Trending Creators in 2025

Trending Creators in 2025Reflect on the inconsistency between knowledge and action

Recently, I've been looking at the market less to avoid repeating past mistakes. I'll come back at the end of the quarter$Tesla(TSLA.US)

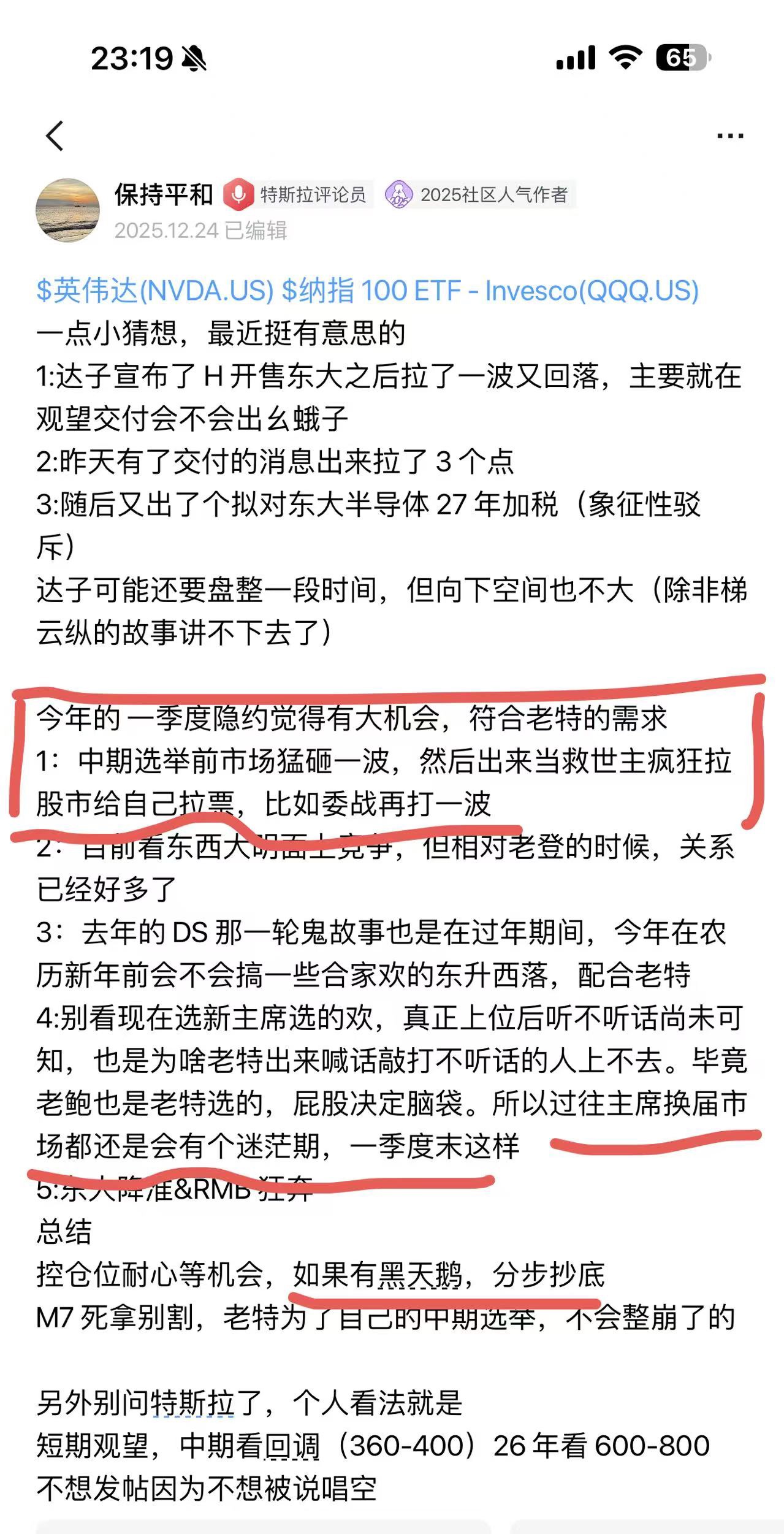

$NVIDIA(NVDA.US)$Invesco QQQ Trust(QQQ.US)

A little speculation, quite interesting recently

1: Dazi announced the H sale in the East and then pulled up a bit before falling back, mainly waiting to see if there would be any issues with delivery

2: Yesterday, news about delivery came out and it rose 3 points

3: Then there was news about a proposed tax increase on East semiconductor in 2027 (symbolic rebuttal)

Dazi might still consolidate for a while, but the downside is limited (unless the story of Tiyunzong can't be told anymore)

This year's January-February vaguely feels like there will be a big opportunity, which also fits Trump's needs: 1: Before the midterm elections, the market crashes hard, then he comes out as a savior to pump the stock market for votes, like another round of Venezuela war

2: Currently, the East and West are openly competing, but compared to Biden's time, relations have improved a lot

3: Last year's DS ghost stories were also during the New Year, will there be some family-friendly ups and downs before the Lunar New Year this year, in sync with Trump

4: Don't be fooled by the current excitement over the new chairman selection, whether he'll listen after taking office is still unknown, after all, Powell was also chosen by Trump, and positions determine opinions, so historically, there's always a period of confusion during chairman transitions, around the end of Q1

5: East cuts reserve ratio & RMB surges

Summary

Control positions and wait patiently for opportunities, if there's a black swan, buy the dip in stages

Hold M7 tight, don't sell, Trump won't let it crash for his midterm elections

Also, don't ask about Tesla, my personal view is

Short-term wait and see, mid-term expect a pullback (360-400), 2026 target 600-800

Don't want to post because don't want to be called bearish

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.