ASML (Minutes): Maintain 2030 target, next year's expectations will be updated in the next quarter

The following are the minutes of ASML's Q3 2025 earnings call. For an interpretation of the financial report, please refer to "ASML: AI Capex Adds Buff, The Worst Period is Over!"

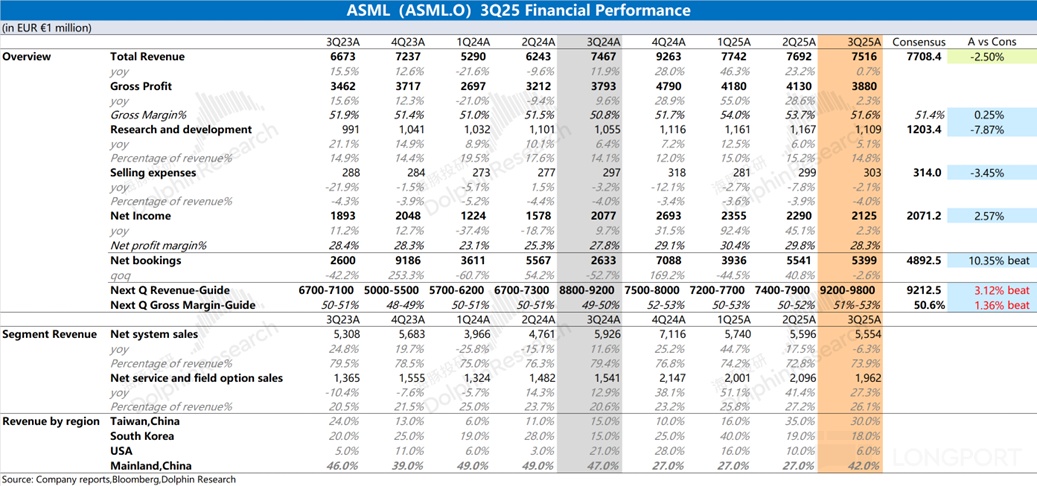

I.$ASML(ASML.US) Review of Core Financial Information

1. Shareholder Returns

Dividend: The first interim dividend for 2025 has been paid, at €1.60 per share. The second interim dividend, also €1.60 per share, will be paid on November 6, 2025.

Share Repurchase: Approximately €148 million worth of shares were repurchased in the third quarter. As of September 28, 2025, 9 million shares have been repurchased under the existing plan, totaling €5.9 billion. The €12 billion repurchase plan (2022-2025) will not be fully completed by the end of 2025. The company plans to announce a new share repurchase plan in January 2026.

2. Effective Tax Rate: 17.8% for the third quarter, expected to remain around 17% for the full year 2025.

3. Guidance for Q4 2025:

a. Total net sales are expected to be between €9.2 billion and €9.8 billion (anticipated to be a very strong quarter).

b. Installed Base Management revenue is expected to be approximately €2.1 billion.

c. Gross margin is expected to be between 51% and 53%.

d. R&D expenses are approximately €1.2 billion, SG&A expenses are approximately €320 million.

4. Full Year 2025 Guidance: Total net sales are expected to be approximately €32.5 billion, with a gross margin of approximately 52%.

II. Detailed Content of ASML's Earnings Call

2.1 Executive Statements Core Information

1. Market Situation: Positive news within the industry in recent months has reduced market uncertainty, and the positive momentum brought by AI is expanding to more logic and DRAM customers. Customers are increasingly applying EUV lithography layers, shifting from multiple exposure deep ultraviolet lithography (DUV) to single exposure EUV, enhancing the overall application of lithography technology.

a. China Market: Demand from Chinese customers and total net sales to China are expected to significantly decline compared to the strong performance in 2024 and 2025 by 2026.

b. Preliminary Outlook for 2026 Performance: The company expects total net sales in 2026 will not be lower than in 2025. The EUV business is expected to grow, benefiting from the demand for advanced DRAM and cutting-edge logic chips. The DUV business is expected to decline compared to 2025 due to dynamics with Chinese customers.

