Posts

Posts Likes Received

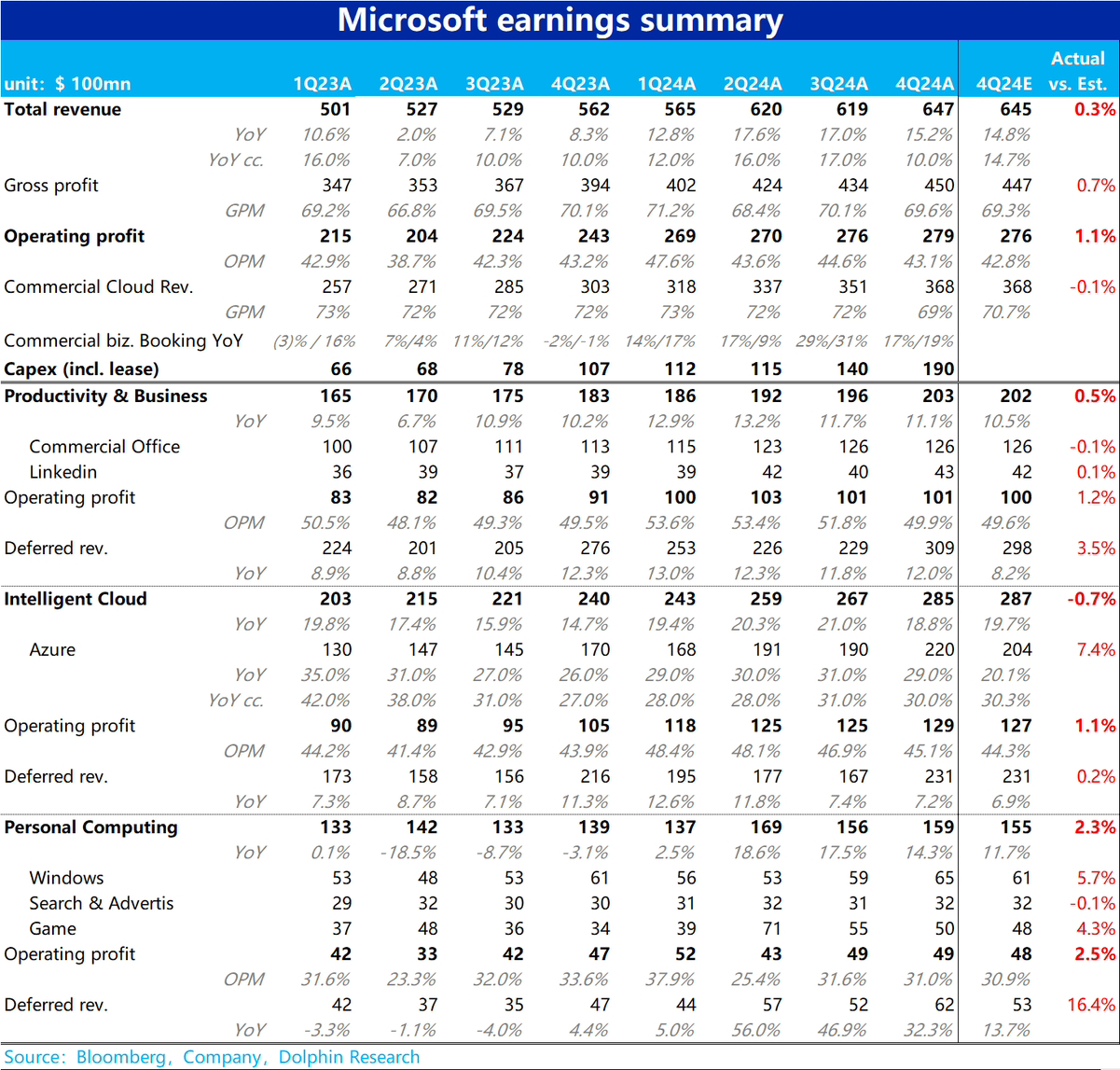

Likes Received$Microsoft(MSFT.US)4Q24 first take: Microsoft's performance this quarter was generally in line with expectations. Although total revenue and operating profit were slightly higher than previous guidance and expectations, the lead was very small. We believe the reasons for the stock price decline after earnings are:

1. Azure, the most watched business that best reflects Microsoft's incremental revenue from AI, had disappointing growth this quarter. Revenue growth and growth under constant currency slowed by 2pct and 1pct respectively compared to the previous quarter. Although the decline was not significant, market expectations for Azure were generally optimistic before earnings, with many investment banks expecting sequential growth acceleration. The actual decline instead of growth reinforced market concerns about the high investment in AI business without (at least for now) bringing considerable incremental revenue.

2. Although operating profit this quarter was still slightly higher than expected, the year-on-year improvement in operating margins for both the Productivity and Intelligent Cloud segments narrowed to 0.4pct and 1.2pct respectively, while these two indicators had been above 2pct and 3.9pct in the previous three quarters. At the same time, Capex spending this quarter further increased to $19 billion, up about 36% sequentially. If Capex continues to rise or remains at the current high level next fiscal year, it most likely means that the efficiency cycle of profits outperforming revenue growth this fiscal year has ended, and there will be pressure for year-on-year margin decline next fiscal year. It's the same "Too much spend, too little to earn" problem.

In fact, there were no particularly major flaws in Microsoft's earnings this quarter, just a lack of highlights. But the problem is that the company's current valuation of over 30x PE based on 2025 profits and the market's very full pricing of AI naturally lead to some correction pressure once earnings fail to continue to surprise.

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.