Orders

Orders Traded Value

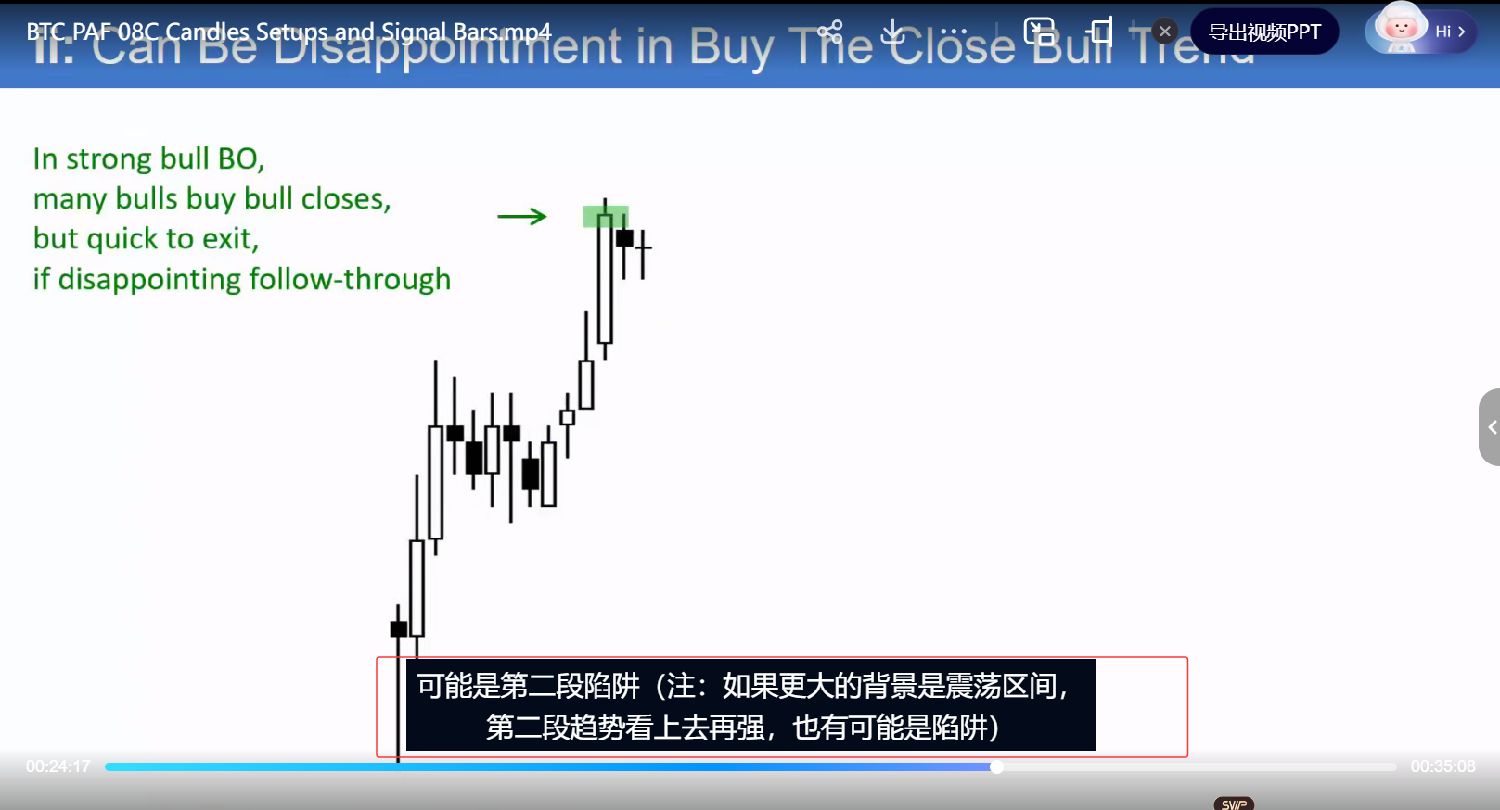

Traded ValueI currently focus on only two high-probability patterns, both of which are here (two-stage rise or pullback within a range, double bottoms and tops, and weak pullbacks followed by breakouts in strong trends). The second-stage rise in a range mentioned in the course, no matter how strong, is likely just a bull trap, as seen in Bitcoin.

