Posts

Posts Likes Received

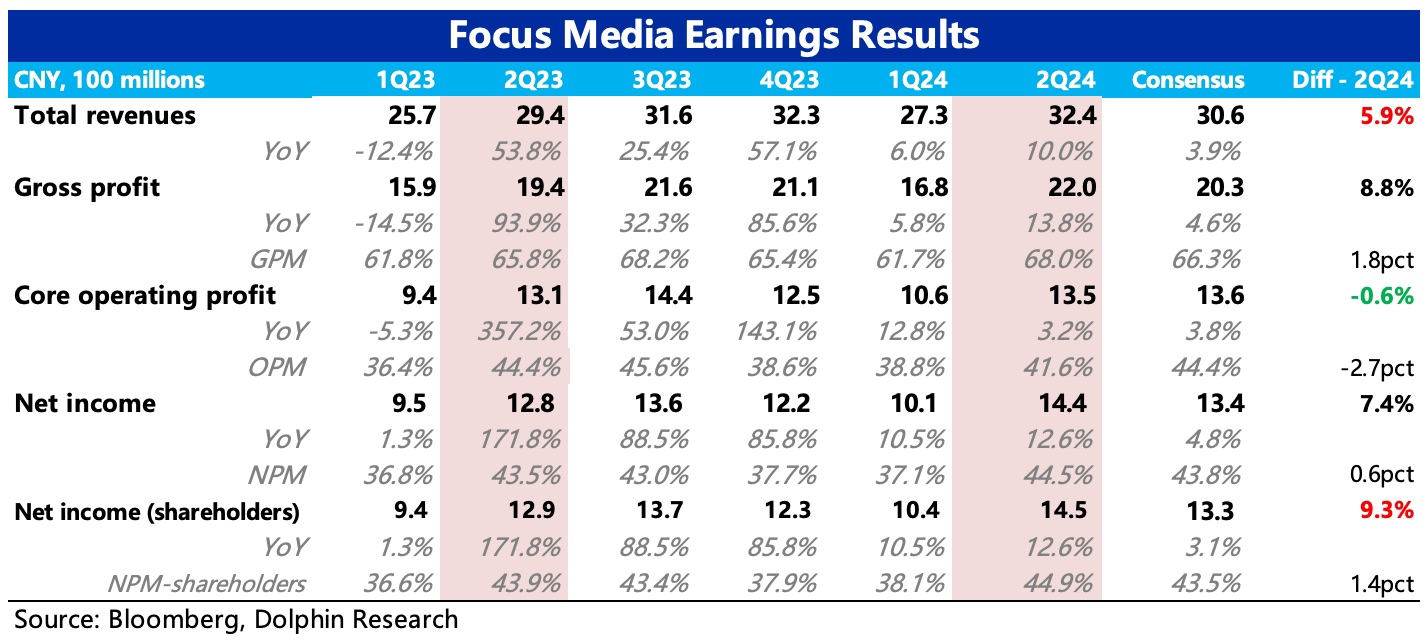

Likes Received$Focus Media(002027.SZ)first take:Overall, the Q2 performance slightly exceeded expectations, with revenue significantly surpassing expectations and core profit meeting expectations.

1) Revenue exceeded expectations: Previously, due to the low growth rate in Q1, the deteriorating macroeconomic environment, the sluggish 618 shopping festival, and the high base effect, market expectations for Q2 performance were generally conservative. However, the actual results showed accelerated year-on-year revenue growth, which seems inconsistent with the trend observed in Q1.

Dolphin Research believes that the significant expectation gap is mainly due to the greater seasonal variation in advertisers' budget allocations in the current environment. Simply put, the off-season is becoming quieter, and the peak season is becoming busier. Advertisers are concentrating their marketing efforts during specific periods to improve overall efficiency, which is also a way to indirectly save on advertising costs.

2) Profit met expectations: The final net profit was higher than expected, but this was mainly due to investment gains and the offset of non-operating expenses. Excluding these factors, the core business operating profit only met expectations because of increased marketing expenses. Focus Media is currently in a phase of expanding its network and returning to normal operations, so subsequent costs and expenses will increase accordingly. In the short term, this may continue to impact the profitability of its core business.

3) Dividends were in line with expectations: Based on its H1 performance, the company plans to distribute a dividend of 1.44 billion yuan, with a payout ratio of nearly 60%. The company previously guided that the 2024 interim dividend ratio would not exceed 80%, so the actual dividend payout was in line with expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.