Focus Media: The cold winter is not cold, and the warm spring is not far away.

Hello everyone, I am Dolphin Research!

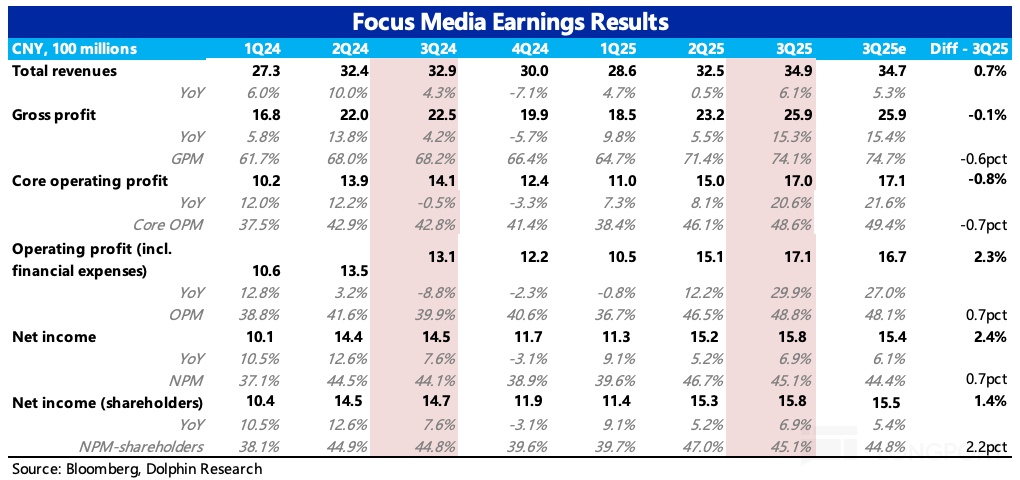

On October 29th, Beijing time, $Focus Media(002027.SZ) released its Q3 2025 financial report. Overall, the Q3 performance met expectations, with environmental pressures and Focus Media's own advantages still prominent. However, Dolphin Research noticed that some institutions slightly adjusted their expectations downward before the report (due to poor consumption and additional marketing expenses), so from the latest expectation difference, the Q3 performance is actually acceptable.

Key points are as follows:

