Posts

Posts Likes Received

Likes Received99 Speedmart: Business Innovation is Good, Operations Also Need Optimization

Hello everyone, I'm DolphinJun from Changqiao!

After the Hong Kong stock market closed on the evening of March 21st Beijing time, Jiumaojiu (9922.HK) released its 2022 full-year results. Since the company had already disclosed its revenue and net profit in its 2022 performance forecast in late February, it didn't matter whether the market had expectations or not (in fact, for losses, the deviation of institutional expectations is quite far and not significant).

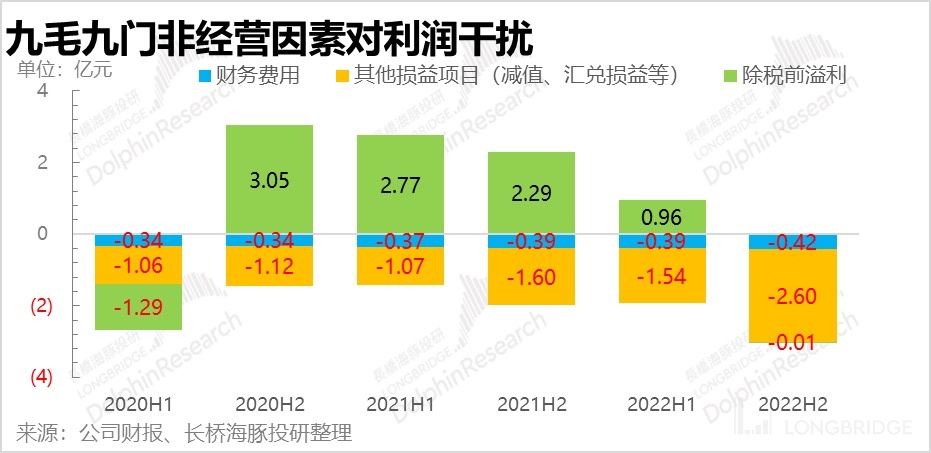

Although the loss in the second half of the year was already anticipated, many irrelevant expenses or losses interfered, further exacerbating the already very poor performance.

The main points are as follows:

1. Store expansion continues, and Songhuo Hotpot is progressing quickly: Last year was undoubtedly a heavy blow to offline catering. Long-term extensive management and frequent flow restrictions made almost all catering stores sparsely populated. It can be said that for every store opened, one is lost. Many catering stores did not go bankrupt in 2020, but did in 2022.

Maintaining continuous store expansion under such circumstances is a major challenge for catering companies. Overall, Jiumaojiu has maintained a certain pace in store expansion. Whether it is Tai'er, Jiumaojiu, or Songhuo Hotpot, they all have varying degrees of store additions. Among them, Songhuo Hotpot has a more prominent growth trend due to its small base, although it currently does not make a significant contribution to the group. However, after its volume gradually increases this year, it will be a business that cannot be underestimated.

Regarding the opening pace for 2023, Tai'er plans to open 120 stores (including 105 in China and 15 overseas), with a sinking strategy in China (around the edge business circle of the high-speed rail) and expansion to North America, East Asia, and Southeast Asia overseas. Songhuo Hotpot plans to open 25 stores, mainly in South China, and choosing opportune times for expansion nationwide. Overall, the pace of rapid expansion is maintained.

2. Occupancy rate declined, but saw improvement after New Year's Day: The tragic situation of customer flow in the third and fourth quarters of last year has already made DolphinJun tired of repeatedly mentioning it in recent days in the financial reports of Li Ning and Anta. What is past is past. From the perspective of after New Year's Day, Jiumaojiu's recovery situation is still good, although the company has not disclosed monthly data for direct comparison. However, it is believed that everyone has seen the waiting situation in restaurants and the like recently, and the recovery effect is quite good.

According to DolphinJun's exchanges with the industry, the accumulated same-store revenue situation in January-February for Tai'er and Jiumaojiu has basically returned to the level of the same period in 2022 (not a small base, still before extensive pandemic prevention and control). Among them, Tai'er's recovery situation is better, and it has exceeded the same period level.

However, compared with 2019, there is still a gap. Tai'er and Jiumaojiu have recovered to 90% and 70% of same-store sales in 2019, which may still not have reached the degree of "revenge rebound" that everyone previously expected.

