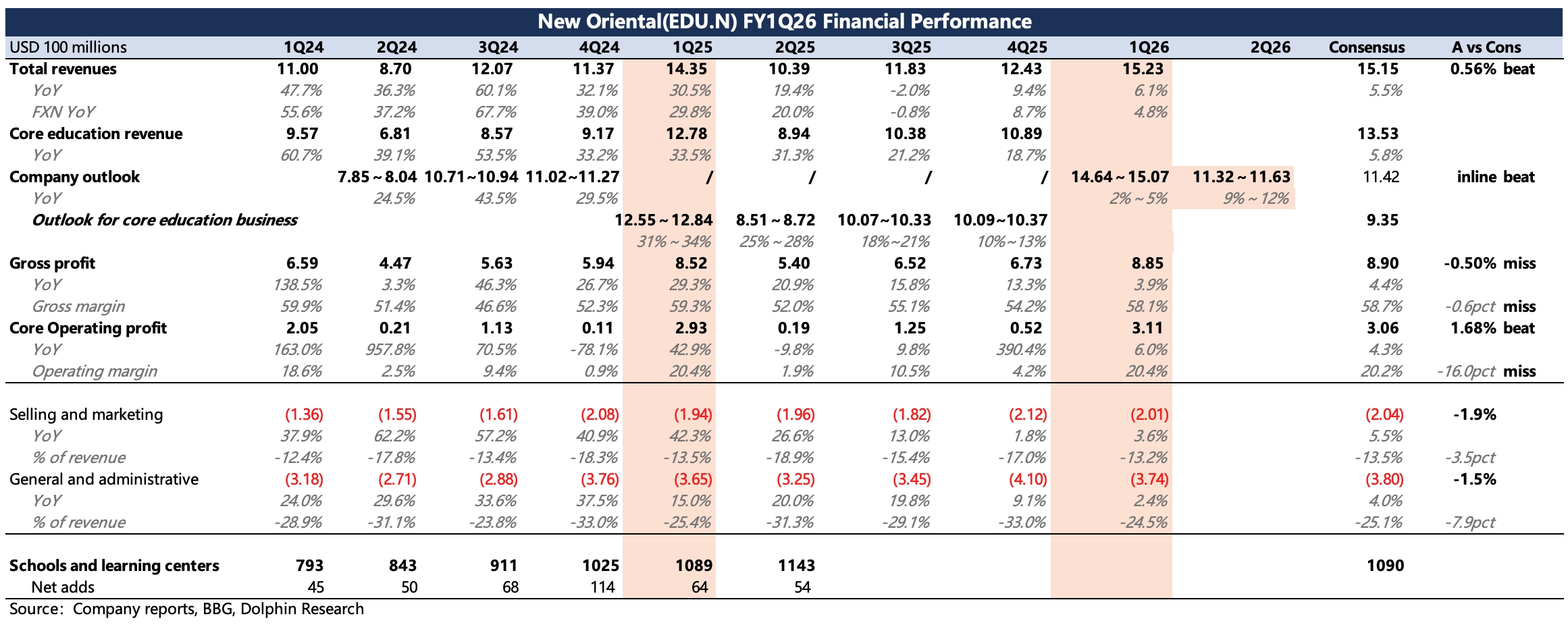

New Oriental FY1Q26 Quick Interpretation: Overall, the third-quarter report is basically in line with expectations, including the revenue guidance for the fourth quarter. The guidance for the full year 2026 remains unchanged (revenue growth of 5%-10%), but the trends in various segments show mixed performance:

1. The two main positives in this financial report (shareholder returns, study abroad business) were already disclosed a month earlier at the preview meeting, reflected in the 20% increase during this period.

(1) Shareholder Returns: The "dividend floor" valuation that Dolphin Research has consistently mentioned has finally exceeded expectations. Last quarter, the company announced a new shareholder return plan to use 50% of the previous year's net profit for dividends or buybacks. In Q3, the company announced a plan for $190 million in dividends and $300 million in buybacks over the next year, totaling $490 million in shareholder returns.

The payout ratio reached 130% of the net profit attributable to the parent company for 2025, far exceeding the minimum baseline of 50%. Based on the market capitalization of nearly $8 billion on the day of the preview, the return rate reached 6% (currently 5%), which is indeed a good investment return in a rate-cutting cycle.

(2) Study Abroad Business: Due to geopolitical risks, study abroad is a business with cautious consensus expectations in the market, originally expected to decline by 5-10%. However, revenue in USD terms actually grew by 1-2% (1% for training, 2% for consulting). Even excluding the tailwind from USD depreciation, it shows a basically stable slight decline, which is much better than Dolphin Research's actual perception.

However, the hidden concerns about studying abroad have not dissipated. The resilience in the third quarter may be due to the substitution effect from non-US regions. But this often exists in the short term, and in the medium to long term, it is still closely related to geopolitical situations, with no substantial turnaround currently. Therefore, it is especially important to pay attention to the management's quantitative guidance on operations during the conference call.

2. New business performed poorly this quarter: Year-on-year growth was only 15%, compared to over 30% last quarter. According to institutional research, intensified competition from local institutions in some cities has had a short-term impact.

However, judging from the trend in the number of enrollments in non-academic courses and the number of learning device subscriptions (accelerating growth), the current performance should be temporary, and growth is expected to recover next quarter. For specific details and outlook, please refer to the conference call.

3. Continued strict control of costs and expenses: Core operating profit for the third quarter was $311 million, with an operating profit margin of 20.4%, flat year-on-year. From a Non-GAAP perspective excluding stock-based compensation, the profit margin improved by 1 point year-on-year. The company stated that it will continue to control costs to ensure profitability.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.