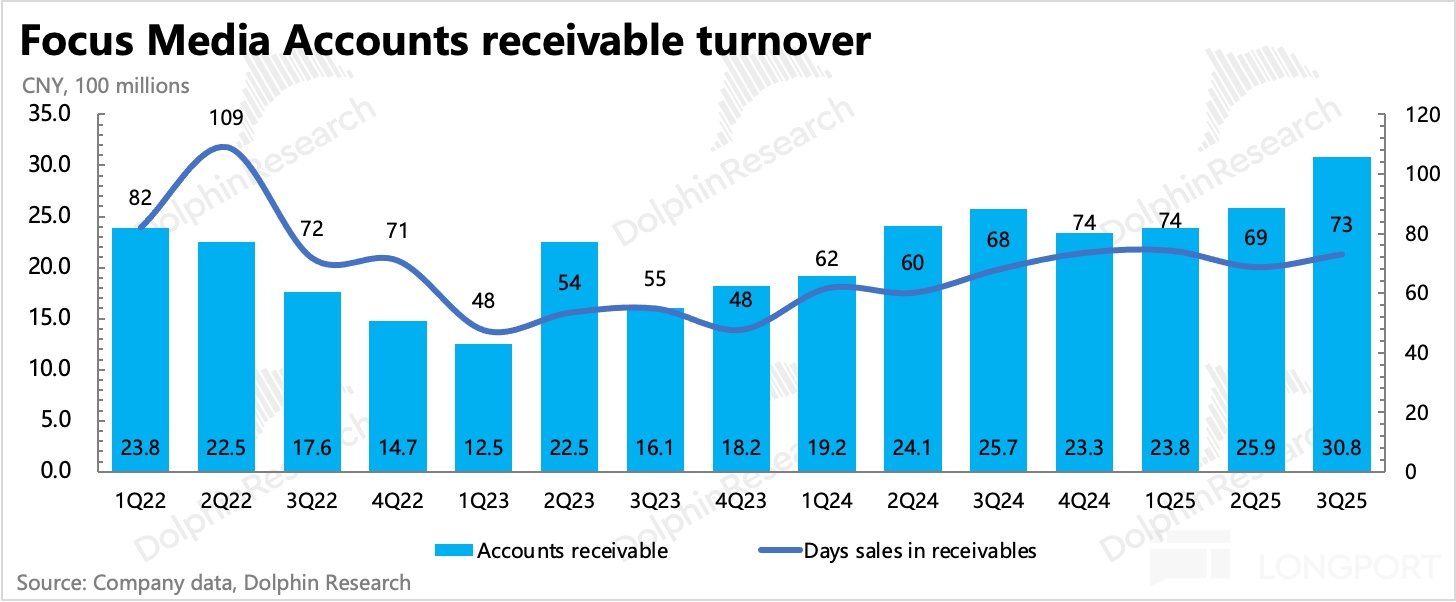

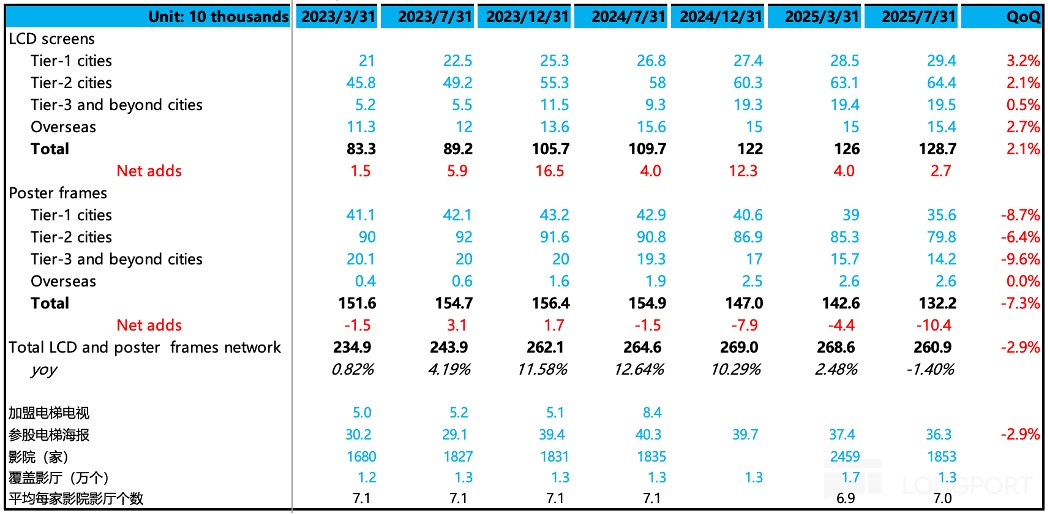

1. Environmental pressure remains: Revenue grew by 6% in the third quarter, showing a warming trend, but mainly relying on Focus Media's own alpha. From the significantly higher accounts receivable, it can be seen that the downstream customers' repayment ability is relatively weaker than last year.

