Posts

Posts Likes Received

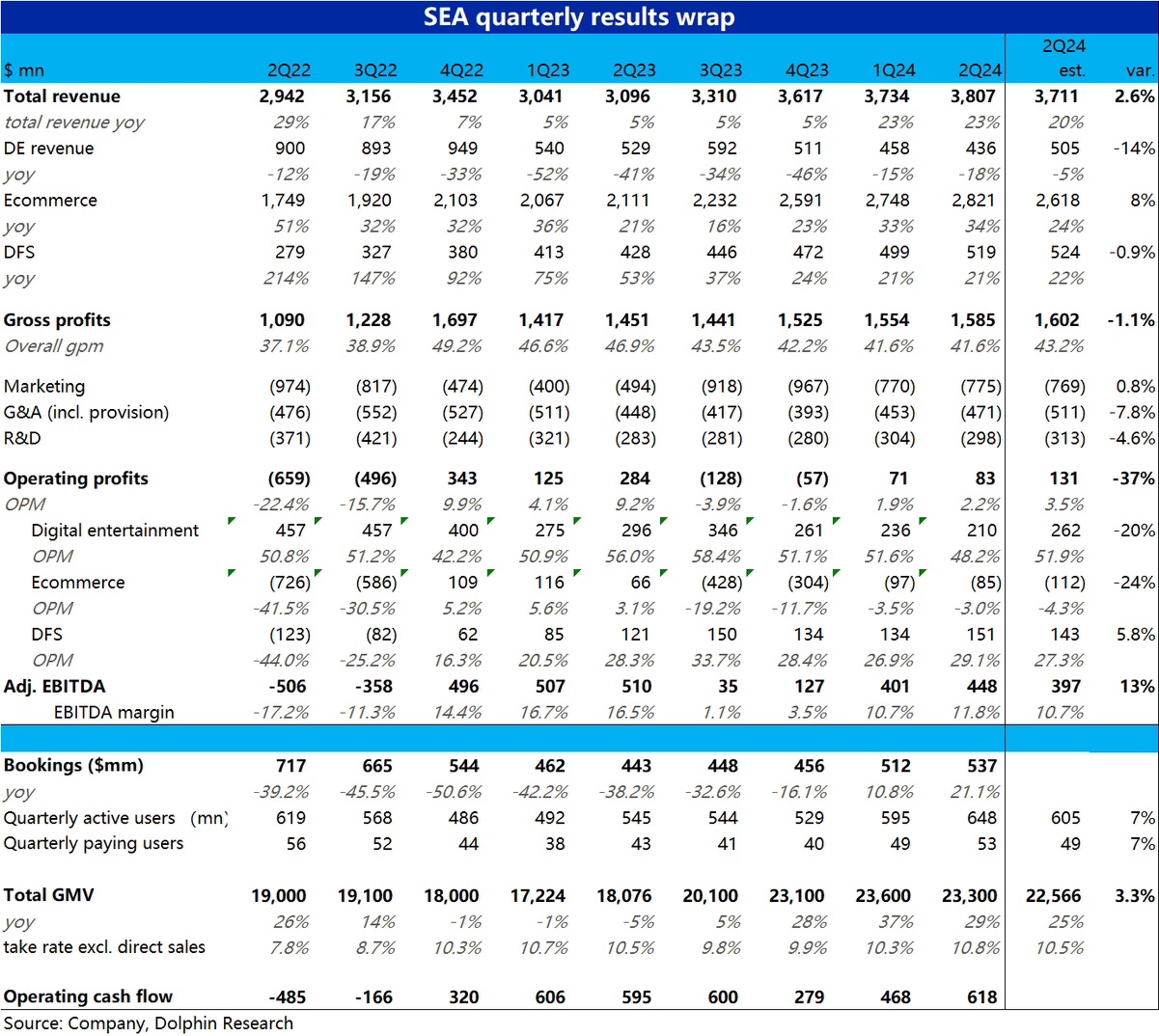

Likes Received$Sea(SE.US)2Q24 first take: Sea's performance this quarter was better than expected overall, with both total revenue and profit metrics (adj. EBITDA) exceeding expectations.

Breaking it down: 1) Although the GMV of the e-commerce business declined slightly quarter-over-quarter, it was better than expected, and the loss did not widen as feared but instead narrowed sequentially. 2) While the gaming business's revenue appeared to fall short of expectations at first glance, this was due to changes in deferred revenue. Key operating metrics such as inflows and monthly active users reflected that the gaming business actually performed well. 3) Although fintech revenue growth was slightly below expectations, profitability was strong, making the overall performance still decent.

However, the issue lies in the fact that Shopee, the core of the company's valuation, has yet to achieve stable profitability. Whether the valuation based on the expected "steady-state" profit can be realized remains an "artistic question." Moreover, the e-commerce market landscape in Southeast Asia is still far from stable. Although platforms like Shopee and Lazada are currently improving profitability, the battle for market share is likely to reignite one day.

Dolphin Research believes that the company's current valuation is no longer expensive, but the medium- to long-term outlook remains unclear.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.