Hong Kong IPO | HashKey Holdings, Hong Kong's "first crypto asset stock", starts subscription today with a minimum subscription fee of HKD 2,808, aiming to raise HKD 1.42 billion

December 9, 2025, HashKey Holdings Ltd. (hereinafter referred to as "HashKey") officially launched its Hong Kong IPO subscription, becoming the first dedicated cryptocurrency exchange to go public in Hong Kong. This milestone event further solidifies Hong Kong's position as a regulatory hub for digital assets in Asia and provides investors with an opportunity to participate in the growth of the crypto ecosystem. Despite Bitcoin losing over $10,000 in market value this month, HashKey's IPO continues to attract market attention, with the expected funds raised to support its steady expansion amid volatility.

I. Company Overview: From Emerging Player to Industry Leader

HashKey Group was founded in 2018 and is headquartered in Hong Kong, serving as a leading digital asset group in Asia. The company's businesses span crypto trading, asset management, brokerage services, tokenization, and venture capital. Among them, HashKey Exchange is Hong Kong's largest licensed crypto exchange, having secured one of the first licenses since the introduction of Hong Kong's dedicated digital asset regulatory framework in 2022. The platform is known for its ISO-certified security architecture and conservative risk management, expanding into markets such as Japan and Bermuda.

As of the first half of 2025, HashKey's assets under management (AUM) reached HKD 7.8 billion (approximately USD 998 million), with trading revenue accounting for nearly 70% of total revenue. The company also operates HashKey Chain—a Layer-2 network focused on real-world assets (RWA), stablecoins, and institutional applications, monetized through mechanisms such as gas fees. Despite the volatile crypto market, HashKey's revenue for the first nine months of 2025 grew 4% year-on-year to HKD 557.6 million (approximately USD 71.7 million), with net losses narrowing to HKD 506.7 million (approximately USD 64.9 million), primarily due to cost control and optimization of trading operations.

HashKey has a clear strategic positioning: to build a "digital asset ecosystem" serving retail investors, institutional clients, and blockchain value chain participants. The company emphasizes compliance, having secured multiple expansion licenses, and plans to use IPO proceeds to strengthen its technology infrastructure, risk framework, and talent pool to capitalize on regulatory benefits such as Hong Kong's stablecoin issuance licenses and global liquidity sharing.

II. Business Overview: Three Pillars Driving Growth

The company's revenue engine is driven by three synergistic business segments, forming a diversified and defensive revenue structure:

| Business Segment | Core Content | Revenue Contribution (1H 2025) | Key Data |

|---|---|---|---|

| Trading Facilitation Services | Provides spot trading via platforms like HashKey Exchange. | 68% (Core Revenue Source) | Cumulative spot trading volume exceeds HKD 1.3 trillion. |

| On-Chain Services | Offers institutional-grade staking, blockchain infrastructure, and RWA tokenization services. | Key Growth Driver | Operates HashKey Chain, a Layer-2 network focused on RWA and institutional applications. |

| Asset Management Services | Provides venture capital and secondary market fund solutions. | Ecosystem Synergy | Assets under management (AUM) reach HKD 7.8 billion. |

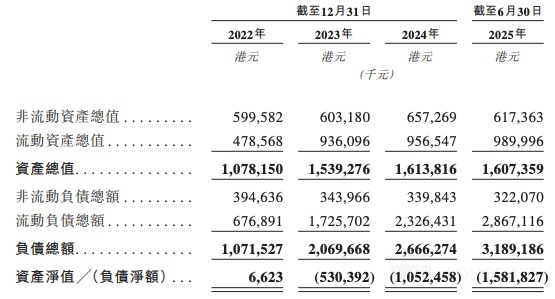

III. Financial Perspective: High Growth and Strategic Investment

Between rapid revenue growth and strategic expansion investments, HashKey's financial data reflects the characteristics of a typical tech growth company:

Rapid Revenue Growth: Total revenue surged from HKD 129 million in 2022 to HKD 721 million in 2024, with a significant compound annual growth rate.

Gradual Loss Reduction: As a company in the market expansion and ecosystem-building phase, it has yet to achieve profitability. However, losses have shown a narrowing trend, primarily due to improved operational efficiency and cost control.

Strong Cornerstone Support: The IPO has successfully attracted nine prominent cornerstone investors, including UBS Asset Management (Singapore), Fidelity Funds, and CDH Investments, demonstrating professional institutions' recognition of its long-term value.

IV. Use of Proceeds and Future Outlook

According to the prospectus, the global IPO aims to raise approximately HKD 1.426 billion, with an offer price range of HKD 5.95 to HKD 6.95 per share. The net proceeds will primarily be allocated to the following strategic directions to consolidate its market leadership:

About 40%: For technology and infrastructure upgrades, including enhancing trading system performance and security levels.

About 40%: For expanding market share and establishing global ecosystem partnerships to enter new markets.

About 10%: For strengthening corporate operations, compliance, and risk management capabilities.

About 10%: For general working capital.

HashKey Holdings' listing is a landmark event in the integration of the digital asset industry with traditional capital markets. The core appeal of its story lies in "growth certainty under a compliant framework." Amid recent significant volatility in Bitcoin prices, HashKey's IPO process remains steady, reflecting the market's preference for leading companies with clear regulatory status and a complete business ecosystem.

Subscribe to new shares on Longbridge! Enjoy limited-time 0 handling fees for cash subscriptions, with support for grey market trading.

Learn more: HASHKEY HLDGS Prospectus

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.