Trending Creators in 2025

Trending Creators in 2025Hold it, time for space

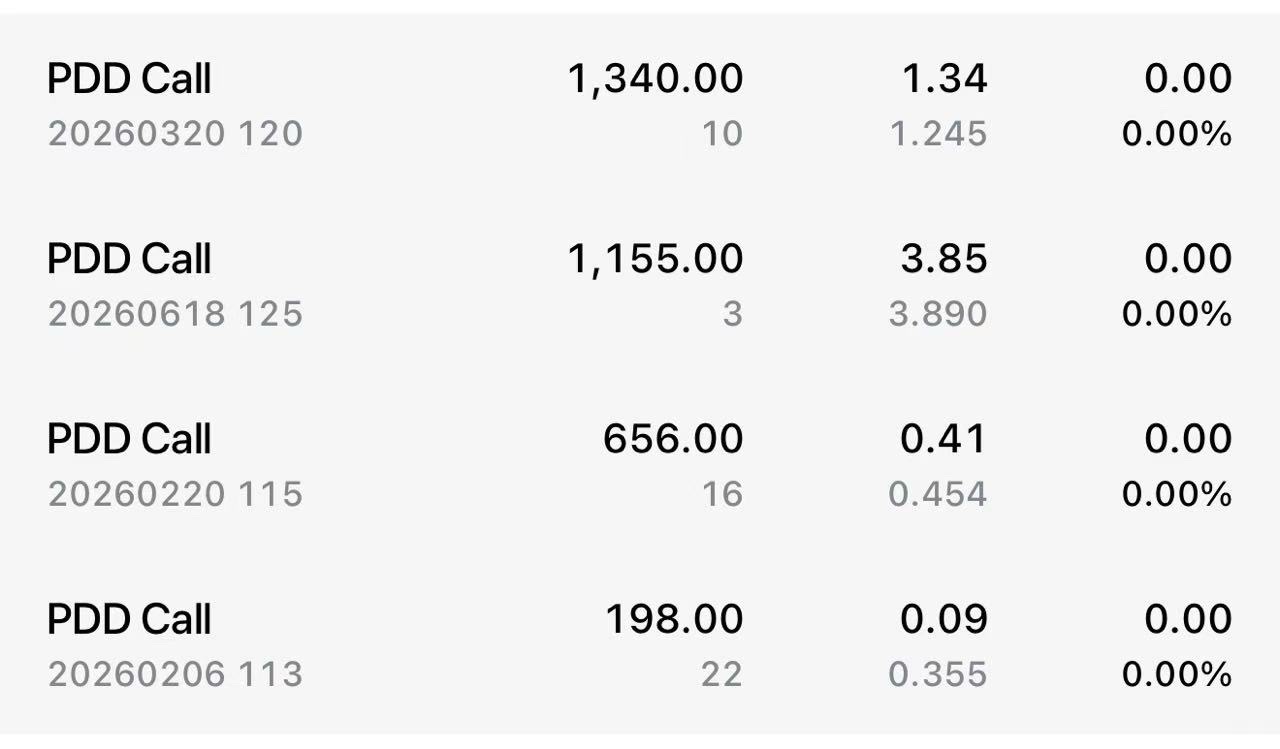

$PDD(PDD.US)

"Have you lived for ten thousand days? Or have you lived one day and repeated it ten thousand times?"

"If you often see what you have, you will be much happier. But unfortunately, most of us often look at what we don't have, and that's why life is full of regrets."

Loss aversion means that when you're making money, you become conservative, and when you're losing money, you become aggressive. It's easier to take profits early and let losses run.

In the trading industry, this leads to you exiting with small profits but continuing to add to losing positions, the so-called 'averaging down.'

These behaviors are harmful to trading, or they go against the essence of trading profits. The essence of trading profits is to cut losses short and let profits run.

You usually don't think about increasing your investment when you're making money because you become conservative when you're profitable.

This mindset is beneficial for survival, but it's the opposite in the trading industry.

Human nature, our human nature, and the profit-making essence of modern financial markets are in conflict. This is the main reason why retail investors lose money in stock trading.

It's often said that the essence of profit-making is not about predicting the future but about being rational or turning counterintuitive behaviors into your second nature. This is the key.

Adding to winning positions is not something ordinary people can do; adding to losing positions is the first reaction for many.

For SLV recently, I was the coward. I was very bullish and had some good deep in-the-money calls, but because the floating profits were so good, I got scared, became conservative, and feared a pullback that would wipe out my gains. This led me to exit too early, missing out on several times the potential profits—could have been forty, but ended up with less than ten.

If I had another chance, I wouldn't add to winning positions, but I would gradually reduce my position instead of going all or nothing with a one-click liquidation.

$Amazon(AMZN.US)

$Meta Platforms(META.US)

$Alphabet - C(GOOG.US)

$Intel(INTC.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.