Posts

Posts Likes Received

Likes ReceivedExpectations were set too high, and the stock price became unstable, $NVIDIA(NVDA.US).

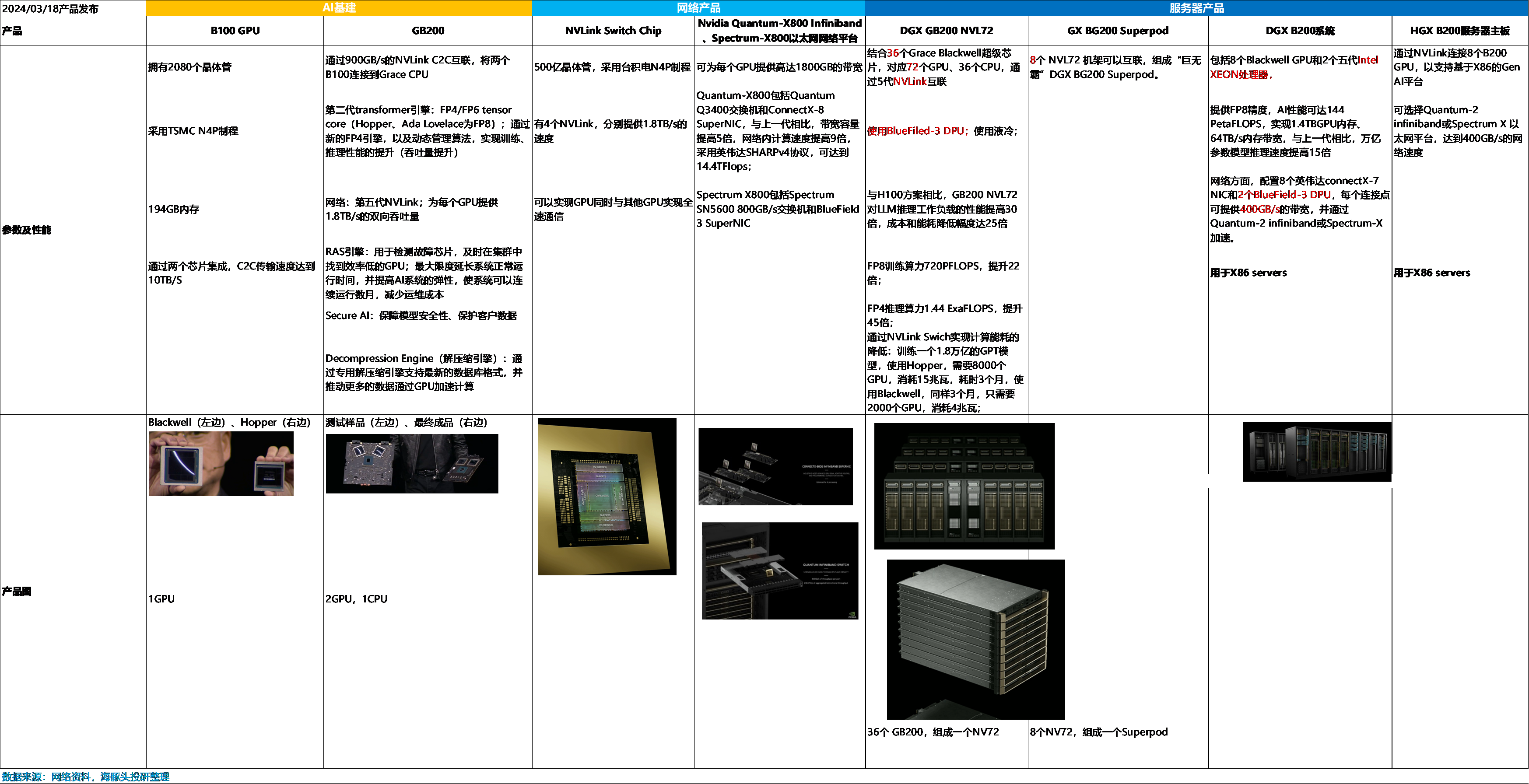

Following Apple's AI report, which intentionally or unintentionally bypassed NVIDIA (though Dolphin Research later suggested there was some confusion), rumors about $NVIDIA(NVDA.US) surfaced again last night. As the company approaches the delivery of its Blackwell platform products (expected to start in Q4 2024), two rumors emerged:

a. The B100 GPU product might be delayed due to capacity constraints in TSMC's more complex Cowos-L packaging technology. In this case, NVIDIA is focusing its capacity on GB200 and integrated solutions like NVL 36/72, which combine GPU and CPU.

b. The entire Blackwell product line might be delayed, partly because large rack-level solutions like NVL face challenges with power supply in cloud computing.

In short, the B-series products, originally expected to be delivered in Q4, might be postponed to late Q1 or early Q2 2025.

This could extend the product cycle of NVIDIA's H-series.

So, in the past few days, this $2.5 trillion market cap giant has seen its stock price fluctuate wildly, behaving like a volatile small-cap company. Clearly, when expectations are too high, even rumors themselves become a risk, regardless of fundamentals.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.