Rate Of Return

Rate Of Returnmark it

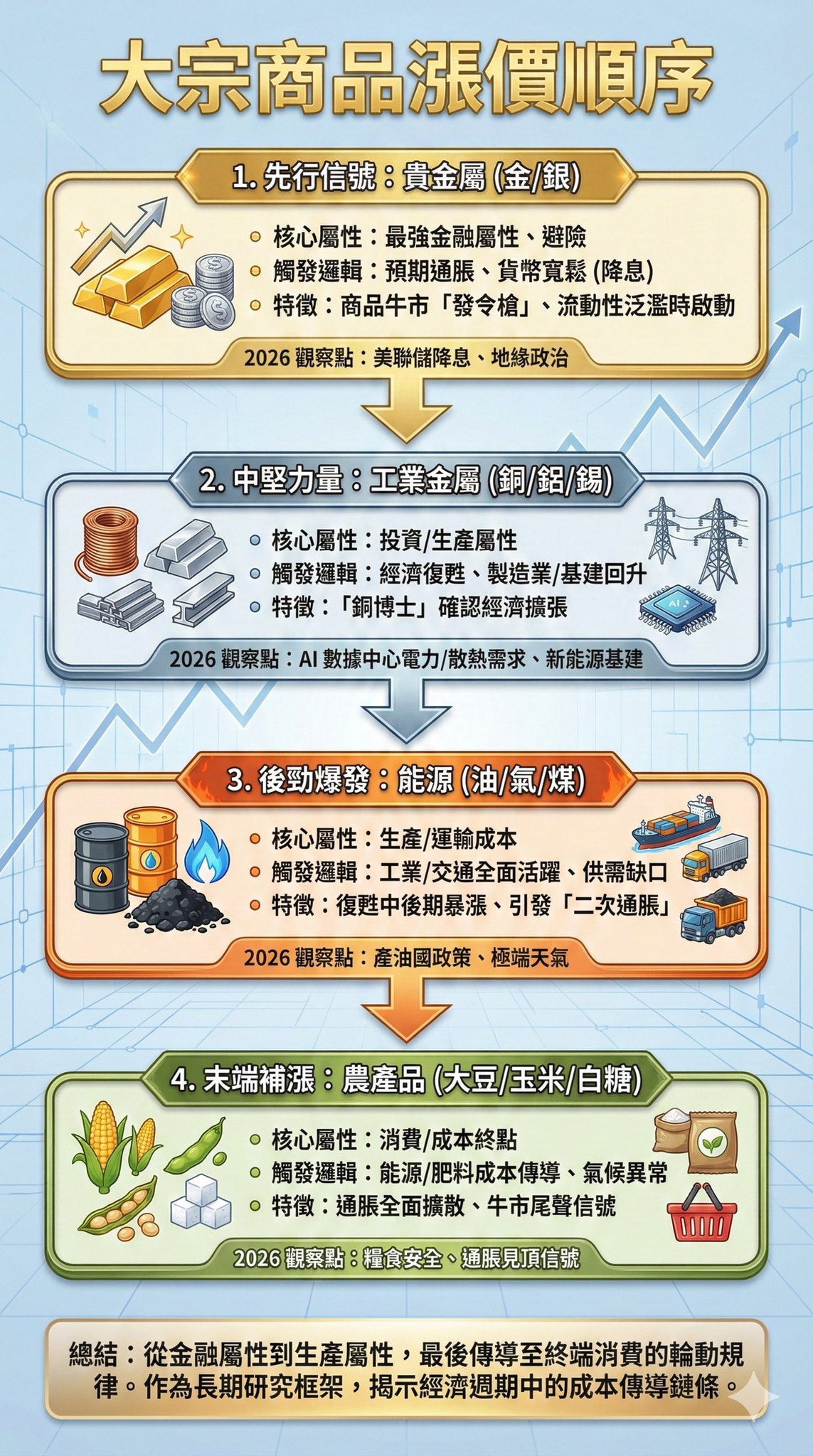

According to historical patterns, bulk commodity price increases will be transmitted. Each sector should have three US-listed companies.

Leading signal gold: $Newmont(NEM.US) $Gold.com(GOLD.US) $Agnico Eagle Mines(AEM.US) Silver: $Pan American Silver(PAAS.US) $First Majestic Silver(AG.US) $Hecla Mining(HL.US) Core strength copper: $Freeport Mcmoran(FCX.US) $Southern Copper(SCCO.US) $BHP(BHP.US) Aluminum: $Rio Tinto(RIO.US) $Alcoa(AA.US) $Norsk Hydro(NHYDY.US) Late-stage breakout oil: $Exxon Mobil(XOM.US) $Chevron(CVX.US) $Shell(SHEL.US) Natural gas: $ConocoPhillips(COP.US) $EOG Resources(EOG.US) $EQT(EQT.US) Coal: $Peabody Energy(BTU.US) $Arch Resources(ARCH.US) $Warrior Met Coal(HCC.US) End-stage catch-up soybeans: $Archer-Daniels-Midland(ADM.US) $Bunge Global SA(BG.US) $Tyson Foods(TSN.US) Corn: $Corteva(CTVA.US) $Mosaic(MOS.US) $Deere(DE.US) Sugar: $Teucrium Sugar(CANE.US) $Archer-Daniels-Midland(ADM.US) $Bunge Global SA(BG.US) Can be considered for layout

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.