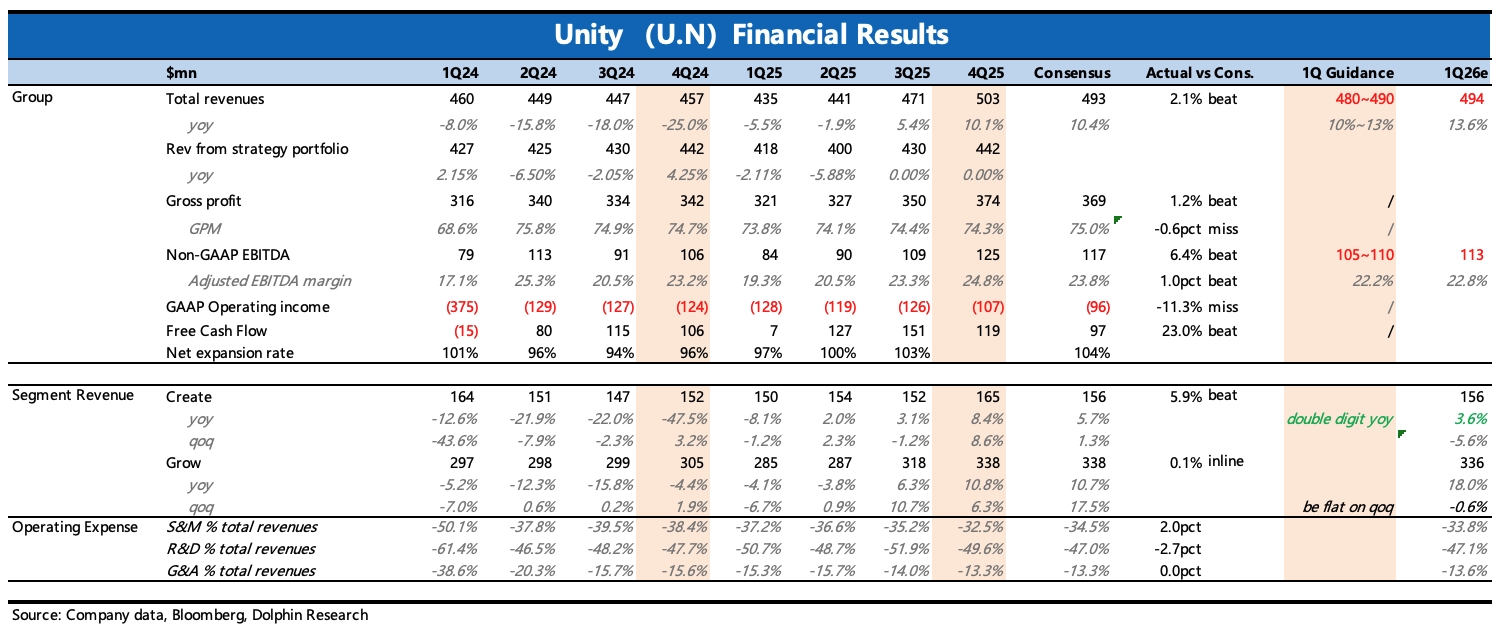

Unity 4Q25 First Take: The battered stock sold off again post-earnings. The quarter beat, but Q1 guidance for Grow missed, triggering another plunge amid fragile sentiment.

The company guided Q1 Grow to be flat QoQ, vs. the Street at +5% QoQ and some bullish buyside at +10% QoQ. Expectations for acceleration were anchored to improving Vector performance and a broader rollout across IronSource and Tapjoy, with D28 optimization expected by some to land in Q1.

These views largely overlooked Q1 seasonality and the fact that there are fewer ad-serving days than in Q4.

Flat growth guidance poured cold water on the bull case, implying those Q1 assumptions will likely be pushed out. Given management’s typically conservative guides, Dolphin Research believes the reality may not be that 'bad'.

That said, based on channel checks, Vector-driven improvement in Unity’s ads revenue still looks intact; the debate is the cadence.

Create performed well, despite recent hits from Genie aimed squarely at the engine business. Management guided double-digit YoY growth for Create in Q1, well above expectations, and the trend points to stronger momentum. $Unity Software(U.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.