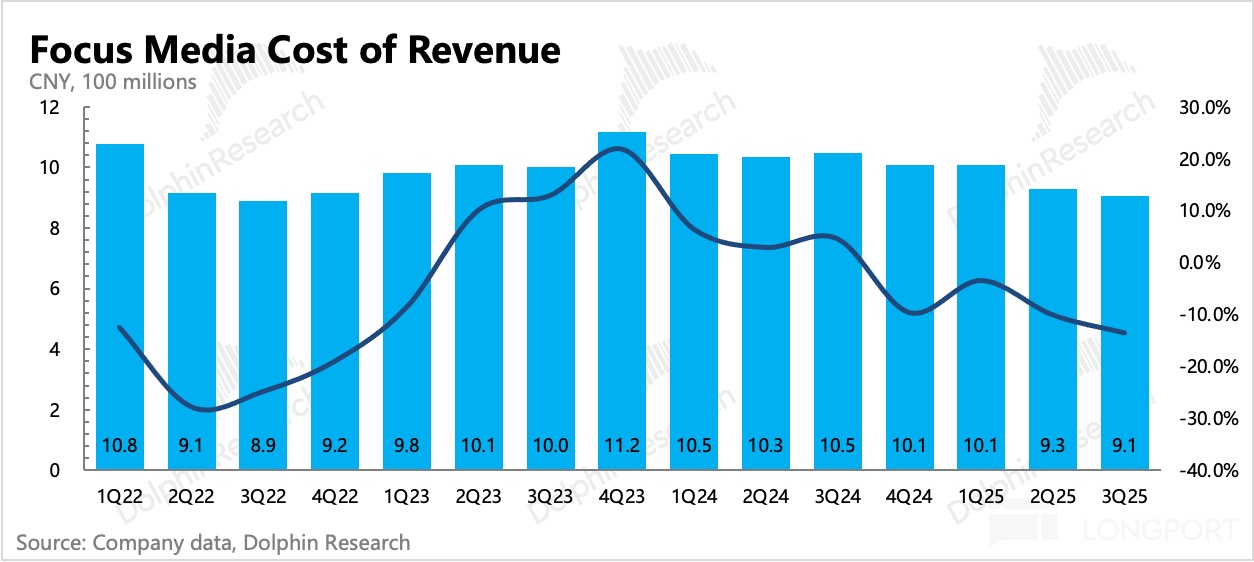

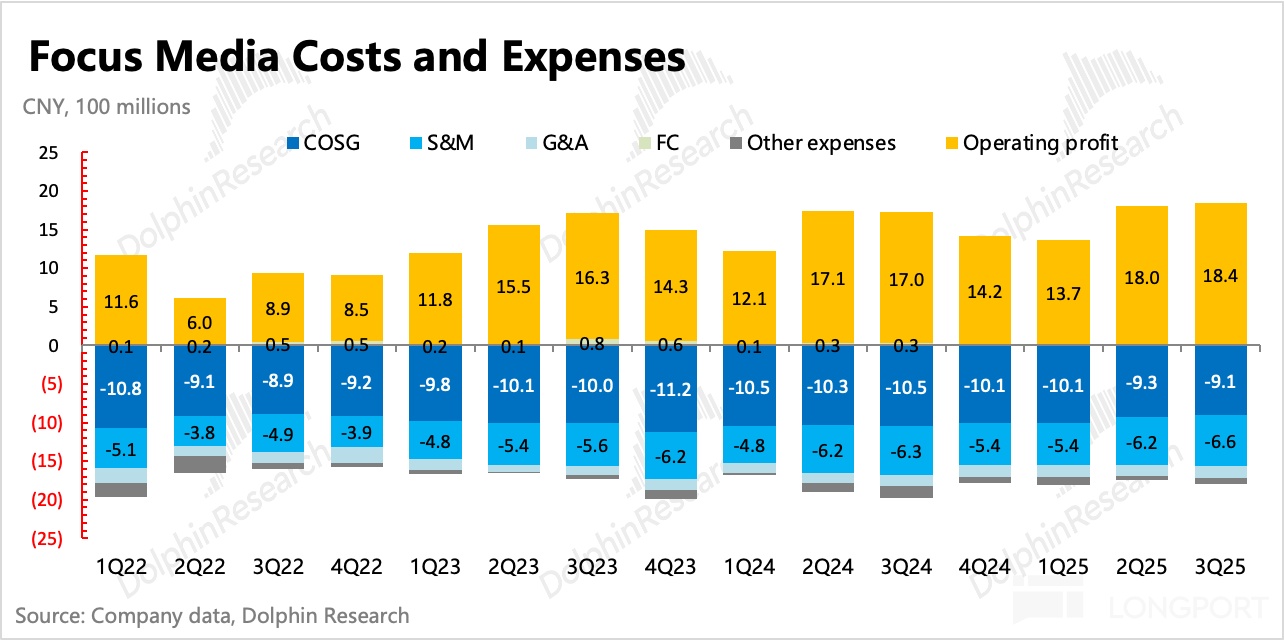

2. Costs continue to decline against the trend: While revenue increased, costs, namely rent, further declined (down 13% year-on-year and 3% quarter-on-quarter). Besides optimizing its own locations, Dolphin Research believes this continues to confirm the benefits of acquiring New Wave. Although New Wave has not been formally acquired, from the perspective of customers and property owners, risks are already being considered, thus enhancing Focus Media's bargaining power. In a poor consumption environment, the main focus is on squeezing the profit margin of property owners.

