Posts

Posts Likes Received

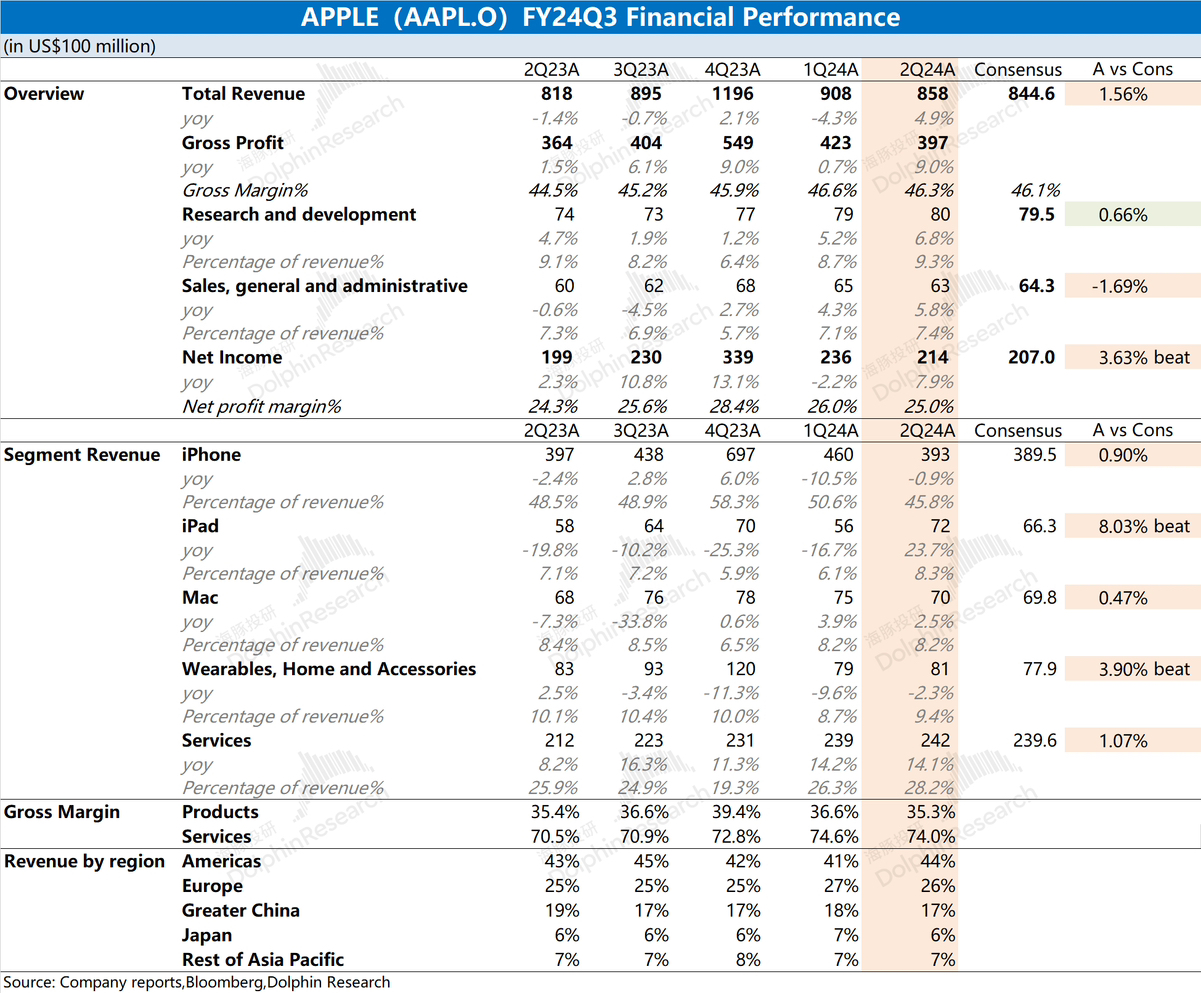

Likes Received$Apple(AAPL.US)First take:This earnings report is quite good. Both revenue and net profit exceeded market expectations. Although the smartphone business is still declining, iPad and wearable devices have significantly outperformed expectations. The gross margin of software services has remained stable at 74% for two consecutive quarters, contributing to the company's better-than-expected profit performance.

Overall, iPhone has halted the decline in business this quarter through measures such as price cuts and promotions. Revenue outside of iPhone grew by 7.5% year-on-year, becoming the main source of the company's revenue growth this quarter. With the improvement in the gross margin of software services, the company's overall gross margin is expected to stabilize above 45%. Although the iPhone business has not shown significant improvement, the performance of other businesses in this earnings report demonstrates the company's risk resilience and operational management capabilities.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.