Posts

Posts Likes Received

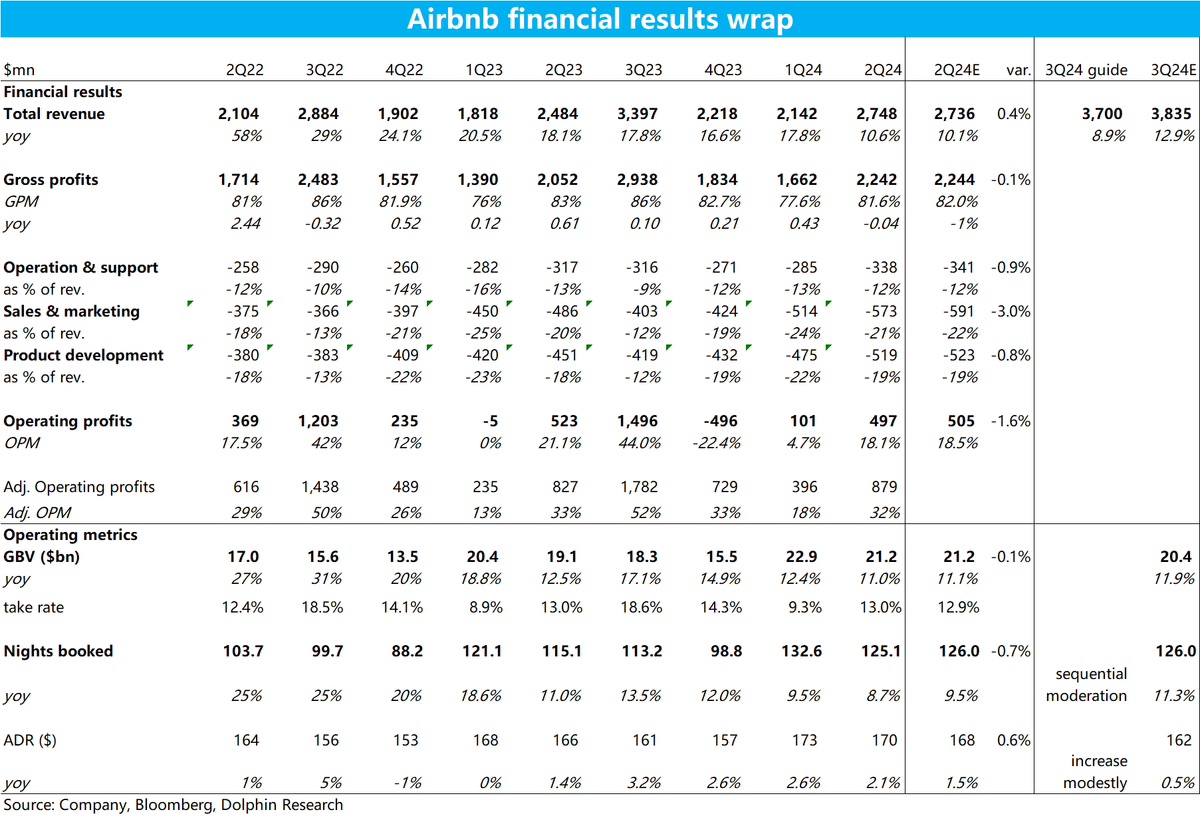

Likes Received$Airbnb(ABNB.US)2Q24 first take: What major issues caused Airbnb's stock price to drop 15% after hours? At first glance, the quarterly performance was disappointing. The two most critical metrics, nights booked and booking value, were slightly below market expectations, with growth showing further signs of slowing. Meanwhile, GAAP operating profit for the quarter was $497 million, down nearly 5% year-over-year, also below market expectations.

The guidance for the next quarter is even weaker, with revenue guidance of $3.67~3.73 billion, significantly below the expected $3.84 billion. For key operational metrics, the expected year-over-year growth rate for nights booked is projected to slow further from the current quarter's 8.7%, while the market had expected a rebound to 11.3% in the second half—a huge gap.

In short, the demand weakness is far more severe than the market anticipated.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.