Rate Of Return

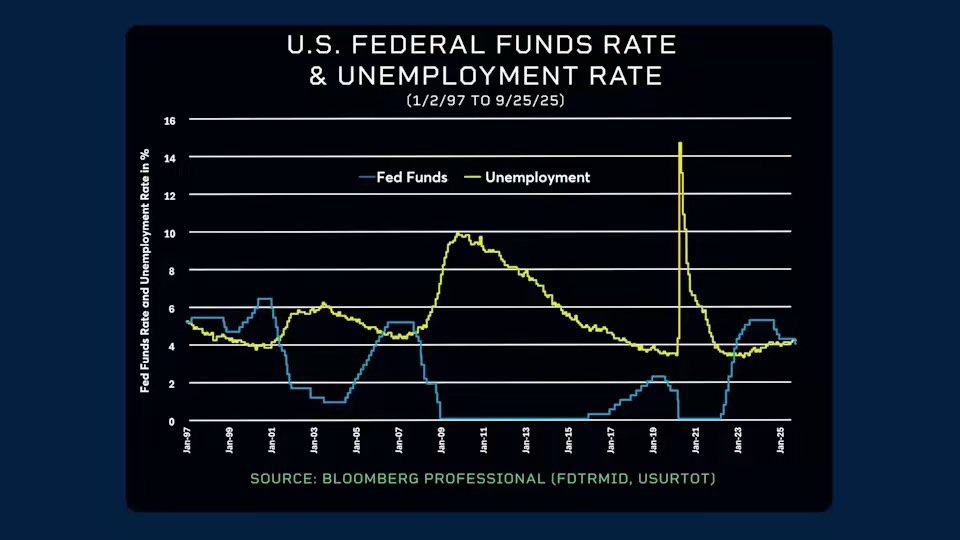

Rate Of ReturnIn the history of U.S. stocks, there have been two interest rate cuts when the unemployment rate was below 4.6%, once in 1998 and once in 2019, both during bull markets.

In both years, the easing stopped after three rate cuts.

This December is highly likely to be the third cut.

In 1998, there were three consecutive cuts from September to November, and the S&P 500 rose from September 1998 to March 2000 before the big drop began.

In 2019, there were three consecutive cuts from July to October, and the S&P 500 rose from October 2019 to February 2020 before the big drop began.

This year, how long do you think the bull run will last?

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.