Posts

Posts Likes Received

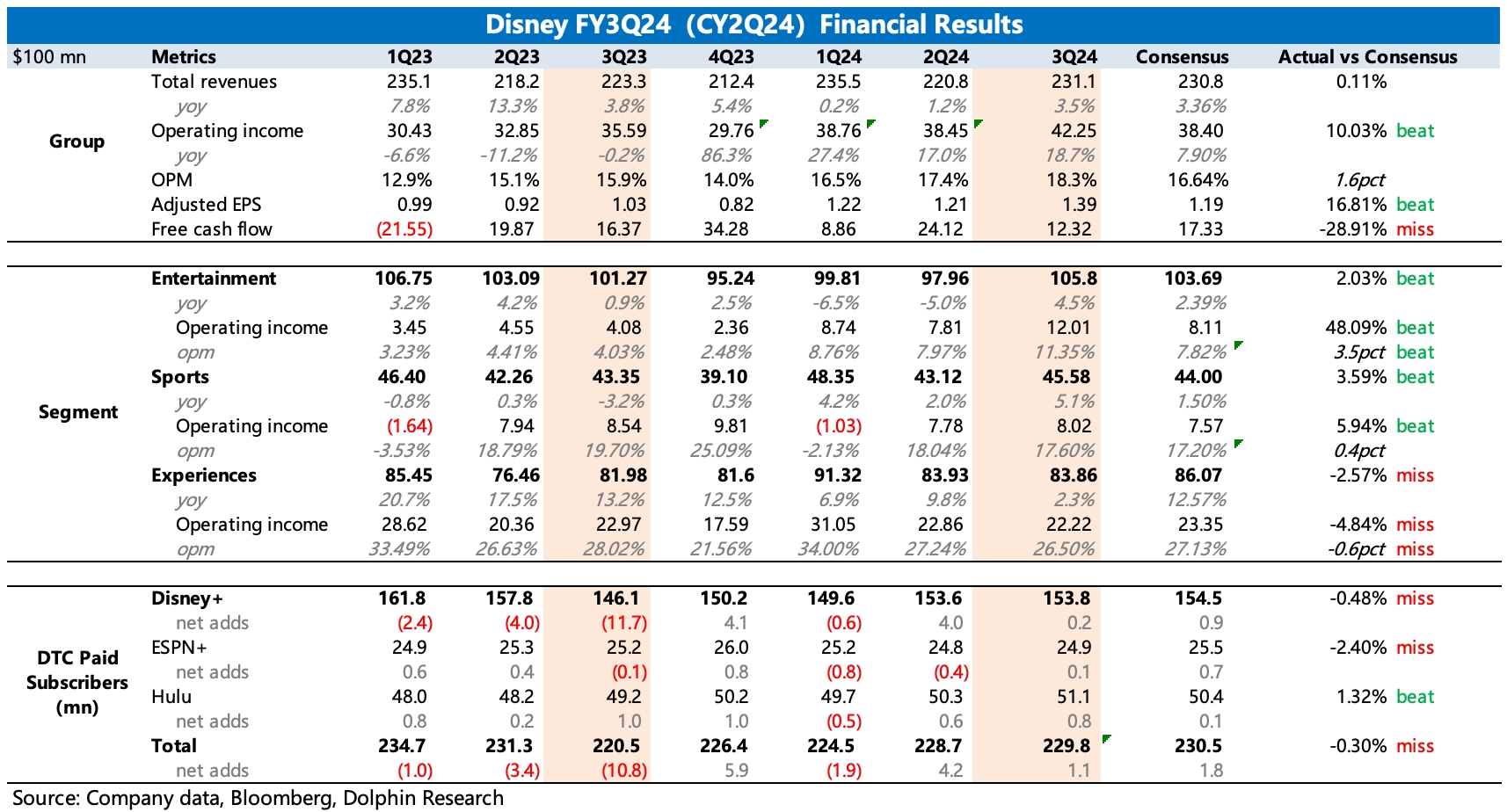

Likes Received$Disney(DIS.US) first take: Disney's Q3 results were mixed. The good news is that streaming losses narrowed and film sales profits exceeded expectations, while the bad news is that the slowdown in park demand significantly impacted current performance.

Additionally, the company expects operating profit from its parks business to decline by single digits year-over-year next quarter. Comcast's recent earnings report already indicated a significant cooling in demand for local theme parks in the U.S. As the profit powerhouse, the theme park division is visibly crucial to Disney's overall performance, so it's essential to closely monitor the pace of the ongoing demand slowdown.

Fortunately, streaming losses narrowed quickly. Including ESPN+ in the overall DTC (Direct-to-Consumer) segment, the streaming business achieved profitability this quarter—a quarter earlier than the company's initial guidance. Yesterday, Disney announced another price hike for Disney+, which is expected to further boost streaming profits in the short term.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.