Posts

Posts Likes Received

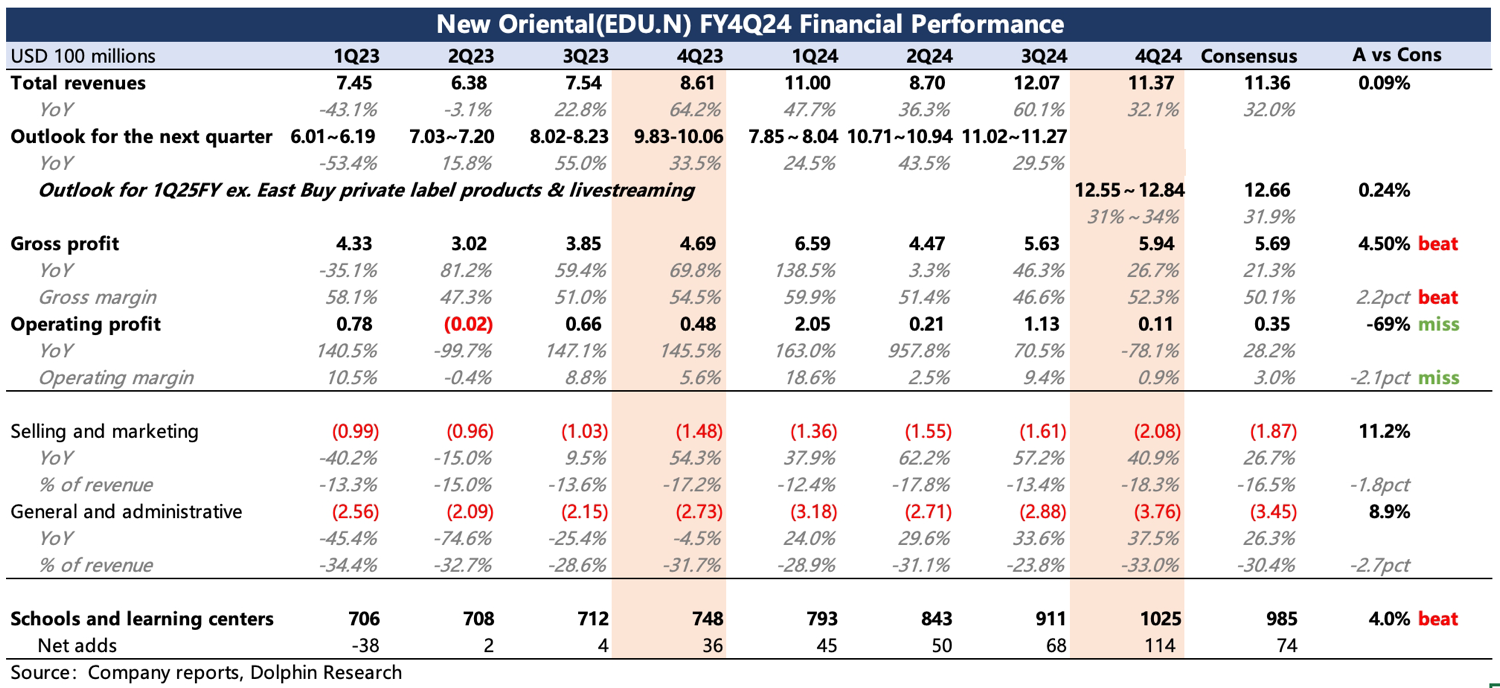

Likes Received$New Oriental EDU & Tech(EDU.US)first take: Under high market expectations, the Q4 performance was relatively mediocre. Revenue met expectations, and guidance was neither surprising nor disappointing. However, the issue lies in the profit margin, where short-term adjustment pressure is greater than the company's guidance last quarter: Non-GAAP operating margin was 3.2%, lower than the expected and guided range of 5-6%.

Looking further into the details: 1) Gross margin was not an issue, possibly due to the positive impact of high-margin businesses like 'With Hui Together,' but mainly reflecting sustained demand for education. Despite accelerated school expansion, classroom utilization rates were not significantly affected. 2) The additional expenses were primarily in operating costs, mainly related to the advancement of self-operated businesses under 'Oriental Selection,' as well as potential increases in marketing and personnel expenses due to the launch of new accounts like 'With Hui Together.' On the other hand, newly established school centers also required early expansion of operational teams, with these investments incurred before revenue generation.

Currently, most investors still prioritize short-term profit margins, so the market reaction to this earnings report may not be positive. However, Dolphin Research also believes that there is indeed an impact of production-investment mismatch here, affecting both livestreaming and education businesses. Therefore, from a medium- to long-term perspective, we remain more focused on the sustainability of education demand.

After the major adjustments in the livestreaming business and the further ramp-up of demand for newly established teaching centers, what are the company's expectations for future profit margins? Additionally, the earnings report provided limited details on segment performance, so it is advisable to pay attention to the upcoming earnings call.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.