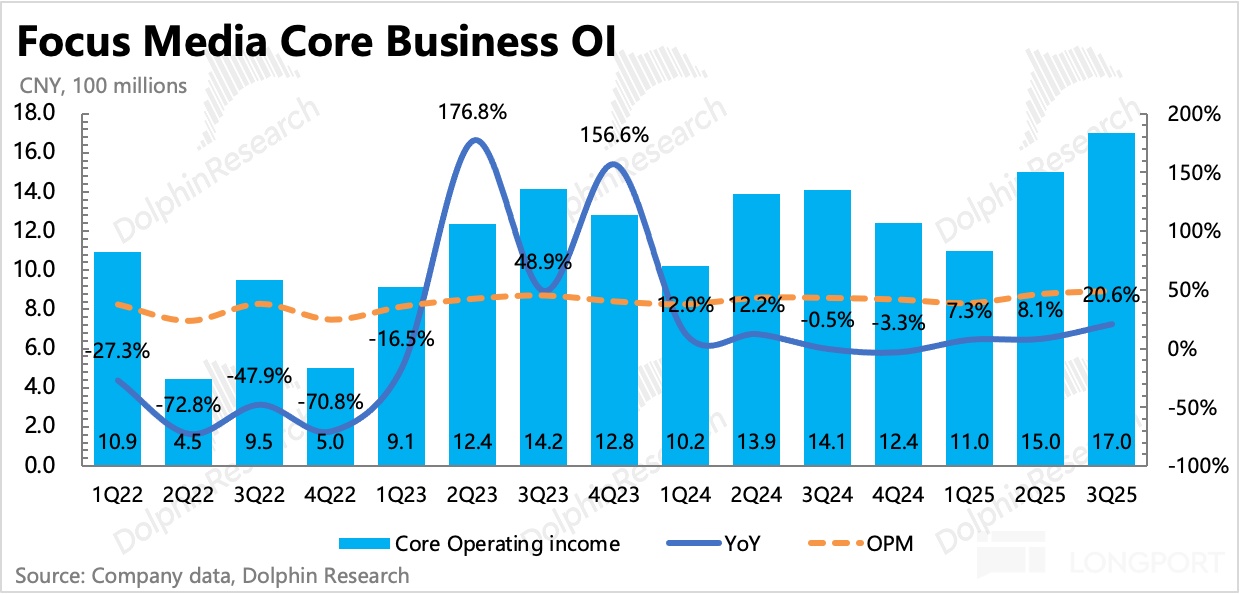

3. Core business profits perform better: Core operating expenses are basically consistent with revenue changes, stable quarter-on-quarter, but the rate shrank by 3 percentage points compared to last year. The core operating profit margin (revenue-cost-three expenses-business tax) continues to rise, reaching nearly 49%, a peak level range, with a year-on-year growth of 20%, much better than the mixed operating profit growth of only 8.5% outside the main business.

