Posts

Posts Likes Received

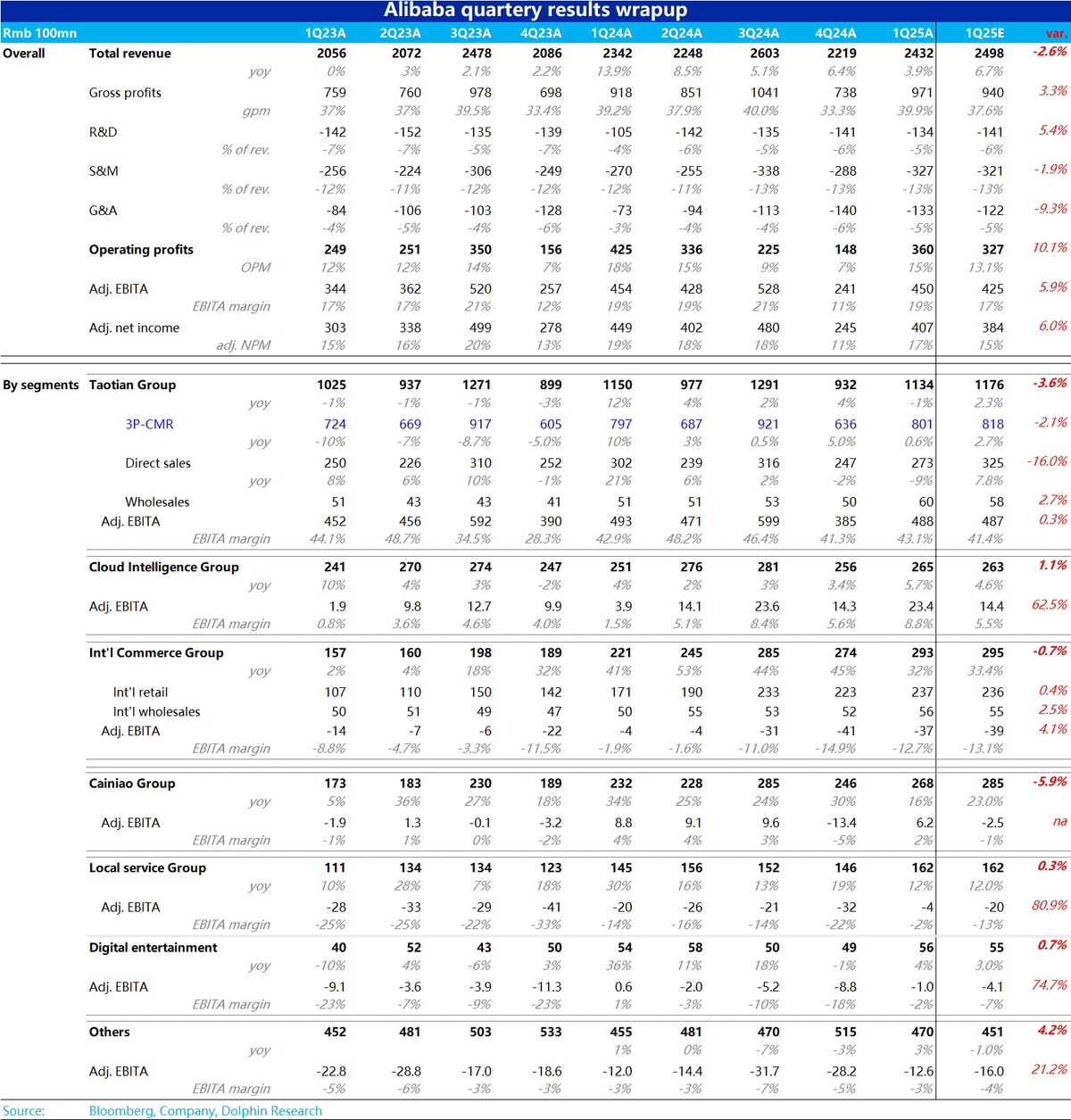

Likes Received$Alibaba(BABA.US)first take: Alibaba's performance this time is a mixed bag. While most segments actually performed commendably, the problem lies in the fact that the most important Taotian Group "dropped the ball."

Against the market's already conservative expectation of less than 3% growth in CMR, the actual delivered growth was less than 1%. This resulted in Taotian Group's revenue falling significantly short of expectations. From a profitability perspective, while it didn't miss expectations, the issue is that market expectations were already conservative, and the adjusted EBITA still showed a slight year-over-year decline, which is obviously not good news.

Compared to other businesses, cloud services stood out with both revenue and profit exceeding expectations; international e-commerce, though slowing as expected, saw better-than-expected reductions in losses, which is still decent; Cainiao, while following the slowdown in international business, turned a profit, which was a pleasant surprise; local services and digital media & entertainment at least saw significantly better-than-expected reductions in losses, nearing breakeven.

However, the importance of Taotian Group even outweighs the sum of all other businesses, so the pre-market stock reaction remains negative. That said, in the medium term, whether Taotian's ongoing promotion of full-site recommendations and the previously announced increase in technical service fees can bring a turning point in take rate and CMR revenue is still something to look forward to.$BABA-W(09988.HK)

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.