Posts

Posts Likes Received

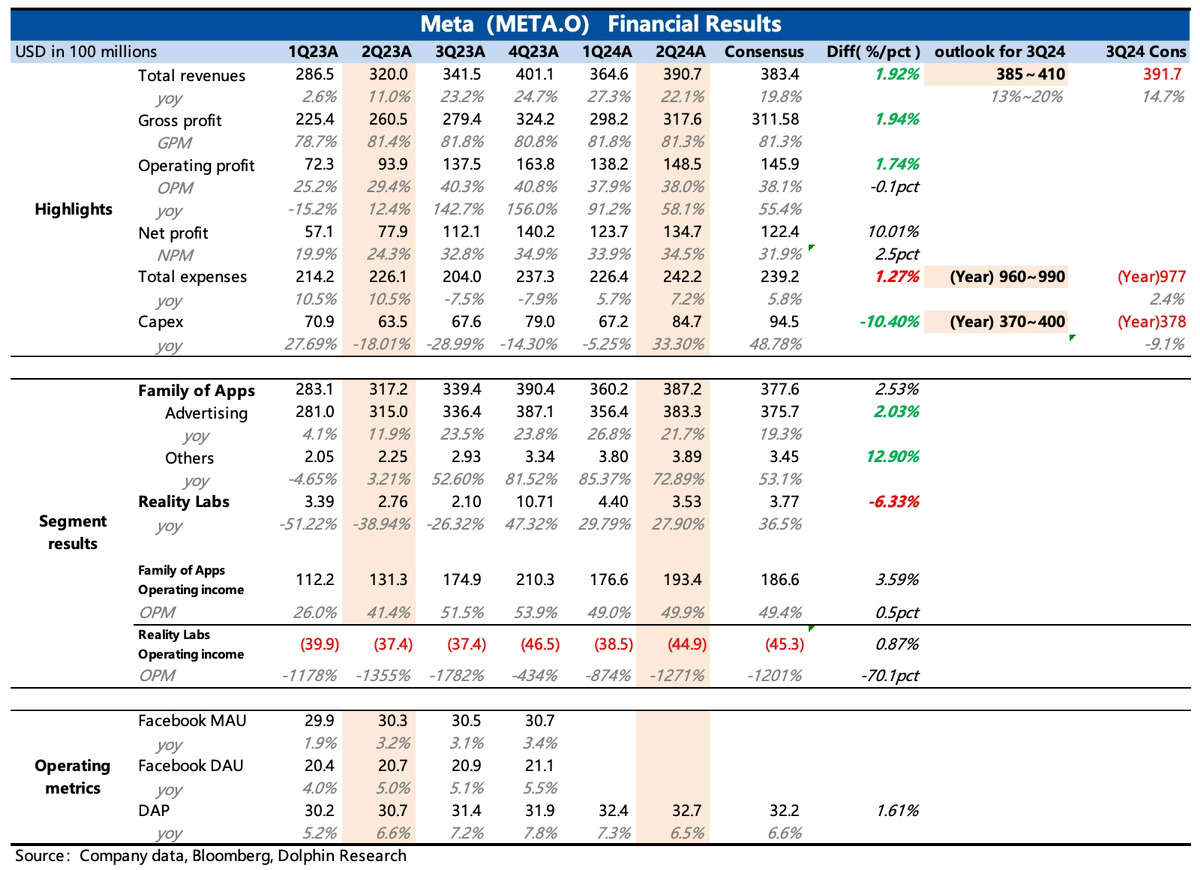

Likes Received$Meta Platforms(META.US)first take:Because Google set the precedent and the bomb from its little brother PINS, market expectations and trading sentiment for Meta's earnings report were not high. However, it was precisely due to these relatively cautious expectations that the actual results brought a "small delight": both current advertising revenue and guidance slightly exceeded expectations, while Q2 Capex was lower than expected. Nevertheless, Meta also faces AI investment anxiety, closely following the footsteps of Google and Microsoft. Not only did it raise the lower limit of its 2024 Capex (from $35 billion to $37 billion, implying a 50%+ sequential increase in Capex in the second half of the year), but it also clearly guided that 2025 Capex will increase significantly, higher than previous plans.

Therefore, Dolphin Research believes that the better-than-expected Q2 results could correct Meta's short-term market sentiment. However, the revenue and capital expenditure guidance provided by Meta also confirms our logic regarding the pressure on advertising growth in the second half of the year, the recognition of incremental AI costs, and the end of the layoff efficiency cycle's impact on profits. This means that after short-term valuation P/E recovers to a neutral level in line with growth (15%~18% CAGR from 2024 to 2026), further upside will face increased risks due to potential downward revisions in EPS in the second half of the year.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.