Posts

Posts Likes Received

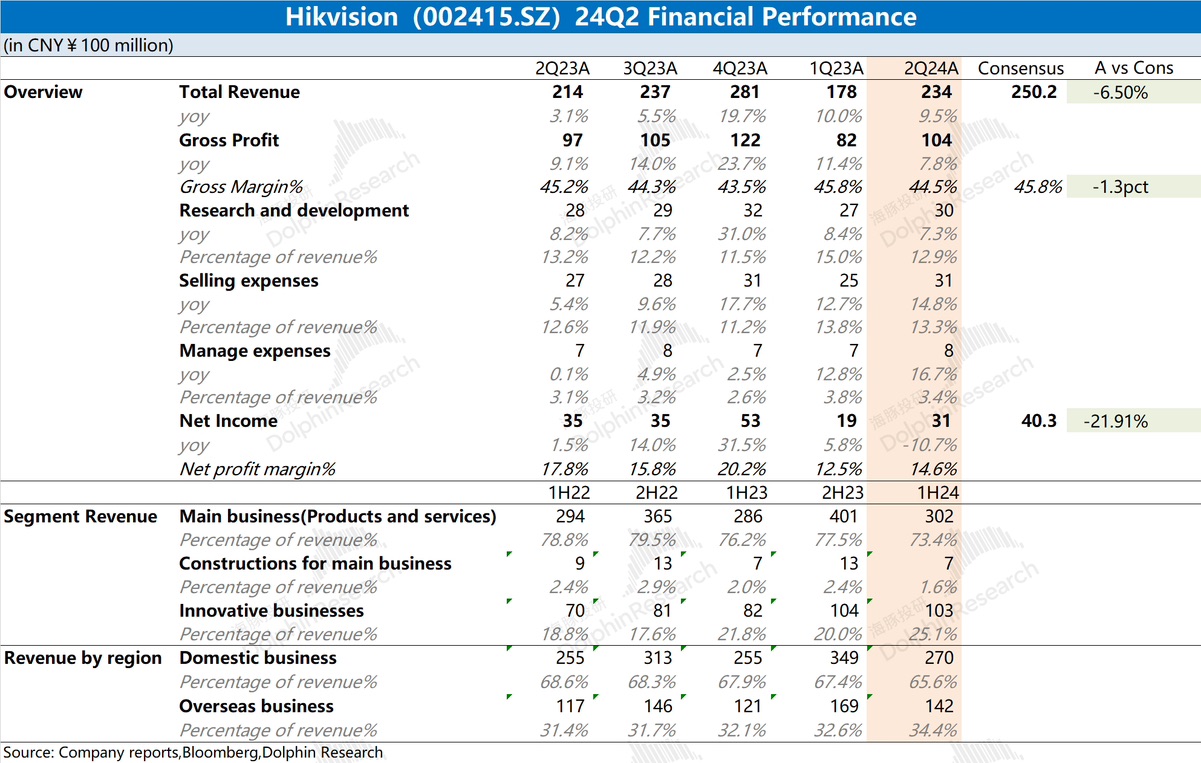

Likes Received$HIKVISION(002415.SZ)First take: The company's revenue and net profit performance this quarter were not very good. Although revenue still rebounded this quarter, the decline in gross margin directly led to a decrease in net profit.

Specifically: 1) Revenue: The innovative business continued to maintain double-digit growth, which is the main source of the company's revenue growth. However, it cannot be ignored that the company is still affected by the government's control of expenditures, and the domestic public service business continues to decline; 2) Gross margin: The proportion of software-based revenue continued to decline to 20%, structurally affecting the company's comprehensive gross margin, leading to a decline in profits this quarter.

Although Hikvision's overseas business continues to grow, the company's core market is still in China. With the current downturn in the three core business divisions—PBG, EBG, and SMBG—the company's performance is weak. The frequent decline in stock prices also reflects the market's lack of confidence.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.