Posts

Posts Likes Received

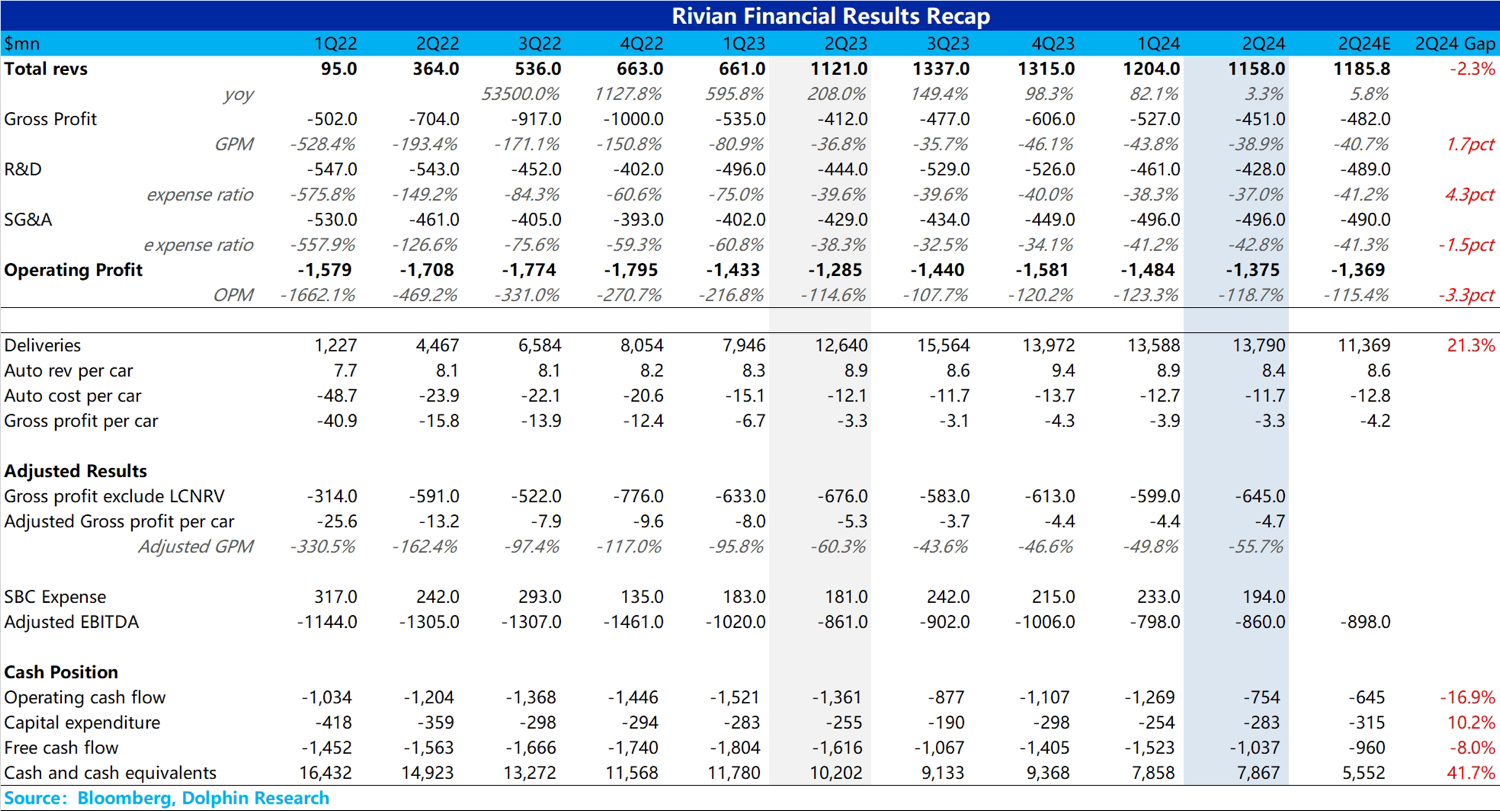

Likes ReceivedOverall, $Rivian Automotive(RIVN.US) delivered another mediocre performance in the second quarter, with revenue slightly below market expectations and gross margin slightly exceeding expectations.

However, the slight outperformance in gross margin was embellished by LCNRV (inventory and contract impairment effects) and one-time cost factors. If we look at the real gross margin (excluding the impact of LCNRV, supplier contract changes due to R1 upgrades, accelerated depreciation, and other one-time costs), the real gross margin continued to decline from -39% last quarter to -51% this quarter, a significant drop.

The main reasons for the decline are:

1) The decline in average selling price (ASP) per vehicle, mainly due to discounts offered by Rivian to clear inventory of the first-generation R1. Although the production-sales gap narrowed this quarter and inventory reduction achieved some results, it also led to revenue falling short of market expectations.

2) The direct shutdown of the Normal factory in the second quarter led to a decline in production, resulting in lower labor cost absorption efficiency and higher variable costs.

However, both factors are impacts caused by the shutdown for upgrades, which the market can understand. What the market remains most concerned about is the extent of cost improvements for the upgraded second-generation R1 and whether the company can achieve its repeatedly emphasized plan to turn gross margin positive in Q4. This quarter, Rivian also provided a detailed breakdown, estimating that the second-generation R1 will reduce material costs by 20% compared to the first-generation R1.

The remaining progress toward positive gross margin still relies on other factors, such as reduced depreciation expenses, lower other variable costs (e.g., shipping, warranties), and increased revenue from regulatory credits (estimated at $200 million in 2024). However, it must be emphasized that demand for the upgraded R1 remains the most critical factor. Weak demand could lead to further ASP declines, lower sales volumes, and higher depreciation expenses, making it difficult for Rivian to achieve its Q4 gross margin positivity plan.

Fortunately, Rivian has received up to $5 billion in investment from Volkswagen ($3 billion directly into Rivian and $2 billion into the Volkswagen-Rivian joint venture). Rivian's most critical cash flow shortage issue has been largely resolved, and a safety cushion for the stock price has been established. The potential for further stock price gains depends on seeing demand improvements and significant cost reductions to achieve the gross margin positivity plan.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.