2. EUV Technology:

a. High Numerical Aperture (High NA) Maturity: Over 300,000 wafers have been processed on High NA systems at customer sites. Customer feedback indicates that the maturity of the High NA platform far exceeds that of the Low NA EUV technology at the same stage. SK Hynix has begun receiving its first High NA system (EXE:5200), positioning it as a key technology for future advanced DRAM.

b. 3D Integration and Advanced Packaging: The first 3D integration product from ICMR, the XT:260 lithography machine, was shipped this quarter, designed for applications such as advanced packaging. With a unique optical design, it can increase productivity by up to four times. 3D integration is crucial for industry development, and there is strong demand from customers for innovative solutions. The XT:260 has garnered significant market interest, with more shipments expected in the coming quarters.

3. Strategic Cooperation with Mistral AI: ASML, as the lead investor, invested €1.3 billion in Mistral AI's Series C financing, holding approximately 11% of Mistral AI's shares and gaining a seat on Mistral AI's strategic committee.

a. Mistral AI is a generative AI company focused on enterprise-level business, leading in large language models (LLM) and software coding development assistance.

b. Motivation for Cooperation: The importance of software in driving the precision and speed of ASML equipment is increasing.

c. Core Objective: To embed AI into ASML's overall lithography product portfolio to enhance system performance, productivity, and customer process yield, while shortening the time to market for advanced solutions and reducing development costs.

4. Long-term Outlook:

a. Market Trends: Dynamics in the end market are driving the product portfolio towards more advanced logic chips and DRAM, which require more intensive use of advanced lithography systems. This trend is expected to continue.

b. Technology Strategy: By combining a strong Low NA product roadmap with newly introduced High NA technology, support customers in further reducing technology costs. Promote more process layers requiring multiple exposures (especially at advanced DRAM nodes) to shift to single EUV exposure.

c. 2030 Financial Targets (Maintained): Revenue targets are expected to be between €44 billion and €60 billion. Gross margin targets are expected to be between 56% and 60%.

2.2 Q&A Session

Q: You mentioned that recent "positive news" has reduced uncertainty. Besides the €5 billion orders this quarter, what specific information makes you more confident about demand in 2026? Have you received clearer commitments or data from customers regarding their capacity needs in 2026 (such as the number of layers requiring lithography)? Or are you mainly inferring based on publicly available industry positive news (such as AI demand)? What exactly has changed your view of the future?

A: Firstly, the numerous positive news in the AI infrastructure field, although not immediately translating into orders, cumulatively creates very considerable future potential opportunities for us. Secondly, more importantly, we see AI opportunities expanding to more logic and DRAM customers, which not only expands our customer base but also provides capacity assurance to meet future huge market demand, which is a positive long-term signal. However, it is still too early to conclude the specific impact of these factors on the next few years, especially 2026.

Q: The Chinese market has always been a key driver of growth, but you expect a significant decline in 2026. Considering the 3-6 month delivery cycle for DUV equipment, your current visibility should only extend to the first quarter of 2026. Is this "significant decline" judgment based on seeing strong orders in the second half of 2024 and weak in the first quarter of 2026, leading to a conservative forecast? Or do you already have a complete picture of the demand in the Chinese market for the entire year of 2026?

A: Our current visibility for 2026 is similar to the same period last year. Regarding the Chinese market, our view has always been clear: the Chinese market has been in an unusually high cycle for the past 2 to 3 years, especially in the last two years, with business levels far exceeding normal levels. Based on our current expectations and visibility, the Chinese market will return to a more reasonable business level in 2026.

Q: How do you view the distribution trend of orders or revenue for the entire year of 2026? What kind of quarterly rhythm will it present? What do these AI investments mean for 2027? Can you share some preliminary thoughts?

A: We have already given our view for 2026, but it is still too early to discuss 2027. Regarding the order rhythm, you will see strong orders in the past two quarters, but orders themselves come "in batches," not linear distribution. As for the positive information flow in the past few months, it is indeed beneficial for the mid-term outlook, but it is too early to translate it into specific expectations for 2027.

Q: DRAM demand is currently strong. But in the long term, there is a market view that when DRAM architecture shifts from 6F² to 4F², it is actually unfavorable for EUV because the number of EUV layers will decrease. Is this view accurate?

A: No. From 6F² to 4F², we expect the number of EUV layers will not decrease. In fact, as the 4F² roadmap progresses, we expect the number of EUV layers to continue to grow—this is the conclusion reached after multiple discussions with customers. Additionally, the 4F² structure is more complex, actually requiring more lithography mask layers, including more advanced lithography masks, which also benefits advanced DUV. So in any case, 4F² is not bad news for ASML, and we are very optimistic about it.

