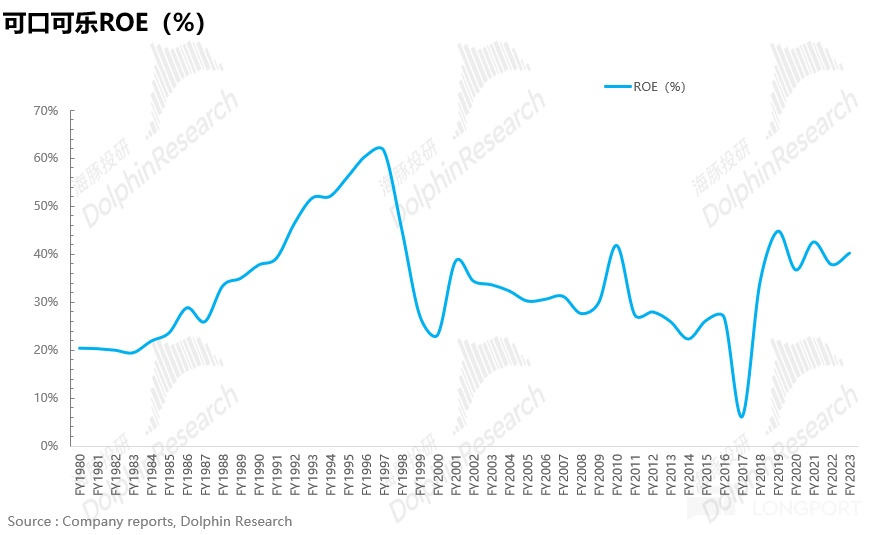

$Coca Cola(KO.US) Why does it have such a high ROE?

Warren Buffett once said, "If I had to pick one metric to evaluate a company's performance, ROE would be the top choice." Over the past 40+ years since 1980, Coca-Cola has maintained an ROE above 20% except in 2017 (when it sold off its global bottling operations, resulting in one-time losses from employee severance and asset impairments). Its ROE peaked at 62% in 1997, which is truly outstanding.

Let’s break down ROE using the DuPont analysis into three key components—net profit margin, asset turnover, and financial leverage—and examine each:

1) Asset Turnover: Except for a slight rebound between 1986-1995, Coca-Cola’s asset turnover has been on a steady decline, dropping from 1.77 to as low as 0.4, clearly dragging down ROE.

2) Financial Leverage: Taking advantage of the Fed’s quantitative easing policies post-2008, Coca-Cola aggressively issued debt, raising its long-term debt ratio from under 7% to over 35%. The leverage effect boosted its ROE.

3) Net Profit Margin: The stabilizer of high ROE. Since 1980, Coca-Cola’s net profit margin has consistently and steadily climbed from 7.5% to 23.4%.

In summary, Coca-Cola’s high ROE stems partly from leveraging low-interest rates for expansion, but more importantly from its rising net profit margin. The latter is driven by its strong brand power, which ensures high pricing power and gross margins, as well as continuous operational efficiency improvements that optimize expense ratios.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.