Posts

Posts Likes Received

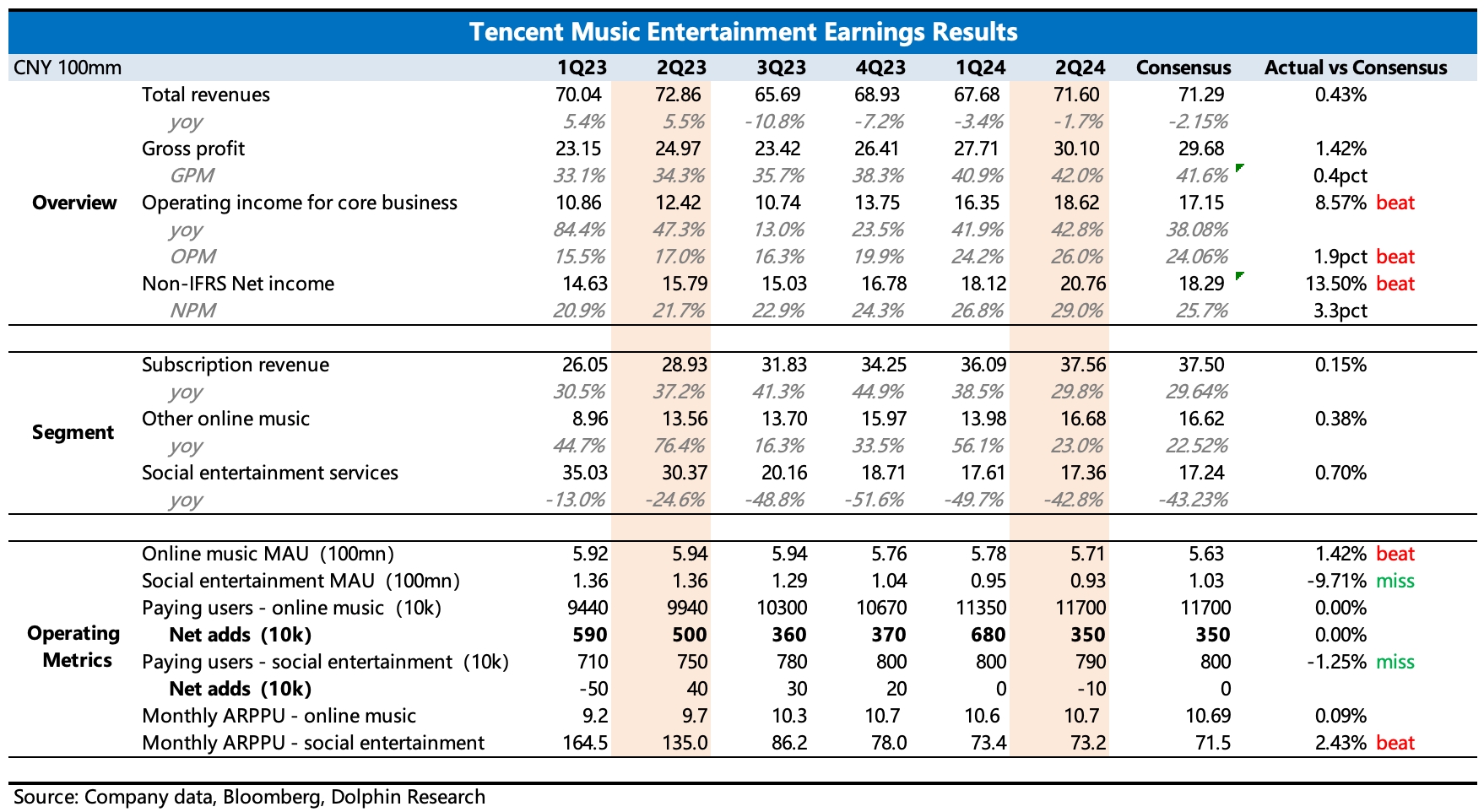

Likes Received$Tencent Music(TME.US) first take: The Q2 performance was actually good, with the subscription business continuing its high growth trend, and the impact of social entertainment rectification gradually easing. However, the latest expectations from leading institutions were quite high (above the Bloomberg consensus), TME slightly missed on revenue, but profits were pulled back due to tighter expense controls, basically meeting expectations.

As Tencent Music Entertainment has been in a period of strong performance release over the past year, its valuation is not low compared to other Chinese concept assets (Dolphin Research also provided a relatively optimistic valuation range in last quarter's review). The recent stock price adjustment of Tencent Music Entertainment is partly due to following the broader market decline and partly due to concerns among some investors about limited industry growth potential and the short-term surge in downloads of Jelly Music, leading to a valuation adjustment.

The pre-market plunge also reflects this factor of "leveraging" the earnings miss to adjust valuations.

However, Dolphin Research believes that the performance itself is not an issue, and there is no need to panic excessively about competition from Jelly Music in the short to medium term. Currently, the user base of the two is not on the same scale, and it is too early to talk about competitive threats. Instead, the focus should be on whether macro pressures will affect the logic of "paid penetration + price increases," slowing down future membership revenue growth. This needs to be seen from the management's statements and outlook during the earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.