3. Per capita consumption is declining: With both quantity and price falling, it is difficult for the catering industry to raise the average customer unit price or per capita consumption if there is no queue situation. Especially when many catering chains establish their brand image in first and second tier cities and start to sink to lower tier markets, they will encounter some difficulties. Dolphin believes that before the turnover rate recovers to the level of 2020 (the turnover rates for 2018 and 2019 were indeed too high), we should not have high expectations for per capita consumption. It needs to be taken slowly.

4. Expense ratio and non-operating factors interfere with net profit at the same time: In addition to the decline in profitability caused by the operating situation itself (the operating profit margin of Tai'er stores decreased from 22% to 14%), there are also non-operating factors that have a major impact on interference. Misfortunes never come singly. The exchange loss for the whole year of last year was close to 80 million, which immediately turned net profit negative.

Dolphin's overall opinion:

Overall, the problems with Jiuhema are still not small, although this is not only a problem with Jiuhema, but also a problem with the entire industry. Indeed, due to the serious decline in offline passenger flow last year, it was a relatively heavy blow to catering with relatively high rigid costs (especially direct sales). But Jiuhema also has its own shortcomings, although it strives to break through continuously, the differentiation from peers is not particularly obvious. It is difficult to solve the problem of repeat customers facing consumers who are fond of novelty and change.

However, the terminal passenger flow is gradually recovering now. From the Solving Zero and Retail data of January and February, the recovery of catering is also relatively advanced. Some investors may be worried whether the current recovery is a short-term behavior. Will the long-term insufficient consumer purchasing power due to economic pressure. On this point, Dolphin can only say that there is no absolute conclusion yet.

But if we look at Jiuhema's long-term development from a neutral and optimistic perspective, we can refer to the early Dolphin in-depth report on Jiuhema, " Jiuhema (II): Can Jiuhema, which is supported by Tai'er stores, go on a stock price skyrocketing?" Under the assumption of a turnover rate of 4.0 and 870 stores (far from reaching at present), and using discounted cash flow to value it, Jiuhema's expected stock price is HK$21. At present, the safety margin is not clear enough, so we can only keep observing.

If you are interested in the management's communication during the earnings call, Dolphin will share the summary of the call through the Longbridge App Community platform or the investment research group by adding the WeChat account "dolphinR123" to join the Dolphin Investment Research Group.

The following is a detailed interpretation of the financial report:

I. Store continues to expand, and Sōng Huǒ Guō makes progress quickly

In terms of the number of stores, it is the only data in this financial report that can be seen to have increased significantly. In comparison, although Sōng's current size is relatively small, its growth trend is very fast, and the average price of hot pot is higher than that of sour fish, which is believed to have a pivotal proportion in the group in the future after several years of accumulation. According to recent communications from the company, the goal of opening stores in 2023 is very ambitious. With the addition of 120 Tai'er and 25 Sombo hotpot restaurants, the expansion has basically doubled, while Tai'er's growth has surpassed 20%.

Second, the operating situation is still recovering in an orderly manner.

Neither the turnover rate nor the average consumption per person is ideal, but it was a reality that had to be accepted under the restricted passenger flow last year. However, the current operating situation is still in the process of recovery, but the pace is not too fast.

From the perspective of sales at the same store, both Tai'er and Jiufen were much worse last year than in 2021, with both declining.

