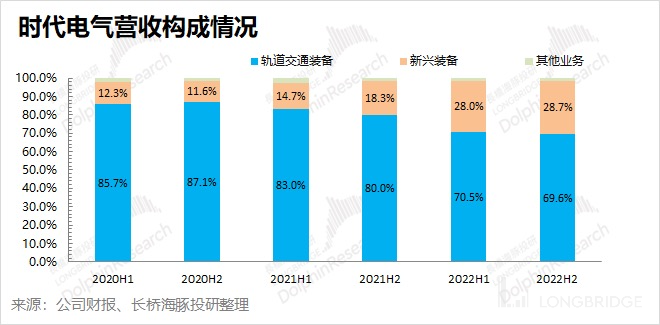

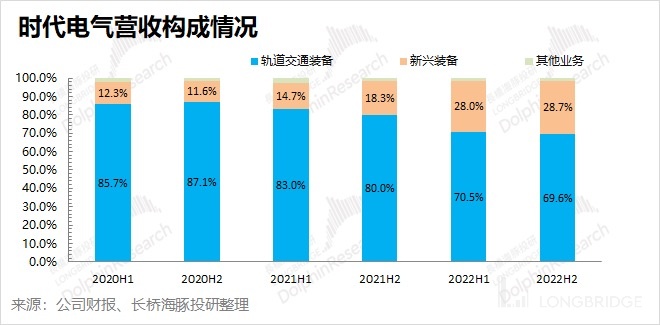

With the growth of new businesses, the company gradually transformed into two-legged operations in rail transit equipment and emerging equipment businesses. From the situation in the second half of 2022, the proportion of rail transit equipment business has dropped to below 70%. As rail transit business is relatively stable, the growth of emerging equipment business has brought new opportunities to the company.

2.1 Traditional Rail Transit Business

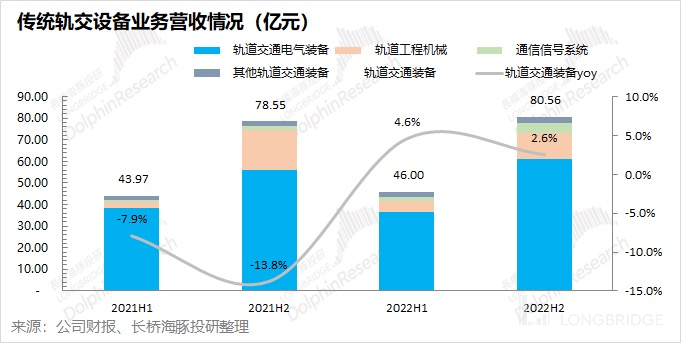

In 2022, Time Electric's revenue from traditional rail transit business reached 12.6 billion yuan, a year-on-year increase of 3.3%. Under the influence of the virus, rail transit business still achieved growth, mainly due to the growth of rail transit electrical equipment and communication business.

Looking only at the second half of the year, the revenue from traditional rail transit business was 8.056 billion yuan, a year-on-year increase of 2.6%. In detail, ①Revenue from Rail Transit Electrical Equipment reached 6.133 billion yuan in the second half of the year, a year-on-year increase of 9.1%. This is the largest category in rail transit business, and returned to growth in the second half of the year, mainly due to the accelerated delivery of rail transit before the year end; ②Revenue from Rail Engineering Machinery in the second half of the year was 1.168 billion yuan, a year-on-year decrease of 37%; ③Revenue from Communication Signal Systems in the second half of the year reached 471 million yuan, a year-on-year increase of 229%.

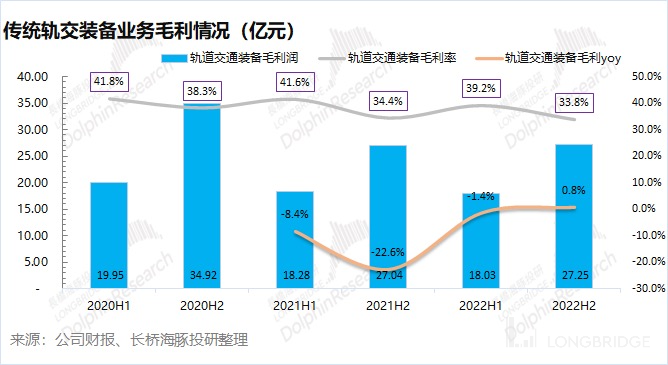

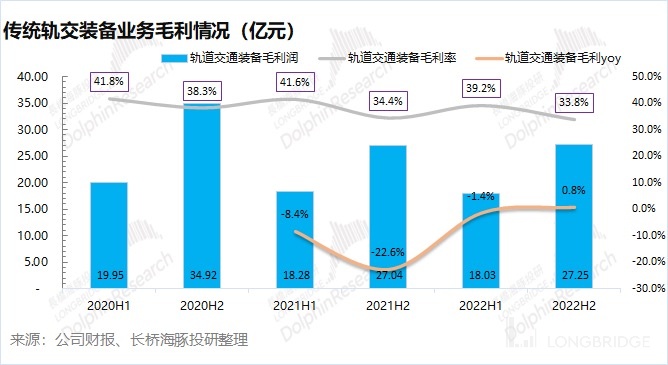

In the second half of 2022, the traditional rail transit equipment business of the company achieved a gross profit of 2.725 billion yuan, a year-on-year increase of 0.8%. The gross profit margin of traditional rail transit business dropped to 33.8%, indicating that the gross profit margin varied between the first and second half of the year. This was mainly because revenue from rail transit electrical equipment was larger in the second half of the year, and the gross profit margin of this category is relatively low, resulting in a lower gross profit margin in the second half of the year.

