Posts

Posts Likes Received

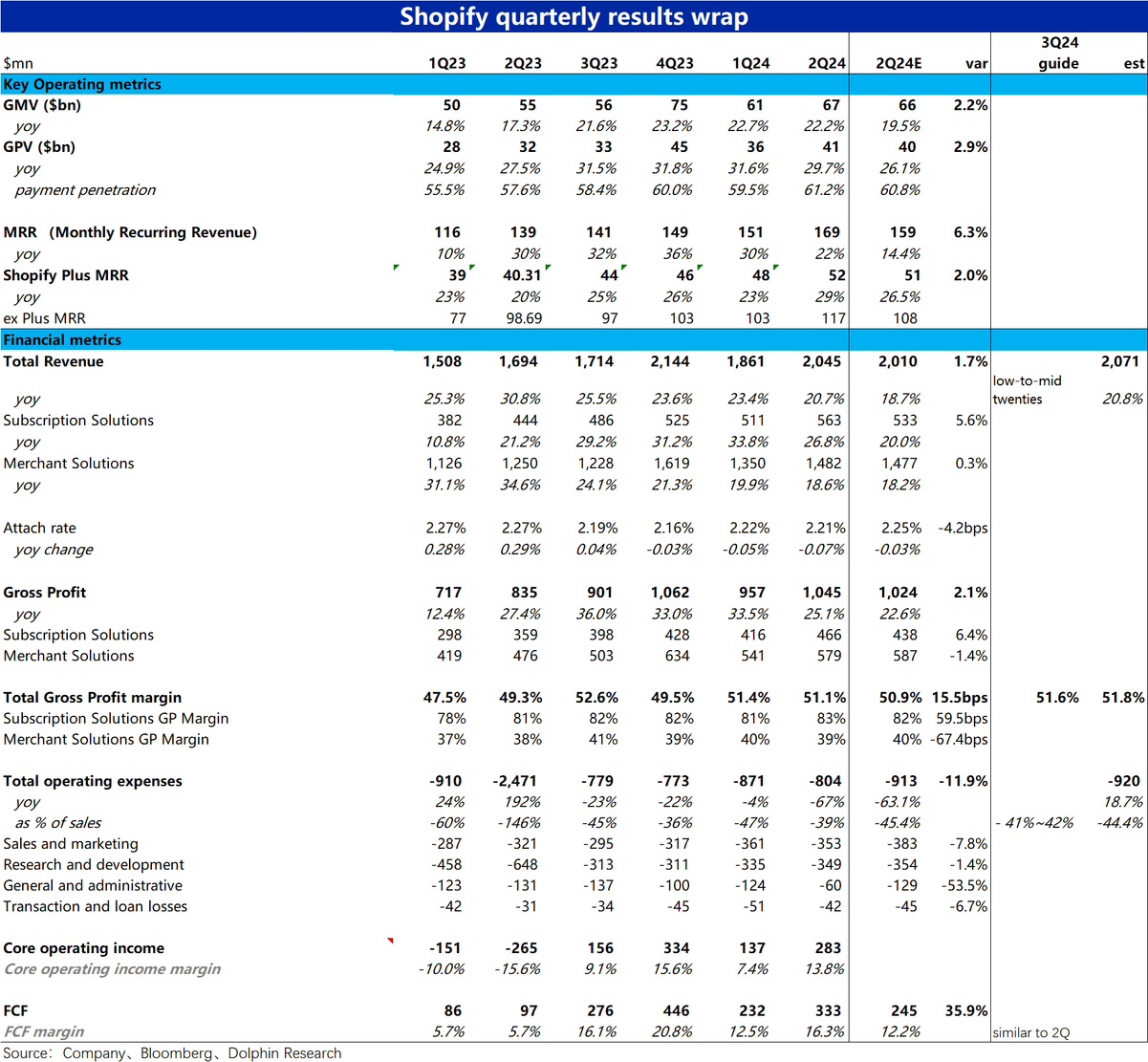

Likes Received$Shopify (SHOP.US) 2Q24 first take: At first glance, Shopify delivered a comprehensive beat this quarter, with key operating metrics GMV and GPV both exceeding expectations by 2%~3%. Year-over-year growth remained strong at approximately 22% and nearly 30%, respectively, while the payment ratio continued to rise. Another indicator reflecting subscription business performance, MRR (Monthly Recurring Revenue), significantly outperformed expectations by over 6%.

Since both GMV and MRR exceeded expectations, the corresponding subscription service revenue and merchant service revenue also outperformed proportionally. Total revenue was slightly higher than expected by 1.7%, amounting to an additional ~$35 million.

Moreover, due to impressive management cost control (-54% YoY) and similarly conservative spending on marketing and R&D, total operating expenses were nearly 12% lower than expected, saving approximately $100 million. Thanks to this exaggerated cost control, core operating profit reached $280 million, doubling quarter-over-quarter.

For next quarter's guidance, the company expects revenue to maintain relatively high growth of 20%~25%, with operating expenses accounting for 41%~42% of revenue—significantly lower than the market's expectation of 44%. In other words, profit release next quarter is also expected to outperform.

In summary: growth, cost control, and profit expansion—indeed, the performance is outstanding.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.