Q: Regarding the updated outlook for 2026, is the more optimistic expectation mainly due to improvements on the DRAM side, or is it equally balanced contributions from both DRAM and Logic (logic chips)? You mentioned "more customers benefiting from AI infrastructure construction," is this mainly referring to DRAM customers? Or does it also include Logic side customers?

A: Actually, this is related to both the DRAM and Logic markets. Last quarter we talked about uncertainty, and now there is positive information flow. One factor of uncertainty at the time was tariff issues, and now there is more clarity in this regard. The previous uncertainty also made it difficult for customers to determine what exactly to do, whether to build capacity, and now this situation has reduced. This has contributed to our latest view for 2026. Overall, when we talk about positive news in the frontier areas and the growth expectations for EUV next year, it involves both DRAM and advanced Logic.

Q: Can you explain in detail the driving factors of the gross margin guidance? I noticed that your gross margin guidance for the December quarter seems better than what was implied last quarter. Is this related to tariffs, product mix changes, or other factors?

A: Clearly, the volume is quite high, which is a positive factor from Q3 to Q4. There are multiple influencing factors in the product mix: we expect to have 2 EXE systems (High-NA EUV) in Q4, which is a negative factor; but on the other hand, we will also have good Low NA shipments. There is slight improvement in the upgrade business, as you can see, this business has grown. Overall, the median has improved slightly compared to last quarter. In general, these are relatively small changes, but combined, they make the median gross margin slightly better than we previously expected.

Q: I want to delve into the topic mentioned earlier. We all saw the press releases from SK Hynix and Samsung after a visit to South Korea, mentioning a letter of intent for a total of 900,000 wafers/month HBM capacity, which may be more than double the current HBM capacity. My question is: According to my estimation, there are currently about 30 EUV devices in the DRAM field, although not all are used for HBM, most should be. If we believe these numbers (although many people think these numbers are too aggressive, but let's use them as a basis for discussion), then only HBM would require about 65 EUV devices, not including the needs of Samsung foundry, Intel, and TSMC.

Could you please: a) How do you view these numbers? b) By 2030, will your Low NA EUV capacity be sufficient to meet this potential demand?

A: We don't want to delve into specific calculations, because as mentioned many times, we are cautious about how these major announcements translate into actual capacity demand. But I want to emphasize again: the expansion of the customer base is very important news. In any case, we agree that the market should not be constrained by supply, which has always been a risk when the number of AI chip suppliers in Logic and DRAM is limited. So the expansion of the customer base is good news.

Regarding capacity issues, we said several quarters ago that we have been preparing for growth and continuously tracking these dynamics. Now we know that EUV demand next year is likely to be stronger, and we are ready for it. We are also planning long-term capacity. In short, we will carefully track the market to ensure we can meet demand, and currently, there is no concern about this.

Q: Assuming Q4 orders are about €5 billion, then the backlog at the end of 2025 will reach about €30 billion. Even after deducting €1.5-2 billion for High NA equipment, this number seems far above the "moderate growth" level. Is there a large portion of the current backlog scheduled for delivery after 2026? Is this why you remain cautious about 2026, not clearly calling it a "strong growth year," "high single-digit growth," or "double-digit growth"?

A: Indeed, a considerable portion of the backlog is scheduled for delivery after 2026, so your calculation is not entirely accurate for 2026. Additionally, orders always have some advance or delay, making it difficult to make specific predictions for 2026 at this stage. But you are right, there is already a significant portion of the backlog for post-2026, with High NA actually accounting for a substantial part.

Q: As a key supplier in this market, you have the potential to become a bottleneck. Although you don't want this and are preparing for growth, given the weekly major announcements, do you feel the industry chain (whether you or your customers) has sufficient understanding and preparation? As a key supplier, how do you ensure that the entire market will not be constrained by supply by 2027-2028?

A: Firstly, we wish there was a formula to precisely translate all announcements into their impact on us in the coming years, but no one has such a formula. The lesson from 2022 is to be prepared and remain flexible because the market will fluctuate. We have done a lot of work in the past few years and are ready for long lead-time projects like factory construction. As for the specific production equipment, the lead time is shorter, and we have more flexibility. Although we cannot immediately answer all questions after an announcement, structurally, we have improved flexibility.

