Nio 3Q25 Quick Interpretation: Overall, Nio's third-quarter earnings performance was decent, but the revenue and sales guidance for the fourth quarter were significantly below expectations. Specifically:

1. Third-quarter gross margin increased significantly quarter-on-quarter, with accelerated loss reduction:

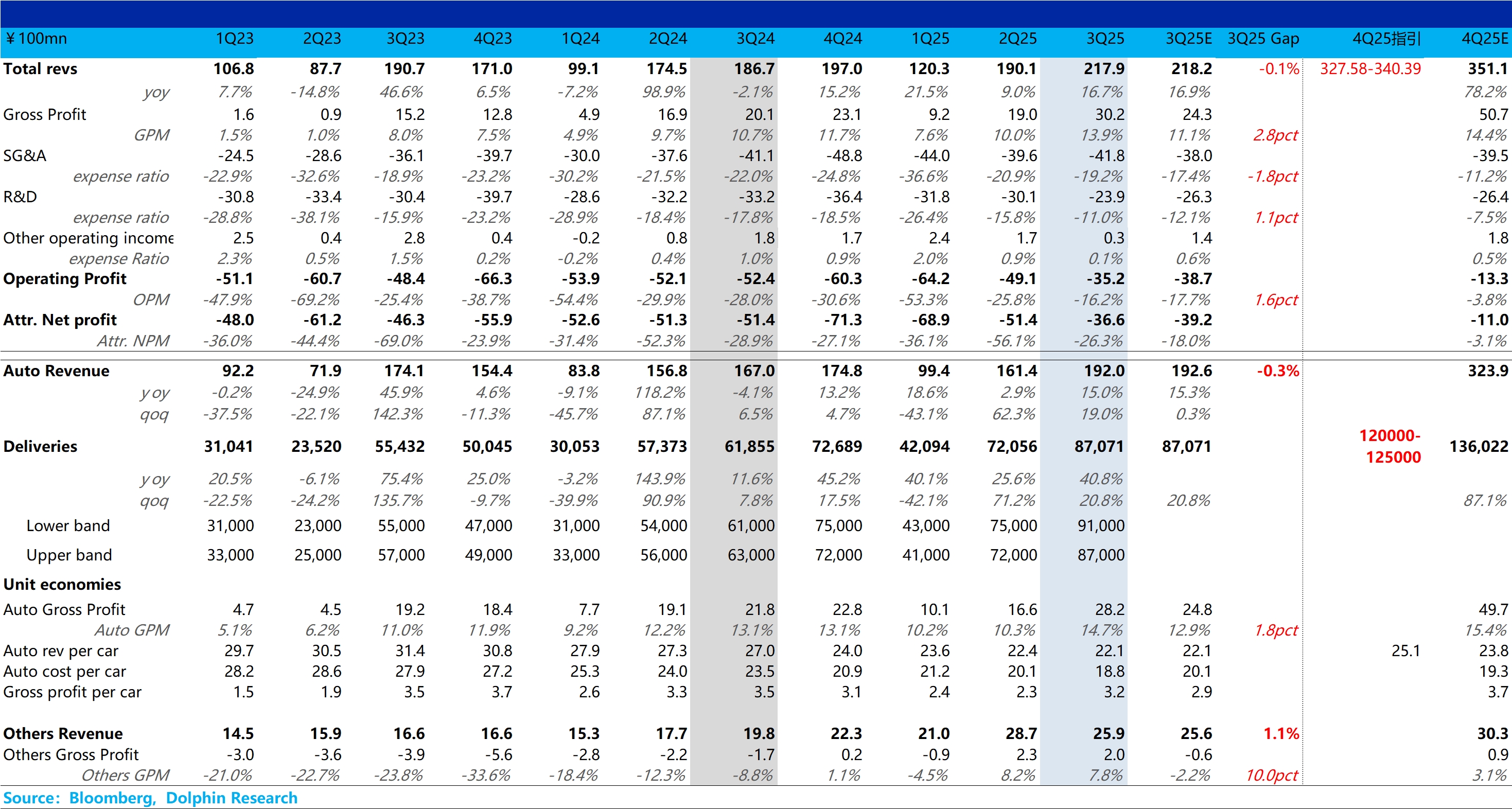

① Third-quarter revenue was RMB 21.79 billion, basically in line with market expectations. In terms of the core vehicle sales business, the average selling price per vehicle this quarter decreased slightly by RMB 3,000 to RMB 221,000, mainly due to disguised price reductions from the "free battery upgrade" promotion and an increase in the proportion of the lower-priced Ledao L90 in the model mix, leading to a downward shift in the product structure.