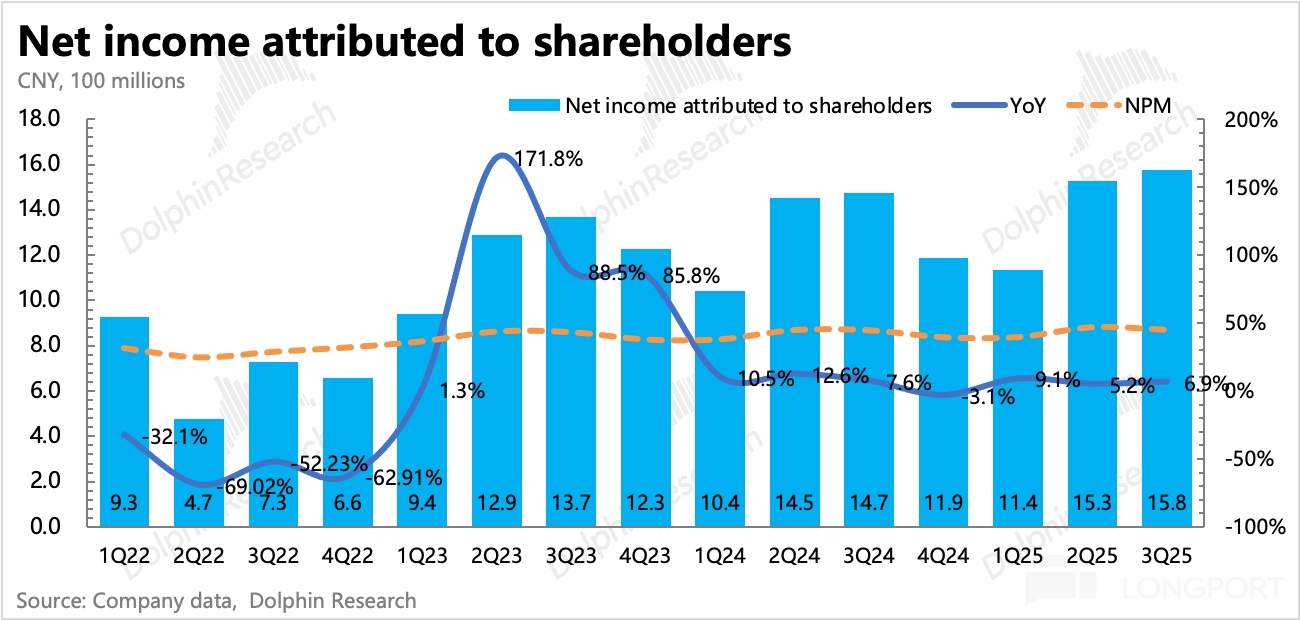

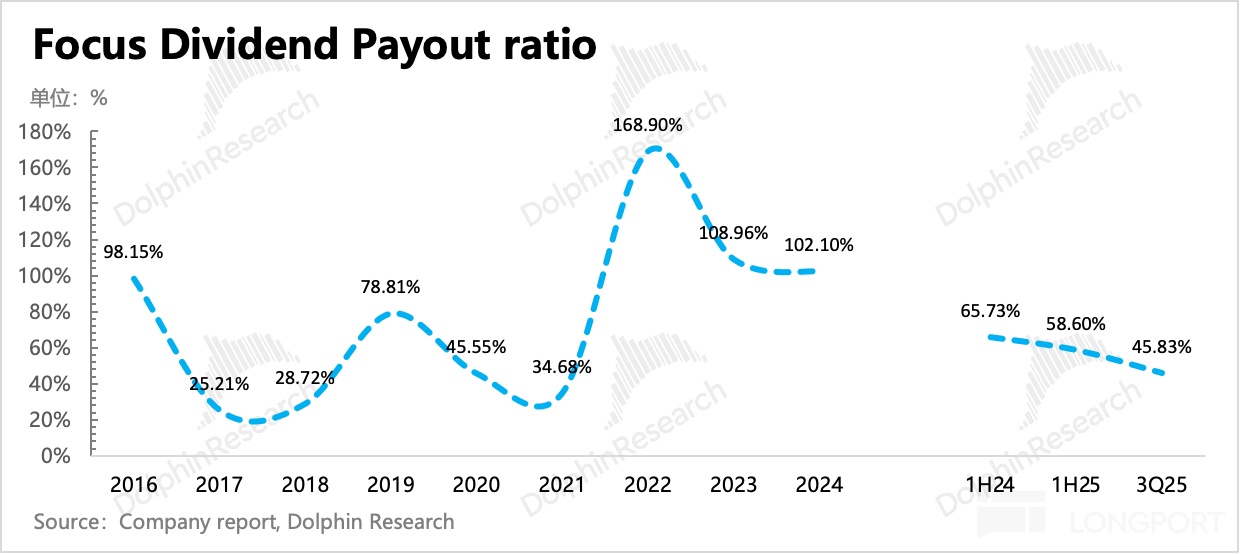

4. Early dividend, but the payout ratio has decreased: This time, it is quite special that the company distributed dividends for the second half of the year in the third quarter instead of waiting until the end of the year, with a total dividend of 722 million yuan, accounting for 46% of the Q3 net profit attributable to the parent company, which is lower than the first half of the year. As of Q3, the cumulative dividend this year is 2.1 billion yuan, accounting for 2% of the current market value of 110 billion yuan. If there is no special dividend in Q4 to raise the overall dividend rate, then this dividend yield at the current market value cannot be highlighted separately.

5. Key performance indicators compared with market expectations:

(Due to fewer institutions making separate quarterly performance forecasts in public reports, there is some deviation between BBG consensus expectations and actual expectations.)