Moreover, ultimately, it is the customers who tell us their needs, which is an ongoing dialogue, and we share it with you every quarter. We have been preparing for growth, considering market activities. By January, we will know more and continue to monitor the market.

We are better prepared than a few years ago, especially in investments in long lead-time projects. But for short lead-time projects, customers need to notify us in time so that we can start the supply chain, recruit personnel, etc. We now have more flexibility, but we also need timely communication from customers to ensure increased capacity and improved supply chain under the existing long-term infrastructure.

Q: Do you feel that customers are notifying you in time? Is there sufficient awareness and communication in the industry chain?

A: We are very satisfied with the transparency and honesty in the discussions, because over time, this is very helpful and helps avoid major surprises. I feel that this communication has indeed improved a lot over the past few years, which is very helpful for them, for us, and for their customers.

Q: There have been no High NA orders for more than two quarters. I understand you are digesting the backlog. But does this mean that if orders don't come until the end of next year, there may be several quarters of zero High NA revenue in 2027 or 2028? In other words, will the revenue growth curve for High NA be quite uneven, showing significant volatility?

A: We are indeed utilizing a substantial backlog for High NA production. As mentioned earlier, these backlog orders cover customers' R&D needs (most have been shipped), as well as systems for verification and introduction. The next wave of orders is expected to arrive after verification data is available and tool maturity is confirmed. In terms of performance, we have basically reached the milestone. As discussed last quarter, we expect this to likely happen in the second half of next year and beyond.

But we are not just waiting for orders; in the next 18 months, we will continue to evaluate progress with customers to assess the possibility of introduction. Just like we have been preparing for EUV growth in recent months, even without fully clear demand, we can prepare through discussions with customers.

Q: You mentioned that revenue from China will significantly decline year-on-year in 2026 due to weak demand. Is it because customers are unwilling to commit to orders, so you take a conservative attitude? Or have customers clearly informed you that they will reduce purchases due to weak end-market demand? We currently do not see signs of further weakening in the Chinese market. So I want to know the specific reason for your prediction of "significant year-on-year decline"?

A: For a long time, we have been digesting the backlog. The reason for the high sales in China is that we are digesting a large backlog—this was caused by previous supply shortages in the Chinese market. A year ago, we said that we expected Chinese sales to be proportional to its share in the backlog, which was about 20% at the time. So actually, the strong sales in China this year surprised us.

But our basic assumptions and views on the Chinese market are consistent with a year ago: the Chinese market is very special, focusing on what we call mainstream logic chips. Considering the dynamics of this market, we assess that this year's sales level is very high compared to the normalized level of the mainstream market. That's why we expect a significant decline.

Will the situation change? It's entirely possible. This year we have already seen that the actual situation may differ from our expectations. But if you ask for our real assessment of 2026 at this stage, it is what we have conveyed.

Q: Can you elaborate on the XT:260 mentioned in your presentation? Including its specific functions, machine price, target customer type, main competitors, and market outlook?

A: We mentioned this product in the press release and conference call, not because of its high price or value, but because it is ASML's first product supporting 3D integration, which is where the important news lies.

As is well known, in terms of Moore's Law, customers require us to double transistor density every two years. But the scaling process of lithography technology has slowed down, which has led to the need for more stacking or packaging of transistors. Customers want us to help because they need speed and precision, which is exactly the technology we have developed for the lithography product portfolio.

We also mentioned that more related products will be launched. It is very interesting that customers are interested in this product. Technically, it is based on i-line scanners—a technology ASML has used for many years. But this time we adopted a new optical design, achieving a fourfold increase in productivity. The main competitors are other i-line scanner manufacturers, you should know who they are.

More interestingly, many customers are eager to adopt this technology next year. Because we provide excellent technology and significant improvements, the business benefits of this product are much higher than our historical performance on i-line.

Q: I know you haven't given guidance yet and will provide more information in January. But considering the situation you described—reduced business in China, more EUV, and more High NA EUV—can we expect an improvement in gross margin next year?

A: We will provide clearer information in January. But you are right, the product mix is indeed a key driver. Currently, the main shipments to China are immersion lithography machines, with very good gross margins. So the reduction in Chinese business will be dilutive in this regard.