② However, in terms of gross margin and loss reduction progress, Nio's overall progress was faster than expected:

The third-quarter vehicle gross margin was 14.7%, a significant increase of 4.4 percentage points quarter-on-quarter, also higher than the market expectation of 12.9% and Nio's previous guidance of improving vehicle gross margin to 13%–14% in the third quarter.

While the average selling price per vehicle continued to decline, the improvement in vehicle gross margin was primarily driven by a substantial reduction in per-unit costs, which decreased by RMB 13,000 to RMB 188,000 this quarter.

Dolphin Research believes the quarter-on-quarter decline in per-unit costs was partly due to economies of scale from increased sales (up 21% quarter-on-quarter to 87,000 units), but more importantly, Nio's series of cost-cutting and efficiency measures have made significant progress (e.g., self-developed NX9031 autonomous driving chip reducing costs by RMB 10,000, improved platform integration, streamlined suppliers, NT3.0 eliminating NT2.0's excessive material stacking, etc.). The market had previously worried that the low pricing of the L90 would limit the release of vehicle gross margin in the third quarter, but this quarter's vehicle gross margin also proved that the L90 maintained a decent gross margin level.

Finally, Nio's overall gross margin was 13.9%, up 3.9 percentage points quarter-on-quarter, also higher than the market expectation of 11.1%. This was due to both the better-than-expected vehicle gross margin and the strong performance of other income gross margin, which was 7.8%, significantly higher than the market expectation of -2.2%, mainly due to improved gross margins in parts, accessories sales, and after-sales services driven by cost-cutting and efficiency measures.

In terms of net profit, Nio's net loss narrowed by RMB 1.48 billion quarter-on-quarter to -RMB 3.66 billion, better than the market expectation of -RMB 3.9 billion. This was due to both the quarter-on-quarter improvement in gross margin and a significant decline in R&D expenses among the three major cost items, primarily resulting from layoffs in the R&D team and the completion of earlier foundational R&D work.

2. However, in terms of Nio's fourth-quarter guidance, both sales and revenue guidance were below expectations:

① Fourth-quarter sales guidance of 120,000–125,000 units is lower than the market expectation of 136,000 units and also below Nio's previous guidance of an average monthly delivery target of 50,000 units and a quarterly delivery target of 150,000 units for the fourth quarter.

Based on this sales guidance, and given that October sales of 40,000 units have already been announced, the implied average monthly sales for November/December are 40,000–42,000 units. Combined with the fact that the waiting period for the Nio ES8 has extended to 22–23 weeks, with deliveries pushed to 2026, Nio remains in a "supply shortage" situation in the fourth quarter. This sales guidance also directly indicates that the pace of capacity release is significantly slower than expected.

② Fourth-quarter revenue guidance of RMB 32.7–34.0 billion is also lower than the market expectation of RMB 35.1 billion. The lower revenue guidance is primarily dragged down by sales, while the implied average selling price in the revenue guidance increased quarter-on-quarter to RMB 251,000, mainly due to a higher proportion of the expensive ES8 in the fourth quarter.

Given the significantly slower-than-expected capacity release, Dolphin Research remains concerned about whether Nio's loss reduction progress in the fourth quarter can meet management's previous guidance of achieving positive Non-GAAP operating profit, as well as potential order cancellations due to excessively long waiting times. The specifics will depend on management's explanation of the reasons for the capacity delay and the fourth-quarter guidance during the earnings call.$NIO Inc(NIO.US) $NIO-SW(09866.HK) $NIO Inc. USD OV(NIO.SG)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.