Posts

Posts Likes Received

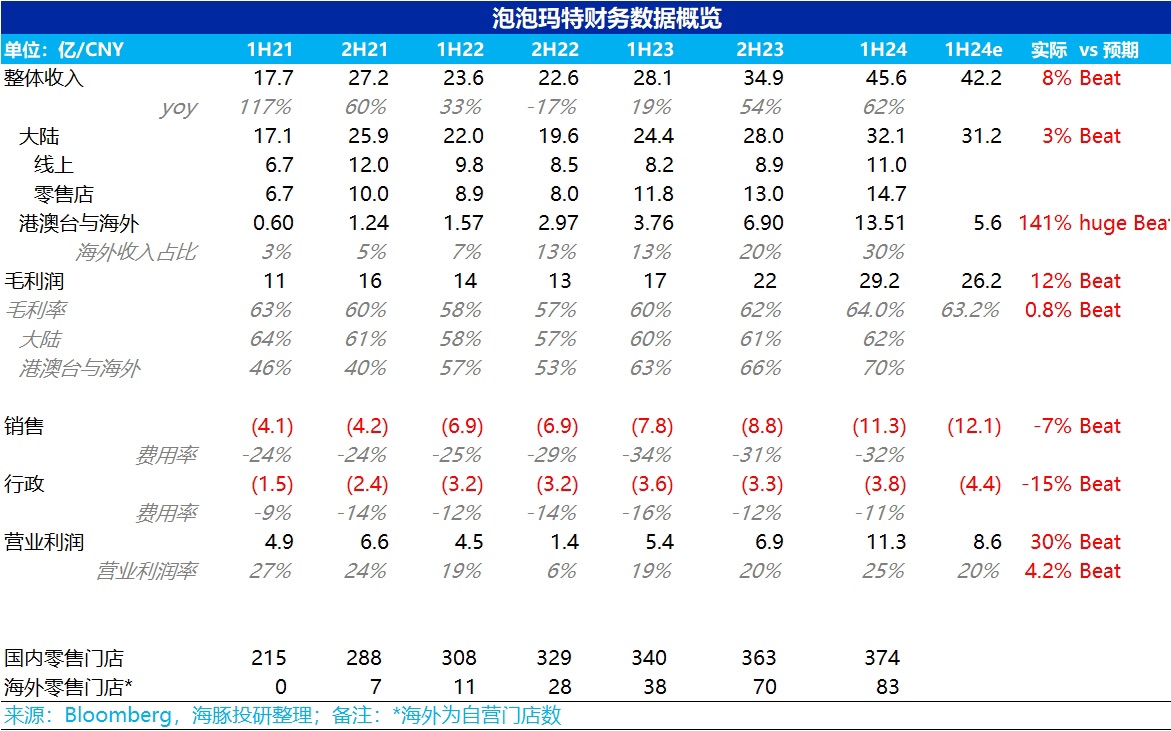

Likes Received$POP MART(09992.HK)first take: As for this quarter's earnings report, since the company had already pre-announced explosive performance in mid-to-late July—forecasting H1 2024 revenue growth of no less than 55%, while actual growth reached 62%; profit growth was forecasted at no less than 90%, but actual growth hit 110%, meeting expectations as promised.

Thus, while the data might seem to show a significant expectation gap, the market's expectations were already lagging behind.

This earnings report offers a more immersive look at how Pop Mart is recreating itself in overseas markets. Judging by the results, it's likely that fun-loving young Chinese globally will soon find a common language—Pop Mart.

In the first half of the year, Pop Mart powerfully demonstrated that, compared to domestic 'lying flat' and involution, or even the production capacity-driven overseas expansion of China's 'Four Little Dragons,' the overseas expansion of cultural products with 'brand' + 'design' added value is the true blue ocean for Chinese companies going global.

In overseas markets, rapid store expansion paired with explosive per-store sales have turned Pop Mart's global expansion into a story of limitless imagination—instantly making it incredibly sexy.

Adding icing to the cake, in the domestic market, perhaps the 'lying flat' Gen Z and post-00s, while not very interested in having kids, have instead found emotional solace in small pleasures like keeping pets or buying trendy toys.

And under this consumption trend, Pop Mart has leveraged Douyin trends to make its domestic business thrive.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.