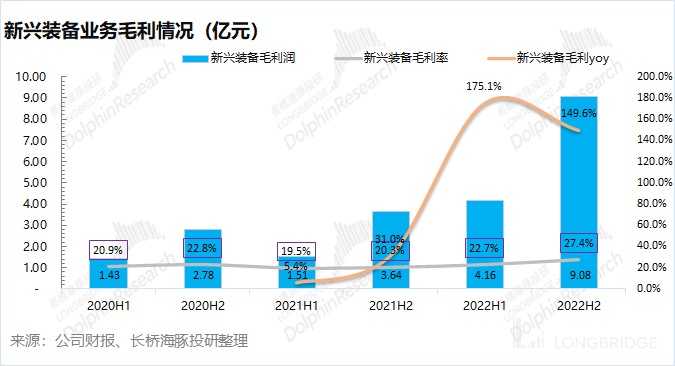

2.2 Emerging Equipment Business

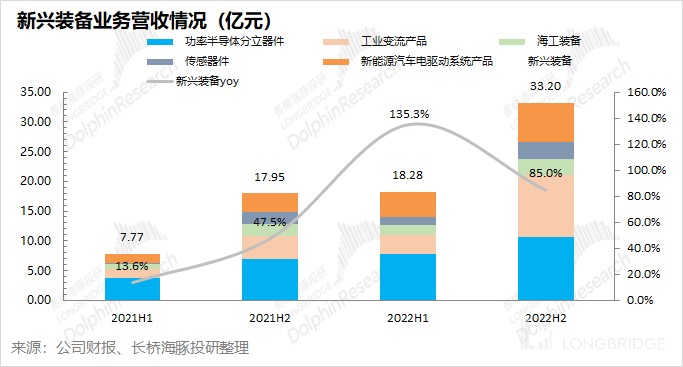

In 2022, Time Electric's revenue from emerging equipment business reached 5.148 billion yuan, doubling year-on-year, which was the main driving force for the company's revenue growth.** Looking just at the second half of the year, the revenue of emerging equipment business reached 3.32 billion yuan, an increase of 85% year-on-year. Breaking it down, ① power semiconductor discrete components are still the largest item in the emerging equipment business, with revenue of 1.063 billion yuan in the second half of the year, a year-on-year increase of 53.2%. The growth rate of power semiconductor is far higher than that of traditional rail transit equipment (2.6%), mainly due to the power of downstream demand such as new energy; ② electric drive system products for new energy vehicles achieved revenue of 657 million yuan in the second half of the year, a year-on-year increase of 112.6%, continuing to maintain a high-speed growth; ③ industrial rectifier products achieved revenue of 1.048 billion yuan in the second half of the year, with a year-on-year increase of 176.5%. Some of the industrial rectifiers are used in rail transit, with high demand during the second half of the year; ④ Other marine equipment and sensor components achieved revenue of 268 million yuan and 284 million yuan in the second half of the year, with year-on-year increases of 26.4% and 40.6%, respectively.

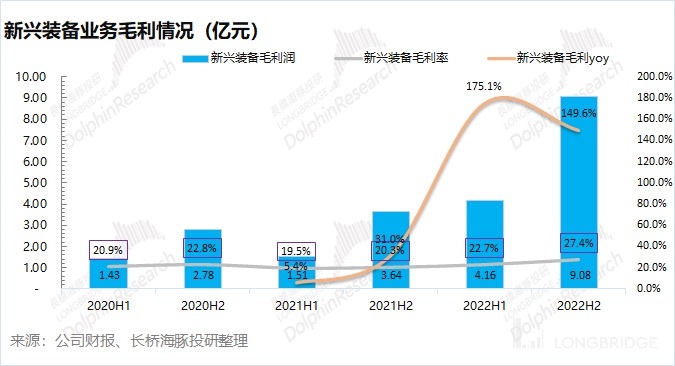

In the second half of 2022, the company's emerging equipment business achieved a gross profit of 908 million yuan, a year-on-year increase of 149.6%. The growth rate of the gross profit of the emerging equipment business exceeds that of the revenue growth. The gross profit margin of the company's emerging equipment business in the second half of the year was 27.4%, a year-on-year increase of 3.2 percentage points, reaching a historic high.

The increase in the gross profit margin of the emerging equipment business is mainly driven by the development of the company's new energy business and the resulting increase in related gross profit margins. However, because the gross profit margin of emerging equipment is still lower than that of traditional rail transit, the overall gross profit margin of the company will still show a downward trend as the emerging equipment business grows rapidly.

Longbridge dolphin CRRC Zhuzhou Electric's historic article retrospective:

Financial Report Season

October 17, 2022, Financial report review《 Overview of CRRC Zhuzhou Electric's 3Q Report》

August 27, 2022, Financial report review《 Spring and Autumn Harvest, The 'Core' Era of CRRC Zhuzhou Electric》

In-depth Analysis

June 14, 2022, Company in-depth analysis《 Jumping on the Safety Mat, Will the IGBT Make a New Era for CRRC Zhuzhou Electric?》

May 16, 2022, Company in-depth analysis《 CRRC Zhuzhou Electric: Galloping on Rail Transit, or Taking IGBT's Malachi Winds?》 This article's risk disclosure and statement: Dolphin Research's Disclaimer and General Disclosure