But on the other hand, EUV has very strong gross margins, especially if we predict Low NA EUV growth, which will be a positive factor. Then there is the issue of the number of High NA tools confirmed, which is still dilutive to the company's overall gross margin, which is important.

Another factor is our expectations for the installed base business. You know the upgrade business is quite important for gross margin. So all these changing factors—the product mix and the composition expectations of the installed base business—will ultimately determine our outlook. These are the primary driving factors.

Q: Can you update your view on 2026? Previously you mentioned that after entering 2026, some upgrade revenue needs to be deducted. What are your current thoughts on the installed base business next year?

A: If you look at our fourth-quarter guidance, you will find that the expectations for the installed base business this year have actually increased. Originally, we thought the first half would be much stronger than the second half, but now the second half is as strong as the first half. This is because the service business has developed quite well. Although there may be more upgrade business in the first half, the second half truly benefits from the service business.

As you know, the service business is closely related to the development of the EUV installed base. As the EUV installed base grows, the service business also grows further. This is an important factor, and you can roughly calculate its impact on next year. The next question is the sustainability of the upgrade business. Clearly, it did not drop off a cliff in the second half of this year. We will update our expectations for 2026 in January.

Q: Summarize your previous comments on the more optimistic view of AI development. The total order volume has not really increased, right? This is more because customers tell you that based on these developments, orders are expected to be stronger in the next few quarters because more capacity is needed to support these demands compared to the current backlog? In other words, if these situations become a reality, does this mean a stronger signal for orders?

A: It should indeed be viewed this way. You know our view on orders—orders are not necessarily a good indicator of business momentum. This quarter's orders are actually quite good, just like last quarter, although not particularly stunning, but certainly quite good.

But indeed, most of the positive developments Christophe talked about, as he said, will only partially affect 2026. So AI investments, multiple customers benefiting from AI (whereas we always said only a few customers benefited), the technological advancements Christophe mentioned, more layers shifting to EUV—all these are good news.

But I want to say, all these good news will not necessarily be realized in 2026, mainly after that. This is the way to look at the problem. They are all good news, some of which will certainly partially affect 2026, but the greater optimism lies in its impact on long-term business.

Q: Can you talk about the indicators where High NA is more mature at a similar time point compared to 0.33 numerical aperture Low NA? Looking ahead to 2028 and its development journey, have you reached halfway or three-quarters of the way?

A: We usually look at system maturity from two aspects. The first is when to demonstrate tools that meet the customer's final specifications. For EXE:5200, we expect to achieve this in the coming months, most likely this year. This means we have verified the overall capability of the system.

The second is tool availability—the percentage of time the tool is available to run wafers. There is a significant difference between Low NA and High NA: when Low NA matured, availability was dragged down by light source performance for many years, and the light source was the biggest hindrance factor for Low NA maturity.

But you should be very clear, the light source for High NA is exactly the same as Low NA. If you look at the availability data of the light source itself, we completely match the performance of Low NA. So the gap between now and final maturity is just the platform itself. Based on our experience, after about 12 to 18 months, we will be in a very good state.

From our perspective today, there are no obstacles to tool maturity. It will take a few more months to verify with customers. But when I look at the technology, the difficulties we encountered on Low NA do not exist on High NA. This is also why customers are eager to report this maturity—this is also what they see, and it is their logic.

Q: Regarding the profitability of High NA, although I know the gross margin is dilutive, are we positive? What is the outlook for development? Additionally, considering the maturity of the High NA platform, what is the outlook for operating expenses? What will be the pace of future R&D expenses and the burden of R&D?

A: High NA is indeed dilutive. The key to reducing dilution or improving gross margin is volume. Because we have equipped High NA with a lot of capacity both in the factory and on-site, but this total cost base is absorbed by a very limited number of tools. So ultimately, what drives gross margin up is volume.

As Christophe said, in the 2028-2029 timeframe, we will enter mass production. At that time, it is likely to see meaningful quantities, and the gross margin situation will improve. I did say on Capital Markets Day that even by 2030, I still expect High NA to be dilutive to gross margin because it takes a considerable amount of time to reach the maturity curve and achieve enough volume to make a meaningful contribution. But within that timeframe, once meaningful quantities are achieved, the dilution will be limited.

