Posts

Posts Likes Received

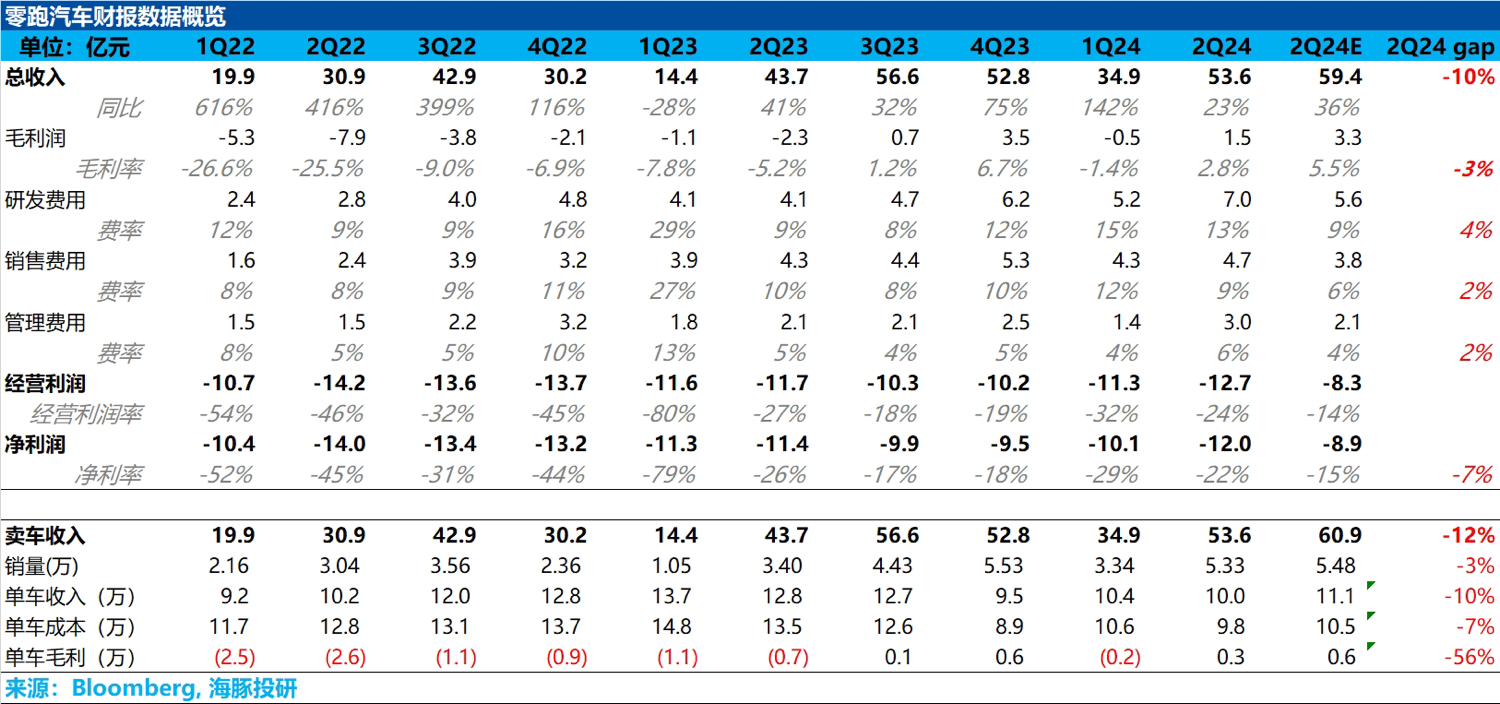

Likes Received$LEAPMOTOR(09863.HK)First take: From the second quarter results, Leapmotor delivered a report card that did not satisfy investors, with both revenue and gross margin falling below market expectations. The core reason for the underperformance lies in the average selling price of its vehicles.

This quarter, the market expected the gross margin to rebound sequentially to 5.5%, driven by improved vehicle mix: the proportion of the T03 compact car declined (from 28% in Q1 to 25.4%), while the higher-priced, higher-margin C16 started deliveries in June, increasing its share by 1.7%. Additionally, the sales recovery was expected to reduce manufacturing costs, boosting overall gross margin. However, the results show that the average selling price continued to decline sequentially in Q2. Dolphin Research attributes this to two factors:

1) The 2024 models launched in March were priced lower than the older versions, but the full impact of the price cuts was only felt in Q2, as only part of the effect was reflected in Q1.

2) The proportion of the mid-size SUV C10, which has a lower price point, increased. Notably, the pure electric version of the C10 saw the fastest sequential sales growth in Q2, and its lower price compared to the extended-range version dragged down the average vehicle price.

Due to the continued sequential decline in average selling price, despite higher sales and lower manufacturing costs in Q2, the automotive business's gross margin still fell short of expectations.

In terms of the most critical operating profit, this quarter's figure was also significantly below expectations. This was due to both the gross margin shortfall and record-high expenses in Q2: all three major expense categories exceeded market expectations. The largest increase was in R&D expenses, primarily driven by Leapmotor's investments in intelligent driving and new model development. The company has begun developing an end-to-end large-model intelligent driving system, increasing manpower, computing power, and equipment investments in this area.

On a positive note, the company's Q3 guidance indicates a significant sequential increase in sales, with expectations of better gross margin performance in the second half. Dolphin Research also believes Leapmotor's sales and gross margin will continue to recover in H2, but maintains that the stock's medium-to-long-term upside potential still hinges on incremental growth from overseas expansion.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.