Posts

Posts Likes Received

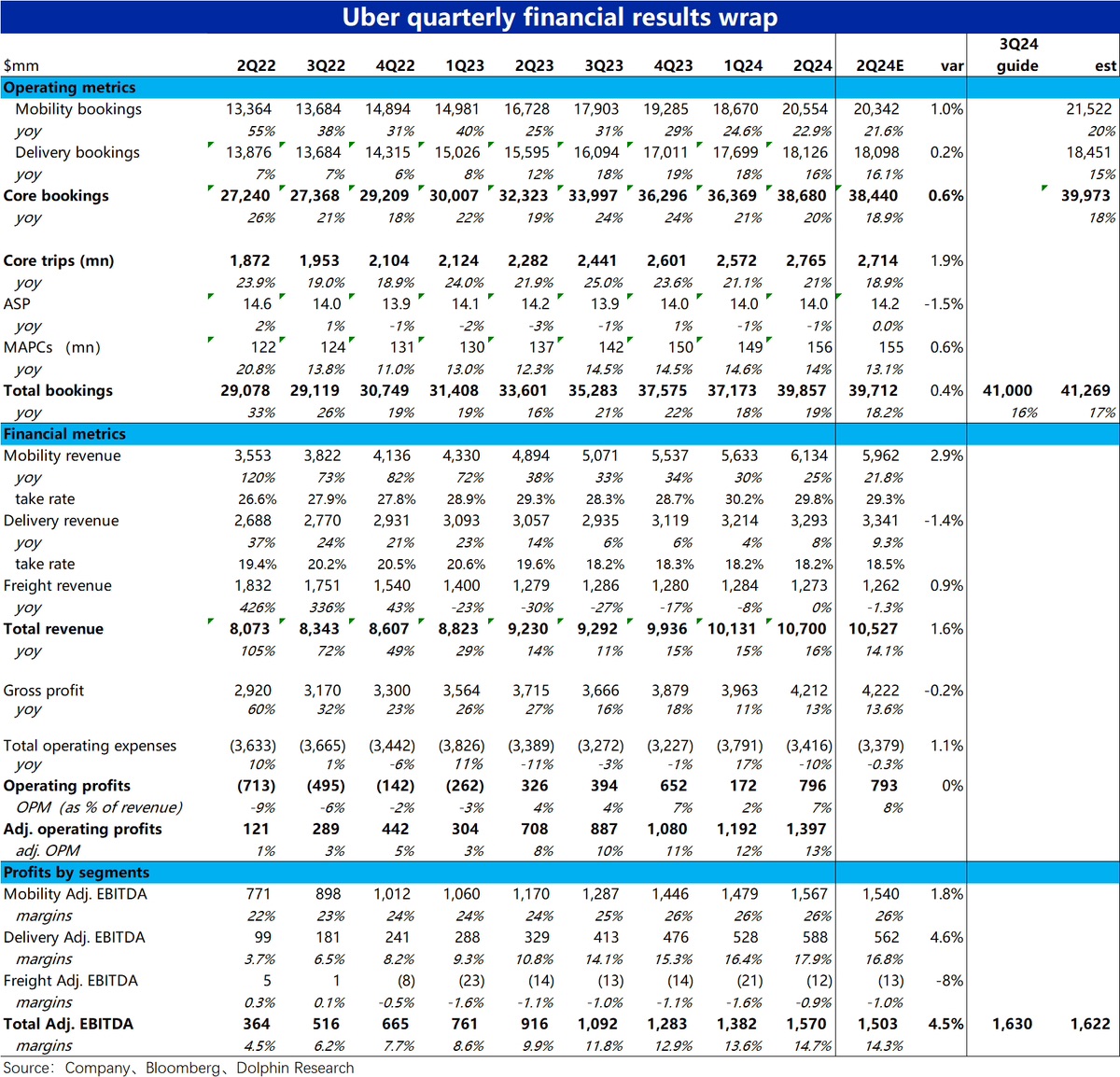

Likes Received$Uber Tech(UBER.US)2Q24 first take: Sell-side expectations for Uber this quarter were "mixed with optimism and concern" ahead of earnings. On one hand, Dolphin Research noted that most sell-side analysts generally expected Q2 results to slightly outperform expectations, but on the other hand, there were some preliminary signs suggesting growth in Q3 might slow down.

1) In reality, the company's core ride-hailing and food delivery businesses slightly exceeded expectations in terms of order value. Excluding currency effects, ride-hailing growth actually accelerated by 1 percentage point year-over-year, while food delivery growth remained flat quarter-over-quarter, showing no signs of weakness. It was indeed stronger than expected.

2) Looking ahead to Q3, although the company's guidance for total order value growth appears to slow by 2 percentage points quarter-over-quarter, this is entirely due to the impact of a stronger US dollar. In other words, actual business growth remains largely in line with this quarter, again showing no signs of slowdown.

3) On the profitability front, the company's key adj. EBITDA metric came in $70 million higher than expected this quarter, slightly exceeding forecasts. Guidance for next quarter's adj. EBITDA is $1.68 billion, also slightly above the expected $1.62 billion.

Overall, while there were no major surprises, business growth remained relatively strong with no concerning signs of weakness. Meanwhile, profit delivery also slightly exceeded expectations. This can be considered a "small but certain happiness" earnings report.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.