Posts

Posts Likes Received

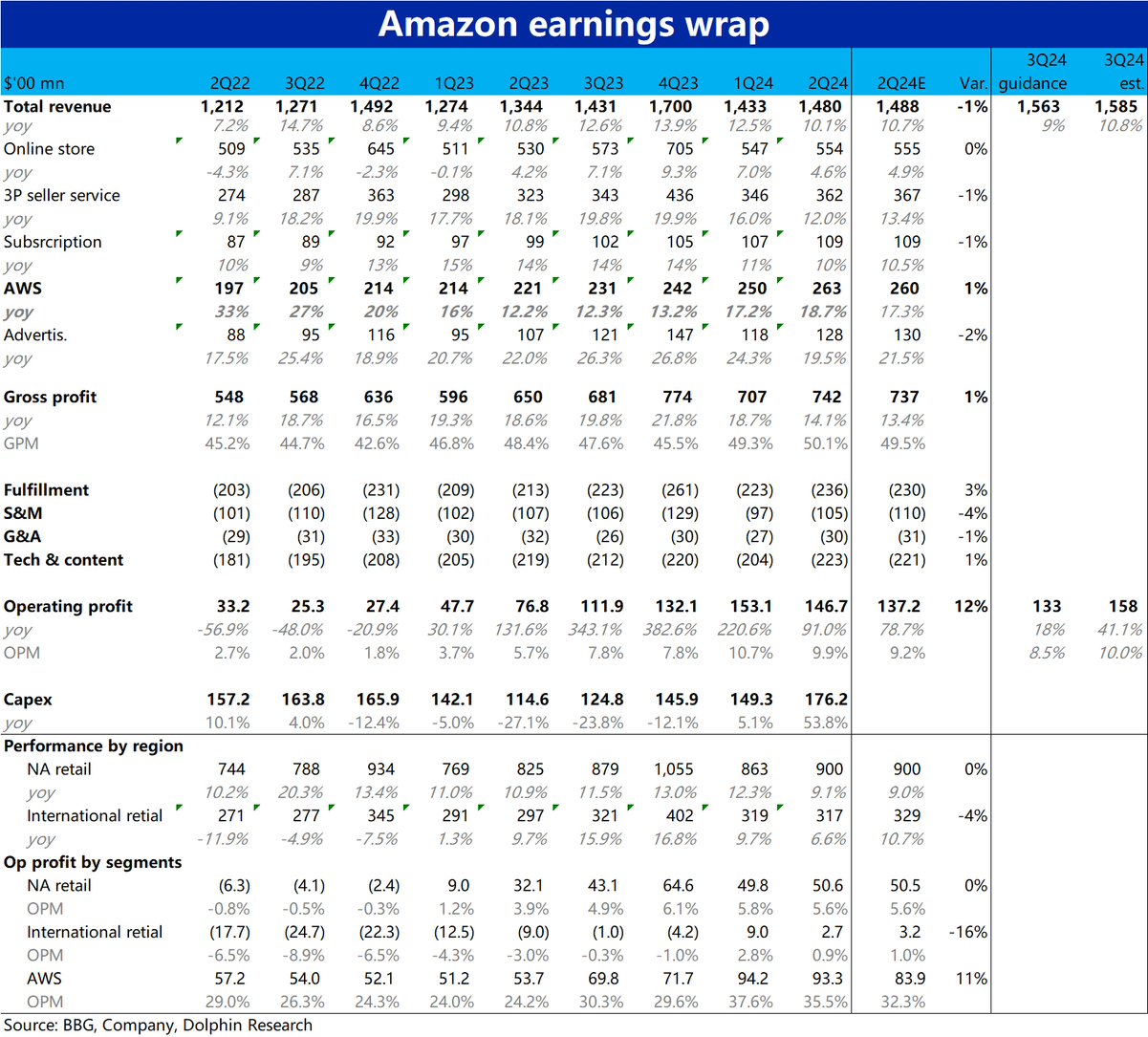

Likes Received$Amazon(AMZN.US) 2Q24 first take: At first glance, compared to the previous quarter's performance which greatly exceeded expectations, this quarter's results are relatively flat. Actual revenue was slightly below the upper limit of previous guidance and market expectations. Although operating profit was still higher than expected, it was only about $700 million above the upper limit of guidance, compared to the previous quarter's actual operating profit being $30+ billion above the upper limit of guidance, the beat is no longer as impressive.

Similarly, the upper limit of revenue guidance for the next quarter is in line with market expectations, while the upper limit of operating profit guidance is slightly below market expectations. Although Amazon's actual delivered profits are mostly above the upper limit of guidance, overall, the guidance for the next quarter does not bring much surprise.

Specifically, there were some small surprises in the AWS business this quarter. The year-on-year growth rate was 18.7%, 1.4~1.5 percentage points higher than the previous quarter and market expectations, while operating profit was also nearly $1 billion higher than expected. We believe this reflects that Amazon, which has been relatively lagging behind Microsoft and Google in this wave of AI, has narrowed the gap in AI products and related cloud services to some extent after nearly a year of catching up.

Correspondingly, the company, which has been relatively conservative in this round of Capex increase cycle, saw a nearly 18% quarter-on-quarter increase in fixed asset spending to $17.6 billion this quarter. Although still relatively conservative, this is the first clear sign of acceleration after about two years of Capex contraction cycle.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.