Dolphin Research's View

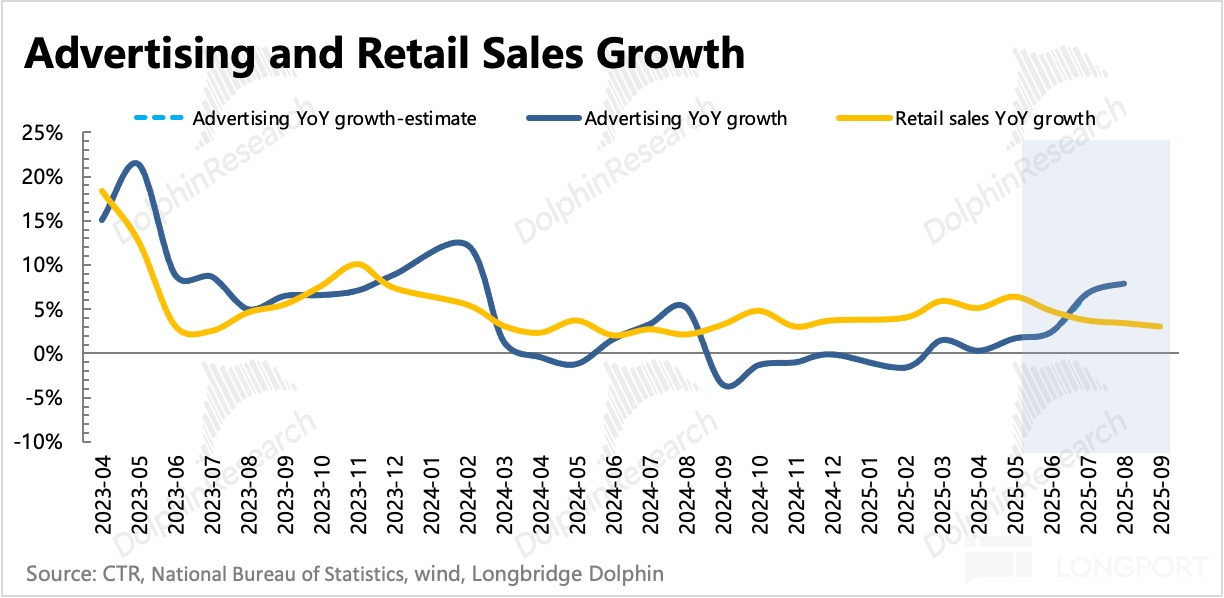

The revenue growth in the third quarter shows a warming trend, expected to be similar to the second quarter, mainly benefiting from the internet and some consumer segments. However, the overall pressure of the consumption environment (with continuous slowdown in retail growth) still somewhat constrains Focus Media's performance. The subsequent consumption environment will continue to rely on policy implementation and actual market digestion.

Regarding Focus Media's own growth alpha, it has somewhat manifested, but the key is that more space is still on the way. Currently, institutions have not yet incorporated the above benefits into expectations, where there is an expectation gap:

(1) The acquisition of New Wave is still awaiting regulatory approval;

(2) The "Touch" advertisement is still in the equipment installation phase (with a plan for 1 million units by the end of the year, but some institutions believe the completion rate may only be 80%), and due to early installations mainly in first and second-tier cities, the conversion rate is not high. After integrating New Wave, promoting installations in third and fourth-tier communities is expected to increase user activity and conversion. Meanwhile, the current pricing is mainly mixed with traditional advertising, and a separate pricing plan will be launched after Double 11.

Therefore, Dolphin Research also believes that in the short-term perspective, looking at the profit margin is more meaningful than revenue. Through the topline pressure test, observe the company's comprehensive external management and control capabilities, competitiveness, and bargaining power, where the company truly holds the initiative.

From this perspective, the third quarter did not disappoint us. The only flaw is the decline in the dividend rate. If this year's dividend rate level continues, then the dividend return at the current market value is not worth highlighting separately.

However, at the same time, discussing the logic of dividend support when adjusting downward at the current position (with a PE of less than 20x this year) is not very meaningful. The main reason is that we believe the subsequent direction of the fundamentals is likely to continue upward. As mentioned earlier, the current expectations do not fully reflect Focus Media's growth story on the way. Dolphin Research still expects the pressure of the consumption environment to gradually ease from the end of the year to next year.

Below is a detailed interpretation of the financial report

I. Environmental pressure, Focus Media warming up

Focus Media's total revenue in the third quarter was 3.49 billion yuan, flat year-on-year, slightly exceeding market expectations. When the stock price was dragged down by expectations of the consumption environment, Focus Media did not return to strong growth, but it was not too "unexpectedly" affected, overall showing a warming trend.

Social retail data shows that growth slowed continuously from July to September, but overall advertising in July and August was actually quite good, mainly driven by the internet, games, short dramas, AI, and other fields. For Focus Media, which has a large share of physical consumption customers, it did not gain much extra benefit.

The pressure of the consumption environment is reflected in Focus Media by the significant increase in accounts receivable, with a slower repayment speed this year compared to last year.

