Posts

Posts Likes Received

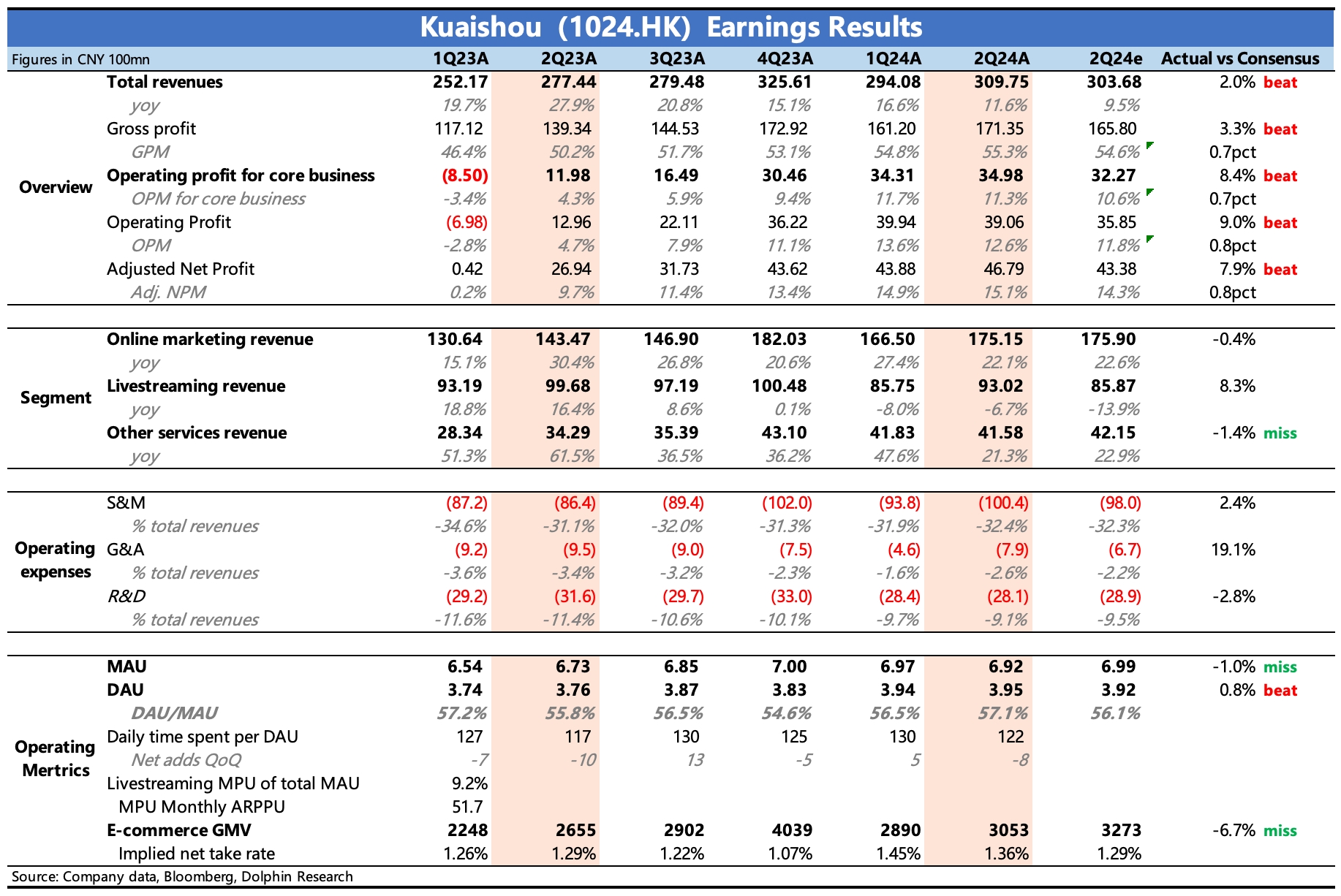

Likes Received$KUAISHOU-W(01024.HK) first take:At first glance, the Q2 results exceeded expectations in both revenue and profit, but the upside mainly came from live streaming gifts, while the key metrics Dolphin Research focuses on didn't bring any surprises. Instead, it confirmed some of our pre-earnings concerns.

1) The positive side: Active introduction of live streaming guilds offset the negative impact of content regulation, leading to slightly better-than-expected total revenue. Reduced costs in revenue sharing, bandwidth depreciation, and intangible asset amortization resulted in slightly higher gross margins, ultimately achieving better-than-expected Non-IFRS net profit.

However, Dolphin Research has some concerns:

2) Q2 GMV growth was only 15% YoY, below market expectations. Third-party data on live streaming e-commerce had already hinted at weakening GMV trends for Kuaishou, and some experts had warned about this. Despite Kuaishou starting the 618 promotions earliest and ending latest, the GMV performance was disappointing. The recent stock price pressure reflects the market's growing pessimism. Investors should pay attention to management's guidance for Q3 GMV during the earnings call, as it may lead to further downward revisions in expectations.

3) General shelf e-commerce accounted for 25% of GMV, showing little change QoQ. The slowdown in Kuaishou's GMV growth reflects the saturation of KOL-driven live commerce. If Kuaishou's transition to general shelf e-commerce had shown better progress, it could have alleviated market concerns. However, the Q2 penetration rate didn't improve much, lagging behind both Douyin and its own expected pace, increasing risks of further slowdown.

4) User acquisition costs exceeded expectations, while MAU growth fell short. This aligns with third-party data showing slow user growth for Kuaishou. The market particularly hoped to see optimization of marketing expenses (over 30% of revenue) amid stable user growth.

5) Share buybacks continue steadily, but there were no announcements about significantly enhancing shareholder returns.

Overall, Dolphin Research isn't particularly positive about the Q2 results. However, given current valuations, management's outlook and guidance will be equally important for market reaction. We recommend tuning into the earnings call later, which can be watched live on the Longbridge app.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.