Posts

Posts Likes Received

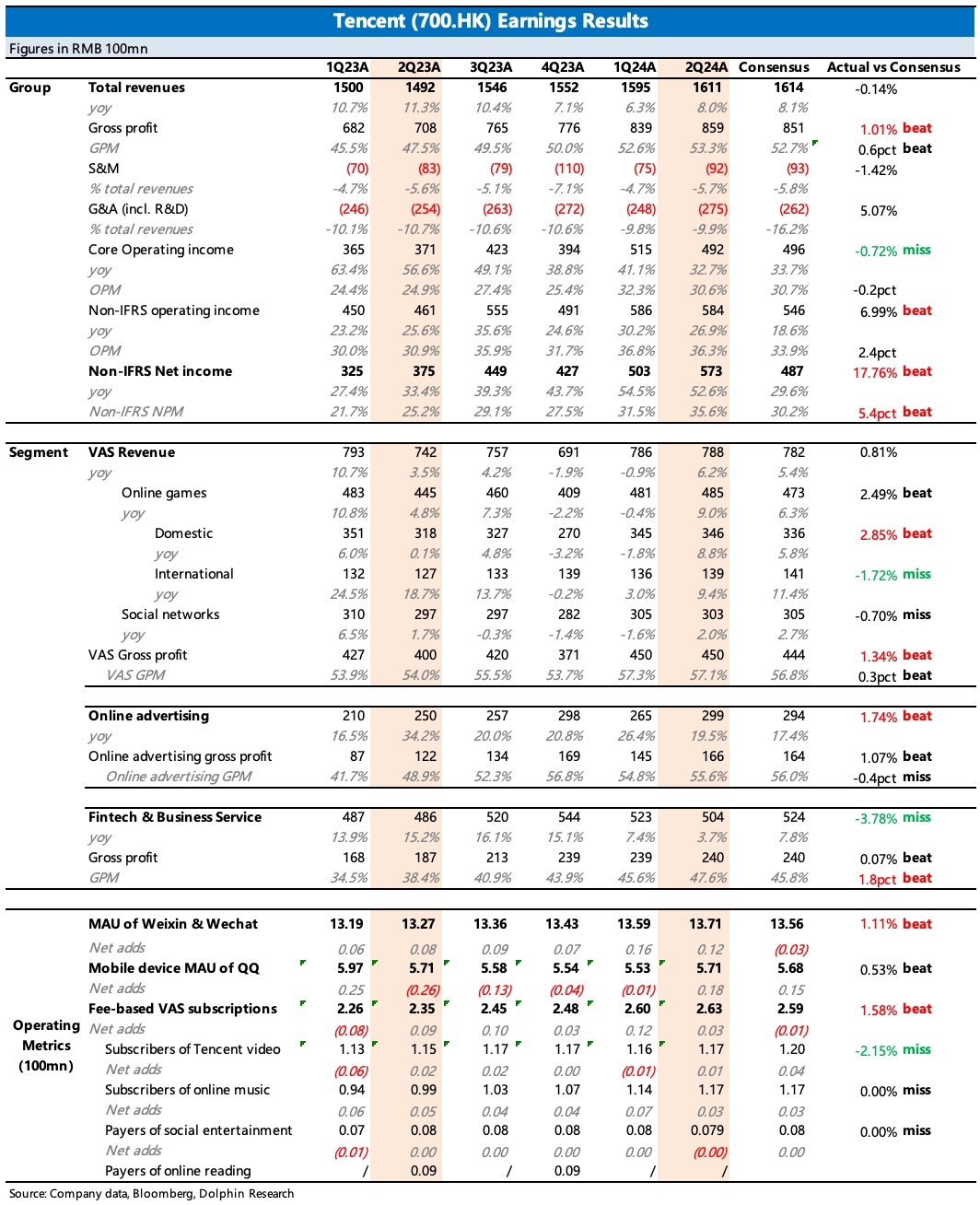

Likes Received$TENCENT(00700.HK) first take: The Q2 results are out, overall performance is in line with expectations, with the profit beat mainly coming from effective tax rate changes. Dolphin Research generally focuses on the performance of core business operations, so we pay more attention to the core operating profit metric. From the results, there are no surprises.

However, breaking it down, the performance varies. The most surprising aspect in terms of revenue is the advertising business. Despite the pressure from macroeconomic data in Q2, some funds had downgraded Tencent's ad revenue expectations, but it remained stable. Of course, given the continuously weakening macro environment, whether Tencent can hold up in the second half of the year remains to be seen—this can be monitored during the earnings call.

However, Dolphin Research believes that, compared to peers, Tencent's performance should still lead relatively due to incremental ad revenue from mini-program games and video accounts.

The highly anticipated gaming revenue did not disappoint, and deferred revenue also suggests short-term strength. However, the lack of significant changes in the fintech business reflects the pressure from the macro environment, with YoY growth continuing to weaken. Of course, given the further deterioration in the industry as reflected in the central bank's reserve funds, the market had already priced in some of this.

In terms of profits, gross margins continue to improve, but Q2 saw rising expenses, exceeding market expectations. The variance mainly comes from R&D expenses, likely due to increased investment in gaming and AI, with Tencent expanding its R&D workforce and compensation incentives. As a result, the excess gross profit was offset by these increased expenses, keeping core operating profit largely in line with expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.