Posts

Posts Likes Received

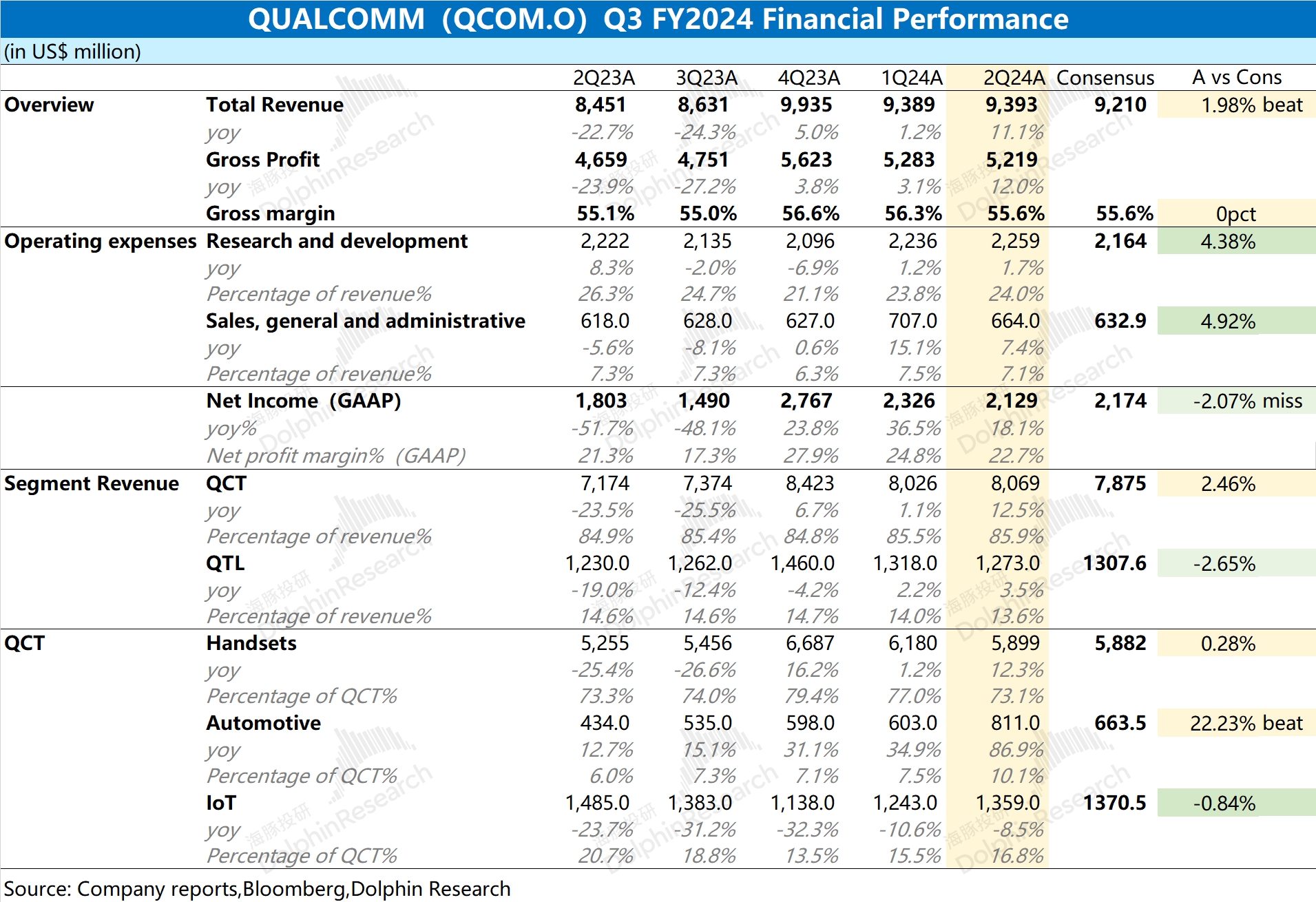

Likes Received$Qualcomm(QCOM.US) first take: The company's revenue and profit this quarter were basically in line with guidance expectations, with year-over-year growth mainly driven by the mobile phone and automotive businesses. Based on the company's guidance for the next quarter: For the fourth quarter of fiscal year 2024 (i.e., Q3 2024), revenue is expected to be between $9.5 billion and $10.3 billion (market expectation: $9.7 billion), and adjusted earnings per share are expected to be between $2.45 and $2.65 (market expectation: $2.48). Both revenue and profit are expected to recover next quarter, but they are close to market expectations. Dolphin Research believes that as demand from mobile phone and other customers recovers in the second half of the year, the company's performance is expected to continue improving. However, based on the company's guidance, the overall recovery pace is largely in line with market expectations.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.