Q: Is High NA profitable?

A: High NA's gross margin is very low, but positive—you see a very low positive profit margin. Regarding operating expenses and R&D, we still have a strong roadmap. Although High NA has started running, if you look at the roadmap, we believe we can still achieve significant breakthroughs in Low NA—improving the productivity and imaging quality of these tools, as well as the continuous progress we are making on DUV tools, so there is still a very strong roadmap.

However, we are further improving organizational efficiency. From this perspective, I believe you will continue to see us manage SG&A and R&D expenses well because we feel we can gain more value and efficiency from ASML's strong R&D team. So you will see us cautiously controlling these numbers and managing growth well.

Q: You mentioned today that there is a positive turning point in lithography intensity. Can you clarify the timeline? To what extent is this the result of progress in the GAA transition rather than other factors?

A: There is not much new content compared to the past few quarters. In terms of logic chips, we have mentioned many times that the GAA transition does not increase the number of EUV layers because customers usually first make transistor changes and then shrink more aggressively, which we expect to happen below the 2nm node. This is very consistent with previous views.

In terms of DRAM, we have discussed 4F² today. Since last year's Capital Markets Day, we have received a lot of confirmation—DRAM is more actively adopting EUV in the 6F² EFCO (Enhanced Field Coupling Oxide Process). So the trend towards more use of advanced lithography technology is very strong there.

Q: We discussed the ambition level of AI investment today. But we also see news reports that AI chip manufacturers are more aggressive in their target nodes for future chips, which seems different from the previous belief that they would position themselves at relatively frontier positions. Can you talk about the impact of these more powerful AI chips moving faster over time on ASML?

A: We also mentioned last November that more AI applications will drive more advanced logic and DRAM. This part mostly remains to be seen because we only look at 12 months, which is only a small part in terms of node time. But as you described, the value of these applications can justify the shift to more expensive new nodes—you noticed the wafer price. But today it can be justified by the value of AI, which indeed changes the way people view the industry.

When we see an industry driven only by mobile devices, there were many doubts about whether the next advanced logic node was meaningful. I think these doubts have disappeared a lot. The scale and ramp-up speed of the 2nm node for logic chips is the first proof. We expect this trend to continue. We have not seen real acceleration yet, but again, the customer base for these products is larger. A larger customer base also means more competition, and there may be more motivation to move faster on advanced nodes. So this question is very good, and we all need to pay attention in the next 12 months.

Q: We all see AI-related headlines, and you have been emphasizing how AI drives incremental investment. But my view is that you are also constrained by increased customer concentration, especially in terms of logic chips—one customer is making all the frontier investments. This in itself brings greater volatility to your orders, backlog, and even quarterly revenue. That is, AI is incremental, but it does limit your visibility?

A: We have discussed this issue. I don't think there is any concern in terms of visibility or sometimes pricing power—this is a question we are often asked when there is only one customer. I think the real concern when there is only one customer is: will we be constrained by supply? Will the market be constrained by supply? Because if there is only one customer, the market size will depend on the scale that customer can deliver. So this is a bigger concern and may be beyond ASML's scope—this is what we have discussed before.

While it's great to hear all the good news about AI infrastructure investment, at some point, you must be able to produce chips. As we have mentioned many times today, more customers have been able to participate in the AI field of logic and DRAM in recent months, and I think this is a very interesting development for the entire market, and of course, it applies to us.

Q: In the past few quarters, inventory and accounts receivable have actually been increasing. How should I view the intensity of working capital? As shipment intensity improves, should I expect working capital and overall operating cash flow to improve?

A: Working capital is rising. The growth in inventory is largely due to High NA—it takes quite a long time to install High NA systems, which obviously pushes up inventory levels. This is the main factor.

Another factor is prepayments, which is the other side of the equation. The arrival of prepayments is obviously related to order intake, which is an important negative impact. I think these may be the two most important factors.

For High NA, an important factor is clearly shortening cycle time. This is the key driver to reduce the working capital occupied by High NA, and we are clearly committed to this. But of course, you need enough shipments to make meaningful progress. So I think the current level of working capital you see is reasonable for our business today. If we can shorten cycle time, I think this will be the biggest single driver to reduce working capital.

<End here>

Risk Disclosure and Statement of this Article:Dolphin Research Disclaimer and General Disclosure