Posts

Posts Likes Received

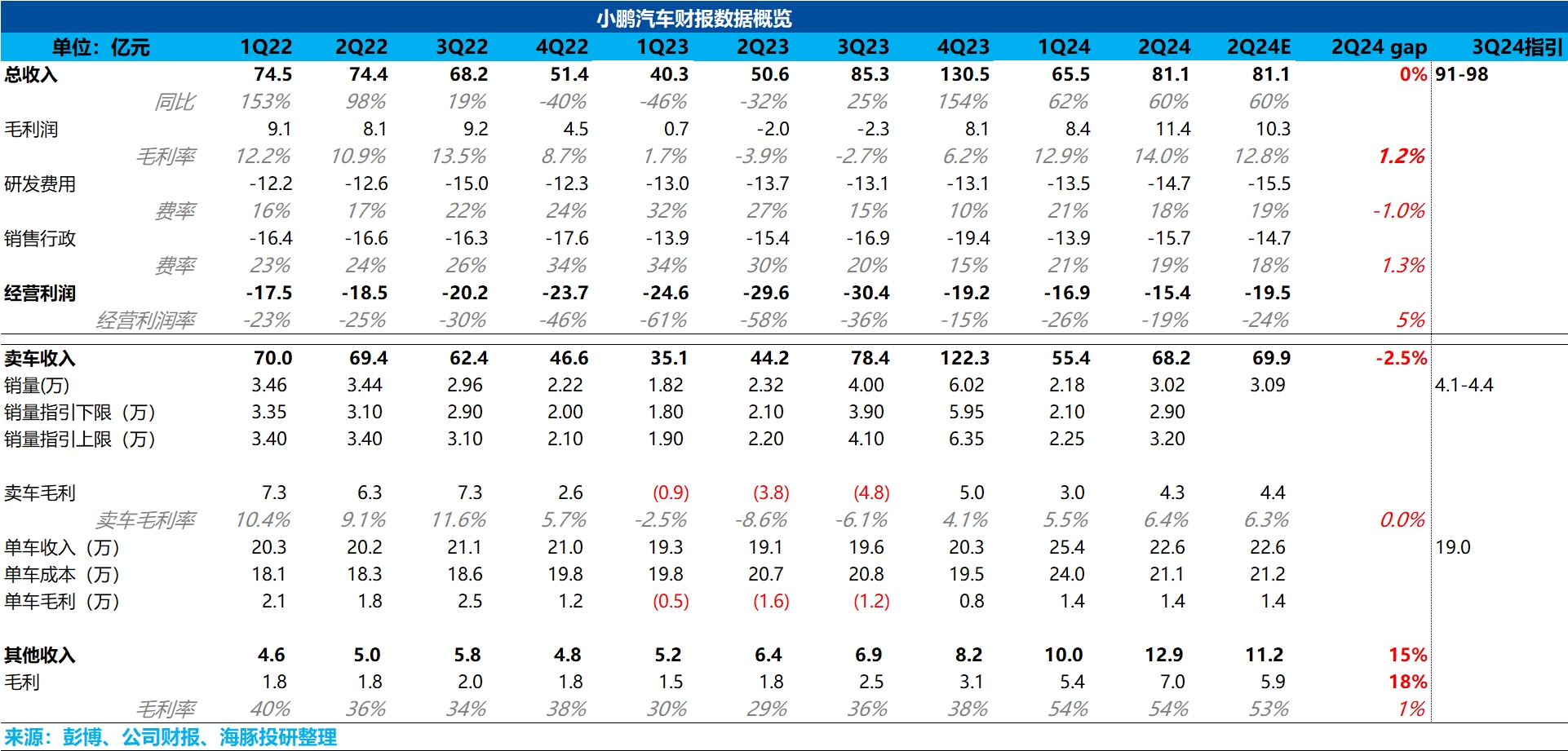

Likes ReceivedFrom the perspective of the second-quarter performance, XPeng delivered a decent report card. The gross margin slightly exceeded expectations, primarily due to other income streams, including increased revenue from the collaboration with Volkswagen, which boosted the gross margin.

In terms of the automotive business, although the sales structure deteriorated this quarter (with a lower proportion of X9) and continued price cuts on the main models G6/G9, the average selling price (ASP) declined compared to the first quarter, roughly in line with market expectations. However, significant reductions in per-unit costs and potentially lower impairment losses on the P5 (not specifically disclosed) led to a sequential improvement in the automotive gross margin. Looking at the sales outlook for the third quarter, XPeng expects to sell 41,000 to 44,000 vehicles, exceeding major banks' expectations of 37,000 units. With July sales already known at 11,000 units and August sales likely similar to July based on weekly data, September sales could approach 20,000 units, indicating strong sequential growth. This suggests that the Mona M03, set for delivery in September, may have exceeded order expectations, driving a rapid recovery in deliveries.

From a revenue perspective, third-quarter revenue is projected at 9.1 to 9.8 billion yuan. Assuming other income remains flat compared to the second quarter, the ASP for the third quarter is estimated at around 190,000 yuan, slightly below market expectations of 200,000 yuan. This implies a higher proportion of lower-priced Mona M03 deliveries, leading to a sequential decline in ASP.

However, both the sales and revenue forecasts for the third quarter suggest that Mona M03 orders are strong, with sales likely exceeding expectations. For XPeng, which has been lagging in sales, this is a tangible positive.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.