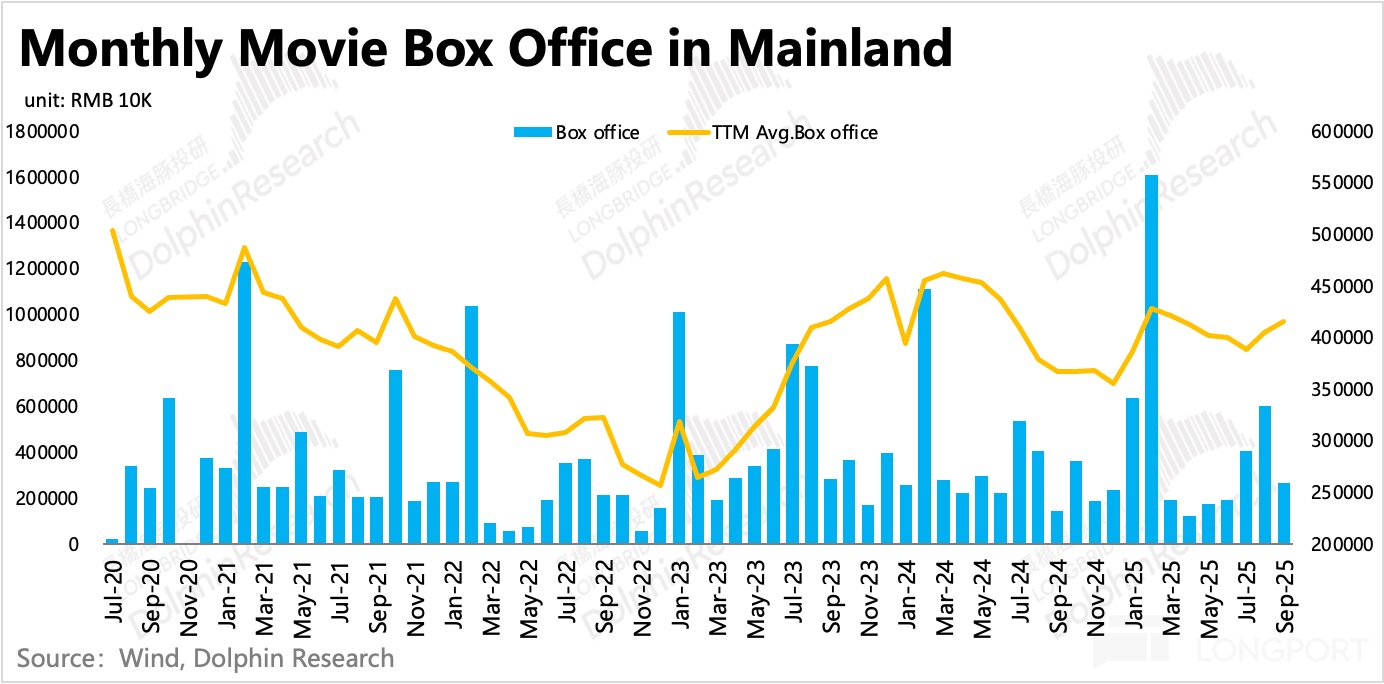

From the perspective of sub-types, Focus Media's growth in the third quarter was undoubtedly driven by elevator media. The summer movie box office was dismal, so cinema advertising is not worth looking at.

