Dashboard for S&P Scalping Traders🍽️

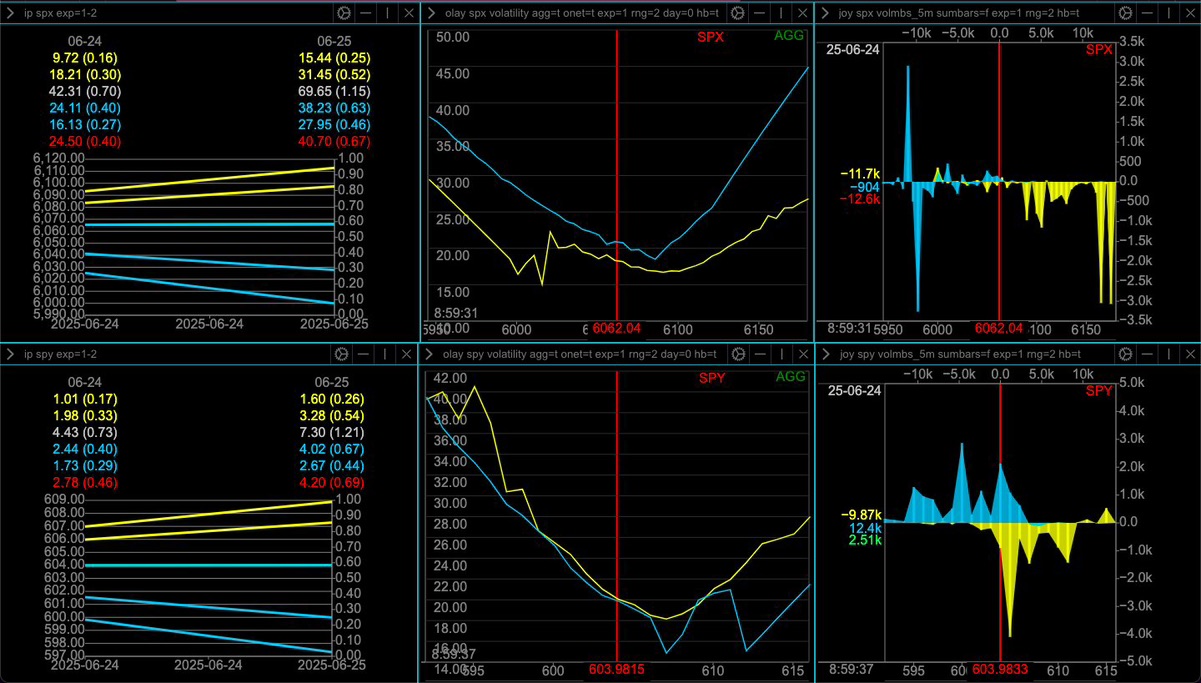

- SPX execution volatility favors put options, with both call and put volatility below spot price, up to 6090-6110. Volume is mostly net selling, with large call option accumulation between 6090-6105. SPY has significant put option buying ITM and OTM. The implied range favors the downside range. This dashboard helps focus on volume movements and market balance caused by implied volatility within an hour.

From left to right: implied movement, strike IV,

Net trading volume in the first 5 minutes

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.