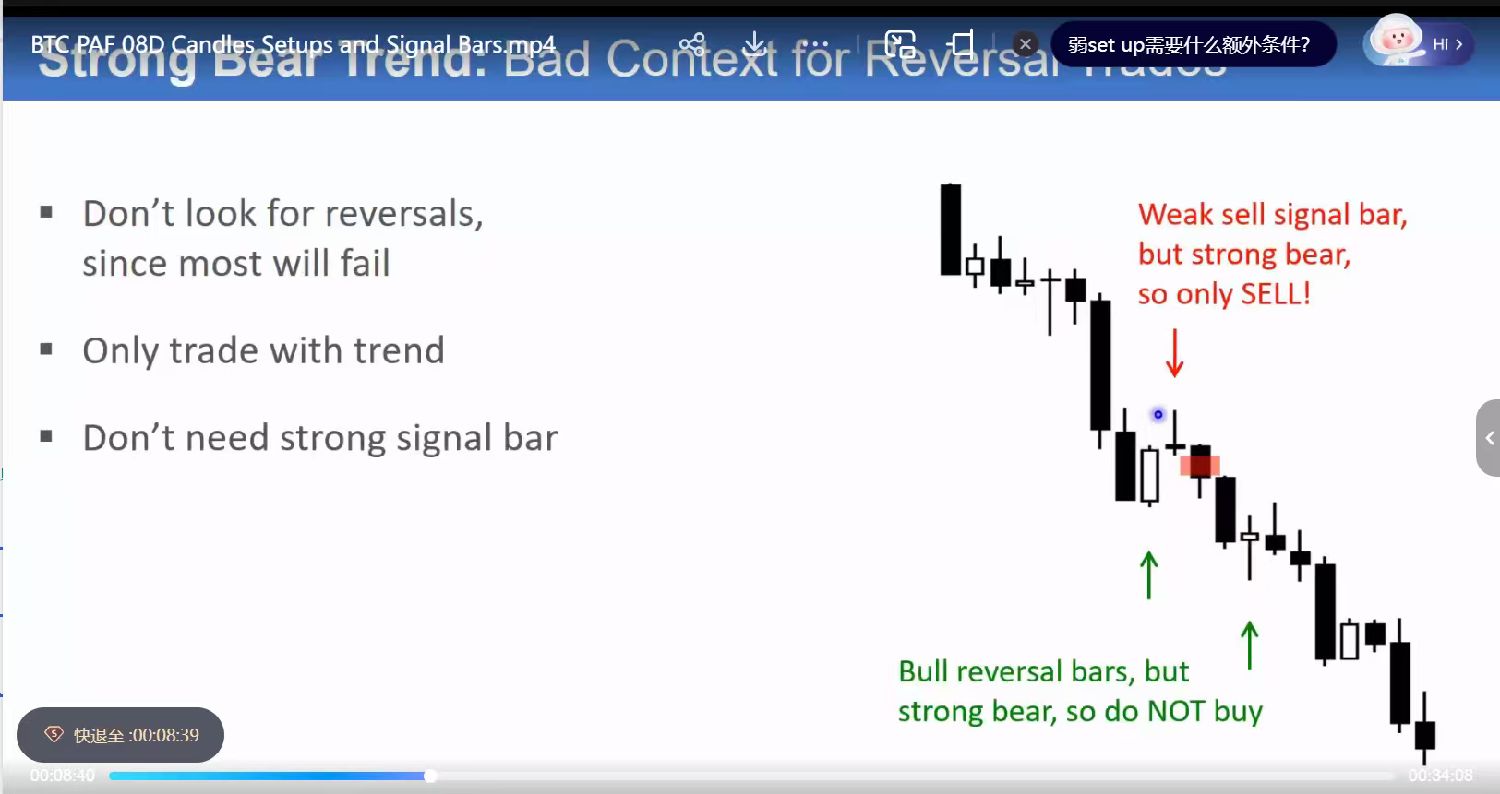

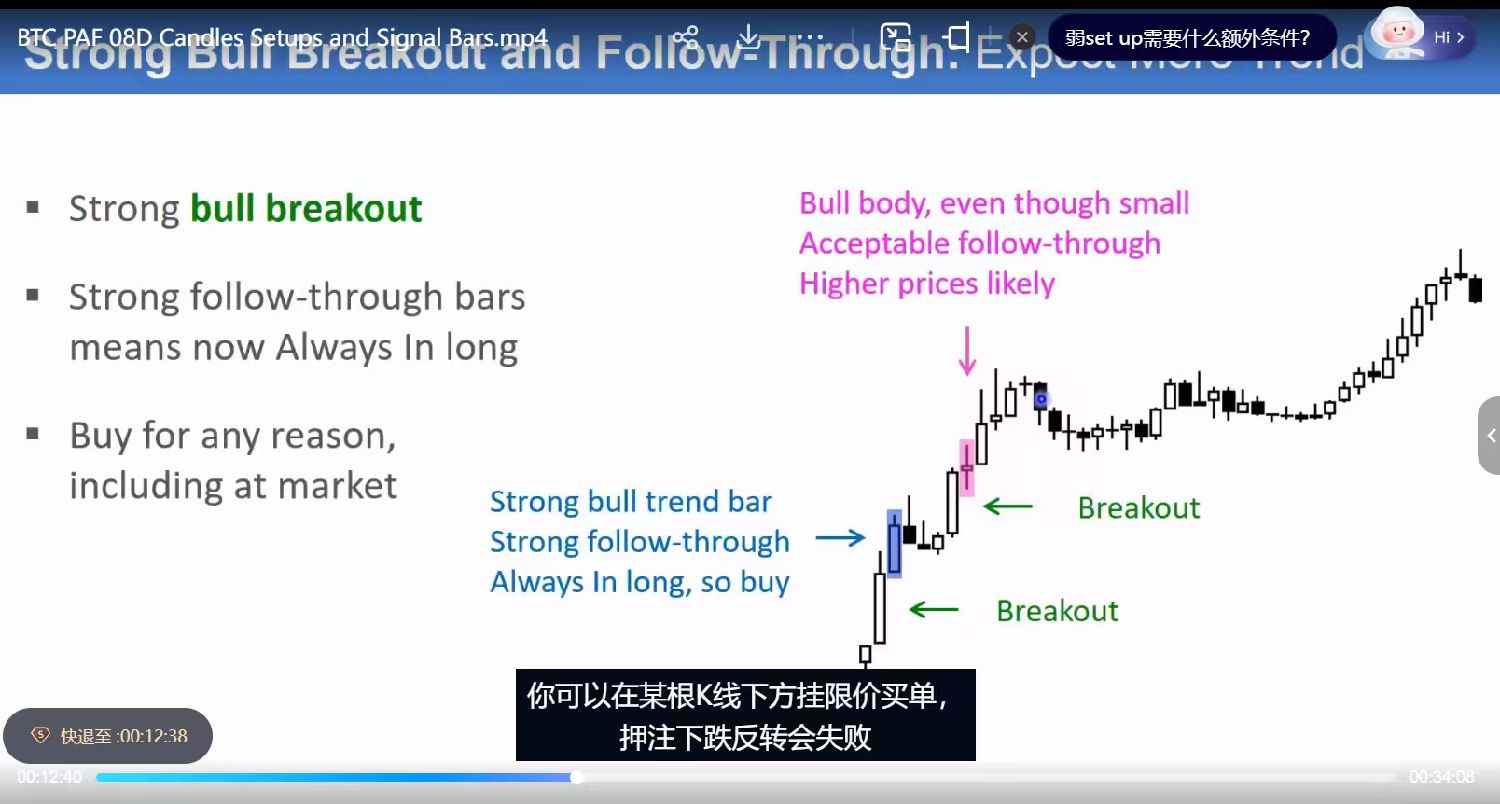

The narrow breakout pattern has also been validated in the U.S. stock market and several individual stocks. In a one-sided trend, as long as the background is solid, the signal candle becomes less important—the background accounts for over 90% of the importance. The quality of the signal candle and entry candle doesn’t determine the win rate.

No matter how much more you learn, everything will first align with these two high-probability patterns. The goal is to continuously refine them—better patterns, higher-quality entries, tighter stops, and better risk-reward ratios—all contingent on having a solid background, as that’s what ultimately determines the win rate of a trade.

A trade with an extremely high risk-reward ratio, say 10x or 20x, but with a very low win rate, isn’t worth taking because the probability of getting stopped out is too high. High-win-rate opportunities don’t necessarily mean low risk-reward ratios. This may seem like a matter of sequence, but the underlying logic is fundamentally different. High win rates can lead to high risk-reward ratios, but high risk-reward ratios often imply low win rates.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.