Posts

Posts Likes Received

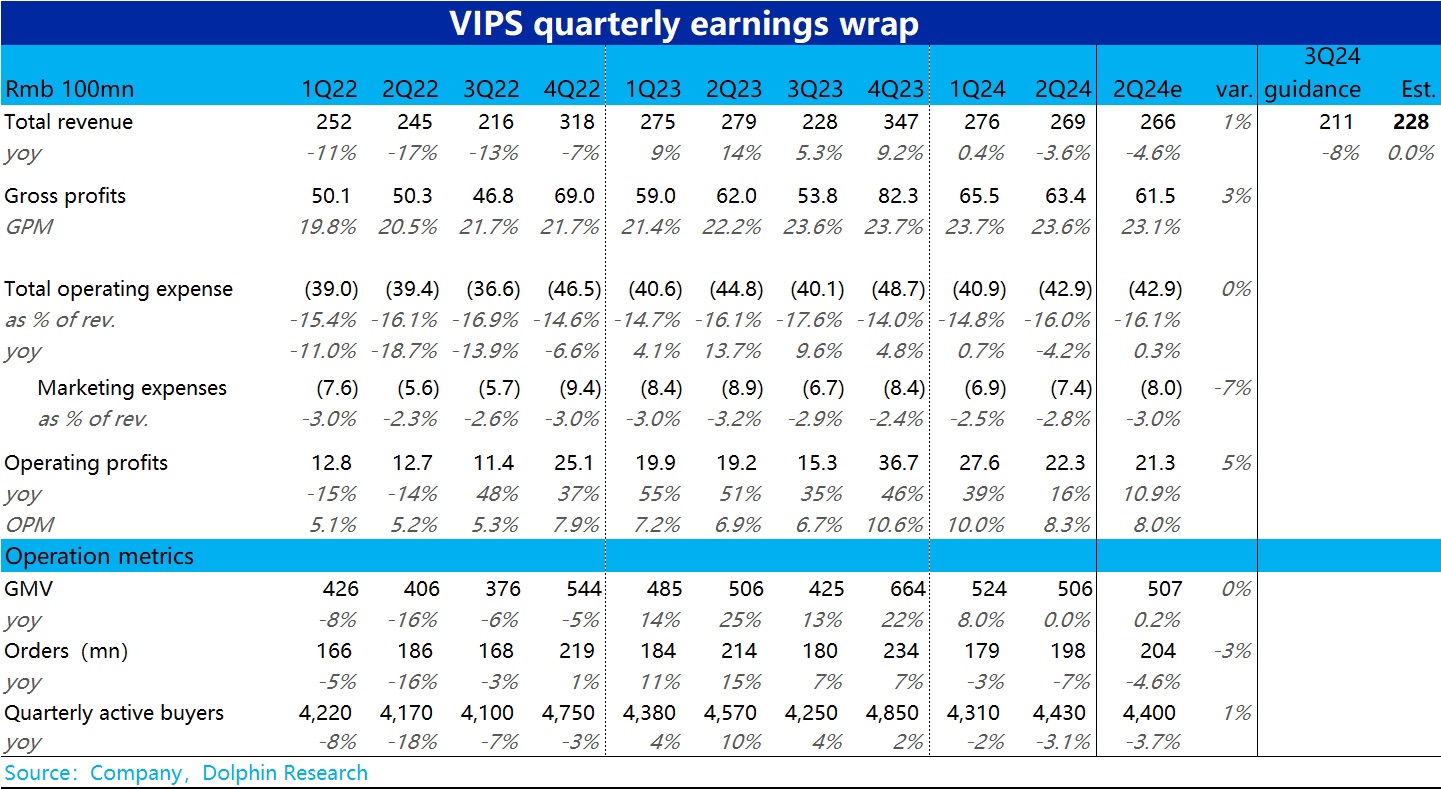

Likes Received$Vipshops(VIPS.US)2Q24 first take: At first glance, Vipshop Holdings' performance this time was in line with already quite conservative expectations. Key indicators such as GMV, revenue, and profit were slightly above or at least met expectations.

However, beyond the expectation gap, we must also admit that Vipshop Holdings' various indicators reflect significant operational pressures on the company.

First, in terms of core operational metrics, both active users and order volume saw year-over-year declines of -3% to -4%, with GMV remaining flat thanks to higher per capita spending from refined SVIP customers.

While financial metrics were better than expected, both revenue and gross profit declined year-over-year. The company maintained profit growth by cutting expenses, which fell even more sharply year-over-year.

For the next quarter, the company guided for a year-over-year revenue decline of -10% to -5%, worse than this quarter, suggesting further deterioration.

In terms of shareholder returns, after three consecutive quarters of significant shrinkage, Vipshop Holdings' buyback amount rebounded this quarter to slightly over $200 million (against a market cap of around $7 billion), which is decent. However, a concern is that the company has recorded negative operating cash flows of -1.3 billion and -800 million yuan in the past two quarters due to high capex and declining operating cash flow. Although the company has over 20 billion yuan in cash on hand, avoiding liquidity issues, the consecutive negative free cash flows are undoubtedly a sustainability concern.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.