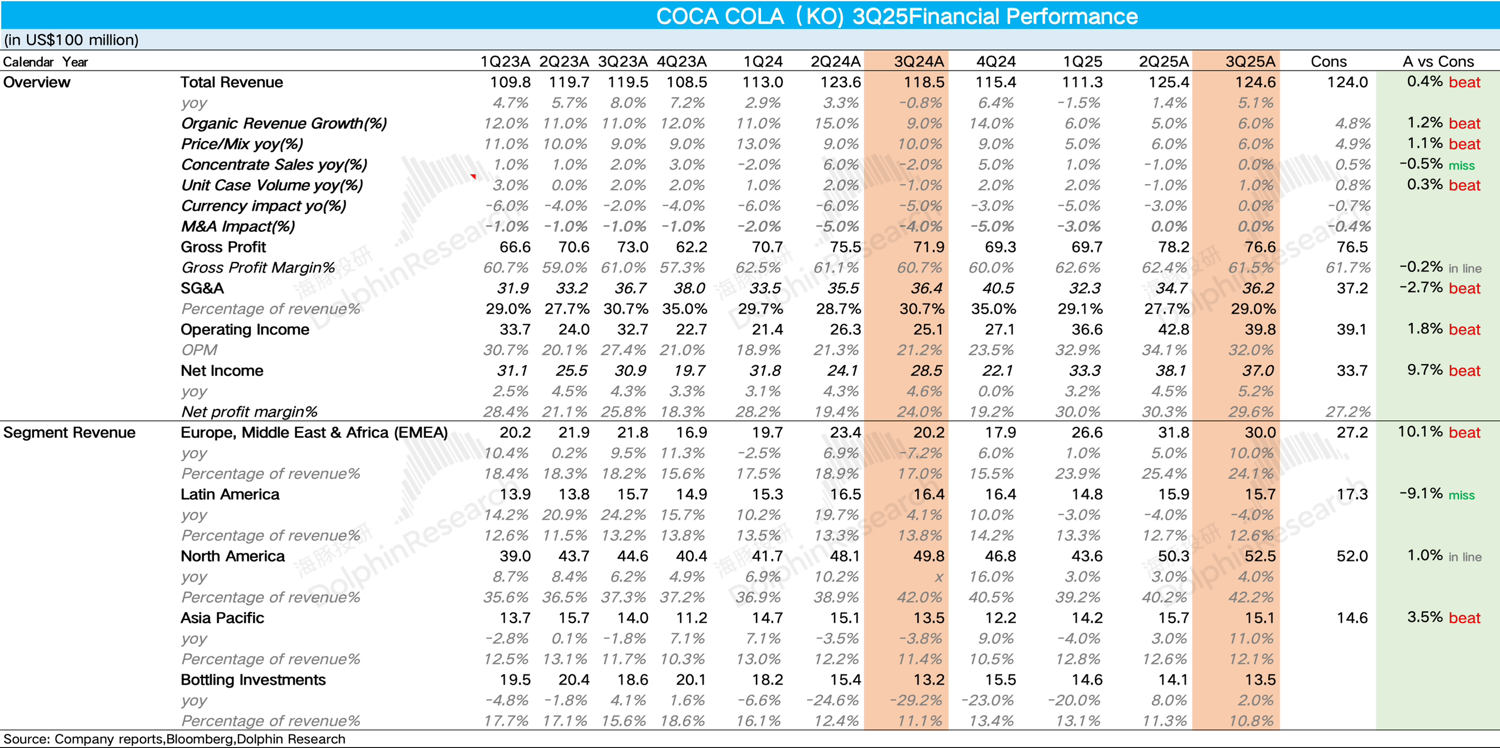

Coca-Cola 3Q25 Quick Interpretation: The company's performance in the third quarter overall exceeded market consensus expectations.

In a small-scale communication in September, the company revealed that in the third quarter, it was affected by geopolitical and economic downturns in certain markets (Mexico, India, Thailand), and sales continued the weak trend from the second quarter. This led many major banks to lower their earnings forecasts for Coca-Cola's third quarter. However, the actual results show that Coca-Cola's overall performance remains resilient.

In Q3, the company's organic revenue grew by 6% year-on-year, reaching the upper limit of the company's guidance from the previous quarter.

Breaking it down, the company introduced small cans and eco-friendly packaging (at lower prices) during the summer for price-sensitive and financially constrained consumers, reducing the threshold for single purchases. Concentrate sales turned from negative to positive, remaining flat overall.

On the pricing front, as the company's core growth engine, the proportion of high-priced products (including zero-sugar and functional health drinks) increased, growing by 6% year-on-year, exceeding market expectations.

Additionally, with the decline of the US dollar index, the impact of foreign exchange headwinds on the company has essentially disappeared.

Regarding gross margin, on one hand, the prices of Coca-Cola's core raw materials (corn syrup, aluminum, PET chips) have gradually decreased. Coupled with an improved product mix, the overall gross margin increased by 0.8 percentage points year-on-year, reaching 61.5%.

On the expense side, although the company increased marketing investment during the peak season, thanks to the continuous application of AI in daily operations (including pricing decisions and marketing ad creation in different markets), the expense ratio slightly decreased by 1.7 percentage points to 29%. The final core operating profit margin reached 32%, exceeding market expectations.

In terms of guidance, the company maintained its full-year guidance. For more detailed information, please continue to follow Dolphin Research's specific commentary and conference call content. $Coca Cola(KO.US)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.