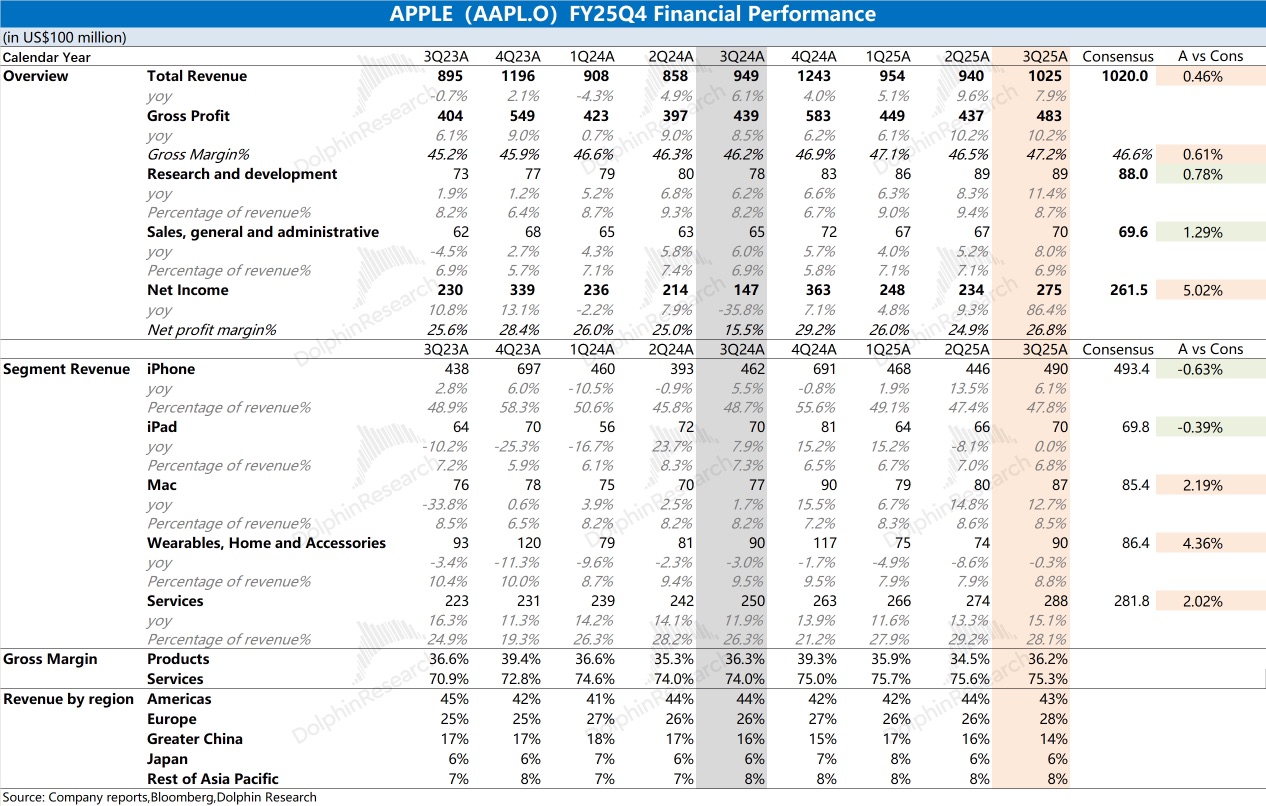

Apple FY25Q4 Quick Interpretation: The company's performance this quarter basically met expectations, with revenue growth mainly driven by the growth of iPhone, Mac, and software services; the better-than-expected gross margin was primarily due to the improved profitability of the software business.

The high growth in profits was mainly due to the impact of the EU's billion-dollar back tax on the company in the same period last year.

Specifically, in the company's hardware business, both iPhone and Mac achieved year-on-year growth, while iPad and wearable products remained relatively weak; the company's software business accelerated its growth, with the gross margin stabilizing above 75%.

Following this 'lukewarm' financial report data, Apple's stock price once fell by 3%. However, the company's management released expectations for the next quarter, which are quite good, pulling Apple's stock price up to +3%.

For the next quarter, the company expects revenue to achieve a year-on-year growth of 10-12%, with a gross margin of 47-48%, both of which are better than market expectations, mainly due to the good performance of the iPhone 17 series new products in the market, which is the main short-term driving point currently being focused on.

From a medium to long-term perspective, if the company can make more progress in the AI field, it will bring more confidence to the market. For more information, please follow Dolphin Research's subsequent detailed commentary and management communication content. $Apple(AAPL.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.