Posts

Posts Likes Received

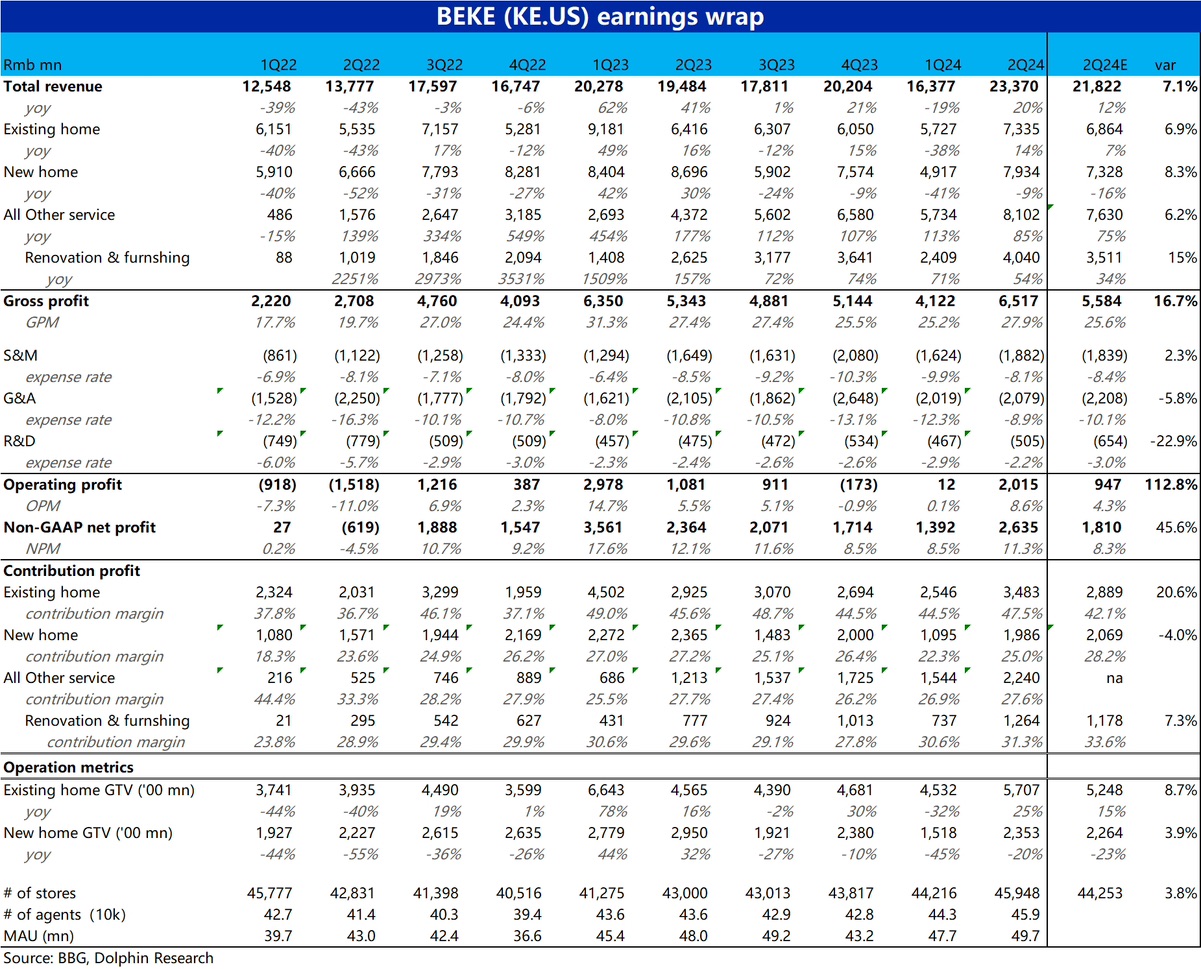

Likes Received$KE(BEKE.US)2Q24 first take: At first glance, KE Holdings delivered a comprehensive earnings beat this quarter. Revenue grew 20% YoY, about 8pct higher than expectations, with all business segments beating estimates by 6%~8%, showing no weak spots. From a profitability perspective, the stronger-than-expected revenue growth drove gross profit nearly 1 billion yuan above expectations, while expenses were about 300 million yuan lower than anticipated. As a result, under relatively low expectations, actual operating profit doubled the forecast.

However, the pre-market stock reaction was muted. We believe this is mainly because, following the May 17 property stimulus policies, the market had somewhat anticipated strong Q2 results. The issue is that the policy effects began to fade after 1~2 months, and since August, there have been clear signs of weakening sequential sales in the existing home market. Therefore, the market remains uncertain about the property market and the company's performance trajectory in the coming quarters.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.