II. Gross margin remains the biggest highlight of the financial report

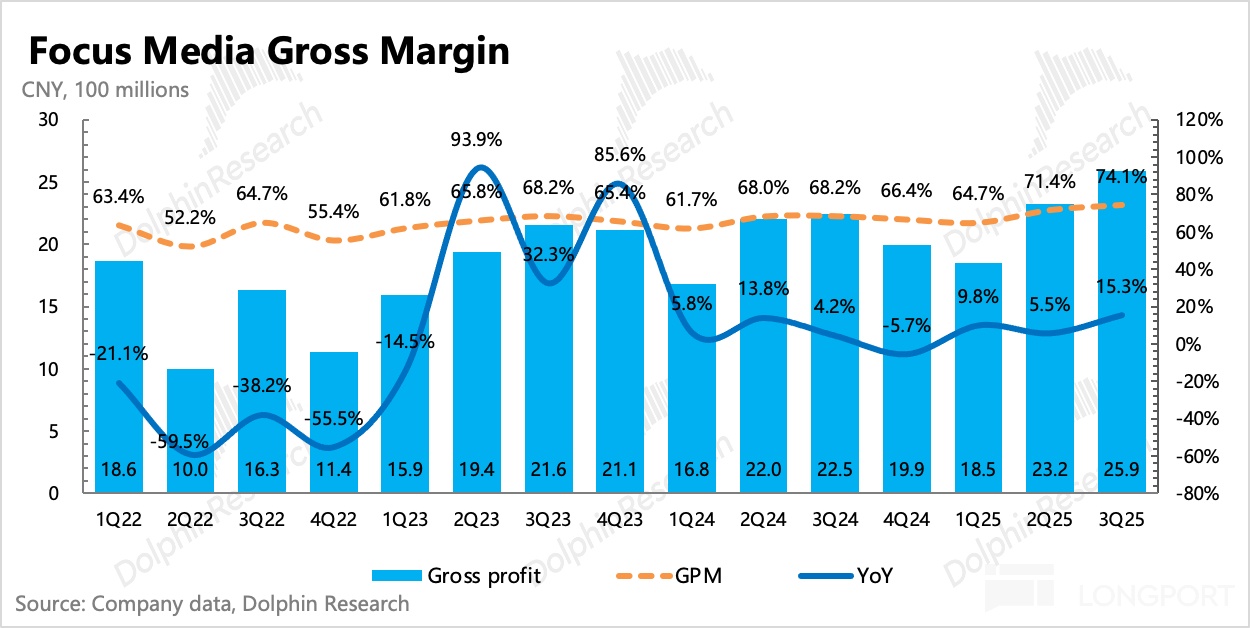

Location optimization and the potential benefits of acquiring New Wave continue to bring Focus Media bargaining advantages in front of property owners. The third quarter costs decreased by 13% year-on-year and 3% quarter-on-quarter, directly pushing the gross margin to a place close to the historical peak—74%.

Operating expenses in the third quarter remained relatively stable in terms of rate, with no significant reduction in absolute value. However, Dolphin Research believes there is still room for improvement, one being the reduction in advertising creation costs by GenAI, and the other being the adjustment of the sales team after integrating New Wave.

Ultimately, the core business operating profit margin (revenue-cost-R&D expenses-sales expenses-management expenses-business tax) was close to 49%, an increase of 6 percentage points year-on-year, with a growth rate of 21%. This is much higher than the growth rate of operating profit mixed with non-core business items such as interest income and investment income.

Ultimately, the net profit attributable to the parent company in the third quarter was 1.58 billion yuan, overall meeting expectations. This time, it is quite special that the company distributed dividends for the second half of the year in the third quarter instead of waiting until the end of the year. However, the dividend rate of 46% continues to decline quarter-on-quarter. If the fourth quarter continues at this dividend rate level (50%), then the annual dividend yield this year will not be enough, compared to the current market value of 110 billion yuan, which is only 2.5%.

<End here>

Dolphin "Focus Media" Historical Research:

Earnings Season

August 30, 2025, Conference Call "Focus Media (Minutes): Benefiting from the takeaway war, expected peak before the Spring Festival"

August 30, 2025, Earnings Review "Focus Media: Short-term pressure is not a big problem, new stories are on the way"

April 29, 2025, Earnings Review "After defeating New Wave, Focus Media's "good days" are not far away?"

October 29, 2024, Earnings Review "Focus Media: The hot expectations and cold reality of "Advertising Mao""

August 9, 2024, Earnings Review "Focus Media: Rising in pessimism, real prosperity or fake rebound?"

April 30, 2024, Earnings Review "Focus Media: Braking on recovery? High dividends are the only solace"

October 19, 2023, Earnings Review "Focus Media: The solid recovery of "Elevator Mao""

August 10, 2023, Conference Call "Focus Media wants to be the water supplier of the AI wave (1H23 Earnings Call Minutes)"

July 12, 2023, Earnings Preview Review "Profit increased by over 150%, Focus Media's hardships are over?"

May 12, 2023, Conference Call ""Gradual recovery" does not mean no recovery, optimistic about Q2 expectations (Focus Media 2022 Earnings Exchange Meeting Minutes)"

April 29, 2023, "Focus Media: Worse than expected? Wave goodbye to the past and look to the future"

October 31, 2022, "Focus Media: Walking through the darkest, but hard to escape the cycle fate"

August 17, 2022, Conference Call "Consumer goods are resilient, manage costs well and wait for real recovery (Focus Media 1H22 Conference Call Minutes)"

August 16, 2022, Earnings Review "Internet collapse, Focus Media "crippled""

July 14, 2022, Earnings Review "Second quarter profit plummeted 70%, Focus Media kneels again in the performance "pit""

April 29, 2022, Conference Call "March revenue fell 45%, Focus Media is too difficult (Conference Call Minutes)"

April 29, 2022, Earnings Review "Focus Media "bleeding rivers of blood"? Opportunity after surviving a desperate situation"

November 4, 2021, Earnings Review "Starting with Focus Media: Expectations for internet advertising should be "lowered again and again""

August 26, 2021, Conference Call "Shrunk, gone, standardized, business in the second half of the year is not easy (Focus Media Minutes)"

August 25, 2021, Earnings Review "Focus Media: Seems good? Actually "bombed""

April 23, 2021, Conference Call "A fragmented Focus Media conference call minutes"

In-depth

December 21, 2023, "Consumption is warming but still cold? Can't stop the spring of advertising"

August 2, 2022, "Another golden pit? Is Focus Media "gold" or a "pit""

July 12, 2022, "Focus Media: The "desperate warrior" changing fate by going against the current"

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.