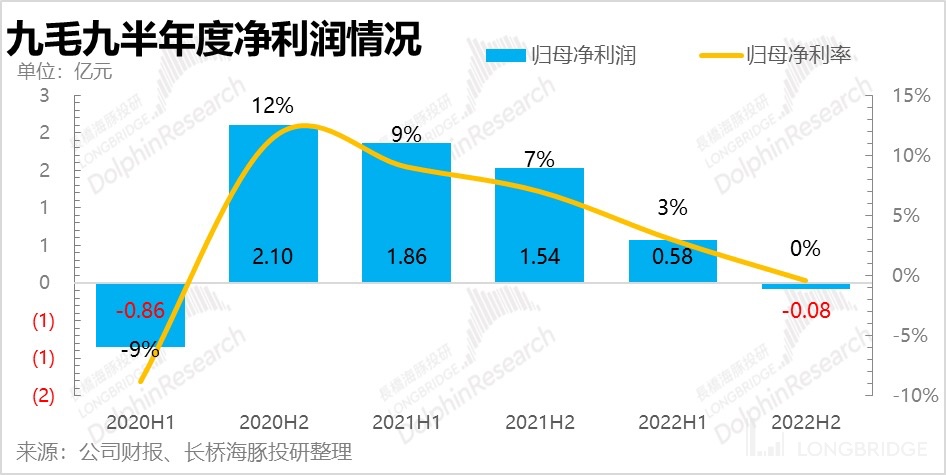

The simultaneous decline in quantity and price led to a straight decline in operating profit margins. From the perspective of different brands, the decline in profit margins at Tai'er's store level was mainly due to the decline in profits. The operating profit margin at Jiufen's store level was 12.9%, the same as the previous year, while Tai'er's was only 14.3%, a 7 percentage point drop from the previous year.

Judging from the social retail data, the recovery situation in January and February of this year was quite good. Considering the low base for the next three quarters, the certainty of recovery this year is very strong.

Third, although other businesses have grown rapidly, their proportion is still too small and mainly supported by Tair. However, due to a decline of more than 20% in same-store sales at Tai'er and a less than 30% increase in the number of stores, the overall revenue only reached that of last year.

Fourth, costs and expenses.

There was not much change in gross profit margin.

Due to the fact that the main cost is only raw materials, the gross profit margin of 99 cents over the past few years has been quite stable, and the change in gross profit mainly follows the influence of revenue changes.

3.2 Cost ratio

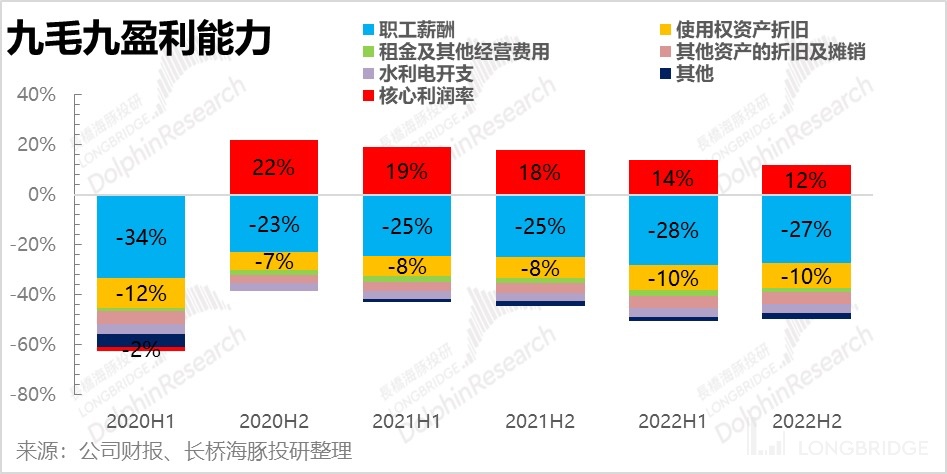

In the current context of store expansion, but with declining customer traffic and average spending, some relatively rigid costs such as labor, rent, and depreciation are relatively disadvantageous for 99 cents, and the cost ratio has increased to a certain extent, with operating profit The rate and the same period of the previous year have dropped by about 6 percentage points.

3.3 There are non-operating projects interfering

Because the operating profit margin has already fallen to 12%, and the income base is not large, the profit is about 200-300 million yuan. However, after digesting financial expenses and some non-operating income and expenses, the net profit attributable to the parent company turns negative. Among them, the main impact is the exchange loss and profit, which is about 80 million yuan.

Long Bridge Dolphin "99 Cents" Historical Articles:

Depth

June 28, 2022 "99 Cents (Part II): Can "Tai'er" support the explosive stock price of 99 Cents?"

June 23, 2022 "99 Cents (Part I): The breeding mentality of "Tai'er" fat fish"

Financial Report Season

August 24, 2022 conference call "Recovery towards the second half of the year, self-disclosure ratio of branzino improved"

August 24, 2022 financial report review "99 Cents: Only full-blood resurrection left after passing the darkest moment?"

Risk disclosure and statement of this article: Dolphin Investment Research Risk Disclosure and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.